Category: Estate Planning

Madison Eubanks

•

Oct 24, 2024

An Intro to Revocable and Sub-Trusts for Estate Planning

A sub-trust, often created within a larger trust, is a type of estate planning tool that can allow you to customize how portions of your estate are managed and distributed to specific beneficiaries. They can add both flexibility and control to your plan, bringing peace of mind that your estate will be distributed according to your wishes and your beneficiaries will be cared for. Whether you want to set aside funds for minor children, protect a special needs beneficiary, or create tax-efficient structures, sub-trusts offer a tailored approach to address the unique needs of your family. In this blog post,...

Madison Eubanks

•

Sep 19, 2024

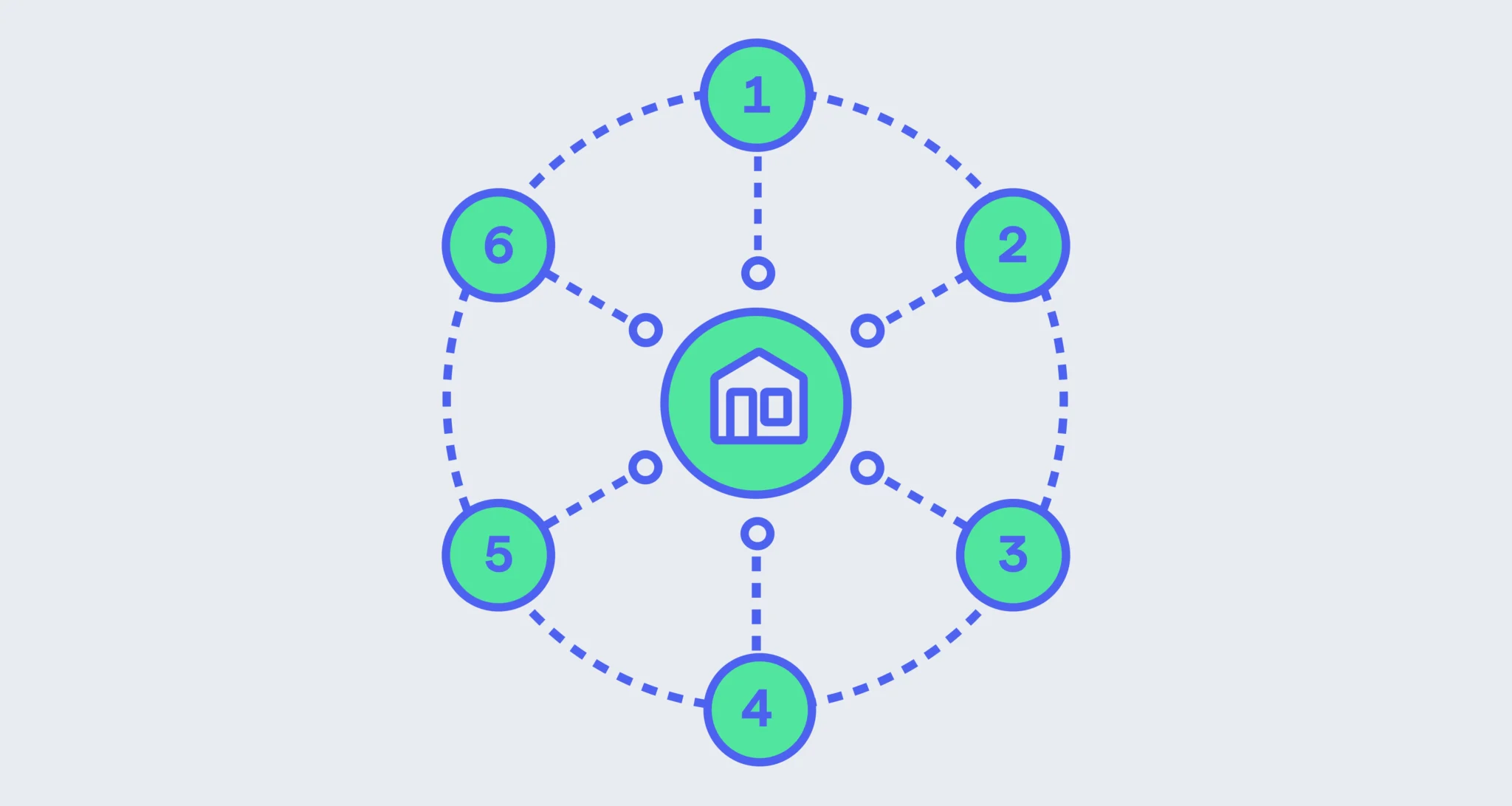

6 Estate Planning Scenarios: When to Use Which Strategy

Estate planning strategies are like tools in a toolbox: Different tools do different jobs. Deciding which estate planning strategies to employ depends on any number of personal factors including (but not limited to) marital status, level of wealth, whether or not someone has children, charitable inclination, liquidity, and many more. A savvy planner takes all these variables into account and chooses the most appropriate tool for a person’s situation, values, and goals. In this article, we provide fictional examples of when someone might use six different trust strategies, and illustrate how the right strategy can achieve their estate planning goals. ...

Madison Eubanks

•

Sep 10, 2024

What to Know About Gifting: Taxes, Returns, and Exclusions

For the ultra wealthy, a well-planned gifting strategy can be a great way to reduce the size of the taxable estate over time. However, various tax laws mean gifting isn’t always as straightforward as it may sound. When gifting, it’s important to understand annual and lifetime exclusions, when gifts must be reported to the IRS, and how to plan for tax exposure. Read on for a complete overview of gifting. For a deeper dive on gifting strategies, download the Vanilla Guide to Gifting here. Introduction to gifting In the eyes of the IRS, a gift is any property or assets...

