Estate planning considerations unique to Washington

Probate laws and proceedings vary from state to state. Here are some probate and estate distinctions to be aware of in Washington.

State estate tax

Washington is one of a few states that imposes a state estate tax in addition to the federal estate tax. Currently, Washington’s tax applies to any estates valued at $2.193 million or more. The rates range from 10% to 20%, depending on the value of the estate.

Simplified probate process

For estates below a certain threshold in value, Washington offers simplified probate procedures. Heirs can use a simplified procedure to claim assets without going through formal probate for qualifying estates.

Community property

Washington is one of 12 community property states, meaning that assets acquired during marriage are automatically considered jointly and equally owned by both spouses. This means marital assets are subject to equal division in the event of divorce or death.

Will formalities

Washington has specific requirements for creating a valid will, including a witness signature. If a will doesn’t meet the state’s validity requirements, the estate may become subject to intestacy laws.

Homestead protections

Washington offers homestead protections or awards in lieu of homestead for a surviving spouse, surviving registered domestic partner, and minor children. These protections can allow them to retain certain rights to the family home or receive financial support during the probate process.

Non-probate assets

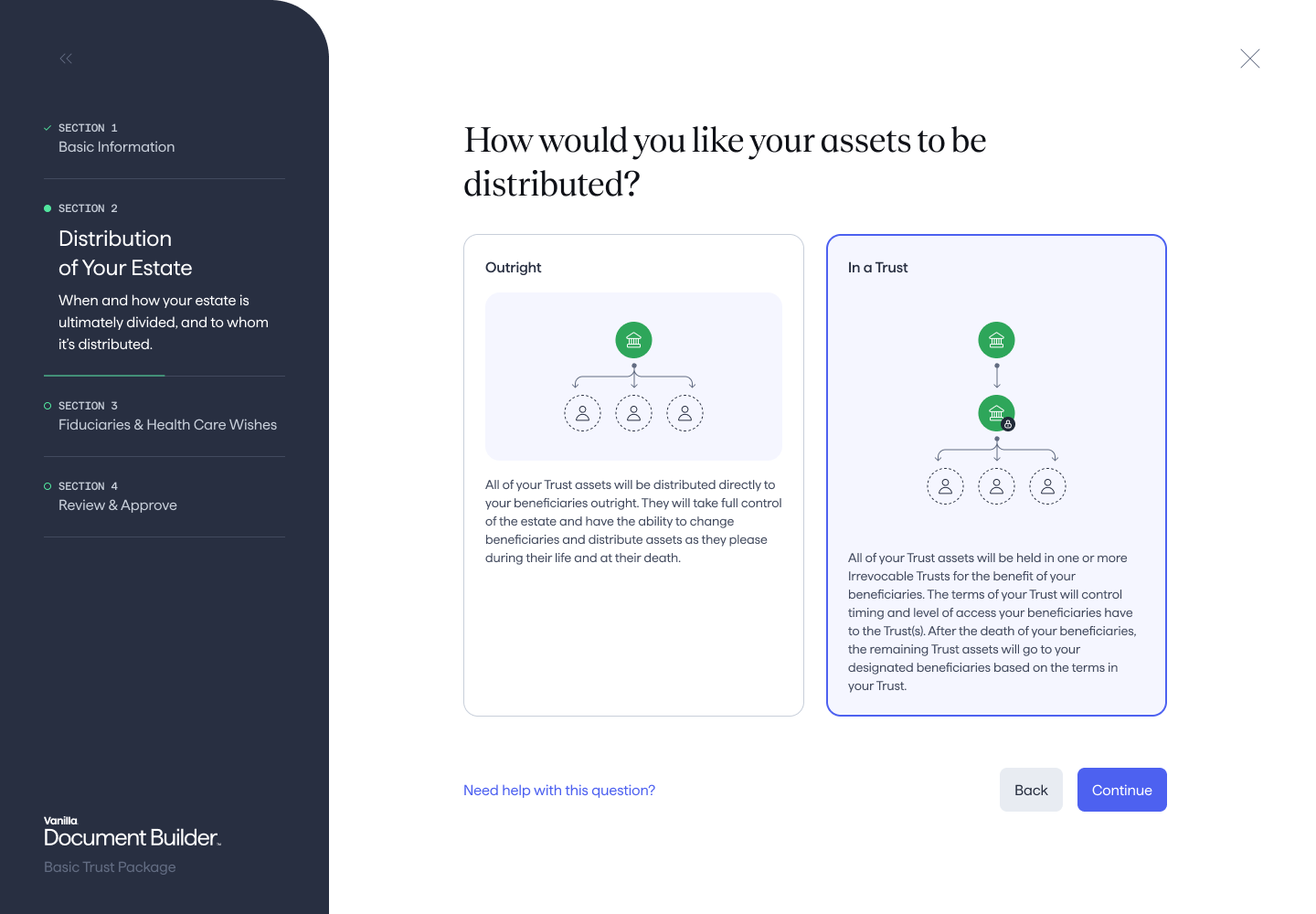

Washington has specific laws regarding non-probate assets, such as joint tenancy property, payable-on-death accounts, and assets held in a trust. Typically, these assets can pass to designated beneficiaries without going through probate.

