Vanilla

•

Oct 08, 2025

10 Questions Every Advisor Should Ask Before Choosing an Estate Planning Solution

By nature, the practice of estate planning has a level of seriousness and substantiality that few other advisor-client conversations will ever reach. When you bring technology into that process, you want to make sure it reflects the importance of the topic at hand. Choosing an estate planning software that brings the appropriate credibility and accuracy is no small task, and it’s easy to get lost in the details when comparing solutions. To help cut through the noise, we built the Buyer’s Guide to Estate Planning Platforms for Advisory Firms, which walks through the criteria to consider when choosing a solution...

Vanilla

•

Oct 07, 2025

Vanilla Approved by Osaic as a Comprehensive Estate Planning Solutions Provider to Over...

The partnership empowers Osaic's advisor network with cutting-edge estate planning technology to enhance client relationships and drive holistic wealth management BELLEVUE, Wash.--Vanilla, the most trusted modern estate planning platform for financial advisors, today announced a strategic partnership with Osaic, Inc. (Osaic), one of the nation's largest providers of wealth management solutions. Through this partnership, Osaic's national network of more than 11,000 financial advisors can now access Vanilla's comprehensive estate planning platform to streamline complex processes, create compelling planning scenarios, and deliver more meaningful, results-focused client experiences. "Estate planning has become essential to comprehensive wealth management, especially as our clients navigate...

Vanilla

•

Oct 03, 2025

Vanilla Appoints Larry Steinberg as Chief Technology Officer

We’re excited to announce that Larry Steinberg has joined Vanilla as our new Chief Technology Officer (CTO). Larry brings decades of technology and business leadership experience, from founding and scaling startups to guiding global tech organizations through major transformation. His career reflects a consistent track record of building high-performing teams, modernizing technology platforms, and driving innovation to accelerate business growth. A proven technology leader Most recently, Larry served as CTO at Spring Health, where he led the company’s technology strategy and operations. Before that, he was CTO at Rent the Runway, playing a pivotal role in preparing the company for...

Sarah D. McDaniel, CFA

•

Oct 01, 2025

Changes in Interest Rates and Why Estate Planning Reviews Matter

The Federal Reserve's September 2025 rate cut may create planning opportunities The Federal Reserve's recent quarter-point reduction to 4.00%-4.25% represents the first rate cut of 2025 with Fed projections indicating additional cuts may follow later this year. While these monetary policy shifts primarily target economic conditions, they create significant ripple effects throughout the estate planning landscape that may warrant immediate attention. Why interest rates drive estate planning effectiveness Estate planning isn't a "set it and forget it" process. The effectiveness of wealth transfer strategies fluctuates dramatically based on prevailing interest rate environments, making periodic reviews essential—particularly during periods of monetary...

