Vanilla

Vanilla

Kitces Survey Spotlights Vanilla as a Leader in Market Share and Satisfaction Ratings for Estate Planning Tech

The 2024 Financial Financial Planner Productivity Study from Kitces, How Financial Planners Actually Do Financial Planning, collects data on the key drivers of team productivity for advisory firms.

This data is crucial for firm success as clients continuously expect more from their relationships with their advisors, and advisors are faced with finding ways to meet these evolving needs without adding hours to their day or increasing overhead costs.

Importantly, this survey reflects how real advisors operate in their practices day to day—shedding light on the tools they use, how they approach certain processes, their client interactions, and more. This sets the Kitces.com study apart from other industry award programs that often require companies to submit applications and pay fees to participate.

Here are some highlights from the 2024 study.

Vanilla was named a top 2 estate planning platform by market share—leave the rest behind

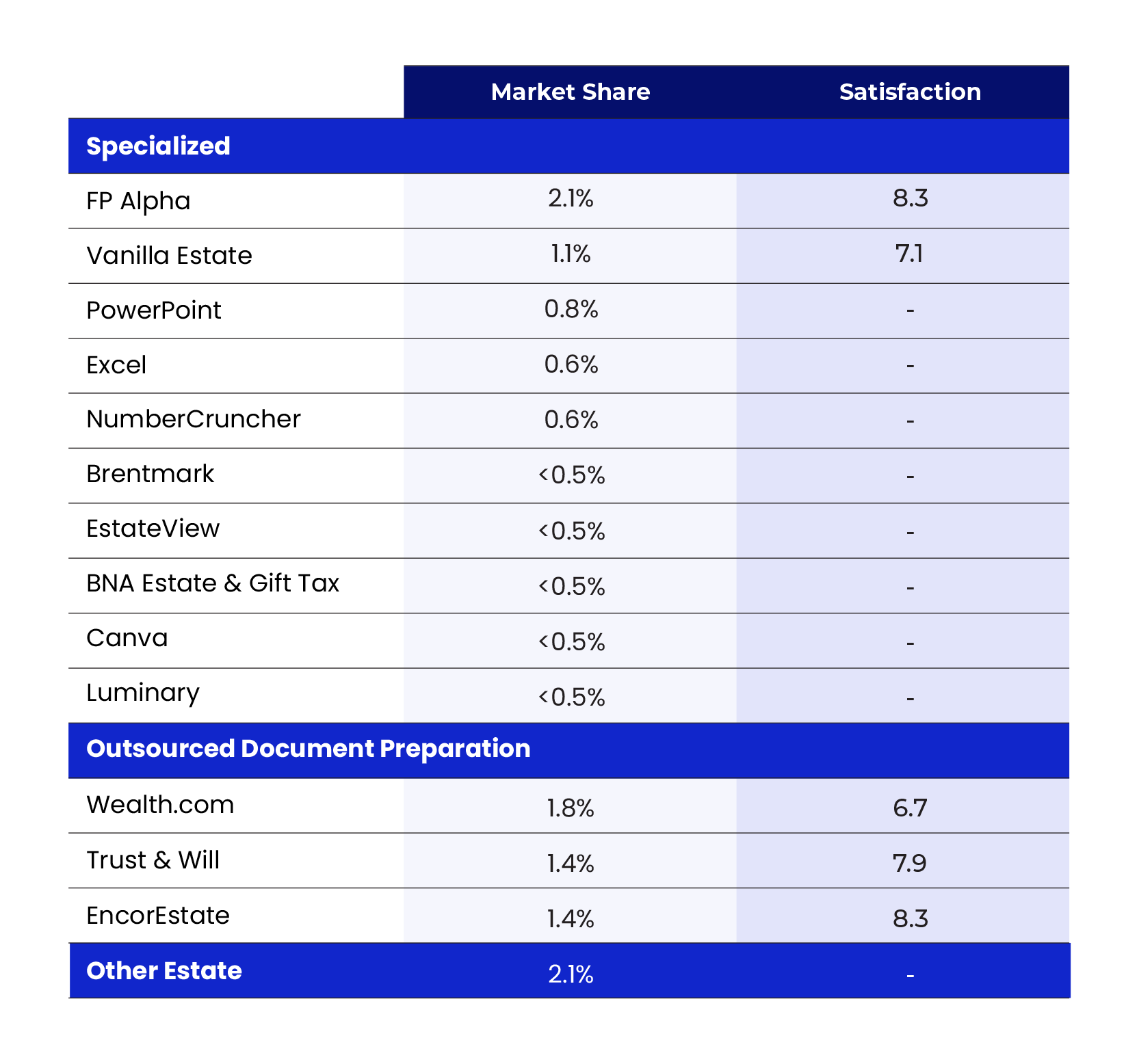

In the 2024 study, respondents reported using Vanilla and FP Alpha more often than any other estate planning software. Real client experience and adoption matter, and those advisors have spoken.

