Category: Estate Planning

Vanilla

•

Mar 04, 2025

10 Diagrams to Explain Advanced Estate Planning Strategies

Tax planning for clients with taxable estates has always been complex. We’ve learned the best way to explain estate planning strategies is with diagrams, not documents. That’s why we’ve put together this deck of 10 diagrams to explain some of the advanced strategies and why household with $10M in assets should care about estate tax. Why $10M in household assets? In 2026 the Estate Tax exemption drops down to just about $10M (or higher based on inflation). The 10 diagrams explain both why you need advanced strategies and how 8 different strategies work. We’ve explained them all below but if...

Madison Eubanks

•

Feb 21, 2025

Why You Need to Periodically Update Your Estate Plan (and the Risks of...

Going to the dentist, getting an oil change, getting a flu shot, cleaning out the gutters, taking your pet to its annual vet appointment—these aren’t things that most people look forward to doing, but they’re all regular maintenance tasks that we do throughout the year. And while no one wants to add yet another item to life’s list of chores, estate planning updates deserve a place on the docket. This doesn’t need to be done every year, but ongoing maintenance is crucial for an optimized plan. In this article, we’ll discuss why updating an estate plan is important, how often...

Madison Eubanks

•

Feb 21, 2025

What Happens if You Die Without a Will? Understanding Intestacy Laws

Intestacy, or dying intestate, is legalese for when a person passes away without a will. When a person dies “intestate,” their estate is subject to the intestacy laws of the state they lived in. This means that who inherits the estate is left up to the government as defined by the state’s intestacy laws, rather than by the deceased person’s choice. This can give rise to any number of issues and can create headaches for the intestate person’s family and loved ones. The purposes of wills and trusts are, of course, to communicate one’s wishes for what should happen to...

Vanilla

•

Feb 04, 2025

The 4 Core Estate Documents: What they are and why they’re essential for...

According to a 2024 survey from Caring.com, 40% of Americans don’t think they have enough assets to create a will. This reveals a general lack of understanding around the purpose of a will, which does more than handle financial assets. There’s an enormous opportunity for advisors to help educate clients about the goals of estate planning and core estate documents. If you have a handle on the core estate documents and how they benefit your clients’ finances in the long term, you’ll be more likely to provide advice and guidance that will strengthen ongoing relationships with clients and their families....

Vanilla

•

Jan 23, 2025

Spotlight on Special Needs Trusts: Everything You Need to Know about SNTs

By Lisa A. Cohen, CEO of Visible National Trust Special needs trusts are the cornerstone of disability estate planning, and disability affects many more people and families than we might expect. Incorporating special needs trusts into estate planning brings certainty that families’ wishes will be implemented for their loved ones. Visible National Trust serves families and individuals across the country with complete turnkey special needs trust solutions that meet families’ high service standards and evolving needs. Seventy (70) million Americans live with a disability, according to the CDC. Twenty-three (23) million people with disabilities require lifetime support, affecting seventeen percent...