Vanilla

•

Sep 30, 2025

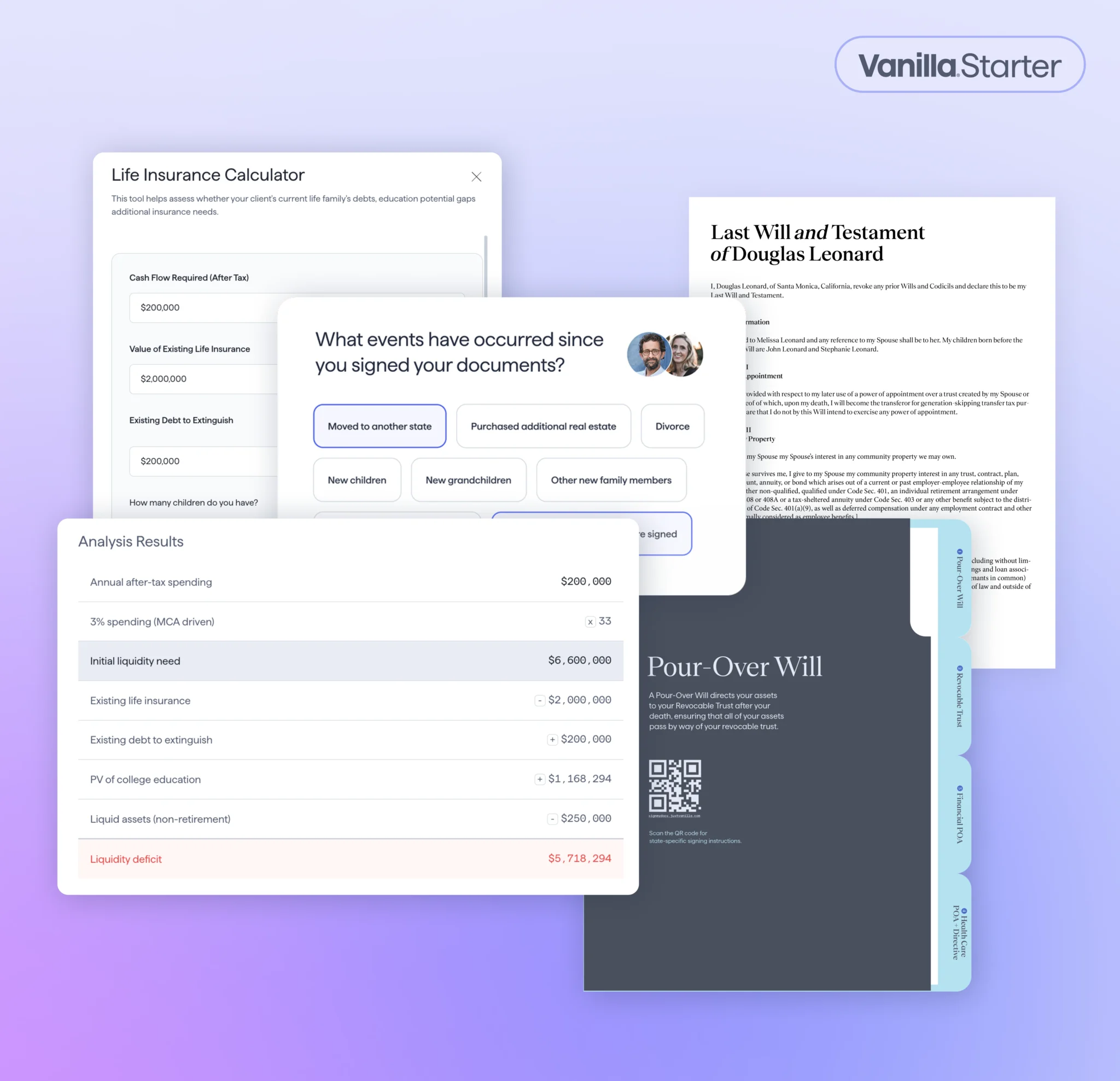

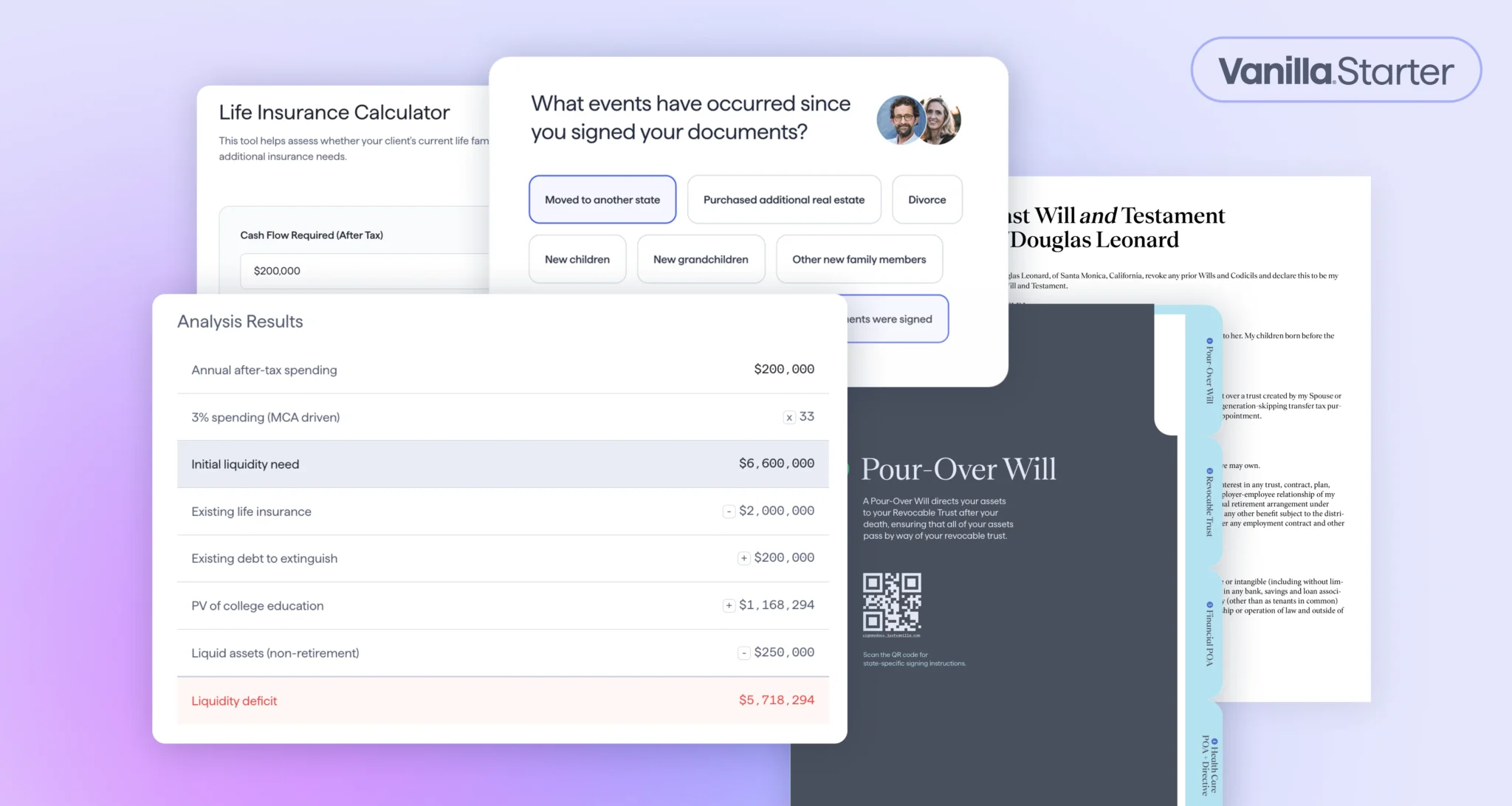

Vanilla Opens Waitlist for Vanilla Starter: Essential Estate Planning Technology for Independent RIAs

New offering brings institutional-grade estate planning capabilities to boutique advisory firms at accessible pricing BELLEVUE, Wash.--Vanilla, the leading estate planning technology platform trusted by several of the country’s largest wealth management firms, today announced the opening of the waitlist for Vanilla Starter, a groundbreaking solution designed to make professional estate planning services accessible for boutique RIA firms. Built on the same proven, institutional-grade technology that serves ultra-high-net-worth clients, Vanilla Starter will launch with pricing starting at $99 per month. Solo practices and small RIA firms have long faced a critical challenge: wanting to offer estate planning services in-house but lacking...

Vanilla

•

Sep 29, 2025

What Is a Spendthrift Trust and How Do You Set One Up?

Many families worry about what will happen to wealth after it passes to the next generation. There may be concerns about poor financial decision-making, personal debts, unstable relationships, or even exposure to lawsuits. In some cases, some traditional estate planning strategies may not offer enough protection if beneficiaries are financially vulnerable. In these situations, there are additional legal structures that can be used to help protect wealth from being misused, mismanaged, or lost to credits when it passes to future generations. This article will offer a detailed overview of one of the most effective tools for balancing long-term support with...

