Jessica Lantz

Jessica Lantz

What’s New in March: V/AI Estate Summaries, New Opportunities, and More!

At Vanilla, we’re excited to share our March lineup of powerful new features designed to enhance your estate planning workflows and provide deeper insights for you and your clients. Here’s what’s new this month:

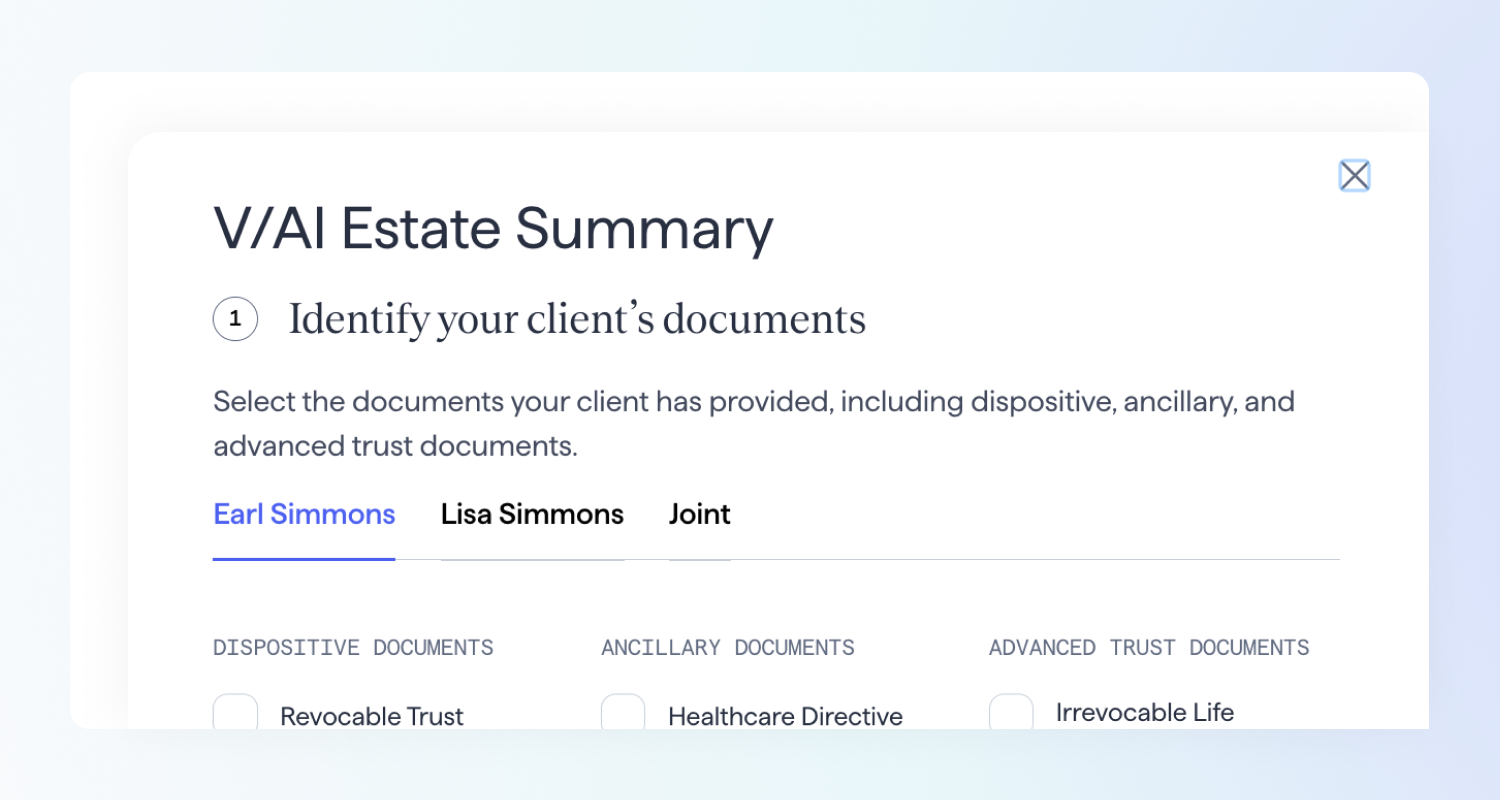

Unlock integrated Estate Summaries and onboard clients in minutes with V/AI

Summarizing documents individually adds value. But synthesizing them into a single, integrated estate view within minutes sets a new standard for what’s possible in estate planning. With the launch of V/AI Estate Summaries and our expanded V/AI Automatic Profiles, you are able to:

- Upload multiple estate plan documents to unlock a high-level overview of your prospect or clients’ estate plan in minutes

- Review, edit and further customize your report

- Easily import key information like family, fiduciaries, and distributions to onboard profiles to Vanilla

- Unlock benefits of a complete Vanilla profile, including estate visualizations, Plan Snapshots, Waterfall calculations, and family trees in minutes

V/AI Estate Summaries is currently available as a private beta – if you’re interested in joining, reach out to your CSM.

