Think Advisor

•

Feb 26, 2025

Vanilla Appoints Marketing Head and Chief of Staff

Vanilla, the estate planning technology provider, has appointed a new chief marketing officer, Joe Abbott, as well as a new chief of staff and vice president of operations, Hanna Grokenberger Byers. The executive appointments come a few weeks after Vanilla closed its fiscal year with nearly 300% year-over-year platform growth, surpassing 15,000 client estates, and some eight months after it secured $35 million in additional capital led by Insight Partners and new strategic investors Edward Jones Ventures, Nationwide and Allianz. “Bringing in experienced startup operators like Joe and Hanna is a critical part of further accelerating business momentum,”...

Citywire RIA

•

Jan 27, 2025

Vanilla rolls out AI assistant

V/AI Copilot gives advisors new capabilities, including one-page summaries of client estate planning documents and answers questions about those documents. Estate planning technology startup Vanilla has launched an artificial intelligence-driven assistant as part of its platform, marking a new step in the broader race to implement AI into wealth management tech. The assistant, dubbed V/AI Copilot, gives advisors the ability to generate one-page summaries of details from client estate planning documents, answers specific questions about those documents and can be used for overall guidance and planning for working with clients. Vanilla chief technology officer Amjad Hussain said...

ThinkAdvisor

•

Dec 12, 2024

Meet the 2024 Luminaries Winners

ThinkAdvisor is pleased to announce the winners of the 2024 Luminaries Awards, who were acknowledged on stage Wednesday at the Fontainebleau Las Vegas. This year’s Luminaries Awards gala was staged in cooperation with the 16th edition of The MarketCounsel Summit, held Dec. 9-11 at the Fontainebleau Las Vegas. The popular wealth management event, led by MarketCounsel CEO Brian Hamburger, serves as the industry’s yearly capstone event. The Luminaries Awards showcase excellence in financial services and spotlight innovative contributions from both firms and individuals. From a large group of nominations, 85 winners were selected from 242 finalist organizations for...

Insurance News Net

•

Dec 01, 2024

The role of life insurance in estate planning and wealth transfer

Life insurance has long played a crucial role in estate planning and wealth transfer. Its evolution has addressed two primary challenges: creating an estate when liquidity is insufficient to support the needs of an insured’s survivors and preserving an estate in the face of illiquidity, which may occur in large estates or business succession scenarios. Life insurance traditionally was viewed mainly as a tool for providing death benefits. Today, it has expanded far beyond this original purpose. It is now often leveraged for its tax advantages, even when there isn’t a significant need for insurance coverage. This expanded role...