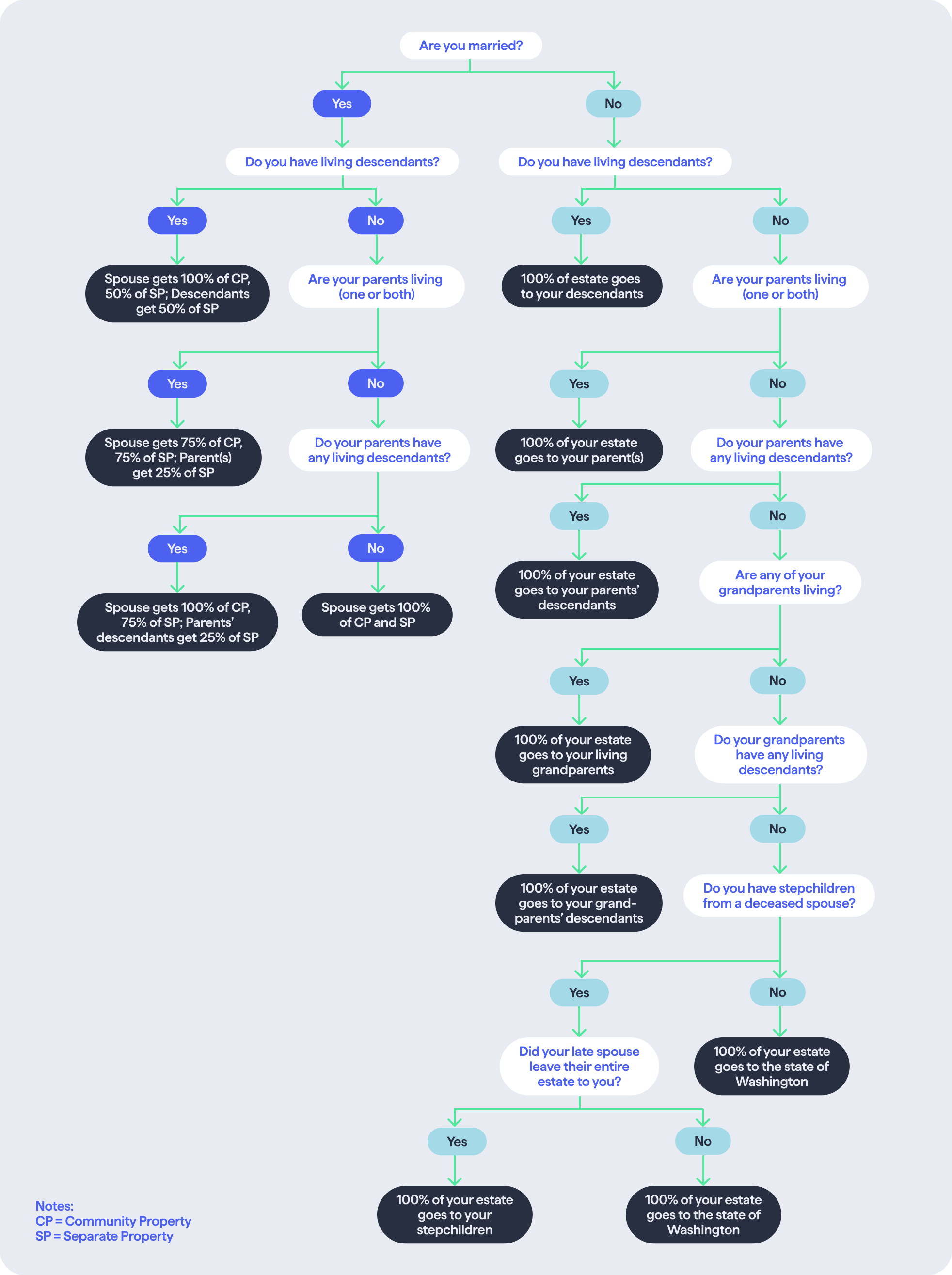

