Jim Sinai

Jim Sinai

How rising interest rates affect estate planning strategies

What changes in estate planning when rates go up? Over the past two years, interest rates have moved from near zero to 5.25%. Most clients are probably worried about how rising rates will affect their investment and retirement accounts. But advisors working with high net worth clients should also consider how a 500+ basis point shift in rates affects advanced estate planning strategies. Some strategies become more attractive as interest rates rise, while others become less attractive.

Advanced estate planning strategies

There are a number of advanced estate planning strategies that can be used to reduce a client’s taxable estate and help them pass more wealth to their heirs. Some of these strategies include:

- Qualified Personal Residence Trusts (QPRTs)

- Grantor Retained Annuity Trusts (GRATs)

- Intra-Family Gift Loans

- Charitable Remainder Trusts (CRTs)

- Charitable Lead Trusts (CLTs)

The common thread across these strategies are that they are either about efficiently using up the lifetime gifting exemption, which will be sunsetting in 2026, or about freezing the assets in an estate and letting them grow outside the estate. While all are established estate planning strategies, not all of these strategies are as successful in higher interest rate environments.

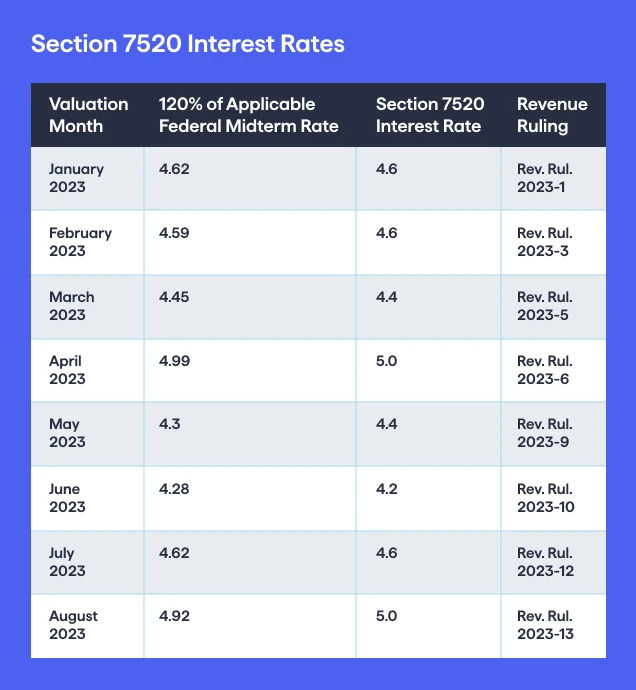

IRS Sets the 7520 Rate

While most of us pay attention to the Federal Reserve’s target Fed Funds rate, the IRS publishes minimum monthly interest rates, including the §7520 rate, which is a key component of many estate planning strategies. This rate is based on a longer term rate, known as the federal midterm rate. The federal midterm rate is a benchmark interest rate used for certain financial instruments, used for longer-term lending.

The IRS has strict rules when calculating the value of assets for estate and charitable tax planning. Internal Revenue Code section 7520 outlines the rules for these calculations, which utilize the §7520 rate. Examples of the past few months rates are below:

Estate strategies that are better with higher rates

With a Qualified Personal Residence Trusts (QPRT), individuals can transfer their home to a trust while still living in the property for a specified period, after which the property is transferred to beneficiaries (typically, a trust for the benefit of descendants and/or a spouse). On the transfer of the home to the QPRT, the individual is deemed to have made a gift of the home at a reduced value because of the retained right to live in the house for the specified period of time. The value of the retained interest is calculated using the current §7520 rate, so when the §7520 rate is higher, the value of the right to remain in the home during the specified term increases, which lowers the value of the gift to the beneficiaries, and therefore makes it a more tax-efficient strategy.

How rates affect QPRTs – a case study

Here’s is an example comparing how a QPRT works with a low rate vs. higher rate:

Let’s say you have a 65-year-old client with a $5 million home. They want to use a QPRT to transfer the home to their children while minimizing gift taxes. Two years ago, the §7520 rate for the month of the transfer would have been 1% (using the April 2021 rate). With a QPRT, your client would retain the right to live in the home for a specified period of time, such as 20 years. At the end of the term, the home would pass to your client’s children.