Madison Eubanks

•

Aug 28, 2024

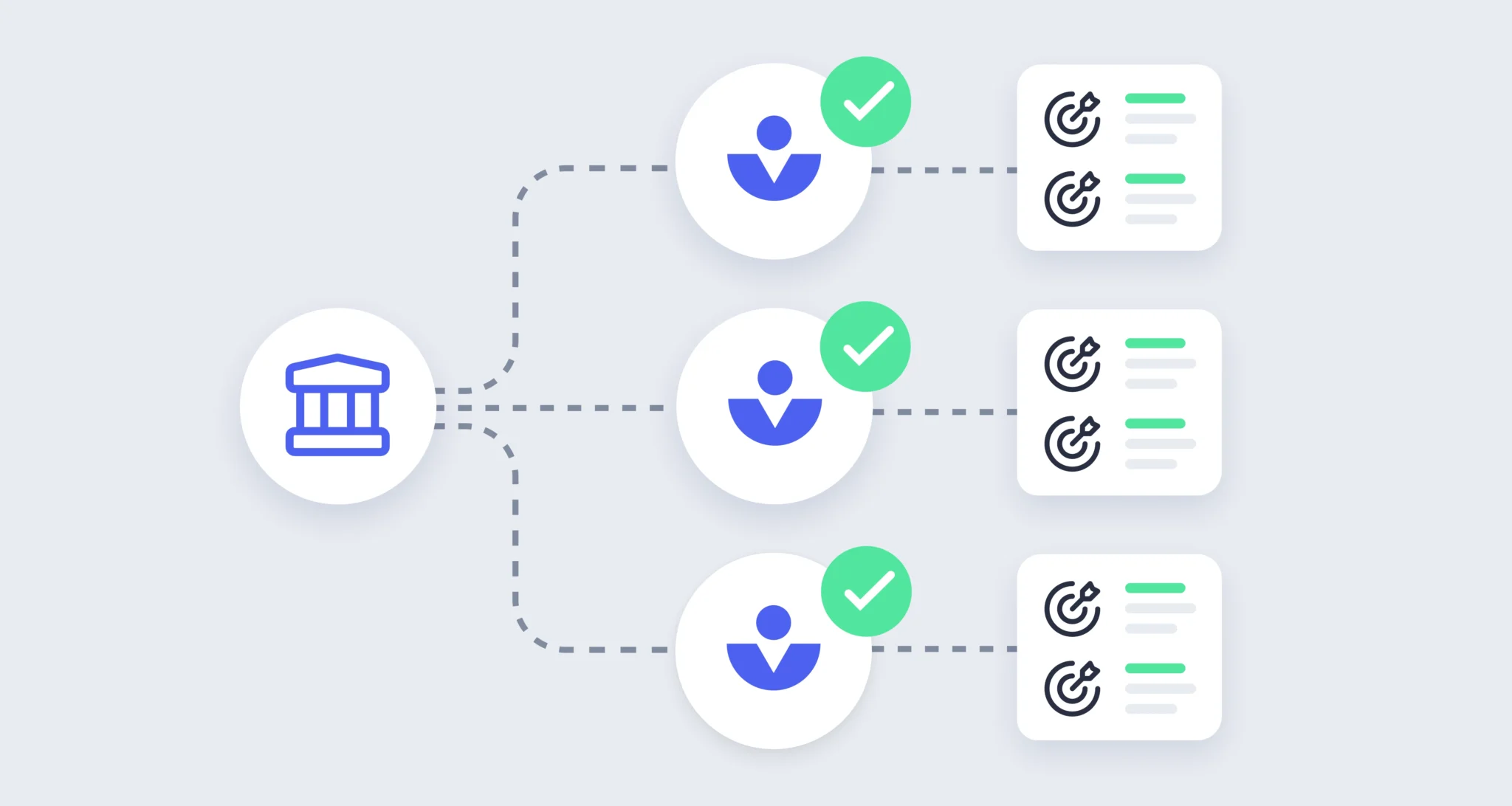

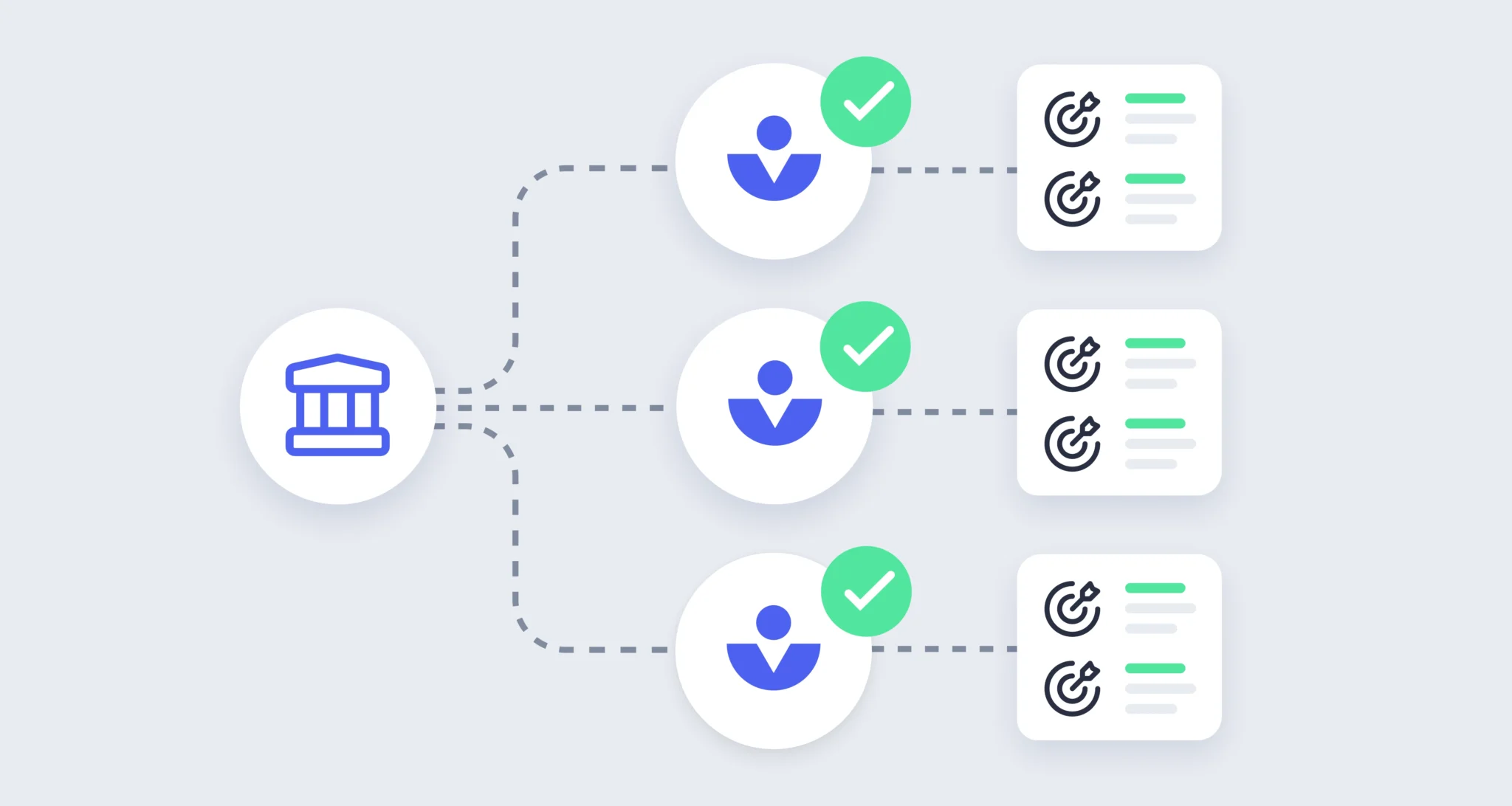

The 4 Hallmarks of Quality Estate Planning Documents Every Advisor Should Know

As a financial advisor, you don’t need to be an expert on estate planning documents. However, you do need enough foundational knowledge to understand what makes quality documents, to spot red flags, and ultimately to ensure your clients’ documents serve their long-term goals. Documents vary widely from client to client, with the complexity, density, and number of documents often increasing as wealth does. With so much nuance, how is an advisor to know what to look for in a client’s plan? Dana Foley, Founder and Partner at Accelerant Law, outlines the four hallmarks of quality estate planning documents that advisors...

Daniel Brockley

•

Aug 06, 2024

Estate Planning with Dementia: Grappling with the Fears and Unknowns

How to take back control with thoughtful financial and estate planning My dad has dementia. He survived stage-four esophageal cancer against every medical prediction, and then, just a couple years after his remission, his memory began to falter. It was hardly noticeable at first. Over a glass of wine, my mom confided in my brother and sister and me that she felt like something wasn’t right, that he wasn’t able to hold on to what they had just talked about or done. We didn’t see it, not at first. We listened to my mom and nodded along, but we all...

