Madison Eubanks

Madison Eubanks

What to Know About Gifting: Taxes, Returns, and Exclusions

For the ultra wealthy, a well-planned gifting strategy can be a great way to reduce the size of the taxable estate over time.

However, various tax laws mean gifting isn’t always as straightforward as it may sound. When gifting, it’s important to understand annual and lifetime exclusions, when gifts must be reported to the IRS, and how to plan for tax exposure.

Read on for a complete overview of gifting.

For a deeper dive on gifting strategies, download the Vanilla Guide to Gifting here.

Introduction to gifting

In the eyes of the IRS, a gift is any property or assets that change hands for less than full consideration, or less than full monetary value.

Everyone has exclusions and an exemption that offset the gift tax:

- Annual exclusion: The gift tax annual exclusion is the maximum amount you can give to a single person per year that is excluded from gift tax. In 2024, the annual exclusion is $18k per gift recipient (or donee), or $36k for married couples who opt to gift-split. It’s important to note that the limit is per donee, not per donor. So you could give up to $18k to several different people in one year and all of the gifts will be excluded from gift tax. If you exceed the annual exclusion, the amount gifted over the annual exclusion is considered a taxable gift. Note that there is a special rule for gifts made to 529 plans. If a gift to a 529 plan exceeds the annual exclusion amount, the donor may elect to treat up to five times the annual exclusion amount ($90,000 in 2024 or $180k if married and electing to gift-split) as being made ratably over a five-year period. This election is made on the gift tax return itself.

- Lifetime exemption: This is a much higher, lifetime limit on how much you can give throughout your lifetime without having to pay gift tax. Any giving above the annual exclusion will be subtracted from this “bucket” before any gift tax is due. Unlike the annual exclusion, the lifetime exemption never resets. Any amount of your lifetime exemption used during life reduces the amount available to offset your taxable estate when you pass away. The lifetime exemption is $13.61M in 2024 ($27.22M per married couple), but this is scheduled to sunset to $5M (adjusted for inflation) at the end of 2025.

Gifting and taxation

Generally, any gift that is below the annual exclusion amount will not be taxed and does not need to be reported to the IRS. So if you gave your grandchild $14k in 2023 when the annual exclusion was $17,000, you did not need to file a gift return and no taxes were owed because the gift amount was under the annual exclusion in that year. However, if in 2024 you decide to give your grandchild $19k, you will need to file a gift return and may be exposed to gift taxes.

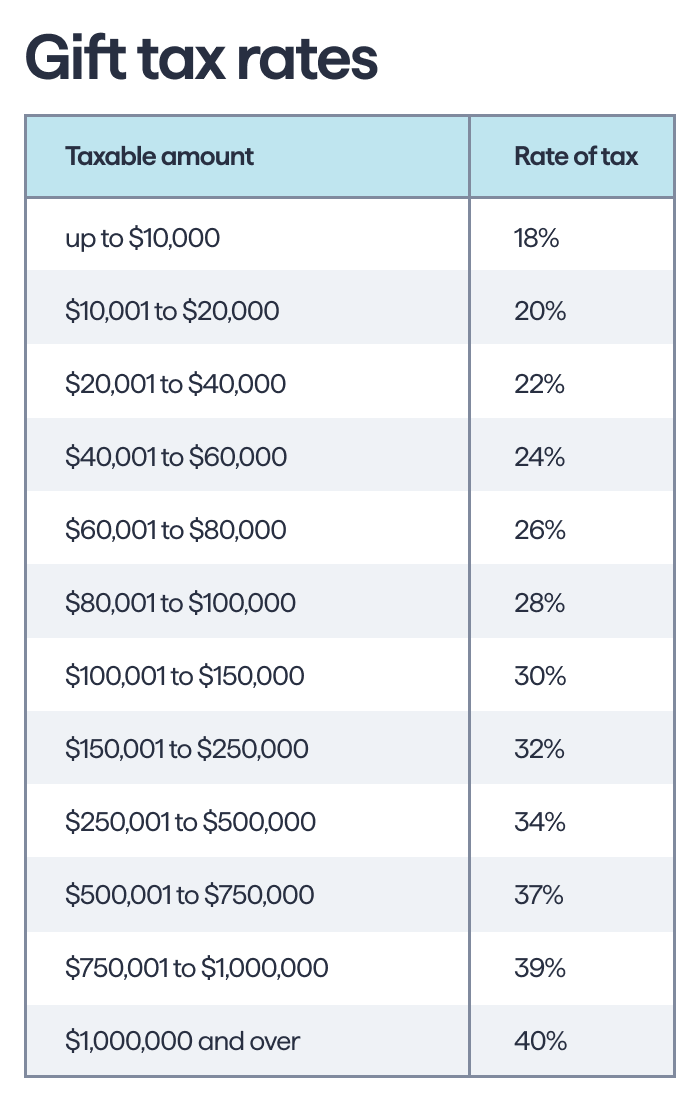

In most cases, the gift tax burden falls on the donor rather than the recipient. The highest possible gift tax rate is 40%.

