John Costello

•

Mar 12, 2024

Vanilla Unveils Vanilla Scenarios™ to Power Interactive Estate Planning and Modeling

Vanilla Scenarios provides advisors and estate strategists with powerful planning tools to identify planning gaps, visualize future projections, and optimize plans for maximum impact. Vanilla, a leading provider of innovative estate planning software, today announced the availability of Vanilla Scenarios™, a powerful new tool designed to optimize clients' estate plans for the future. Vanilla Scenarios modernizes estate planning by providing advisors, wealth planners, and estate lawyers with unparalleled capabilities to model multiple planning scenarios dynamically and in real-time. Advisors can effortlessly layer multiple strategies onto existing plans and customize the details of each strategy, including changes to their client’s state...

Vanilla

•

Feb 12, 2024

Vanilla’s new features for February – detailed projections, collaborative onboarding, charitable calculations

February is a short month, but that doesn’t mean we’re short on new features. The Vanilla team has been working hard and are excited to bring three high-impact new features in February: Enhanced Projections Collaborative Onboarding Auto-calculations for Charitable Gifts Let's dive in. Visualize the future value of an estate with the new Projections Wealth advisors play a crucial role in helping their clients understand the full picture of their wealth both today and in the future. Generalized financial planning tools are helpful for understanding how assets grow and fall over time. But they fall short when it comes to...

John Costello

•

Jan 23, 2024

Vanilla Launches AI-Powered Estate Planning Assistant and Expanded Document Builder Capabilities

New AI assistant VAI Chat helps advisors with estate planning concepts; streamlined document creation gives clients a modern estate planning experience Vanilla, a leading provider of innovative estate planning software, today announced new additions to its platform, including VAI Chat, Collaborative Onboarding, and the expanded availability of Vanilla Document Builder™. VAI Chat is an AI-powered assistant designed to simplify the estate planning experience for wealth planners, advisors, and their clients. Currently in beta, VAI Chat offers an intuitive chat experience in the Vanilla platform, answering practical estate planning questions sourced from a curated corpus of estate planning content. Its capabilities...

Vanilla

•

Dec 29, 2023

2024 IRS Updates to Inflation-Adjusted Numbers for Estate Planning

Welcome to 2024! It's a new year which means higher inflation-adjusted exemptions. Accordingly, we have updated the Vanilla Estate Advisory Platform with the newest inflation-adjusted estate planning figures recently released by the IRS. This will enable advisors to accurately project the growth of clients’ estates and strategize on trust structures, gifting, tax mitigation and more. Source: IRS.gov Federal Estate Tax Exemption The federal estate tax exemption has increased from $12.92M to $13.61M per individual (or $27.22M per married couple). For advisors whose clients have taxable estates, it’s important to note that estate tax exemptions are “unified”. This means that if...