Vanilla

•

Sep 25, 2025

45,000 Documents Later: The Most Common Estate Planning Mistakes

Estate planning is one of the most impactful ways advisors can help clients protect their families, preserve wealth, and ensure their intentions are honored. Yet, despite its importance, we’ve seen time and again that estate plans—even carefully drafted ones—often contain blind spots. At Vanilla, we’ve abstracted over 45,000 estate planning documents. This vantage point provides a unique window into the recurring mistakes and oversights that surface in client plans. For advisors, understanding these pitfalls is critical not just for catching errors, but also for building trust and proactively guiding clients through difficult conversations. Below are the most common mistakes we...

Jessica Lantz

•

Sep 23, 2025

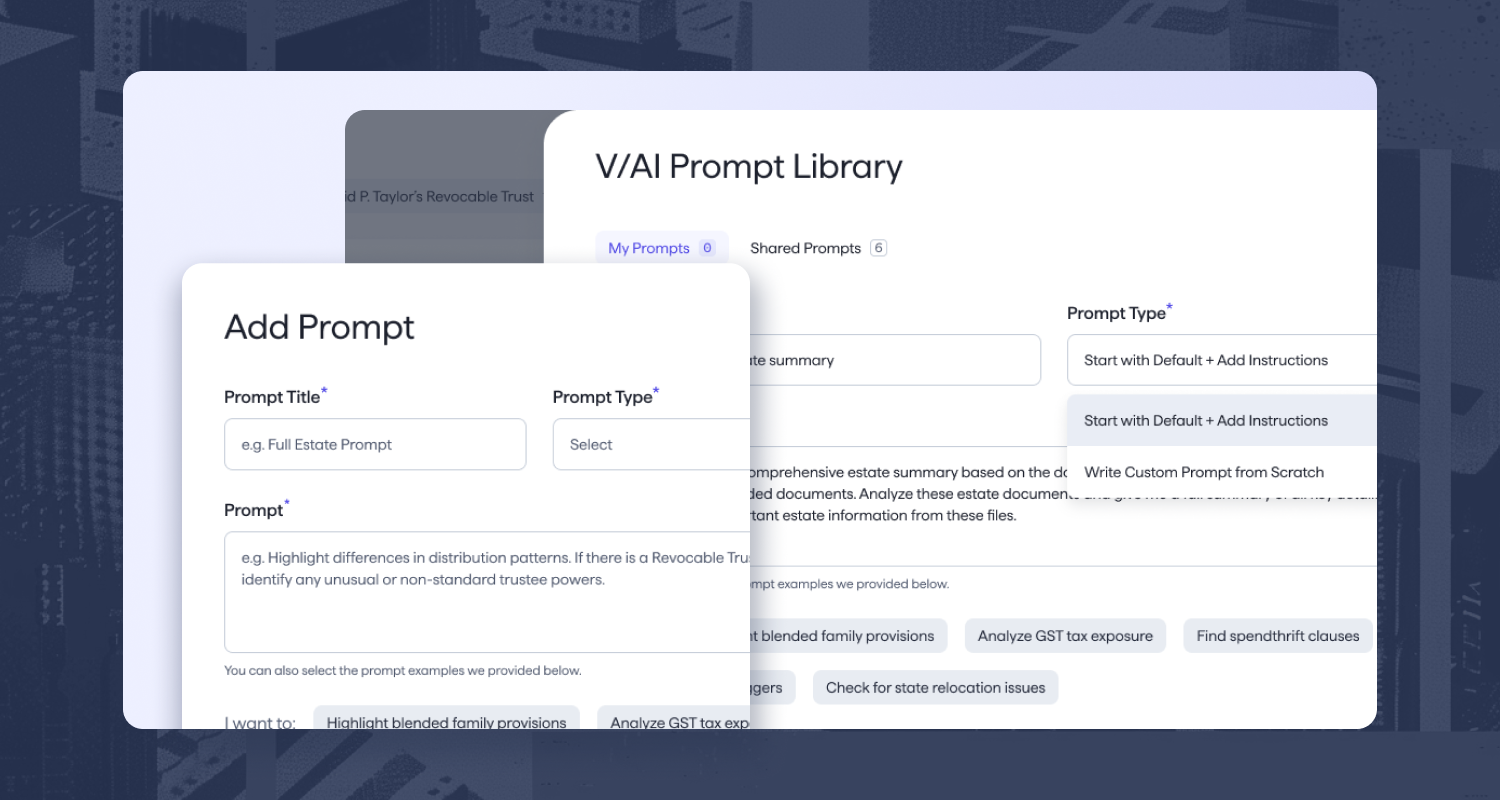