Vanilla

•

Aug 01, 2024

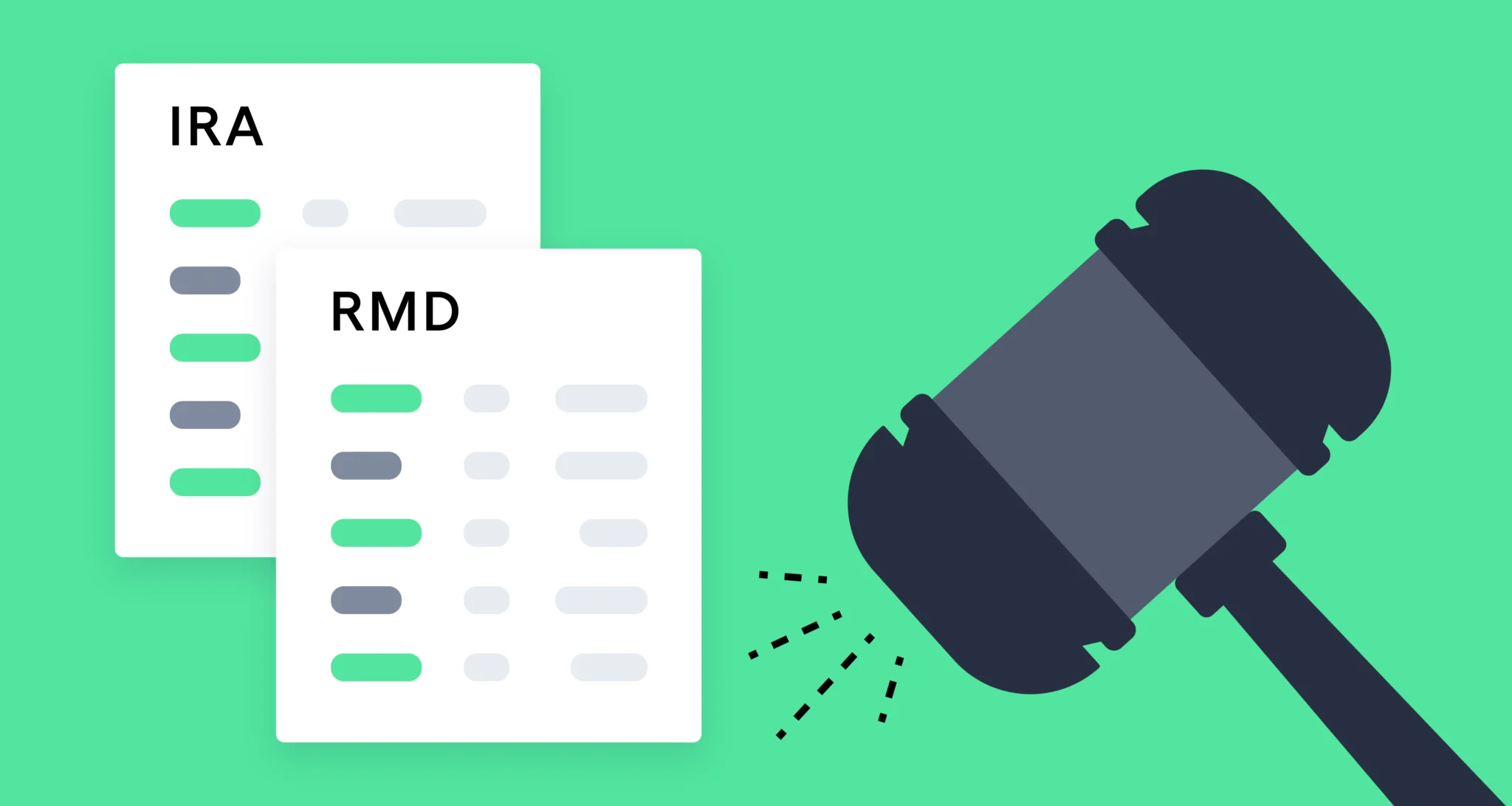

Breaking Down the IRS’s New Ruling on IRA RMDs

A new IRS ruling issued on July 18, 2024 cleared up lingering confusion around inherited individual retirement accounts (IRAs) and required minimum distributions (RMDs). Here’s a quick overview of why this long-awaited ruling was necessary and what it can mean for the beneficiaries of IRAs going forward. Summary In short, the new IRS ruling says that non-eligible designated beneficiaries (which includes most non-spousal beneficiaries) of inherited IRAs from someone who died on or after their Required Beginning Date (RBD) do have to take the annual RMD each year after an inheritance, and that the account must be fully depleted at...

Madison Eubanks

•

Jul 26, 2024

3 Income Tax Strategies for IRA-Heavy Estates

Traditional estate planning advice revolves around moving as many assets as possible out of the estate to minimize estate tax liability. However, most people’s estates will never approach taxability, meaning they need a different approach to estate planning. At the most foundational level, planning for non-taxable estates—those valued at less than $13.61 million—means ensuring clients have appropriate documents like wills, trusts, and powers of attorney in place. However, just because a client isn’t subject to federal estate tax doesn’t mean they can ignore tax planning. In this blog, we’ll look at tax planning strategies for non-taxable estates where the owner...

Madison Eubanks

•

Jul 26, 2024

50 Estate Planning Statistics and Facts You Need to Know

Whether or not you’re a financial planning professional, being on top of trends and facts about estate planning can help you make informed decisions with regards to finances. In this article, we’ve rounded up 50 estate planning statistics from 2024 from Vanilla research and sources around the web that you’ll want to remember. Why estate planning matters Why is estate planning important, and why does it seem like more people are talking about it now? Not having a plan can cause problems down the road Over a third (35%) of US adults say they or someone they know have experienced...

Madison Eubanks

•

Jul 15, 2024

Qualified Disability Trusts: Everything You Need to Know

For families planning for individuals with disabilities or special needs, special considerations have to be made to ensure the person is cared for long-term. In some cases, specialized planning tools like qualified disability trusts can be used to achieve certain benefits like tax exemptions or federal aid eligibility. At the most basic level, a qualified disability trust (also known as a QDisT or QDT) is a trust that qualifies for a federal tax exemption. It’s a financial planning tool that an individual with special needs or disabilities’ family or caregivers may use to provide for their needs. Here, we’ll walk...