Vanilla

•

Dec 04, 2023

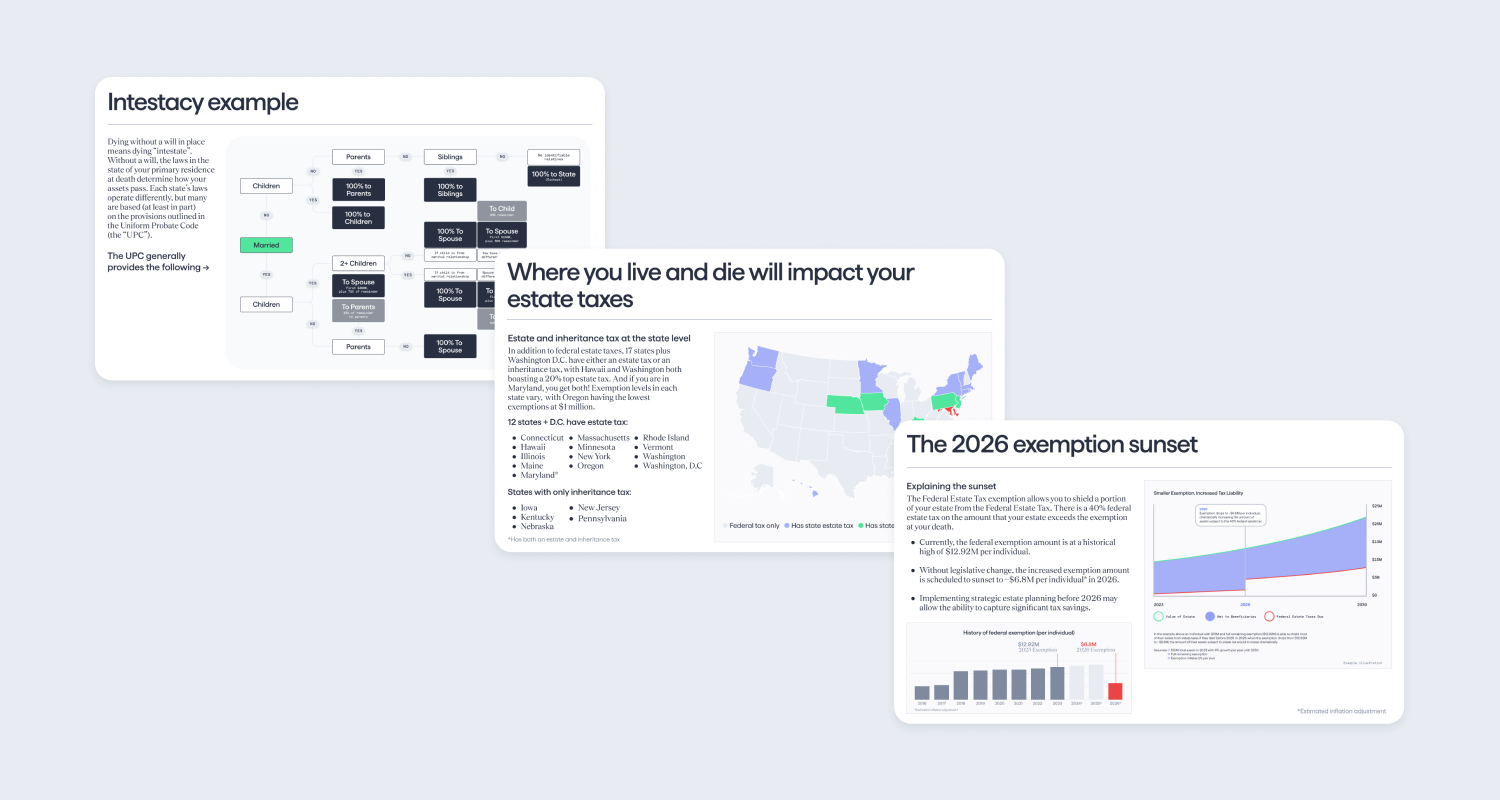

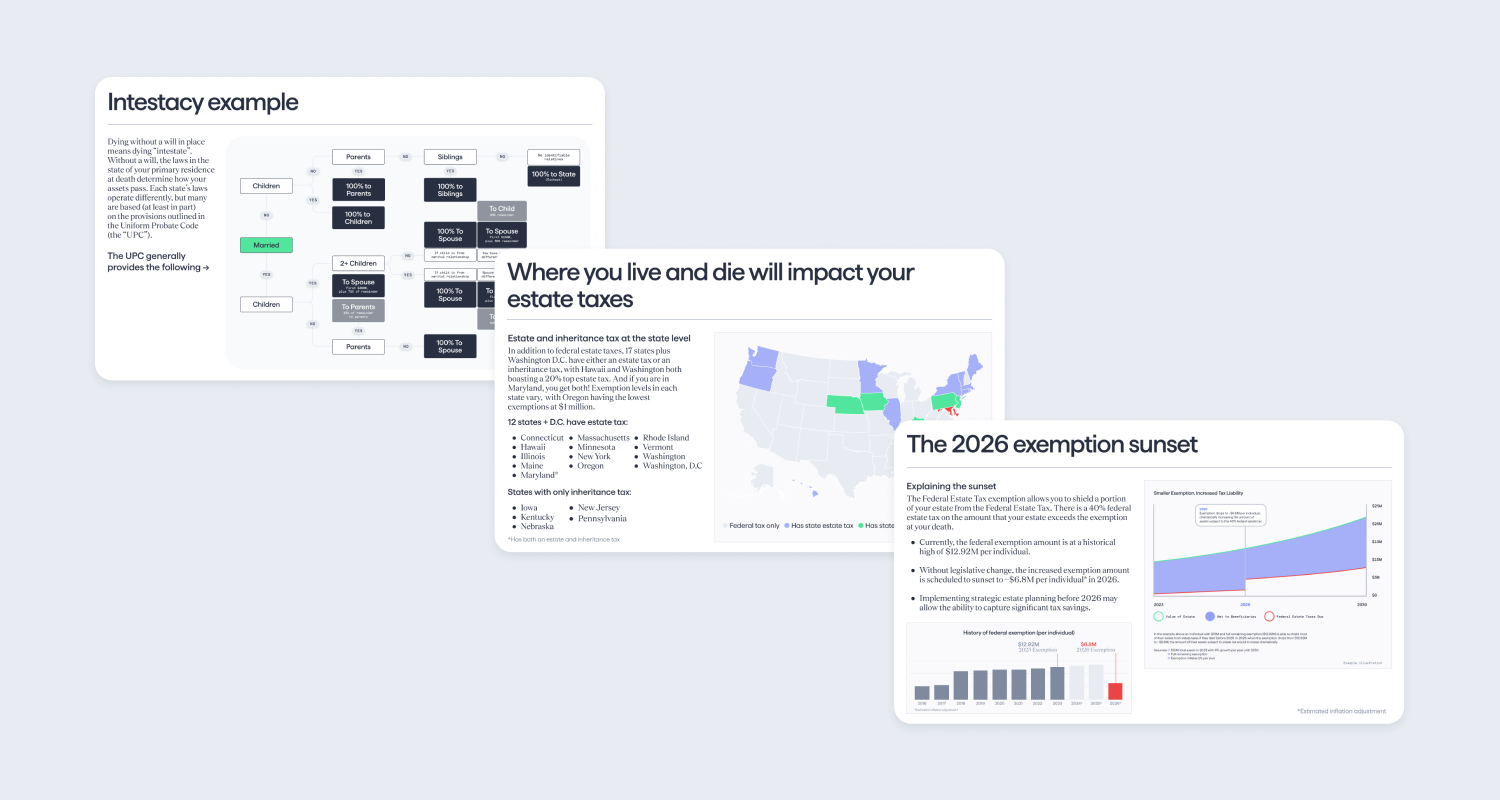

New educational pages and enhancements for Vanilla reports

If there’s one thing we all agree on here at Vanilla it’s that estate planning matters, a lot. But not every client understands just how important estate planning is. Proper estate planning ensures the preservation of wealth – and its intended purpose for clients and their families. The best planning keeps a client’s family secure, both while they’re alive and long after, whereas improper or lack of planning may expose a client to lengthy legal proceedings, unnecessary taxes, probate fees, and more. We know from advisors that clients need ongoing education to make the most informed decisions for their estate...

Amjad Hussain

•

Oct 19, 2023

New Vanilla innovations accelerate customers’ ability to deliver Estate Advisory

When we launched the Vanilla Estate Advisory Platform just over a year ago, we did so because we saw a problem without a solution. There was a deep need for a tool that enabled wealth advisors to help clients with their estate strategy as part of their holistic financial planning. Over the past year, our customers have not only used the Vanilla platform to grow their business and bring value to clients – they have helped us grow, too. We have worked hand in hand with our customers, from small RIAs to the largest enterprise firms to innovate and bring...