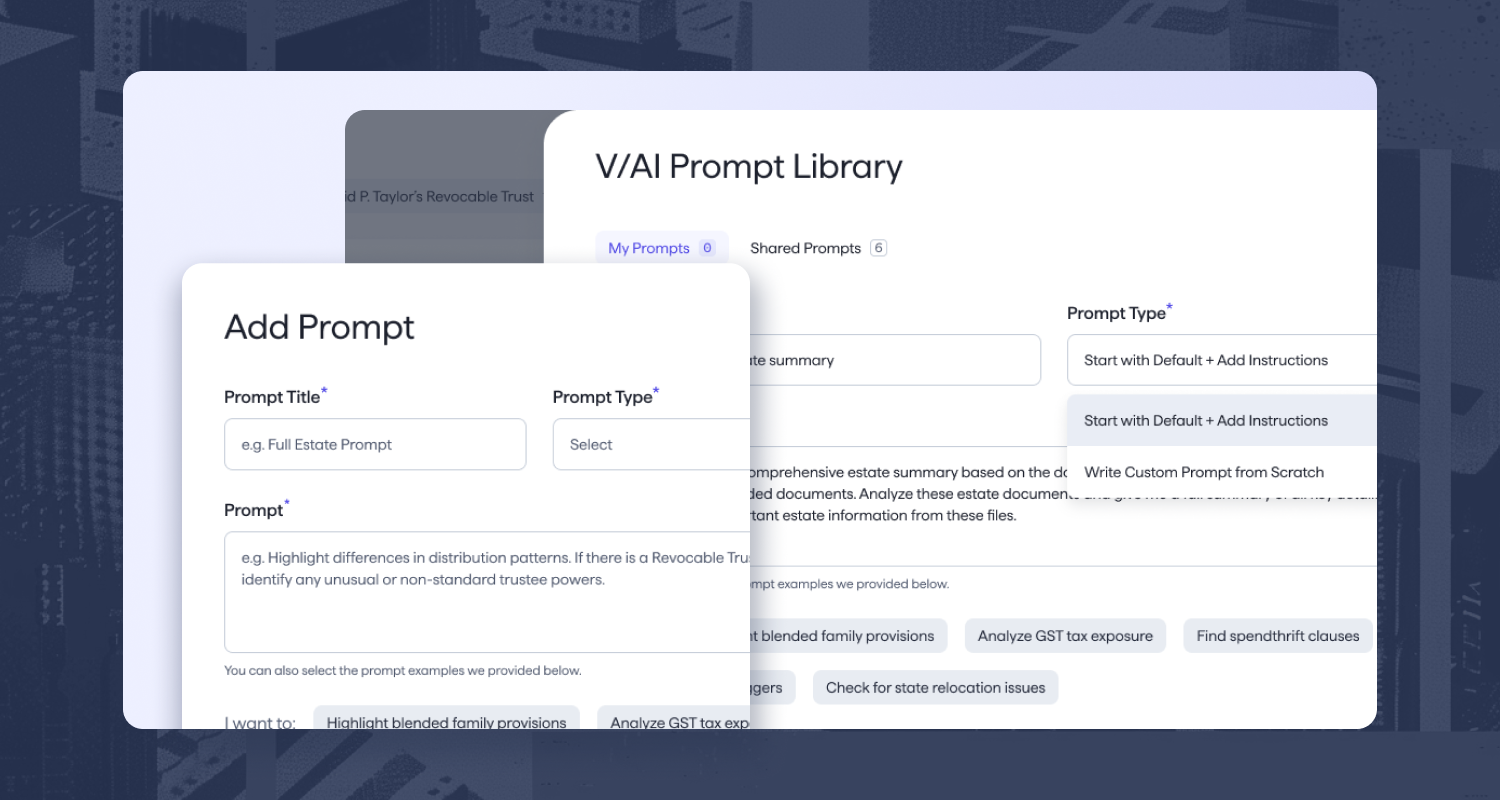

What’s New in September: Nationwide Inheritance Tax Calculations, New V/AI Features, and more!

This month's release tackles the friction points you've told us about—from inconsistent AI results across your team to managing multi-state inheritance tax requirements. Each enhancement works seamlessly with your existing processes while expanding what's possible. Here’s what came out in September, along with some features that are coming soon. Nationwide inheritance tax: Never miss inheritance tax implications again The challenge: Advisors with multi-state clients manually track varying inheritance tax rules across jurisdictions, risking costly oversights and planning errors. The solution: Vanilla is introducing inheritance tax calculation support for Maryland, Nebraska, and New Jersey—completing our nationwide coverage Automated, state-specific calculations integrate...

Vanilla

•

Sep 10, 2025

Betterment Advisor Solutions Launches Partnership with Vanilla to Make Advanced Estate Planning Technology...

New York, NY - September 10, 2025 - Betterment Advisor Solutions, an all-in-one custodian for modern RIAs, today announced a new partnership with Vanilla, the modern estate planning solution for advisors. Through this partnership, advisors who custody assets with Betterment Advisor Solutions will have special access to the Vanilla platform in addition to exclusive educational opportunities with Vanilla’s team of estate planning experts. Vanilla’s tools enable advisors to offer customized estate planning services at scale to clients across all wealth levels. “Having the right technology in place can make or break an advisory firm, and we want advisors to have...