Investment News

•

Nov 26, 2024

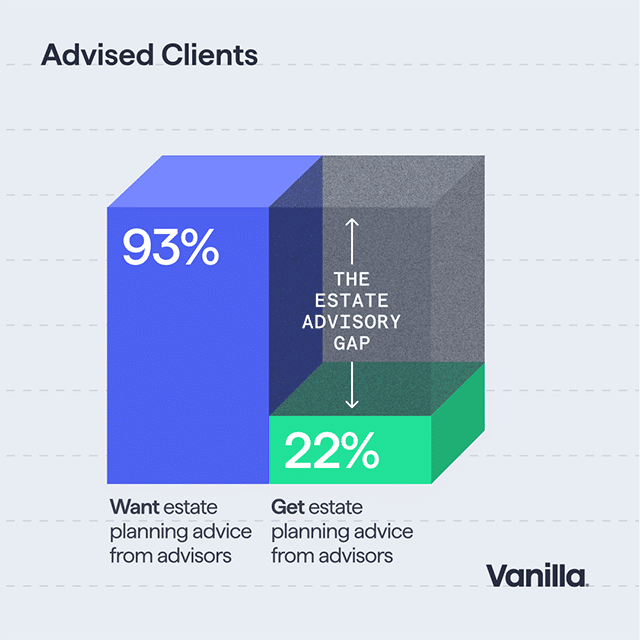

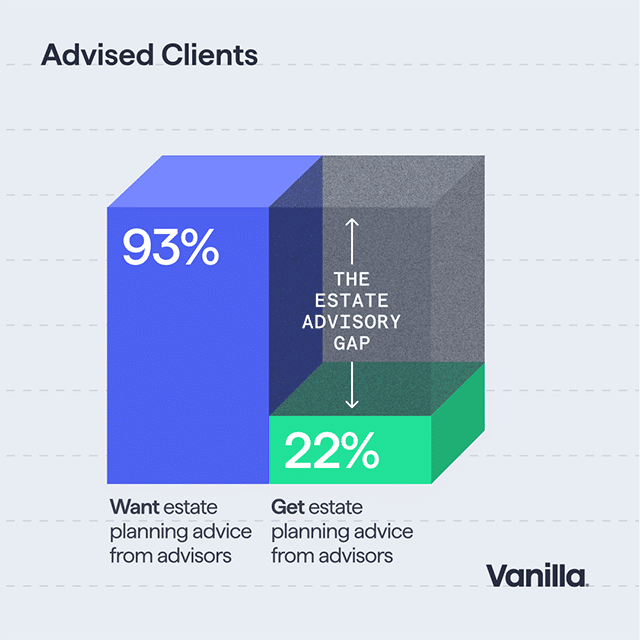

Advisors at a disadvantage if estate planning isn’t a core service

Advisors who aren’t prioritizing estate planning as a core service offering might be doing themselves a disservice, a recent report from Vanilla has found. Vanilla’s second annual State of Estate Planning report revealed an overwhelming 93 percent of people said it’s important to discuss estate plans with loved ones, with 80 percent expecting estate planning support from their advisor. “If you're an advisor who's not offering this, I think you're at a huge disadvantage when you're competing for business, and we see that play out in the data,” said Gene Farrell, CEO of Vanilla, an estate planning platform....

CityWire

•

Nov 19, 2024

Estate planning now an expectation among advisor clients

High taxes, the integration of artificial intelligence (AI) and tensions with the next generation of heirs remain front of mind for consumers when it comes to estate planning. Those were some of the main takeaways from estate planning technology startup Vanilla’s 2025 ‘State of Estate Planning Report,’ in which the company surveyed 1,000 consumers nationwide. The survey asked respondents to evaluate their stance toward various factors impacting their estate planning decisions along with their evaluation of advisors in that process. ‘In short, estate planning has become central to how clients manage their lives and legacy, not just their...

Wealth Management

•

Nov 19, 2024

Estate Planning Offerings are Quickly Becoming Table Stakes

Clients increasingly view estate planning as a core element of holistic wealth management, not just a one-time task, according to a survey from online estate planning platform Vanilla. ... The survey results imply a preference for advisory services that integrate estate planning into broader financial strategies, with concerns around taxes and complicated, often conflicting feelings about legacy driving more personalized and comprehensive estate strategies. [...] Read more: Estate Planning Offerings are Quickly Becoming Table Stakes [Wealth Management, David Lenok]

Fortune

•

Nov 18, 2024

Why millennials and Gen Z should have a basic estate plan

Though “estate planning” may bring to mind visions of rich families squabbling over the ancestral silver, it isn’t just for the wealthy or older people, financial planners say. It can be beneficial for families with more modest assets and 20- and 30-somethings, as well. The first time many people start considering creating an estate plan—which can include something as simple as crafting a will, to more complex maneuvers like establishing irrevocable trusts—is when they have children. That’s a good time to do so, says Jessica Majeski, wealth management advisor at Northwestern Mutual. But it can also make sense to...

ThinkAdvisor

•

Nov 14, 2024

There’s More to Estate Planning Than Tax Exemptions

Gene Farrell, the president and CEO of Vanilla, finds that media coverage of estate planning tends to focus almost exclusively on tax-savings strategies that apply to the ultra-wealthy. This is especially true in the current post-election environment, with many policy experts monitoring what will happen with the many provisions of the 2017 tax overhaul set to expire at the end of 2025 — including the historically high estate tax exemption for individuals and couples. The consensus is that the Republican Party’s control of Congress and the White House almost assures a long-term extension of the 2017 legislation, with...

Wealth Management

•

Oct 16, 2024

Vanilla Closes on $35M in Funding

Estate-planning platform provider Vanilla announced this week that it had closed a previously announced $35 million in additional funding. The funding round, which was previously announced in August without the exact amount, was led by returning investor Insight Partners, with contributions from Venrock, Vanguard, strategic investors Edward Jones Ventures, Nationwide and Allianz, and new investor Alumni Ventures. A note on the post said that it had been updated from August “to reflect new investors in the round” (Nationwide and Allianz were not present earlier). As announced in August, the funding will support growth, customer adoption and continued development...