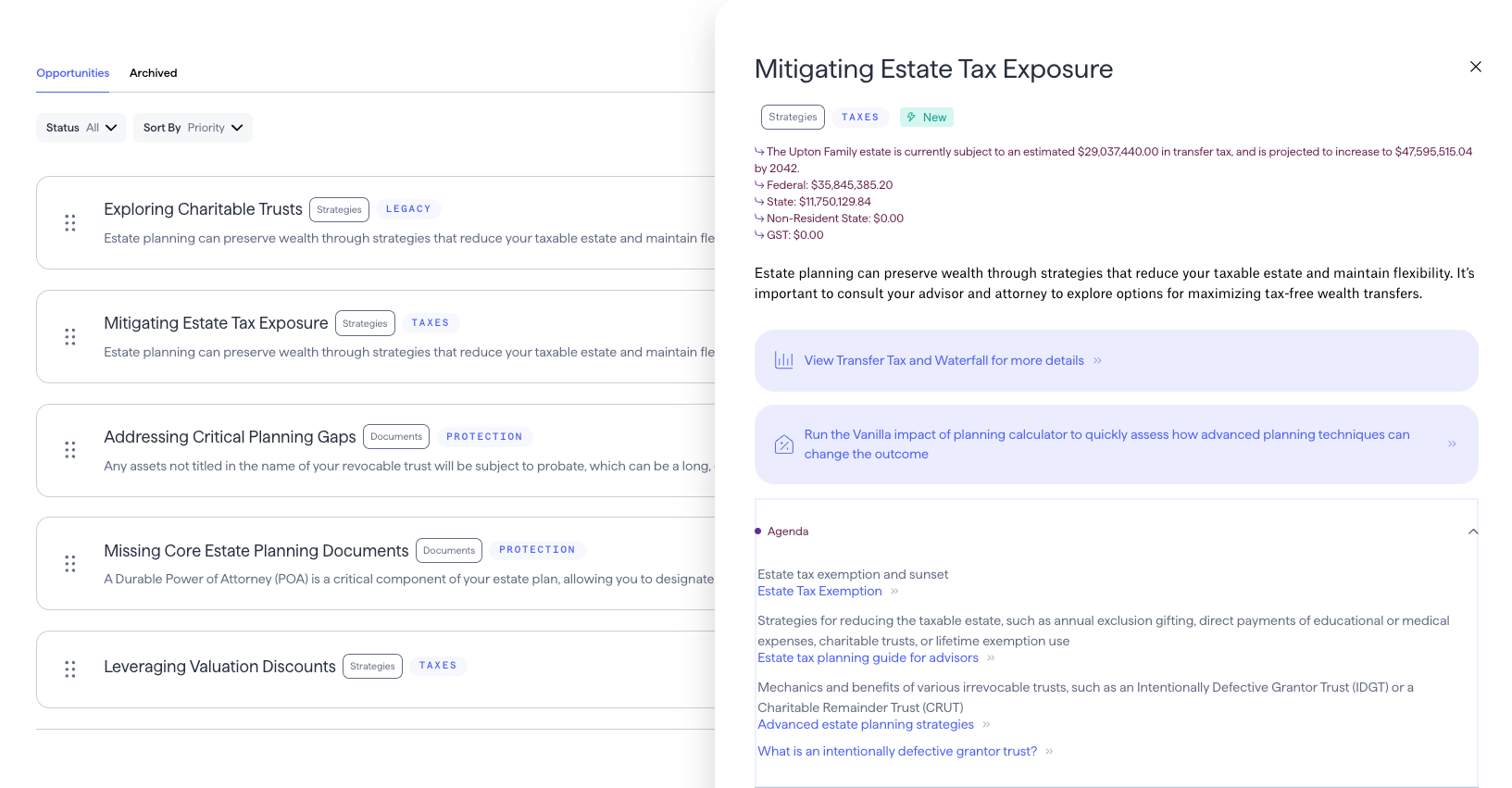

Engage with clients more strategically

Our breakthrough enhancements to Vanilla Opportunities transform how financial advisors proactively identify and act on planning opportunities. This robust ecosystem:

- Delivers timely, data-driven insights to identify meaningful next steps that support client goals

- Provides detailed agenda items with supporting educational content

- Offers clear, actionable recommendations to guide client interactions

Vanilla Opportunities is currently available as a private beta – if you’re interested in joining, reach out to your CSM.

Streamline Tax Planning for Pennsylvania Clients

We’re excited to announce support for Pennsylvania’s unique inheritance tax structure. This enhancement addresses a significant need for advisors serving Pennsylvania clients through:

- Calculating inheritance tax automatically with different percentages based on beneficiary relationships

- The ability to customize tax percentage assumptions

- Displaying inheritance tax information across the Vanilla in pages such as the Waterfall, Transfer Taxes, and Plan Snapshot.

