Estate Planning Considerations Unique to Arizona

Estate laws and probate processes vary from state to state. Here are a few distinctions to note in Arizona:

Survivorship requirements: In Arizona, there are specific laws regarding heir survivorship. By law, a beneficiary must survive the decedent by at least 120 hours (5 days) to be eligible to inherit assets either according to the will or through intestate succession if there is no will. The purpose of this is to ensure heirs can be clearly determined in situations where deaths occur close together.

Community property: Arizona is one of nine states that recognizes community property, meaning that any assets acquired during a marriage are considered jointly owned by both spouses. This means that, during probate, the decedent’s spouse is entitled to half of the community property.

Small estate affidavit: Like many states, Arizona offers a small estate affidavit for estates that follow below certain thresholds of value. To qualify, an estate’s personal property must be valued at $75,000 or less, or its real property (like a residence) must be valued at $100,000 or less. In these cases, beneficiaries can claim the property without going through the full probate process.

Formal vs. Informal probate: For estates that are uncontested and properly executed, Arizona allows informal probate. This is a simplified probate process that doesn’t require court hearings and thus may be faster and lower cost than a formal probate. For estates that are contested, complex, or in which other complications arise, formal probate and court supervision are required in Arizona.

Distinct timelines: Unlike many states, Arizona sets out explicit timelines for starting the probate process. For example, probate must begin within two years of the person’s death unless there are special circumstances. Additionally, once probate has been initiated, creditors have exactly four months after the executor makes public notice of the probate to make any claims against the estate.