Axios

•

Oct 16, 2024

Axios Exclusive: Estate planning startup Vanilla raises $35 million

Vanilla, which provides estate planning software for financial advisers and wealth management firms, has raised $35 million, CEO Gene Farrell tells Axios exclusively. Why it matters: More than $80 trillion in assets will be handed down through the great wealth transfer, but only about a third of Americans have an estate plan. How it works: Vanilla's platform enables financial advisers to create new estate plans for clients who don't have them, review and update existing plans, and analyze and optimize taxes for those with more complex needs. It uses AI to ingest existing client documents and extract information...

WealthTech Today

•

Aug 30, 2024

The $59 Trillion Question: How Vanilla Plans to Leverage New Funding Round to...

The wealth management industry faces a seismic shift. A staggering $59 trillion wealth transfer looms on the horizon, promising to reshape the landscape of estate planning. Meanwhile, technology stands ready to modernize this traditionally paper-heavy process. Enter Vanilla. This newcomer to the estate planning software arena has just secured a significant round of funding. Their move underscores a growing appetite for innovation in a sector long dominated by conventional methods. I recently sat down with Gene Farrell, CEO of Vanilla, to discuss the company’s latest fundraising efforts and their vision for the future. Our conversation painted a picture of...

Investment News

•

Aug 15, 2024

Estate wealth tech platform Vanilla gets a boost from Edward Jones

Estate planning software company Vanilla has closed a new funding round to expand its platform and accelerate adoption among financial advisors. The fintech provider’s latest funding round, which also includes Alumni Ventures and Vanguard, will support its continued growth and AI push. [...] Read more: Estate wealth tech platform Vanilla gets a boost from Edward Jones [Leo Almazora, Investment News]

ThinkAdvisor

•

Aug 15, 2024

Vanilla Estate Planning Platform Wins Backing From Edward Jones

Vanilla has gained a new strategic investor in Edward Jones Ventures, a recently launched venture capital program aimed at finding new areas of growth for the firm via partnerships. The estate planning platform provider has also announced new fundraising led by returning investor Insight Partners, alongside contributions from Venrock, Vanguard and other previous investors. Vanilla is also working with new investor Alumni Ventures. In addition to supporting growth goals and customer adoption, the company will use the funding to expand its platform, including its embedded artificial intelligence capabilities. Vanilla’s core goal remains modernizing how financial advisors and estate...

Wealth Management

•

Aug 09, 2024

Securing Legacies During Market Turbulence

As financial advisors, we’re no strangers to the roller coaster of market volatility. This week's sell-off is a stark reminder of how quickly market conditions can change and the need for proactive planning. Amidst this turbulence, estate planning is one area where advisors can truly add value. This often-overlooked aspect of financial planning becomes crucial when markets are volatile, offering unique opportunities to secure your clients’ legacies and provide them peace of mind. FOMO is real, and missing out can also be expensive. During periods of extreme market volatility, advisors should consider certain estate planning opportunities that are (almost) too...

Kiplinger

•

Aug 08, 2024

How to Help Your Kids Inherit More Than Just Your Money

The transfer of wealth across generations has long been a complex and emotionally charged topic. Parents often struggle with balancing their desire to provide financial security for their children while ensuring this wealth does not diminish their drive, values or happiness. As an adviser specializing in wealth transfer and focused on the impact of wealth, I have observed the profound effects that money can have on individuals and families. Most parents I know emphasize the importance of passing on not just financial assets but also values, principles and a sense of purpose to ensure the well-being and happiness of future...

Wealth Management

•

Jul 29, 2024

Steve Lockshin’s Vanilla Relaunches Vanilla Academy

Estate advisory platform Vanilla announced the relaunch of education-focused Vanilla Academy on Monday. The revamped educational platform will feature multimedia content ranging from checklists to client-facing PowerPoint presentations to free, on-demand courses approved for continuing education credits. “One of the biggest obstacles to getting advisors into estate planning is education.” Vanilla Director of Content Marketing Dan Brockley said. “We’re trying to give advisors the information they need to engage in estate planning conversations more confidently and comfortably.” Vanilla Academy’s content, which will initially be free with sign-up for advisors (though in the future, some courses will be...