Vanilla

•

Aug 17, 2023

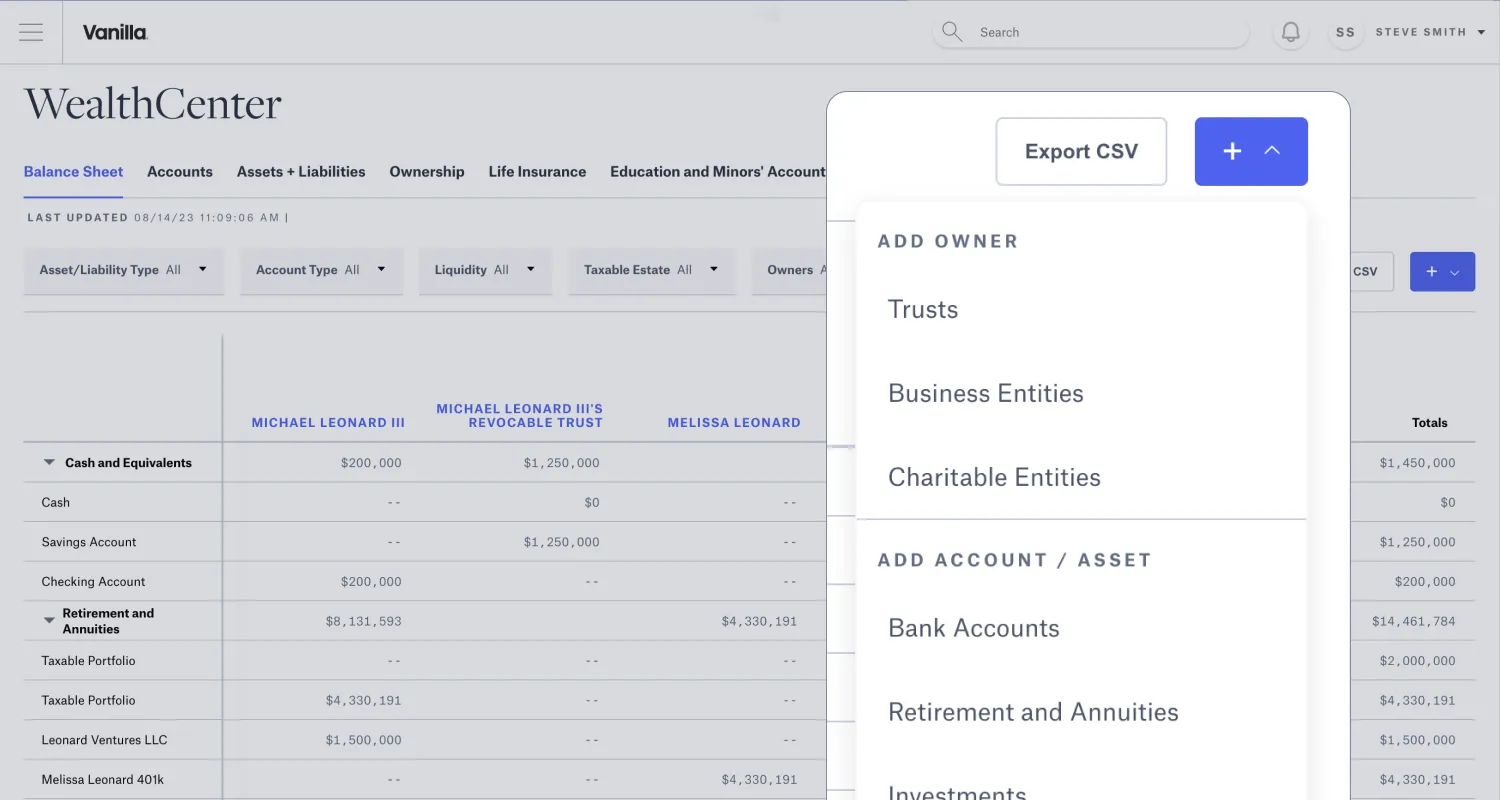

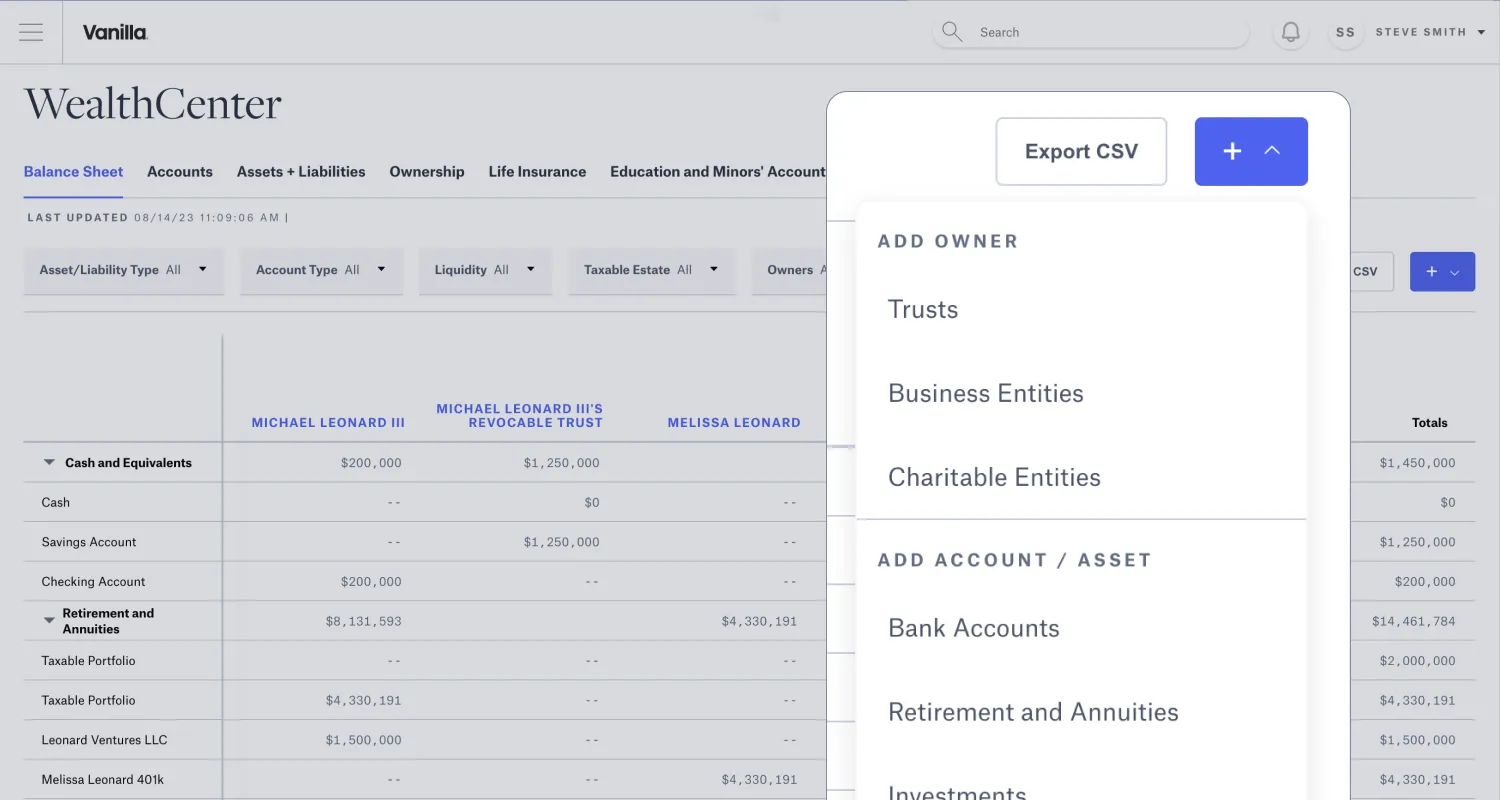

Accelerate client onboarding with the new Balance Sheet Builder

Today, we are launching a refreshed Balance Sheet Builder to help advisors bring client financial information into Vanilla more quickly. The new ownership-driven balance sheet makes it easier to enter client accounts and data. Instead of creating individual assets, entering a client’s information now begins at the account level through one centralized drop-down menu. New dynamic fly-outs for each account or asset type require minimal information to get set up which allows for a faster and more intuitive data entry process. Or if you’re using one of our integration partners, your client’s data will be reflected in the balance sheet...

Vanilla

•

Aug 08, 2023

Expedite the document abstraction process with ‘Request for Information’ notifications from Vanilla

Today, Vanilla is excited to release a new feature available during the document abstraction process. Advisors who use the Vanilla Document Abstraction Services will now receive in-app messages and e-mail notifications after submitting their client’s estate planning documents, if additional information is required. Additionally, advisors will receive a status update in Vanilla with detailed notes indicating exactly what is needed to finalize the abstraction submission. With more direct feedback between an advisor and Vanilla during the document review, advisors can onboard their clients onto the Vanilla platform faster, enhance communication, and speed up the document abstraction process for them and...

Vanilla

•

Jul 27, 2023

Quickly onboard clients and easily build customizable PDF reports

Build a more comprehensive balance sheet with new partner integration features Today, we are excited to announce several upgrades to our integrations with Black Diamond, Orion, and Addepar that enable advisors to import client financial data faster onto the Vanilla Estate Advisory Platform. With these new enhancements, an advisor can bring in more data from portfolio management systems to their client’s balance sheet for a more accurate representation of their estate. Advisors can select any number of clients in an estate to sync to a single Vanilla client profile when building out the balance sheet in the WealthCenter. Multiple clients'...