Vanilla

Vanilla

What is an irrevocable life insurance trust (ILIT)?

Estate planning presents a significant challenge when substantial assets could face hefty taxation after death. Irrevocable Life Insurance Trusts (ILITs) offer a strategic solution as specialized legal vehicles designed to own life insurance policies during your lifetime. By keeping insurance proceeds outside your taxable estate, these trusts help beneficiaries avoid the steep 40% federal estate tax that would otherwise diminish their inheritance.

ILITs serve dual purposes by either creating immediate liquidity for families or preserving estates by covering tax obligations without forcing the sale of illiquid assets. Business owners, real estate investors, and families approaching the federal estate tax threshold stand to gain the most from these powerful planning tools. Understanding how these trusts function can make the difference between preserving your complete legacy or leaving your heirs with significantly reduced resources.

What exactly is an irrevocable life insurance trust (ILIT)?

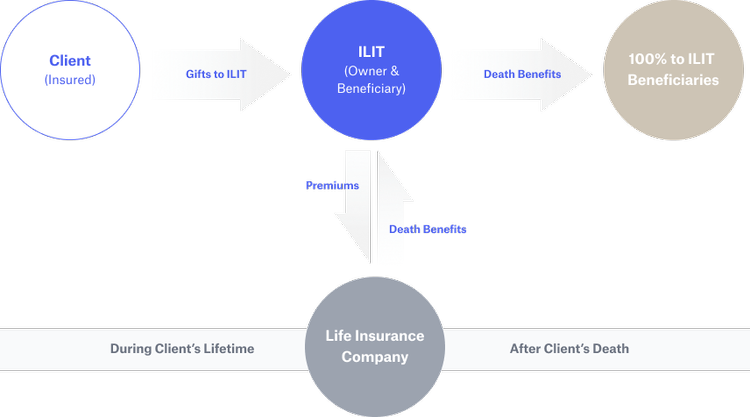

Irrevocable Life Insurance Trusts (ILITs) is a trust established specifically to own one or more life insurance policies and are set up during an insured’s lifetime. ILITs are created to own a life insurance policy and keep its proceeds out of the insured’s or owner’s estate to avoid increasing the size of their estate when the insured dies.

When an individual owns an insurance policy (whether on his or her life or the life of another individual), the insurance policy is included in the individual’s estate at death and is therefore subject to federal estate tax (to the extent the estate exceeds the federal estate tax exemption). The federal estate tax is imposed at 40%, which can drastically reduce the insurance proceeds available to surviving family members. However, if the policy is held in a properly-structured ILIT, the policy is excluded from the individual’s estate, and the proceeds are fully preserved for the surviving family members.

Insurance is typically purchased to either: create an estate or, preserve an estate.

Examples of an irrevocable life insurance trust

Although many different types of life insurance can be used in an ILIT, here are some of the most common:

Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. It pays a death benefit if the insured person passes away within the policy term. Term life insurance policies are often chosen for their affordability, making them a popular choice within an ILIT.

Whole Life Insurance

Whole life insurance is a permanent life insurance policy that provides coverage for the entire life of the insured person. It offers both a death benefit and a cash value component that grows over time. Whole life policies are typically more expensive than term life policies but may be suitable for individuals seeking lifelong coverage within an ILIT.

Universal Life Insurance

Universal life insurance is another type of permanent life insurance that provides both a death benefit and a cash value component. It offers more flexibility in premium payments and death benefit amounts compared to whole life insurance. Universal life policies may be suitable for individuals who want more control over their policy within an ILIT.

Second-to-Die Life Insurance

Also known as survivorship life insurance, this policy insures two lives, usually spouses, and pays out the death benefit upon the death of the second insured individual. Second-to-die policies are often used within ILITs for estate planning purposes, as they can help cover estate taxes that arise when both spouses pass away.

The specific type of life insurance policy chosen for an ILIT depends on the goals and circumstances of the insured individual and the beneficiaries. It’s essential to consult with an experienced estate planning attorney or financial advisor to determine the most suitable policy type and structure for your specific needs.

How does life insurance create an immediate estate in an ILIT?

In the case of creating an estate, let’s use the example of Sandy, a young entrepreneur with a spouse and a few young children. Sandy has built a business whose value may approach the estate tax exemption; however, she has not accumulated significant liquidity or assets outside of the business. Moreover, let’s further assume this entrepreneur is the primary breadwinner in the family. She is concerned that, should she die unexpectedly, her spouse and children would not have access to funds to enable them to live comfortably. In this case, life insurance is an excellent vehicle to create immediate liquidity that would be available for the surviving spouse to provide for their family.

However, in the event of an immediate tragedy that affected both spouses, the benefit of the insurance – if owned by either of the deceased spouses – would be decimated by a 40% federal estate tax, plus any state inheritance or estate taxes. Alternatively, if that policy were held in an ILIT, the proceeds would be available to the surviving heirs without the 40% haircut of the estate tax.

How does life insurance preserve an estate with an ILIT?

The federal estate tax is imposed at 40% and is due nine months after an individual’s death. However, sometimes an individual’s estate is comprised primarily of an illiquid asset that cannot be easily liquidated, such as an operating business or real estate. In those cases, insurance may be used to help create a large cash position for a taxable estate that does not have sufficient liquidity to fund its estate tax liability.