Investment News

•

Jul 29, 2024

Vanilla boosts advisor support with education platform reboot

Vanilla, the estate planning-focused fintech provider, is helping to raise the bar on estate planning across the wealth space as it revives a key advisor education initiative. The fintech firm is doubling down on its mission to raise estate planning awareness with the relaunch of its learning program, Vanilla Academy. [...] Read more: Vanilla boosts advisor support with education platform reboot [Leo Almazora, Investment News]

Financial Planning

•

Jul 25, 2024

How financial advisors can serve clients diagnosed with dementia

Financial Planning as published an article written by Daniel Brockley, head of content at Vanilla, on the crucial role financial advisors can play in helping clients and their families navigate the challenges of dementia. Drawing from personal experience, Daniel writes: "Financial planning is a game of 'what if.' We plan for fluctuations in the market, for business buying and selling, for education, for retirement — even for premature death. But one scenario we tend to overlook, maybe because it’s so utterly painful to consider, even harder than the idea of death for many, is dementia. And it’s an...

Wealth Management

•

May 30, 2024

The Estate Tech Revolution Is Picking Up Speed

One of the growing trends in the financial advice industry is advisors talking (and for the most part, just that) about leveraging estate planning to both add value for current clients and to create stronger connections with their families (aka potential future clients). In response, the past few years have seen several tech companies (largely founded by financial professionals) create products to facilitate the estate planning process for clients, advisors or both... [...] Steve Lockshin’s Vanilla, after unveiling its fully integrated estate advisor platform in mid-2023, then announced its own partnership with Vanguard in January of this year after a successful...

etf.com

•

May 15, 2024

What Wealthy Clients Want From Advisors

Most financial advisors are in constant pursuit of wealthy clients, but they might not fully understand what it takes to land and keep high-net-worth clients. With that in mind, etf.com spoke with an advisor who specializes in working with wealthy families and individuals. Steve Lockshin is a principal of Los Angeles-based AdvicePeriod, a Mariner Wealth Advisors company, and a co-founder of Vanilla, the estate advisory platform. Jeff Benjamin: How do you gain access to high-net-worth prospects? Steve Lockshin: It's hard to break in. I would become an expert at something ultra-high-net-worth people need and want. Aviation, estate...

FPA New England

•

May 14, 2024

Estate Management and Legacy Building with Vanilla’s Jim Sinai

Host Brad Wright is joined by Jim Sinai. Jim is Chief Marketing Officer at Vanilla, the Estate advisory platform designed to transform how wealth advisors help their clients manage their estate and build their legacy. Jim is a seasoned cloud executive and experienced marketer, with a background in sales, business development, and a passion for new technology, telling the story and helping make complex software easy to understand. Jim is also a former college rugby player, at Brown. They discuss: Adding estate planning software to an advisor’s arsenal How it integrates with performance and tax planning software, as well as...

Kiplinger

•

Apr 30, 2024

A Letter of Wishes: No Legal Power But Powerful Nonetheless

Over the years, I’ve seen many estate plans that have been well crafted and tax-optimized fail when it comes to the one thing that matters most: leaving heirs better off for their inheritance. Contributing to this is poor or little guidance for the trustees and little thought given to the damage that sudden wealth can cause. You need not look further than the statistics of lottery winners to see the failures caused by unexpected and rapid access to money. What do you want to achieve with what you leave behind? And how can you prepare your trustees and...

Wealth Management

•

Apr 29, 2024

Celebrity Estates: Steve Lockshin on Len Bias and NIL Deals in Estate Planning

Len Bias was a star basketball player at the University of Maryland drafted by the Boston Celtics in 1986 and one step away from becoming a pro athlete. Unfortunately, he passed away just two days after being selected but before signing any MBS or sponsorship documents, leaving him and his family just out of reach of the riches he would have gotten due to the timing of his death. With host David Lenok and special guest Steve Lockshin, founder of AdvicePeriod and a co-founder of Vanilla, an estate planning advisory platform, they unravel the nuances surrounding name, image and...

The WealthStack Podcast

•

Apr 26, 2024

The WealthStack Podcast: Why Estate Planning Is the Next Frontier of Wealth Management...