Vanilla

•

Sep 09, 2025

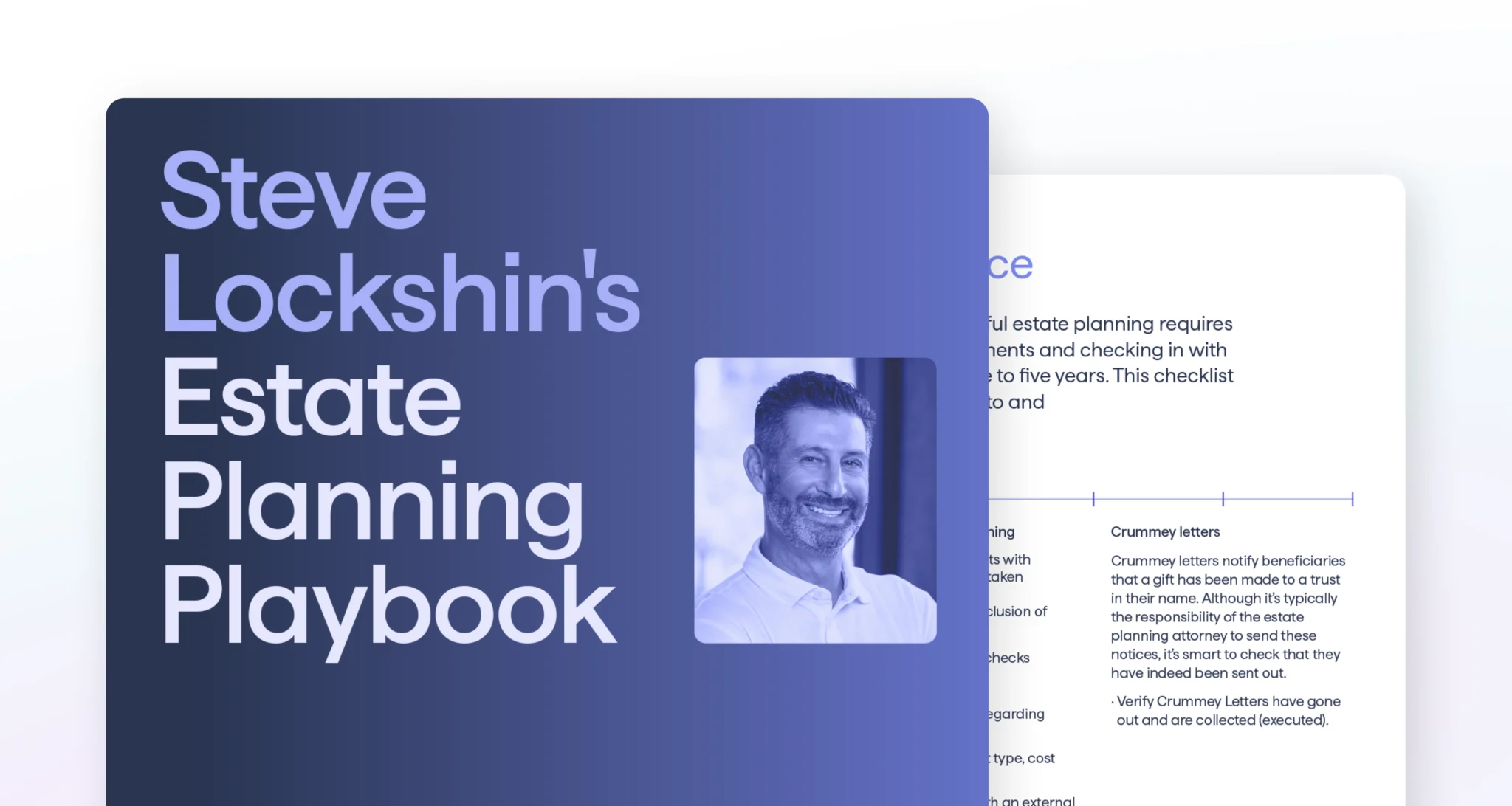

4 Lessons from Steve Lockshin’s Estate Planning Playbook

As an advisor, you probably know how rare it is to retain AUM after the death of the primary wealthholder. You may also know that there’s a proven way to decrease the likelihood of getting fired when the relationship passes to a surviving spouse or the next generation: estate planning. Advisors who engage their clients and clients’ families in estate planning are more likely to retain assets as they transfer to a surviving spouse or next generation. If wading into the waters of estate planning with clients seems intimidating, we have practical advice for navigating these conversations and processes. Here,...

Vanilla

•

Sep 05, 2025

Vanilla’s Industry Leadership Recognized with Two 2025 Wealthies Awards

Bellevue, WA — September 5, 2025 — Vanilla, the most trusted estate planning platform for advisors, today announced it was a two-time winner at the 2025 Wealth Management Industry Awards (the “Wealthies”), held on September 4, 2025 in New York City. Vanilla’s was recognized for the following categories and achievements: Advisor Service and Support category: Document Abstraction Services Thought Leadership Category: The State of Estate Planning Report 2025 These prestigious awards highlight Vanilla’s ongoing leadership in delivering innovative solutions to advisors and thought leadership to the broader wealth management community. "We are extremely proud to once again be recognized by...

Vanilla

•

Sep 03, 2025

10 Helpful Benefits of Trusts You Should Know

Trusts are one of the most versatile and frequently used tools in estate planning. Not only do they help clients protect their wealth, they can also provide clarity, flexibility, and peace of mind for families. Whether you work with high-net-worth clients, blended families, or individuals who simply want more control over their legacy, trusts offer benefits that go far beyond what a will alone can accomplish. In this article, we’ll explore 10 helpful benefits of trusts you should know, and the strategic advantages each offers for clients. 1. Avoiding probate saves time and costs Probate is the court-supervised process of...