Vanilla

Vanilla

What is probate, and how can you make it easier for clients?

When it comes to estate planning, there is often a lot of focus on avoiding delays, reducing costs, and making things easier for loved ones. One topic that comes up again and again in these conversations is probate. Clients may not always understand what it involves, but they know it is something they want to avoid or simplify.

As a financial advisor or estate planner, helping clients prepare for probate can make a big difference in how smoothly their estate is handled. From guiding clients through the planning process to helping them put the right documents in place, your role is key. In this article, we will explore what the probate process typically looks like, how it can vary depending on whether or not there is a Will, and what steps can be taken to make the experience easier for everyone involved.

What is probate?

When it comes to estate planning, “probate” is a term that looms large. You might hear talk of the complexity of probate, or strategies for avoiding probate — but what exactly is it?

Put plainly, probate is the legal process that occurs after a person’s death. In probate, the court recognizes the validity of a Last Will and Testament (a “Will”) and appoints a personal representative for the decedent’s estate. The representative – also known as an executor or administrator – pays the decedent’s debts and then distributes the remaining assets to the beneficiaries.

Part of estate planning is ensuring that a decedent’s loved ones are taken care of after they are gone. This includes simplifying the probate process and the distribution of assets under the decedent’s Will. As a financial advisor, you can make the entire process worry-free for your client and their loved ones by understanding probate and encouraging your client to put documents in place that will simplify the process.

What’s the probate process?

Probate begins after a person (the “Testator”) dies, and the Testator’s Will, along with other supporting documents, is submitted to the court.

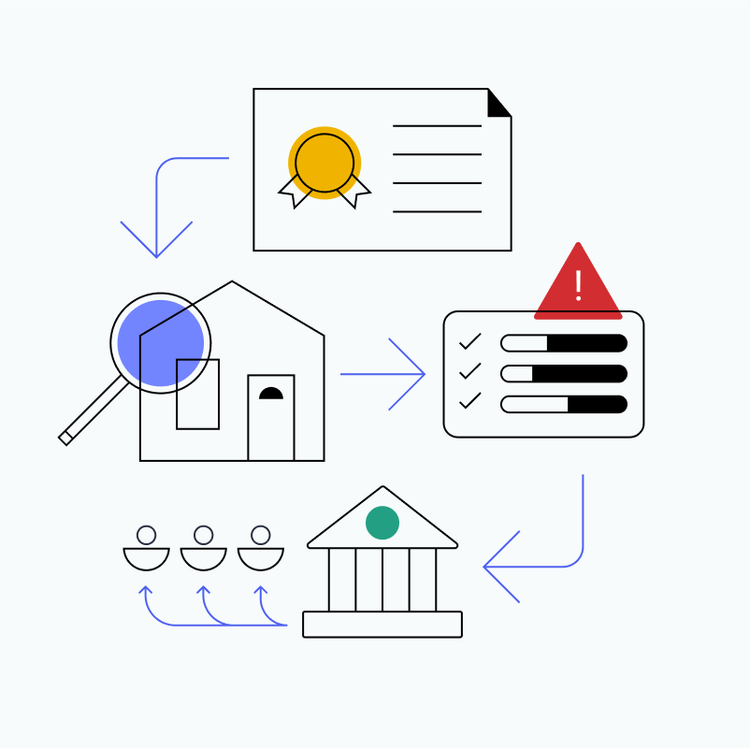

Probate typically follows this general timeline:

- The court validates the Will by acknowledging the Will’s existence, validity, and authenticity.

- The court officially appoints a personal representative who has been named in the Will. The personal representative oversees the administration of the Testator’s estate.

- The personal representative informs the beneficiaries and creditors of the Testator’s death and the Will’s existence.

- The personal representative determines the value of all assets and property.

- The personal representative pays off outstanding debts (including taxes) and files any required tax returns (e.g. the Testator’s income tax returns, estate income tax returns, estate tax returns).

- The personal representative distributes the remaining assets in the estate according to the Will.

Probate is generally more straightforward and faster when the decedent dies with a Will (called dying testate), but we’ll also discuss when a decedent dies without a Will (called dying intestate).