“The end result is that there has been a concomitant rise in specialty estate planning tools, for which FP Alpha has successfully positioned itself as an emerging leader by both market share and satisfaction ratings, followed by Vanilla, while no other provider even generated enough adoption in the aggregate for us to calculate a satisfaction rating (and notably, the most popular after FP Alpha and Vanilla was simply advisors building their own estate planning flow diagrams in PowerPoint!).” –2024 Financial Financial Planner Productivity Study from Kitces

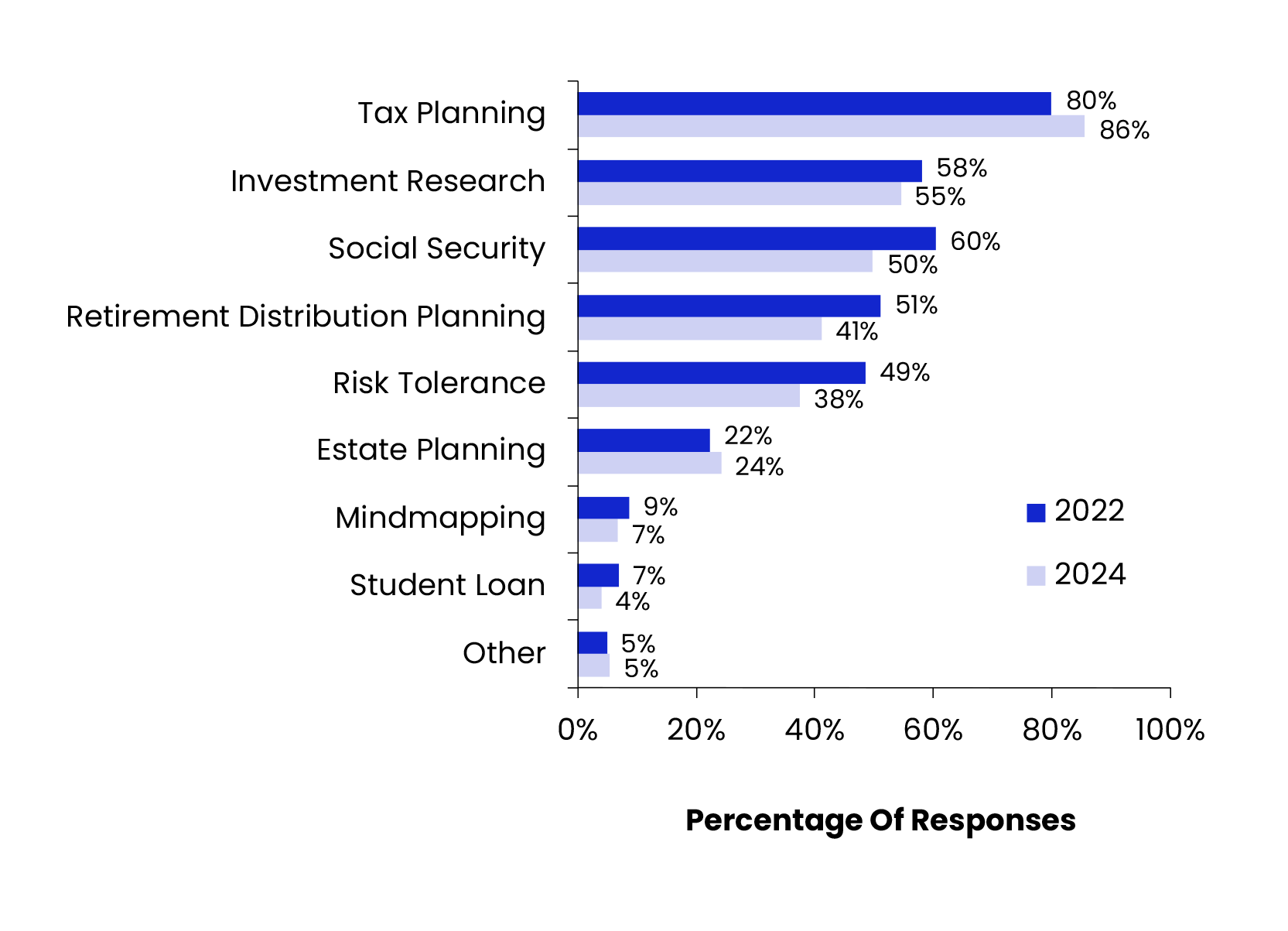

Use of estate planning software is growing

Of the specialized software used by advisors and wealth management firms, estate planning is one of the only usage areas that grew in the past two years. In 2024, 24% of firms used an estate planning solution, up from 22% in 2022. Aside from tax planning software, estate planning is the only software category that has seen a rise in usage since the previous study.

