Vanilla

Vanilla

Traditional estate planning has an inclusivity problem. Here’s how to fix it.

It’s sad and shocking to learn that beloved actor Chadwick Boseman died recently without a will. At no point did he draw up documents to ensure his loved ones knew his wishes for how to handle his near-million-dollar estate after he was gone.

Chadwick Boseman is just the latest in an ever-growing list of Black public figures—and famous people from other marginalized groups—who left an enormous positive impact on the world but left legal strife for their loved ones.

If so many extraordinarily successful people die without a clear plan for what should happen in the event of their death, what does that say about the state of estate planning for regular families?

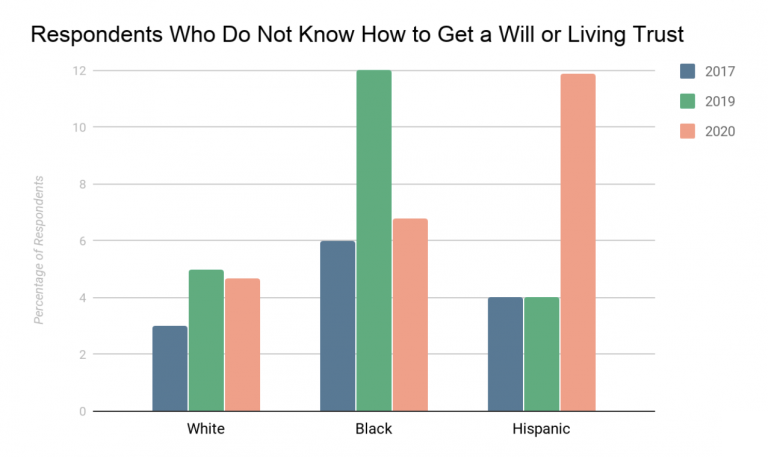

In a year when untimely deaths from the novel coronavirus are on the rise, it’s alarming to see that 68% of Americans do not have a will. And when you account for race, the statistics get even more dire: people of Black and Hispanic descent are twice as likely as white Americans to not know how to create an estate plan.

Numbers like these reveal that estate planning is ripe for democratization. But even as digital tools like Vanilla become widely available, it’s still up to financial advisors to educate all their clients on the importance of estate planning.

Let’s examine why such crucial services remain out of reach for so many—and how to fix a broken, inaccessible estate planning process.

What holds back clients from doing estate planning?

The reasons many people don’t seek estate planning services reveal cultural assumptions about who is entitled to have an estate plan, and a system that reinforces those assumptions.

Here are just some of the reasons people from marginalized groups forgo estate planning.

“Estate planning is for old, rich, white men.”

It’s not as if the perception of estate planning as the exclusive domain of straight, white, wealthy male patriarchs is without merit. We live in a nation that traditionally passed inheritance through the male line—and passed on human beings as property for at least 12 generations.

The historical exclusion of Black Americans, women, and LGBTQ people from inheritance laws led to disenfranchisement today.

Black Americans are still fighting for the generational wealth that was denied to their families under slavery, Jim Crow laws, and racist institutional policies, such as redlining. They aren’t the only group not doing estate planning, but according to estate planning and probate attorney Lori Anne Douglass, Black Americans are 50% less likely to have a living will in place.

“I am convinced that if the African-American community got on the good foot and every Black person who is alive over 60 did their estate planning, we’d be the richest minority group in the United States in one generation,” says Douglass. “We used to be the assets. Now we have assets.”

Caring.com’s Estate Planning and Wills survey revealed that Hispanic and Black Americans are less likely to know how to get a will or living trust. Source

‘We used to be the assets. Now we have assets.’

— LORI ANNE DOUGLASS

It was only in the last century that state inheritance laws began to uniformly treat widows and female heirs as equal to their male counterparts. In heterosexual marriages, women are more likely to outlive their husbands, yet they’re still less likely to have an individual estate plan.

Despite the legalization of same-sex marriage in 2015, most LGBTQ people in the United States remain unmarried and unprotected should anything happen to them or their same-sex partner. Four in 10 LGBTQ adults are estranged from their relatives, which makes their estate plans (or lack thereof) vulnerable.

It’s easy to see why people who don’t fit the description of “straight, white, wealthy, male” might feel left out of the estate planning process.

“I don’t have an estate to leave behind.”

Even when you remove race, gender, and sexual orientation as a barrier, many people think they need to be wealthy to have an estate plan.

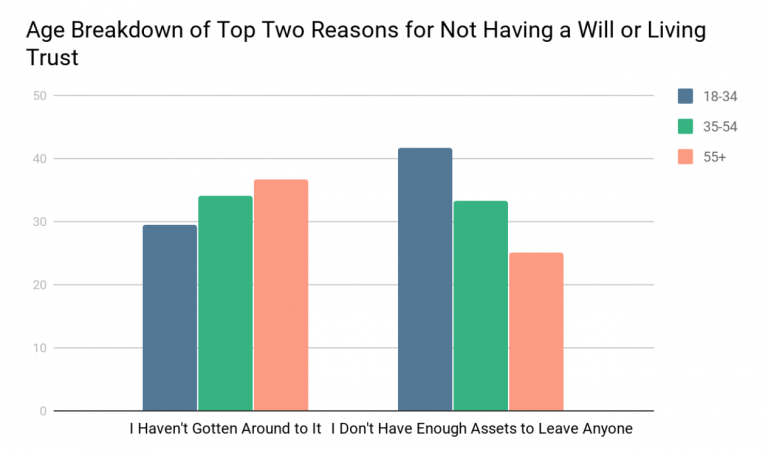

This belief is most common among people under 55. When asked in a Caring.com survey why they didn’t have a will or estate plan in place, over half of respondents between the ages of 18 and 54 said they didn’t have enough assets.