For married couples, second-to-die insurance is typically the preferred vehicle due to its favorable premium-to-death-benefit ratio. In this example, a family has amassed a large estate that is primarily illiquid. The matriarch and patriarch purchase a second-to-die life insurance policy that will pay out on the death of the survivor. Once paid out, the life insurance proceeds can be used to satisfy the tax liability without requiring the estate to sell illiquid assets. And as in the example above, the problem with owning insurance in the estate is that it only increases the estate and the associated estate or inheritance tax.

The benefits of an irrevocable life insurance trust (ILIT)

Whether insurance is purchased to create an estate or preserve an estate, an ILIT provides the most important benefit of keeping the proceeds of the life insurance from being included in the insured’s estate and losing any of those proceeds to unnecessary taxes. However, there are other benefits to an ILIT that accompany most irrevocable trusts, including:

Estate tax avoidance

Irrevocable Life Insurance Trusts offer a solution to one of the most pressing concerns in estate planning, taxation. When life insurance policies remain personally owned, their death benefits become part of the taxable estate, often resulting in significant tax burdens for heirs. Transferring policy ownership to an ILIT keeps these proceeds outside the estate, potentially saving beneficiaries hundreds of thousands or even millions in estate taxes. This advantage becomes critical for estates approaching or exceeding the federal estate tax exemption threshold.

Protection from creditors

The legal structure of an ILIT creates protection that personal policy ownership simply cannot provide. Insurance proceeds held in trust remain shielded from the insured’s personal creditors, beneficiaries’ creditors during bankruptcy, and claims from divorcing spouses of either party. This protection ensures that funds intended for loved ones remain secure against unexpected financial claims. The strength of this protection varies by state, making local legal consultation essential.

Preservation of government benefits

For families with members receiving needs-based government assistance like Medicaid or Supplemental Security Income, ILITs solve a critical problem. Direct inheritance would typically push beneficiaries above asset thresholds for these programs, resulting in benefit disqualification. Properly structured trusts with specific distribution provisions allow trustees to improve a beneficiary’s quality of life without jeopardizing essential government benefits. This balanced approach maintains both the inherited assets and necessary public assistance.

Avoiding the generation-skipping transfer tax

ILITs provide sophisticated solutions for families planning wealth transfers across multiple generations. The generation-skipping transfer tax typically applies when assets move directly from grandparents to grandchildren, creating an additional tax burden. Strategic application of GST exemption to trust contributions allows multiple generations to benefit from insurance proceeds without triggering this tax. Most insurance trusts require specific provisions to achieve GST exemption, necessitating experienced legal counsel.

Controlled distributions

The trust structure provides unparalleled control over how and when beneficiaries receive insurance proceeds, perhaps its most practical advantage. Trustees follow grantor-established guidelines that might provide steady income or release funds at significant life milestones rather than distributing large sums at once. This approach mitigates risks associated with sudden wealth and protects financially inexperienced beneficiaries from poor decisions. The structured distribution system transforms simple asset transfer into lasting financial security.

The downside to an ILIT

Beyond the cost of setting up an ILIT and the additional nominal burden of properly funding and administering the trust, there are limited downsides to establishing an ILIT. A couple of relevant considerations follow:

Irrevocable trusts are, as their name suggests, irrevocable. However, with modern features that allow for certain flexibilities, the trust may be built to ensure that it continues to meet the needs of the settlors and grantors of the trust as well as the beneficiaries over time.

In order for the insurance policy to not be included in the individual’s estate, the individual cannot retain ownership or control over the insurance policy. Therefore, an independent person should be named as trustee of the ILIT. However, given the relatively minimal burden of administering an ILIT, this should not be a particularly difficult role to fill.

In order for the ILIT to pay the ongoing insurance premiums, the grantor will likely have to make additional gifts to the ILIT over time. These gifts typically require a minimal amount of additional paperwork to ensure that the gifts are made in a tax-efficient manner.

From an advisor’s perspective, one should always consider placing insurance in an ILIT when funding a life insurance policy and likely start with the question of “why shouldn’t I use an ILIT?” instead of asking why they should.

About Vanilla

Transform how you serve high-net-worth clients with Vanilla, the premier estate planning platform that turns complex legacy strategies into clear, actionable plans. Our platform empowers financial advisors to strengthen client relationships through intuitive visualizations, precise inheritance flow diagrams, and proactive monitoring tools that showcase your expertise. Vanilla’s powerful estate planning software doesn’t just simplify the process but creates compelling client experiences that drive retention and referrals. Schedule your personalized demo today and discover how Vanilla can elevate your practice while helping clients protect what matters most.

Media inquiries: Please contact press@justvanilla.com

This article is for educational purposes only and should not be considered legal advice. If you feel that the information in this article is pertinent to your situation, you may wish to consult a qualified attorney for advice tailored to your circumstances.

FAQs

Are irrevocable trusts included in the gross estate?

Once an irrevocable trust has been created, it falls outside of the grantor’s estate for tax purposes.

What is the difference between irrevocable trust and ILIT?

An ILIT is a type of irrevocable trust. There are many different types of irrevocable trusts, with varying mechanics. Talk to your financial advisor about which trust(s) is right for you.

Can you withdraw from an ILIT?

The ILIT may include provisions known as “Crummey powers,” which allow beneficiaries to receive withdrawal rights for a limited period after contributions are made to the trust. (Typically 30 days after an annual payment.)

Published: Jan 26, 2023

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.