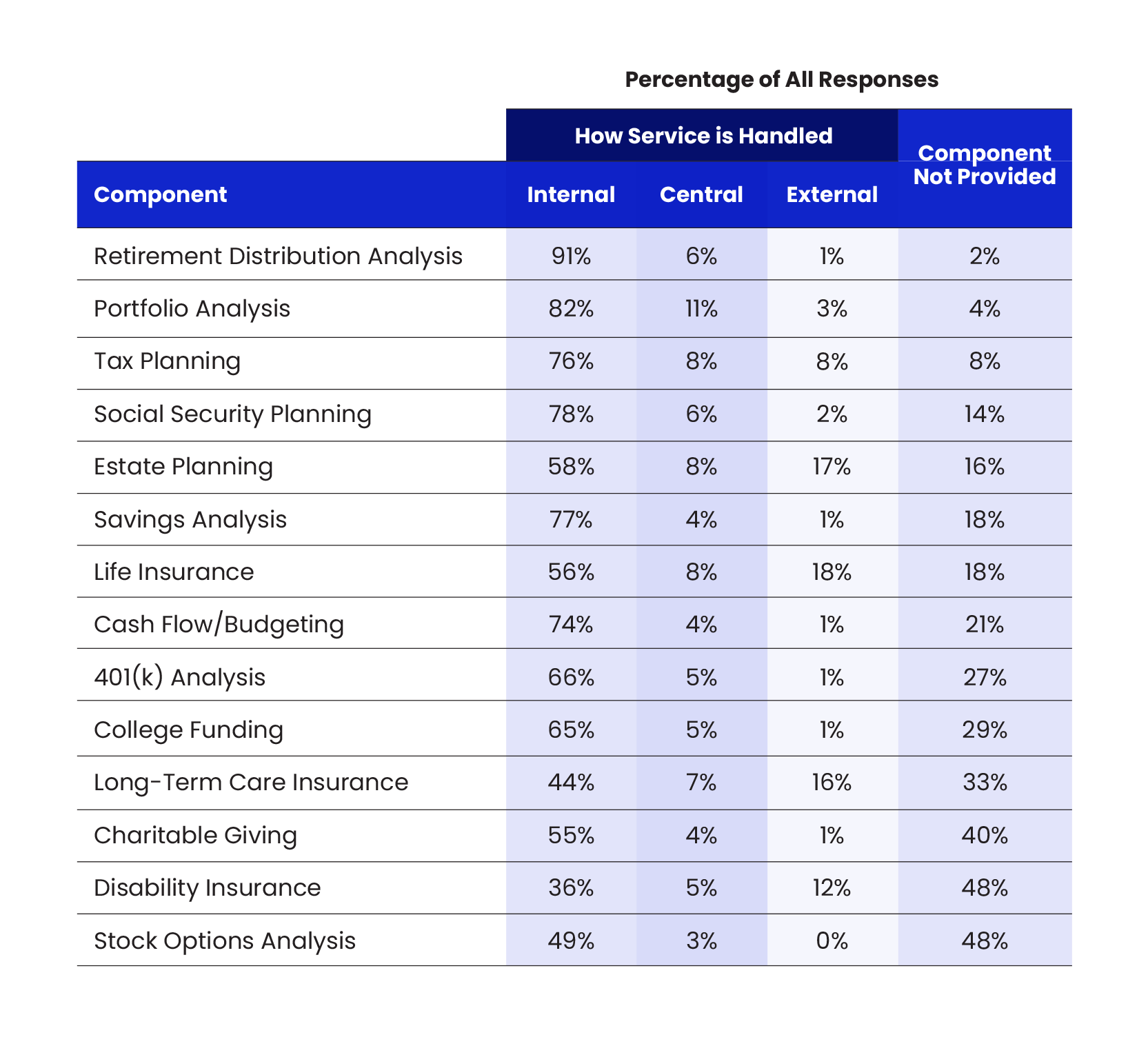

Many firms are outsourcing estate planning services

The study looked at which financial planning services handled internally, centrally, or externally. Estate planning was reported as the second most outsourced service with 17% reporting it’s handled externally. Only life insurance was reportedly outsourced more often at 18%.

This is significant because, according to the study, estate planning is included in 84% of financial plans, meaning advisors who are outsourcing these services could be leaving revenue on the table.