There are very real economic inequalities at play behind this attitude. The wealth gap between generations has doubled in the last 20 years. While baby boomers are enjoying a significant increase in their net worth compared with their parents, millennials earn 20% less than their parents did at their age.

Plus, considering the staggering amount of student debt that most Americans between the ages 35 and 49 carry, how can they leave any money to their kids?

It’s understandable that younger Americans have questions about whether setting up an estate plan is worthwhile, especially if they owe more money than they’d leave behind.

“Estate planning is too expensive.”

There’s no getting around this one: professional estate planning services are cost-prohibitive for average-income families.

Creating a will is less expensive, especially with direct-to-consumer digital tools on the market. Still, without documents like a living trust, a will is subject to probate, which incurs hefty legal costs.

A well-made estate plan, crafted to anticipate contingencies and to clearly communicate the wishes of the departed, can run over $10,000.

How can the average family possibly afford such a hefty expense? This is one of the reasons Vanilla exists: to help financial advisors offer a more affordable path to creating estate planning documents that go beyond a cookie-cutter will. Learn more about Vanilla here.

Traditional estate planning has a gatekeeper problem, and financial advisors hesitate to step into the role

There’s also an issue with getting estate planning tools into the hands of the people who need them most. As professionals working to help people achieve financial goals, financial advisors are in the best position to get their clients started with estate planning by initiating sensitive conversations about after-death goals.

But many financial advisors shy away from having conversations about wills and trusts and health care directives. The reasons for this go beyond discomfort over the subject matter. Like their clients, some financial advisors have false assumptions about who needs an estate plan.

And those assumptions could be placing already-vulnerable clients at risk.

Let’s address the common reasons why a financial advisor might fail to bring up estate planning with their clients.

“My client is too young.”

This may sound morbid, but no one is too young to die. If your client is over the age of 18, they need to plan for health care directives, guardianship of children (or pets), and life insurance. It’s never too early to determine what should happen in the event of their death or incapacity.

“My client doesn’t make enough to leave anything behind when they die.”

Let’s say your average-income client has a small amount of money set aside in their retirement account, and they die unexpectedly. Their spouse stayed home with the kids and has no source of income. The money that was set aside is all the family has to live off of.

If the client hasn’t designated beneficiaries, probate costs may eat up what little they leave behind, leaving their family with nothing.

As their financial advisor, you have the power to prevent this scenario from happening. All it takes is a straightforward conversation about proper beneficiary designation. And while you’re at it, talk with them about the other documentation they’ll need to keep their family protected.

“My client’s wealth is too ‘new.’”

If your client has a windfall, it’s important to preserve their wealth for their loved ones. With “new money,” estate planning is more time-sensitive than investing is. Your clients need to reduce estate tax burdens, protect digital assets, and designate beneficiaries so that new money doesn’t end up in the wrong hands in the event of their death. You can educate them on the importance of estate planning while referring them to a licensed attorney to accomplish these goals.

“My client isn’t the ‘type’ to need an estate plan.”

As we discussed earlier, there is no “type” that dictates who needs an estate plan. Examine any unconscious biases that may prevent you from serving all of your clients equally.

“I’m not an estate planning attorney. I’m worried about accidentally giving legal advice.”

As a financial advisor, your role is to ensure your clients are reaching their financial goals in life and beyond. You can guide clients in identifying estate planning needs, but you can’t take the next step and identify a solution without an attorney being involved. You should bring in an attorney whenever you’re educating a client about estate planning, and you’ve discovered unmet needs.

Plus, digital tools like Vanilla can help you partner with estate planning attorneys to review documents and consult with clients for all of their estate planning needs.

“It’s just too difficult.”

There’s no arguing with the fact that traditional estate planning is complicated. Advisors need clearer frameworks to help walk clients through these considerations in a sensitive, informed, and goal-oriented way. We created Vanilla to make estate planning less burdensome for you and your clients.

With the help of technology, Vanilla gets rid of each of these common estate planning excuses. To learn more, get in touch.

How can we make estate planning more accessible for clients and advisors?

At Vanilla, we firmly believe that estate planning can and should be for everyone. As a financial advisor, you hold the keys to evening out the playing field. Here are the ways advisors can make estate planning more inclusive:

-

Focus on client education. Initiate conversations about estate planning with your clients on a regular basis. These don’t have to be long or drawn out. Just check in to see if anything in their lives has changed (births, deaths, job changes) that could impact how their estate will be handled.

-

Use tools that make estate planning more accessible. Vanilla exists to help you empower your clients with simple, high-quality estate planning services. Our estate reporting tool helps you visualize what your clients’ estates look like today, so you can educate your clients on the advantages of various estate planning documents and connect them with an attorney to act on the information. Our document tool offers an end-to-end process that allows your clients to quickly and affordably create documents and receive a one-on-one review call with a licensed attorney.

-

Embrace and honor the diversity of your clients. You don’t want to prejudge people based on their race or gender. But it’s also important not to completely overlook the financial realities that come with being a member of a marginalized group. Provide resources that address your clients’ specific estate planning issues as members of marginalized communities.

Learn more about the estate planning challenges of underrepresented groups:

Why Estate Planning Is The Secret To Building Generational Wealth In Our Community – A guide for Black women

Estate planning protects your clients’ most important asset: their legacies

What kind of world do you and your clients want to leave behind? With the right tools in place, you can help your clients make decisions that will impact future generations for the better. Get in touch to get started.

Change the way you serve your clients

This article is for educational purposes only and should not be considered legal advice. If you feel that the information in this article is pertinent to your situation, you may wish to consult a qualified attorney for advice tailored to your circumstances.

Published: Nov 18, 2020

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.