Reduce manual data entry with updates to our Balance Sheet import tool

Important functionality updates to the Balance Sheet import tool allow you to:

- Export existing Balance Sheets and update values

- Add new accounts to an existing Balance Sheet

- Delete accounts from an existing Balance Sheet

Change document package or trust type without an email to our team

We’ve empowered your clients with greater control over their document experience:

- Clients can now independently clear answers, change document packages, or delete packages as needed

- All self-serve options are available from a convenient menu within the Vanilla Document Builder menu

- This enhancement gives clients more customization and flexibility over their document creation experience

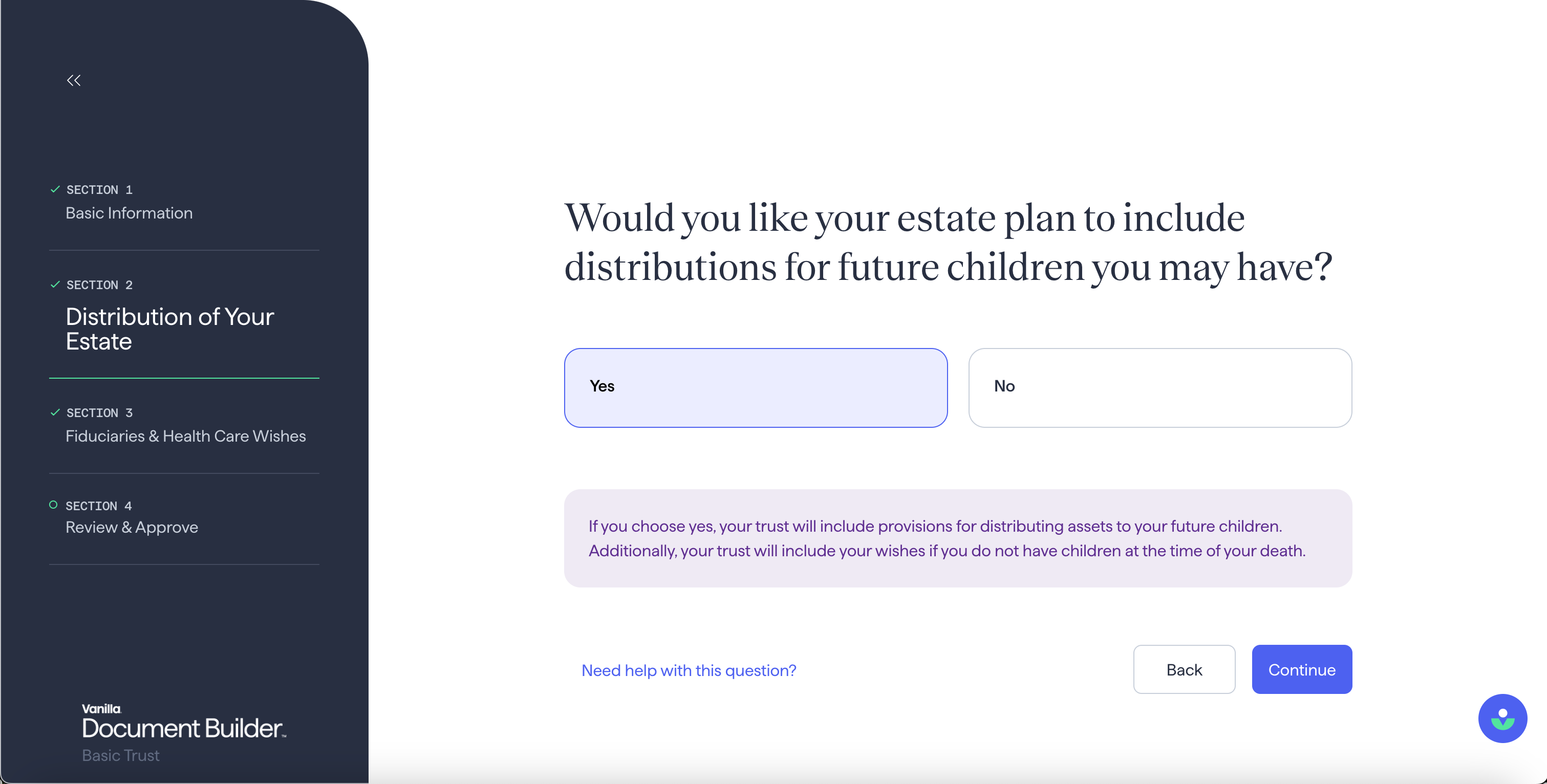

Plan for future children in your estate plan

Our Vanilla Document Builder now allows the optionality to accommodate future children, ensuring your clients are prepared for life’s possibilities:

- For clients who already have children, provisions for future children are automatically included

- For clients without children, we now allow them the option to incorporate planning for potential future children

- This flexibility helps create more customized estate plans that adapt to your client’s changing needs

Looking forward

As spring arrives, we continue our commitment to making estate planning more accessible, efficient, and comprehensive for advisors and their clients.

Ready to explore these new features? Contact your CSM to learn more about how these tools can transform your practice, or get a demo.

Published: Mar 26, 2025

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.