Madison Eubanks

•

Dec 10, 2024

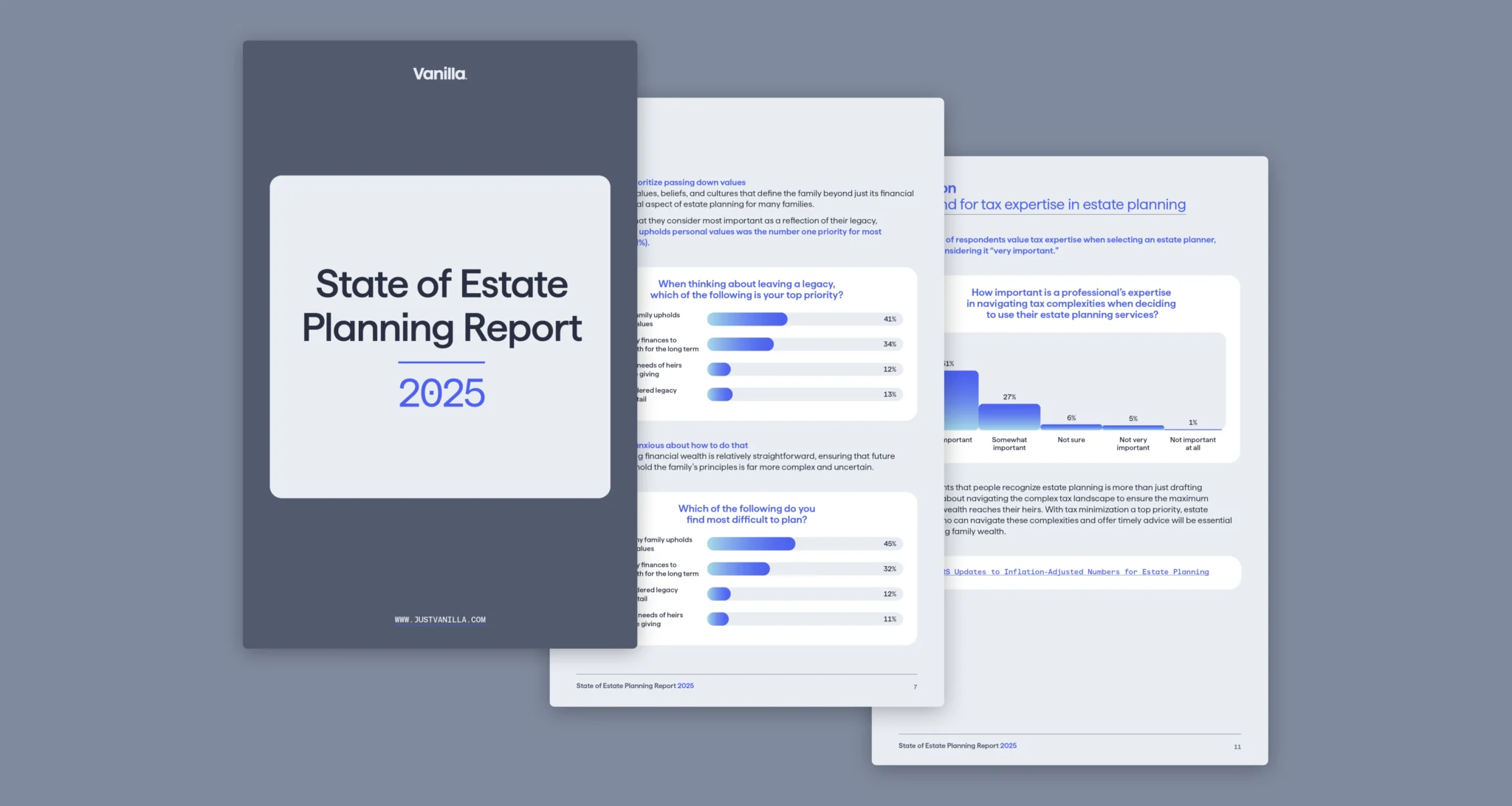

18 Stats to Know from Vanilla’s 2025 State of Estate Planning Report

In case you missed it, our recently released Vanilla’s 2025 State of Estate Planning Report is chock full of relevant facts and figures about what’s new and noteworthy in consumer mindsets around planning. This annual survey of 1,000 US consumers is designed to unlock insights about how people view their families and values as well as the role of advisors and technology in the context of estate planning. While the full report is well-worth a read, we also put together this skimmable roundup of some of the most important (and sometimes surprising) findings. Read the complete, ungated State of Estate...

Vanilla

•

Dec 05, 2024

3 All New CE Courses Now Available in Vanilla Academy

The best advisors (and, truthfully, our favorite people) are the curious ones—they dig in, ask questions, and are always learning. They want to bring clients great advice that’s backed by education, experience, and perspective. For all the lifelong learners out there, Vanilla is your partner for refreshing, broadening, honing, brushing up, mastering, reviewing, or just dipping your toes into estate planning topics and skills. Vanilla Academy launched earlier this year as an estate planning learning hub for advisors who want to up-level their offering and show clients a breadth of expertise, and we’ve just added three additional courses to the...

Sarah D. McDaniel, CFA

•

Dec 03, 2024

A New Year, a New Approach: How to use estate planning to keep...

Let’s face it—most people procrastinate. Deadlines are often the only motivators that spur action, and for financial planning, this “crunch time” tends to hit in November and December. Unfortunately, this end-of-year rush isn’t ideal for a number of reasons: The holidays: Advisors and clients alike are juggling travel, vacations, and family obligations. Emotional rollercoasters: Whether it’s the stress of family reunions or the joy of celebrations, emotions can cloud judgment. Rushed decisions: Big-picture financial planning requires clarity and focus, neither of which are easy to achieve in a hectic environment. The result? A less-than-optimal setup for making critical long-term decisions....

Vanilla

•

Nov 13, 2024

Estate Planning for Business Owners: Strategies and Solutions for Wealth Advisors

There are over 33 million small businesses in the United States, employing over 60 million people. In many ways, private businesses are the heart and soul of the country’s economy, and—unsurprisingly—business owners often feel passionately about what happens to their share when they pass away. Wealth advisors should be prepared to help their business-owning clients create a thoughtful succession plan, regardless of the size or value of their business. In a recent webinar, estate planning experts Steve Lockshin and Patrick Carlson sat down to discuss everything from foundational concepts to advanced strategies wealth advisors should consider for clients who own...