Probate with a Will

When a valid Will exists, probate typically follows the above steps. The personal representative initiates the probate process and files the required documents with the probate court. Once the probate court officially accepts the Will and appoints the personal representative, the personal representative has the legal power to act on behalf of the decedent’s estate.

Even with a Will, probate can be time consuming and expensive, due to legal fees. In addition, in the process of probate, your Will becomes publicly available, anyone can view it. Many people prefer to keep the details of their estate plan private, which can be accomplished with the use of a revocable trust structure.

Probate without a Will

If an individual dies without a Will (or a valid Will), their estate will still go through probate, but the process can be costly, drawn-out, and complicated. This is because when an individual dies without a Will (intestate), and the direction it would provide, the settlement of their estate is determined according to the applicable state law.

The court will appoint an administrator to act on behalf of the decedent’s estate. An administrator differs from a personal representative in that they are selected by the court, but their duties and responsibilities are similar to a personal representative. The important thing to note here is that, because the decedent died intestate, the court chooses who oversees the administration of the decedent’s estate, not the decedent.

The administrator uses the estate assets to satisfy the debts of the decedent. They also locate heirs. The probate court then determines the division of the intestate decedent’s estate, based on applicable state law. Most state laws divide property between the spouse and children, if both are then living.

If the court can’t locate heirs, or heirs do not step forward within a specified time period, then the intestate decedent’s assets are transferred to the state, known as escheatment.

What are a Personal Representative’s duties?

The Will designates a personal representative, and the court officially appoints the personal representative to settle the decedent’s finances.

Once the court appoints the personal representative, he or she gets to work locating all of the assets of the decedent. This includes tangible personal property, bank accounts, real estate holdings, trusts, life insurance policies, retirement funds, and more. They will inventory the assets and determine an estimate for the estate’s value. The personal representative will usually determine the fair market value of the assets as of the decedent’s date of death.

Before distributing assets to the beneficiaries, the personal representative must pay the remaining debts and taxes of the decedent, and file any applicable tax returns. In most states, creditors have anywhere from several months, up to one year to make a claim against the decedent’s estate. The personal representative will also usually have to file annual reports with the court.

Once the personal representative has settled the obligations of the decedent, the personal representative may distribute the remaining assets to the beneficiaries according to the Will.

Methods to avoid probate

You can speed up probate or even avoid probate altogether. Consider a few strategies when working with your clients on estate planning:

Establish a revocable trust

Assets titled in the name of a decedent’s revocable trust generally avoid probate. The assets titled in the decedent’s revocable trust will be disposed of according to the instructions contained in the revocable trust agreement. A revocable trust is commonly thought of as a Will “substitute.”

Give assets away while alive

Giving away assets before death can reduce a client’s estate and simplify the probate process. Your client can also enjoy some tax advantages from the gift as well.

Set up beneficiary designations

Many assets, like bank accounts and life insurance policies, have the option for you to add beneficiary designations. These assets are not subject to probate, and will pass according to the instructions contained in the contract between your client and the financial institution.

Title property jointly

Property that your client owns jointly (whether as joint tenants with right of survivorship or tenants by the entirety) will pass to the surviving joint owner by operation of law.

Set your clients’ estates up for future success

Probate can be time consuming and expensive. By creating thoughtful estate plans, you can help your clients save time and money, all while ensuring that your clients’ wishes are met.

Help your clients build and visualize a better estate plan with Vanilla.

About Vanilla

Vanilla is the Estate Advisory Platform, purpose-built to enable financial advisors to build deeper relationships with their clients and empower clients to build and protect their legacy. From robust and easy-to-understand visualizations of complex estates, detailed diagrams of how assets transfer to future generations, to ongoing estate monitoring, Vanilla is reinventing the estate planning experience, end-to-end. Learn more about Vanilla at https://www.justvanilla.com/.

Media inquiries: Please contact press@justvanilla.com

This article is for educational purposes only and should not be considered legal advice. If you feel that the information in this article is pertinent to your situation, you may wish to consult a qualified attorney for advice tailored to your circumstances.

Published: Feb 09, 2023

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.