Madison Eubanks

Madison Eubanks

State-Level Estate Planning Laws You Should Know

Where you live (and where you own property) can have a major impact on your estate planning. Taxes, probate, documents, and other estate planning processes vary from one state to another, and a quality plan takes these factors into account to ensure a person’s family isn’t left high and dry when they pass.

The best course of action is to hire a professional planner or attorney who’s experienced with the laws in your state, but familiarizing yourself with the basics is a good place to start. Here are some of the most notable state-specific estate laws to know.

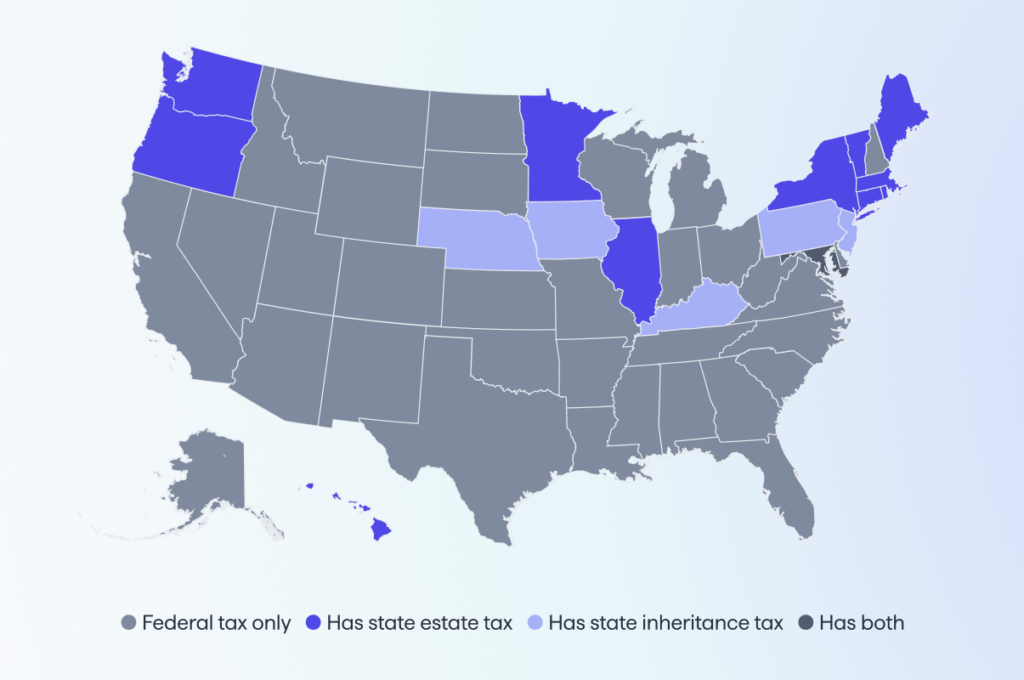

States with estate and inheritance taxes

We talk a lot about the federal estate tax exemption, which is currently $13.99 million per person and is slated to be reduced to about half of that in 2026. However, many people don’t realize that certain states have their own additional estate tax exemption rates imposed on residents. Those states and exemptions are:

- Oregon ($1m)

- Rhode Island ($1.774m)

- Massachusetts ($2m)

- Washington ($2.193m)

- Minnesota ($3m)

- Illinois ($4m)

- D.C. ($4m)

- Vermont ($5m)

- Hawaii ($5.49m)

- Maine ($6.8m)

- New York ($6.94m)

- Connecticut ($13.99 m)

Additionally, some states impose a statewide inheritance tax. Those are:

- Iowa (2-4%)

- Kentucky (4-16%)

- Nebraska (1-18%)

- New Jersey (11-16%)

- Pennsylvania (4.5-15%)

And then, of course, there’s Maryland—the lucky state that has both a state estate and inheritance tax.

- Maryland ($5m estate, 10% inheritance)

Community property states

Some states recognize “community property,” meaning that any assets acquired during a marriage are owned equally by the two spouses and should be split evenly upon divorce. Those nine states are:

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

Another five states have opt-in community property laws:

- Alaska

- Florida

- Kentucky

- South Dakota

- Tennessee

Worst places to die intestate

Probate and intestacy laws vary from state to state, and range in costliness, level of complexity, risk to assets, and clarity of process. According to a 2023 report, these are the top 10 worst states in which to die without a will:

- Hawaii

- Maryland

- New Mexico

- Alabama

- Wyoming

- Ohio

- Tennessee

- Georgia

- Alaska

- New York

Miscellaneous notable state estate laws

Georgia: Year’s support

Unlike other states, Georgia offers residents a provision called “year’s support.” This is a petition a surviving spouse and minor children may file with the probate court to grant them financial support from the estate for one year following the death. This can take precedence over creditors’ claims against the estate.

Louisiana: Forced heirship

In Louisiana, it’s required that a portion of a deceased person’s estate must go to their children, regardless of what the will says. This system of “forced heirship” applies to children under 24 or those who are permanently incapacitated.

Texas: Muniment of title

This is a probate procedure unique to Texas in which a will can be probated without the need for an administrator or executor. If there are no debts to be paid by the estate, this can enable a simpler and less expensive way to transfer assets.

Wisconsin: The “Slayer Statute”

This rule says that anyone convicted of intentionally killing someone may not inherit from the person’s estate. While some other states have a variation of this law, Wisconsin’s is particularly strict, disinheriting the murderer (or slayer) from not only the direct estate but also any family trusts or life insurance policies connected to the deceased.

New York: Right of election

In New York, a surviving spouse may claim a share of the decedent’s estate even if the will disinherits them, according to the right of election law. Regardless of what the will states, the surviving spouse may take either $50,000 or a third of the estate, whichever is greater.

California: Proposition 13

Proposition 13 impacts property tax assessment for real property in California. The proposition established the concept of a base year value for all real property. It limits the rate of taxation on real property to 1% of the assessed value, and restricts the amount by which taxes can increase each year to 2%.

This information is accurate as of August 2024, but details are subject to change. The information provided here does not constitute legal, financial, or tax advice. It is provided for general informational purposes only. This information may not be updated or reflect changes in law. Please consult with an estate attorney, financial advisor, or tax professional who can advise as to your particular situation.

Published: Feb 16, 2025

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.