Is estate planning the next frontier of wealth management? Estate planning solutions are becoming steadily more popular with advisors, especially those seeking to differentiate their services. As clients become increasingly aware of the complexities of wealth transfer, asset protection and legacy planning, they expect comprehensive guidance from their advisors. By using estate planning tools, advisors can offer a holistic approach to wealth management, addressing not only investment strategies but also the essential aspects of estate distribution and tax implications. In this episode, Shannon Rosic, director of WealthStack content and solutions, speaks with Gene Farrell, CEO of Vanilla, about the...

Investment News

•

Apr 24, 2024

Tech firm Vanilla sweetens its estate planning platform

Vanilla, a leading estate planning software provider, has enhanced a key piece of its platform to provide a better experience for advisor users. At the firm’s biannual virtual event, Legacy Now, the financial advisors, attorneys, and planners in attendance became the first to know about the new features for its Vanilla Document Builder. The expanded features within the Vanilla Estate Advisory Platform include the ability to directly get in touch with top legal experts through an attorney engagement package. That offering is being launched in partnership with Accelerant Law, who will work directly with clients to build plans...

Financial Planning

•

Apr 11, 2024

To be indispensable, advisors must expand their estate planning playbook

In my 30-plus years of experience as an financial advisor, I’ve delivered impactful service not by simply focusing on maximizing investment performance, but by considering approaches that improve and protect the well-being of my clients and their families on a more human level. My most important objectives as an advisor are ensuring that my clients sleep well at night, safe in the knowledge they are in good hands; helping them to meet their financial goals; and ensuring their experience is such that they can wholeheartedly say they are glad they met us. Advisors who want to ensure that those...

USA Today

•

Apr 03, 2024

Facing mortality, more Americans wrote wills during the pandemic. Now, they’re opting out

Fewer of us are writing wills, a new survey says, a finding that suggests Americans are worrying less about mortality as the pandemic fades. [...] A downturn in wills could be bad news for survivors. [...] Someone who dies without a will might leave big questions unanswered: Who cares for a child? Who gets the family home? Some assets are tricky to divide among multiple heirs. “People with children should probably have a will. People with minor children should probably have a will, just to determine who will take care of them,” said Gal Wettstein, a...

ThinkAdvisor

•

Mar 13, 2024

Vanilla Rolls Out Estate Plan Visualizer

Vanilla announced Wednesday the launch of a new estate plan visualization and evaluation tool called Vanilla Scenarios. The tool enables advisors to visualize potential federal and state estate tax mitigation strategies in real time, according to the firm’s announcement. Advisors can layer multiple strategies onto existing plans and customize the details of each strategy, including changes to their client’s state of residency or beneficiaries. This approach to modeling allows advisors to showcase the potential impact of each scenario, the firm explains, providing clients with actionable insight and recommendations for meaningful planning improvements. [...] Read more: Vanilla Rolls...

CityWire

•

Mar 12, 2024

Vanilla launches new estate modeling software

Estate planning tech firm Vanilla today launched its new planning software, making it available to clients for the first time, the firm said. The new software, called Vanilla Scenarios, will allow advisors and estate lawyers to model different estate planning strategies for their clients to help them see the implications of those strategies in real time. Scenarios will allow customers to layer a Grantor Retained Annuity Trust (GRAT), a Spousal Lifetime Access Trust (SLAT), an Irrevocable Life Insurance Trust (ILIT) and a Qualified Personal Residential Trust (QPRT) over a client’s existing estate plan, allowing them to make more...

Investment News

•

Mar 12, 2024

Tech provider Vanilla unveils estate planning scenarios tool

Estate planning technology firm Vanilla is looking to shake up the wealth landscape with a new planning visualization tool. The platform's latest offering, Vanilla Scenarios, seeks to modernize how advisors, wealth planners, and estate lawyers plan and optimize their clients' estate strategies. [...] Read more: Tech provider Vanilla unveils estate planning scenarios tool [Leo Almazora, Investment News]

ThinkAdvisor

•

Feb 23, 2024

Estate Planning Is ‘The Next Frontier’ for Advisors: Steve Lockshin

Estate planning is moving to the forefront of the consumer’s mind,” says Steve Lockshin, the founder of the estate planning platform Vanilla. His goal is to move it to the forefront of the financial advisor’s mind. In a recent interview with ThinkAdvisor, the AdvicePeriod co-founder and principal argues that estate planning is “the next frontier. This is true for anybody who has any wealth at all.” Lockshin, an early champion of high tech for advisors, discusses why he thinks estate planning will become “a staple” with financial advisors and why it is “an important family security issue.”...