Additional deductions and exclusions in gifting

There are some additional deductions and exclusions from what was discussed above that also offset the gift tax.

Gifts between spouses

In most cases, gifts between spouses are not subject to gift tax. This is on account of the unlimited marital deduction, which allows most couples to make an unlimited amount of gifts between themselves. The unlimited marital deduction is not allowed if the recipient spouse is not a U.S. citizen. There is a larger annual exclusion, however, for gifts to non-U.S. citizen spouses. ,In 2024, this “super” annual exclusion is $175k.

Charitable giving

Gifts made in any amount to qualified charities receive the unlimited charitable deduction. The gift tax charitable deduction is in addition to any income tax charitable deduction that may be available.

Tuition or medical expenses

Gifts to pay for someone’s school or medical needs receive an exclusion from gift tax, as long as the payments are made directly to the school or medical provider. If, for example, a grandparent wants to pay for their grandchild’s college tuition, giving the money directly to the grandchild would be subject to gift tax and exclusion and exemption limits would apply. However, if the grandparent pays the money directly to the university, the gift is excluded from gift tax altogether regardless of the amount…

Political donations

Funds given to political organizations are not considered taxable gifts; therefore, gift exclusion and exemption limits do not apply.

Gifting pitfalls

One important point to note about gifting is that whether or not a transfer of property qualifies as a gift is objectively determined by the IRS, regardless of the giver’s intent. There are situations that can arise in which gift tax laws apply even though the people involved in the transaction don’t see it that way. Here are a few common examples:

Loans

In some cases, what an individual sees as a simple loan to a friend or family member is a gift in the eyes of the IRS. The IRS requires that any loan between family members be made with a signed written agreement, a fixed repayment schedule, and a minimum interest rate. For example, if you loan your sister $20k to use as a down payment on a house,but you don’t charge adequate interest, the IRS could classify this as a gift. Similarly, if you initially see it as a loan but later decide your sister doesn’t need to pay you back at all, the loan becomes a gift.

Joint bank accounts

Giving someone broad access to money or assets can also be classified as a gift. For example, let’s say a parent wants to pay all of their adult child’s living expenses. To make things easier, the parent sets up a joint bank account with the child funded with only the parent’s money that the child can pay bills out of. To the IRS, if the child withdrawals money from the joint bank account, this is considered a gift and is subject to gift tax laws.

Lavish presents

Giving someone an expensive gift like a new car, paying for a trip, or writing a check to pay for a wedding or other major expense triggers the gift tax.

Digital assets

The gift tax doesn’t only apply to money and tangible property—it is also relevant for digital assets like cryptocurrencies, NFTs, and any other “digital representations of value that are recorded on a cryptographically secured distributed ledger or any similar technology.”

Filing a gift return

Generally, any gift that exceeds the annual exclusion limit must be reported to the IRS on Form 709 unless the gift is otherwise excluded from gift tax as outlined above. Form 709 is due at the same time as your income tax return is due – generally April 15 of the year following the year the taxable gifts are made plus extensions, though it’s one of a handful of tax forms that cannot be e-filed. If you need to file a gift tax return, it has to be printed, filled out, and mailed to the IRS.

Form 709 is a five-page document broken down into four parts:

- Schedule A: Computation of Taxable Gifts

- Schedule B: Gifts from Prior Periods

- Schedule C: Portability of Deceased Spousal Unused Exemption (DSUE) Amount and Restored Exclusion Amount

- Schedule D: Computation of GST Tax

Most people will never need to worry about gift taxes, but for the ultra-wealthy, gifting can be more complicated than simply writing a check.

To learn more about gifting strategies, download Vanilla’s Guide to Gifting here.

Interested in learning how Vanilla can help your firm increase AUM and impress clients? Schedule a demo.

The information provided here does not constitute legal, financial, or tax advice. It is provided for general informational purposes only. This information may not be updated or reflect changes in law. Please consult with an estate attorney, financial advisor, or tax professional who can advise as to your particular situation.

Published: Sep 10, 2024

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.