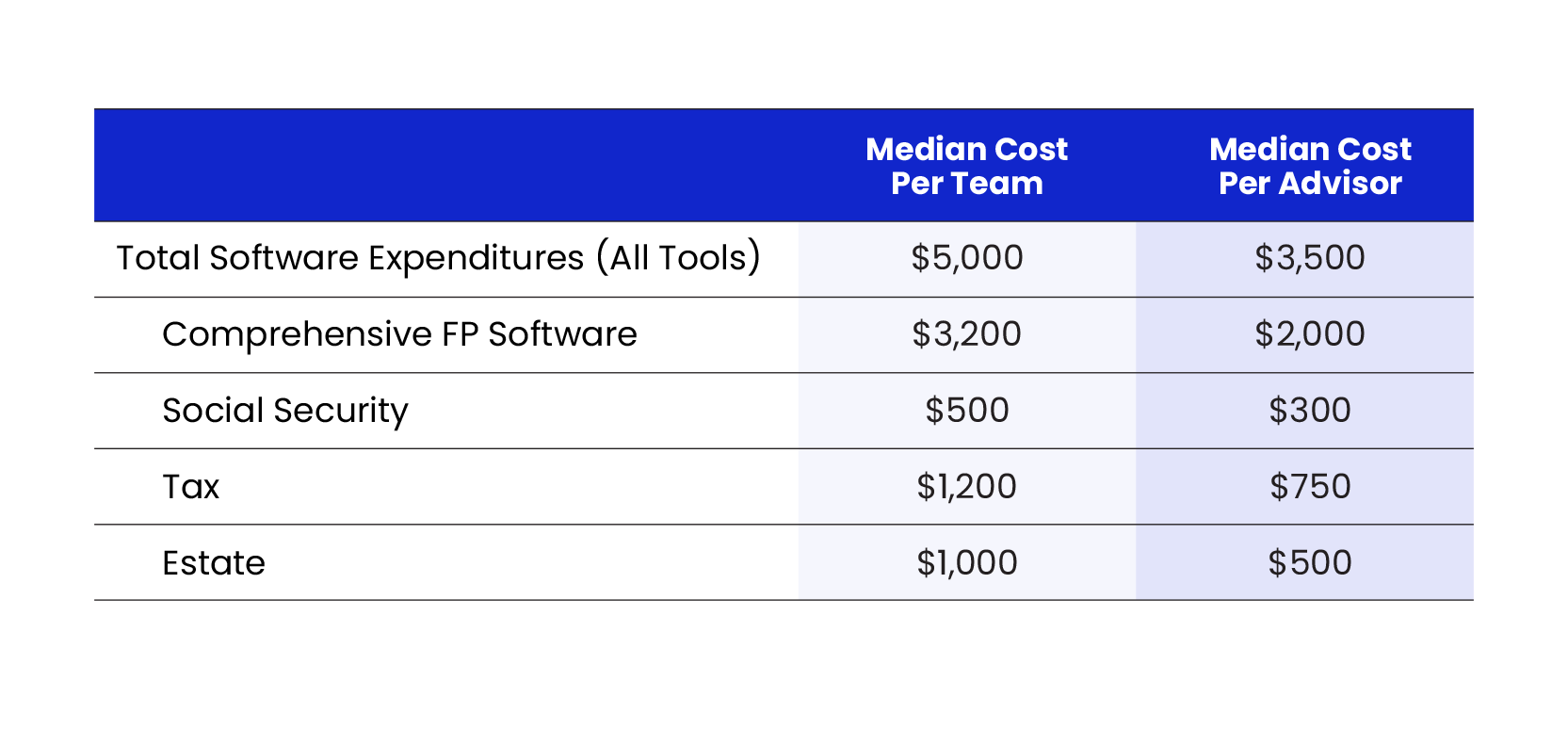

Estate planning software is relatively low cost

When asked what their firm spends for access to software, estate planning platform licenses were among the least costly for respondents, at a median cost of $500 per advisor and $1000 per team.

Take into consideration the potential ROI of offering estate planning, and it’s easy to see how estate planning software quickly pays for itself. For example, in a recent study, Vanilla found that Mariner Wealth Advisors with high adoption of Vanilla’s estate planning platform saw a 2.2x increase in growth rate and 5.2x higher overall revenue compared to offices with low or no usage.

As the emphasis on estate planning continues to grow, advisors who approach it proactively with tech-enabled solutions are likely to attract, retain, and delight clients in a meaningful way.

Read the full study from Kitces.com here.

If you’re ready to learn about how a specialized estate planning software can benefit your firm, get in touch with the Vanilla team.

Published: Apr 07, 2025

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.