Vanguard Pressroom

•

Jan 18, 2024

Vanguard Introduces Enhanced Digital Estate Planning Tools to Investors Through Partnership with Vanilla

Vanguard is introducing new and enhanced intergenerational wealth and legacy planning capabilities through a partnership with Vanilla, an innovative provider of digital estate planning tools and solutions. The offer was successfully piloted to a small cohort of eligible advised clients in Vanguard Personal Advisor Wealth Management over the past year and will scale to provide ultra-high-net-worth Vanguard investors with a powerful visualized approach to help manage and achieve their current and future estate planning objectives. [...] Read the full article here: Vanguard Introduces Enhanced Digital Estate Planning Tools to Investors Through Partnership with Vanilla [Pressroom, Vanguard]

SHIFT with Ross Marino [Podcast]

•

Jan 05, 2024

Preventing Trust Fund Monsters with Steve Lockshin

Steve Lockshin joins Ross Marino on advising high level investors on their retirement plans and preventing "trust fund monsters." [...] Listen to the full episode here: Preventing Trust Fund Monsters with Steve Lockshin [SHIFT with Ross Marino]

The Diamond Podcast for Financial Advisors

•

Dec 14, 2023

Barron’s Top Advisor and Industry Visionary Steve Lockshin: Lessons from the Life of...

Steve Lockshin, founder of Vanilla, AdvicePeriod, and others, offers a unique perspective on how an advisor’s entrepreneurial DNA can drive their ability to serve clients and grow untethered, particularly in the independent space. Many advisors often face an unfortunate truth: The decision-makers at a firm often know very little about being an actual financial advisor. Steve Lockshin has sat on both sides of the proverbial table, and he shares two unique vantage points: The perspective of an advisor who recognizes the limitations at his current firm and the entrepreneur and problem solver who fills those gaps with new solutions....

Investment News

•

Oct 20, 2023

Estate planning gets an AI makeover thanks to Vanilla

Artificial intelligence is certain to change how financial advisors and wealth managers operate, with many applications streamlining and accelerating processes. Estate planning solutions firm Vanilla is aiming to leverage the power of AI to speed up everyday tasks such as turning estate documents into diagrams, creating projections for federal and state-specific estate tax, and beneficiary summaries. Using its own purpose-built AI model called VAI, the firm’s newly launched suite of tools will assist advisors in understanding the unique circumstances and issues for high-net-worth families. This will include identifying planning opportunities to help advisors stay ahead of the curve....

CityWire

•

Oct 19, 2023

Vanilla unveils AI estate planning tools for advisors

Estate planning software provider Vanilla on Thursday revealed the launch of a suite of artificial intelligence (AI)-powered resources, which the company says will save advisors time when navigating potentially complicated estate issues. The new tools, the company says, will use AI to assess family structures and tax implications, both to provide more well rounded planning strategies and to produce graphics to help clients better understand their situation. ‘We’re proud to introduce comprehensive, tech-forward solutions that make it easy for wealth planners and advisors to deliver proactive planning advice to clients at enterprise scale,’ stated Gene Farrell, Vanilla’s chief...

Forbes

•

Sep 18, 2023

Why Modern Wealth Management Must Include Estate Planning

You’re not your grandfather’s financial advisor. The remit of advisors has been forced to adapt to a changing world and new client needs. This seismic shift, from a laser focus on assets directly under an advisor’s management to a holistic approach to monitoring wealth, is one that has benefited everyone, client and advisor alike. For the clients, the appeal is clear. They stand to gain more and feel safer when their wealth as a whole is being monitored and balanced by skilled professionals. And for advisors, the new approach allows them to serve their clients better and to develop deeper...

Financial Planning

•

Sep 07, 2023

Study reveals UHNW fears in estate planning

While most Americans worry about having enough to leave behind, a new study finds that the ultrarich fear leaving too much behind and feeding "trust fund monsters." Estate planning wealthtech firm Vanilla, which is backed by investors including Michael Jordan, published a report on Thursday that dives into the motivations and fears driving Americans at all wealth levels in legacy planning. The report examines attitudes and behaviors in Americans with less affluence, reporting under $1 million of household net worth, as well as those in the high net worth and ultrahigh net worth spheres. Overall, respondents said they...