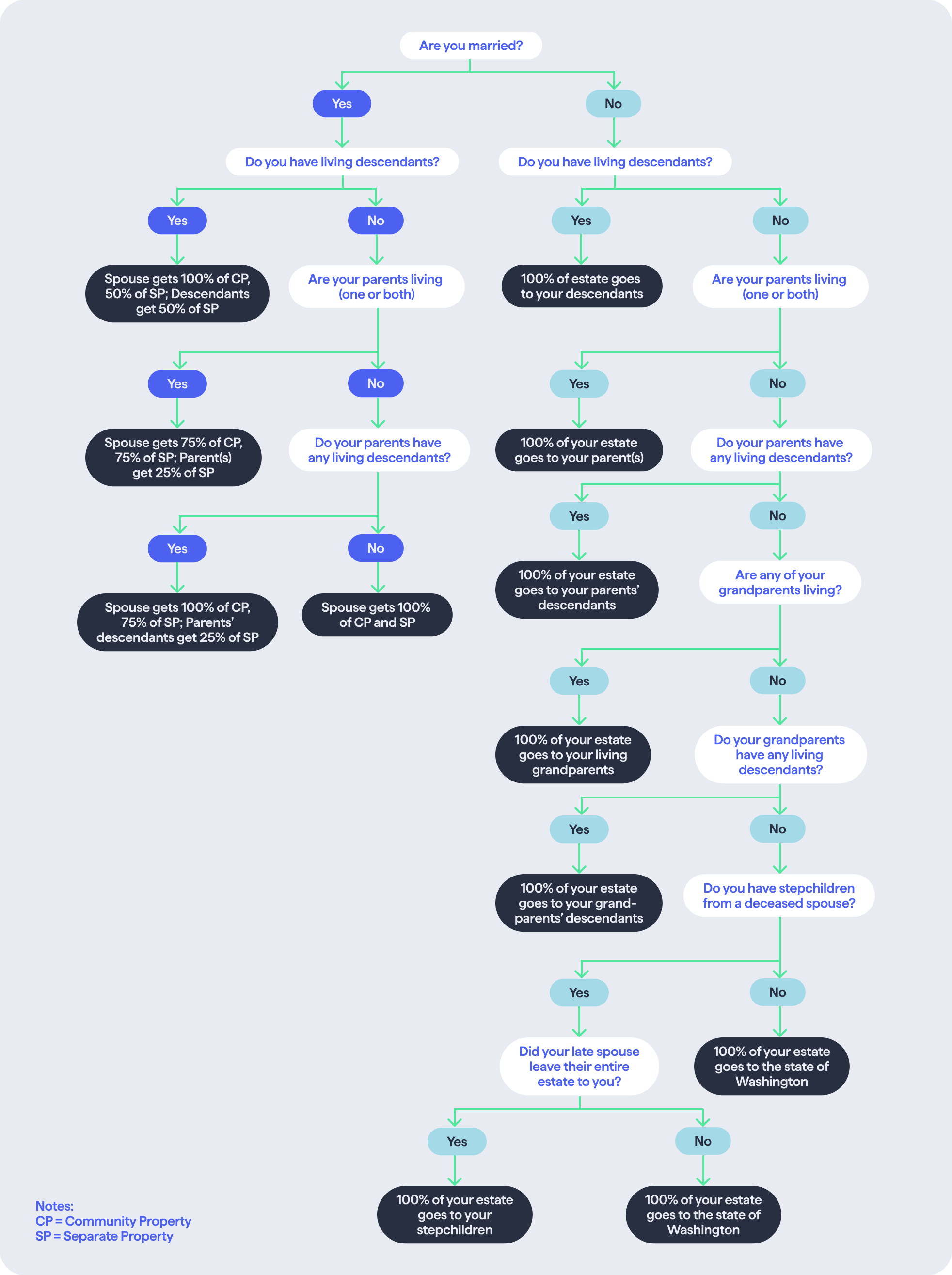

Intestate succession in Washington