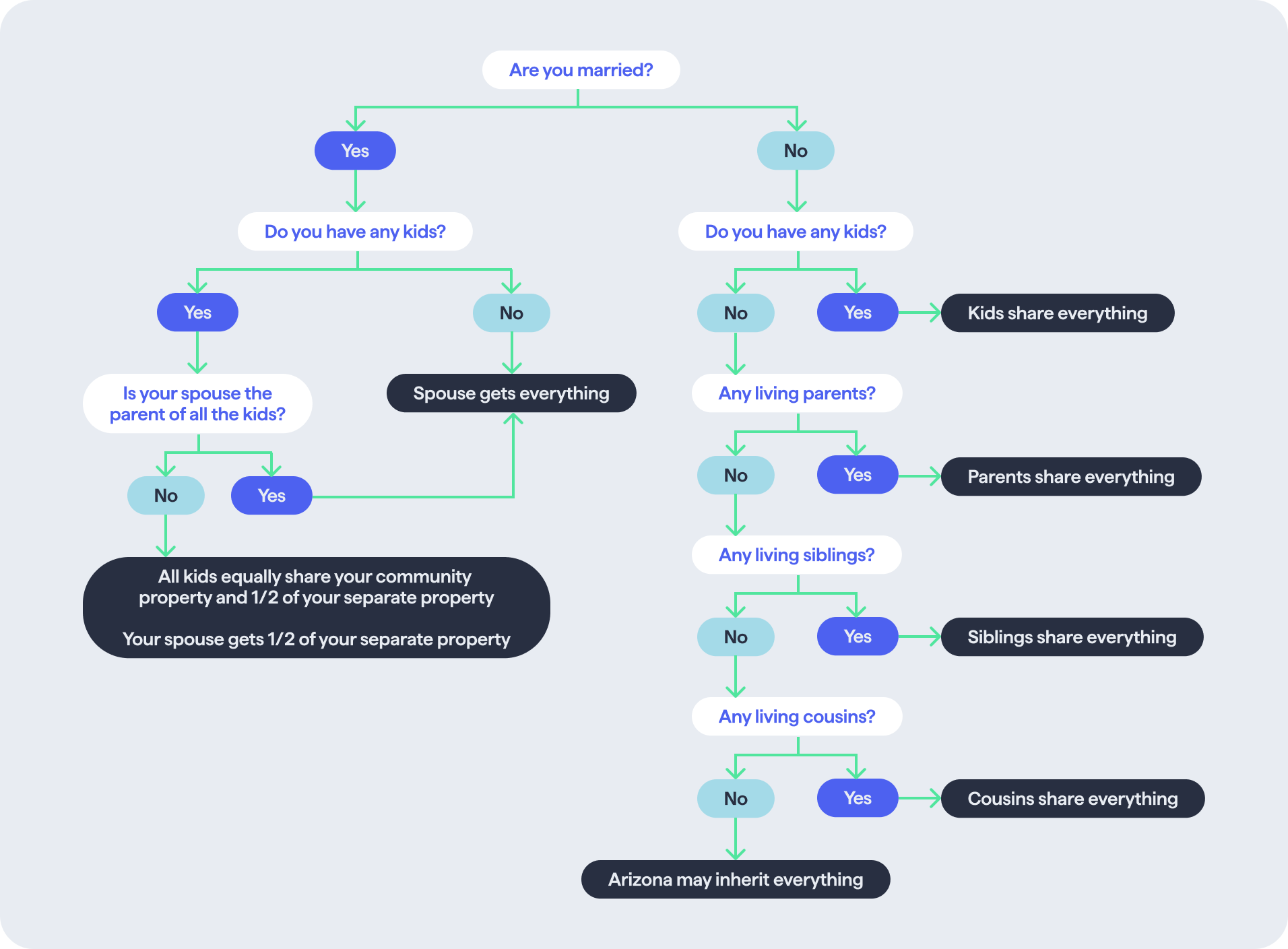

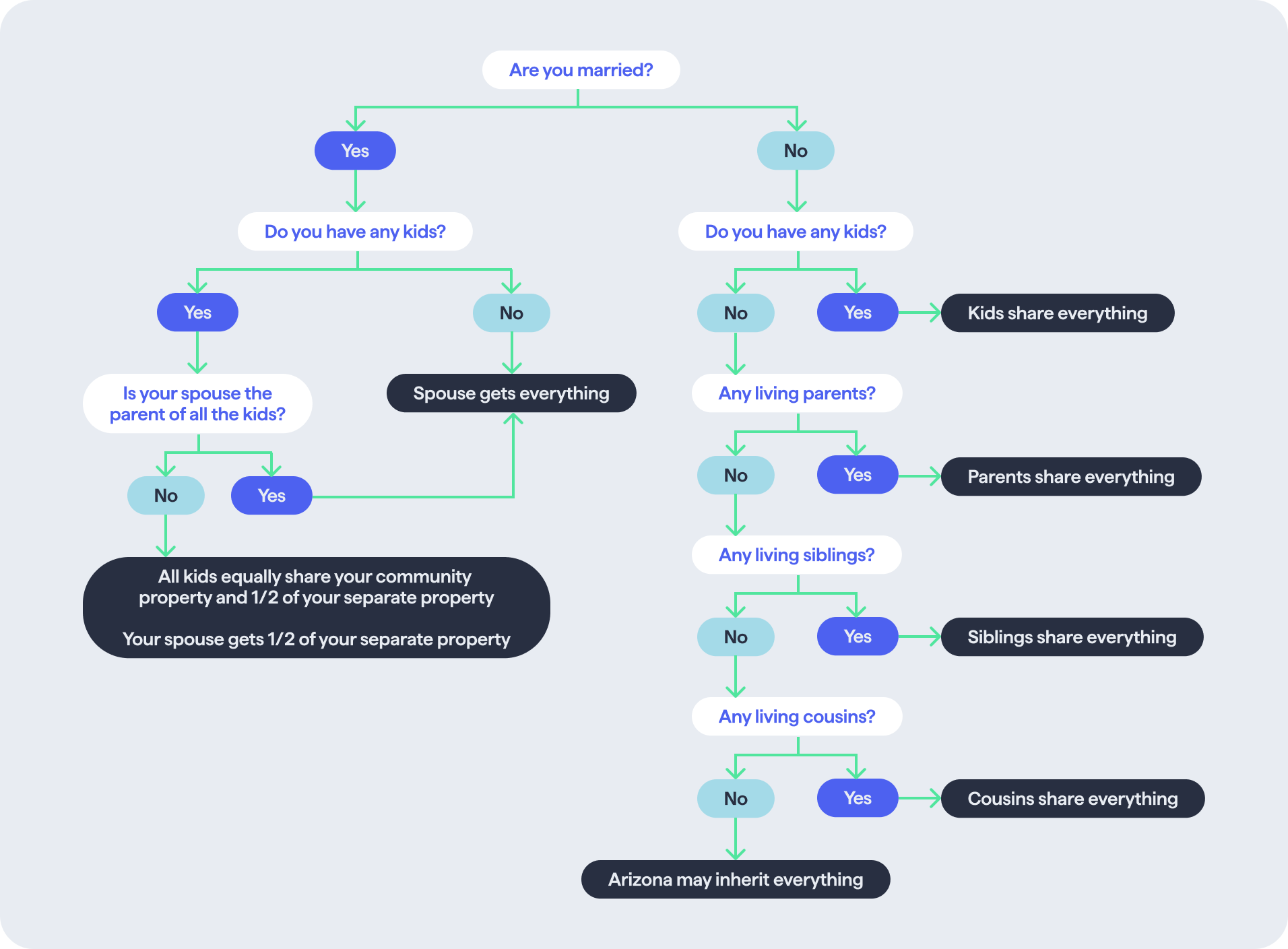

Intestate succession in Arizona