WealthTech Today [Podcast]

•

Sep 07, 2023

The Evolution of Estate Planning: A Conversation with Steve Lockshin, Vanilla

You’re listening to Episode 201 of the WealthTech Today podcast. I’m your host, Craig Iskowitz, founder of Ezra Group Consulting. This podcast features interviews, news and analysis on the trends and best practices, all about wealth management technology. My guest for this episode is one of the most well known leaders in the industry, Steve Lockshin. Steve is a serial entrepreneur in the wealth advisory industry. He’s a principal of RIA AdvicePeriod and co founder of Vanilla, a software platform for estate advisory and that’s what we’ll be talking about today, the estate planning software provider called Vanilla that...

Rethinking65

•

Aug 31, 2023

How Total Wealth Advisors Differentiate with Estate Planning and Insurance

At a recent conference, the speaker asked the audience of advisors, “Who in the room thinks they are smarter or a better investor than the people they are sitting next to?” A few bold people put their hands up, but most did not. Why? Because everyone in the room knows that beating the market consistently over a long period of time comes down to just luck. While clients would love to receive market-beating advice, no self-respecting advisor would try to win over clients by claiming to be exceptionally lucky. So, if investing and beating the market is not the...

ThinkAdvisor

•

May 22, 2023

Act Now to Avoid Estate Planning Logjam in 2025

Clients with sufficient wealth to leave them exposed to future estate tax burdens need to understand that the time to act on the generous estate tax exemption established in 2017 by the Tax Cuts and Jobs Act is now — not when the expanded exemption sunsets the end of 2025. In fact, according to Steve Lockshin, an experienced financial advisor and the founder of AdvicePeriod and Vanilla, it is already becoming more and more difficult to timely source the capabilities of specialist tax planning experts and estate attorneys who understand the rapidly evolving needs of high-net-worth and ultra-high-net-worth clients....

Wealth Management

•

May 15, 2023

The Rise of the ‘Estate Advisor’

Move over estate planners, it’s time for "estate advisors" to take the lead. At least that's what Steve Lockshin and Vanilla hope. Estate planning tech leader Vanilla announced Tuesday the launch of what it calls the first fully integrated estate planning platform—The Vanilla Estate Advisory Platform. The product purports to offer advisors visualizations of the estate, beneficiary summary and projections, estate tax projections, a dynamic balance sheet integrated with the leading personal finance management tools and an on-demand report builder. Vanilla also offers estate-planning educational resources for both clients and advisors as part of its "Vanilla Academy." ...

AdvisorHub

•

Dec 15, 2022

Advisor Launches Startup That’s Anything but Just Vanilla

Steve Lockshin knew early on in his career as an advisor that he was, what he now terms “a Cassandra.” He saw future trends in the financial services industry before they happened, which is, in part, a definition for the metaphor originating from Greek mythology. Lockshin started creating businesses two decades ago, which he typically would sell to the highest bidder before going back to the drawing board to create another company. As an advisor who happens to be a serial entrepreneur, Lockshin might still be following the same successful pattern had he not created a startup that ultimately...

Wealth Management

•

Jan 05, 2022

Steve Lockshin’s Vanilla Adds CEO, CTO

Digital estate planning software developer Vanilla has added three new executives to its team as it seeks to grow its user base of advisors, according to an announcement. Former Smartsheet strategy and product executive Gene Farrell is joining Vanilla as chief executive officer, where he will be work alongside ex-Amazon Web Services (AWS) executive Amjad Hussain, who joins Vanilla as chief technology officer, and ex-Addepar executive Robin Melnick, Vanilla’s new senior vice president of revenue. The C-suite hires signal a new chapter for the firm, founded by Steve Lockshin in 2019. Farrell will formally lead the firm, reporting to...

Wealth Management

•

Sep 22, 2021

Michael Jordan’s First Direct Fintech Investment Is in Estate Planning

It was a routine call for Vanilla founder Steve Lockshin. He was talking with the head of the family office for one of his highest-profile clients, a billionaire known around the globe. During the call, Lockshin mentioned he was doing a capital raise for his estate planning startup and on the spot he had two additional investors. NBA legend Michael Jordan, who has worked with Lockshin for 25 years, was so impressed with the advice and leadership he received from Lockshin, that he decided to make his first direct fintech investment in Vanilla. He joined Curtis Polk, Jordan’s family office...