The value of the retained interest in the home transferred to the QPRT is determined using the §7520 rate. In this case, the retained interest would be valued at $902,278. This is because the present value of $5 million in 20 years, discounted at the 1% §7520 rate, is $4,097,722.

The taxable gift your client would make by transferring the home to the QPRT two years ago would be $4,097,722. This is the difference between the value of the home ($5 million) and the value of the retained interest ($902k).

Now let’s say your client wants to do the same strategy in 2023. For this example let’s say the §7520 rate for the month of the transfer is 5% (using the April 2023 rate to keep the numbers round). In this case, the value of the client’s retained interest in the home transferred to the QPRT would be $3,115,553. This is because the present value of $5 million in 20 years, discounted at the 5% §7520 rate, is $1,884,447.

The taxable gift your client would make by transferring the home to the QPRT in 2023 would be a much lower number of $1,884,447. This is the difference between the value of the home ($5 million) and the value of the retained interest ($3,115,553).

[retained interest = property value * (1 – (1 + i)^-n)

Where:

- property value = The fair market value of the property

- i = Interest rate

- n = Number of years

As you can see, the taxable gift your client made by transferring the home to a QPRT is higher when the §7520 rate is lower. This is because the value of the client’s retained interest is lower when the §7520 rate is lower.

In this example, the taxable gift you would make would be $4,097,722 if the §7520 rate was 1%, and $1,884,447 if the §7520 rate was 5%.

Estate strategies that are less attractive with higher rates

- Grantor Retained Annuity Trusts (GRATs): GRATs allow individuals to transfer assets to beneficiaries at a reduced gift tax cost. The individual who creates the GRAT transfers assets to the trust and retains an annuity payment for a specified period of time. The gift is equal to the fair market value of the assets transferred to the GRAT less the present value of the annuity from the GRAT, which is determined based on the §7520 rate. When evaluating a GRAT, the §7520 rate becomes the hurdle rate that the assets must clear to make the GRAT strategy successful. As interest rates rise, the §7520 rate rises as well, as does the value of the annuity increases. This, in turn, means that the assets must appreciate at a greater rate than the hurdle rate in order for the GRAT to be successful.

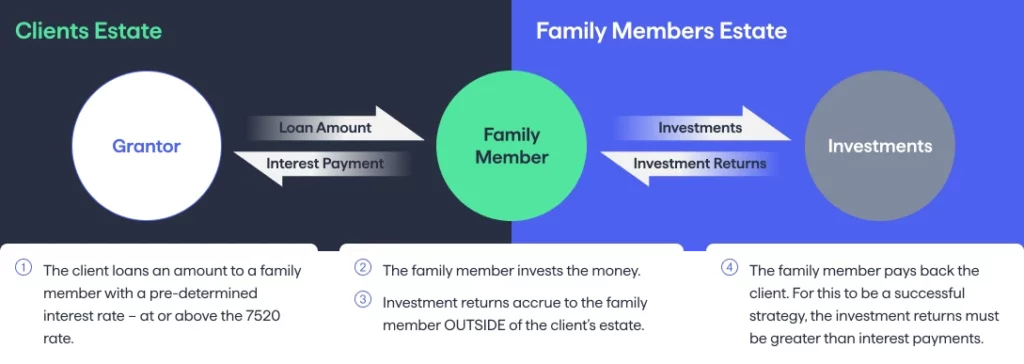

- Intra-Family Gift Loans: Intra-family gift loans are loans that are made between family members. The benefit of this technique is that the loan “freezes” the loaned funds in the hands of the family member lender at the current interest rate, which is based on the §7520 rate. Ideally, the borrower will invest the funds and the appreciation will benefit of the borrower’s estate. But, as interest rates rise, the §7520 rate rises as well, which means that the amount of interest that must be paid to the family member lender rises. This, in turn, means that the investment made by the borrower must increase at a rate greater than the 7520 rate in order for the freeze technique to be successful.

The effects of higher rates on charitable estate planning strategies

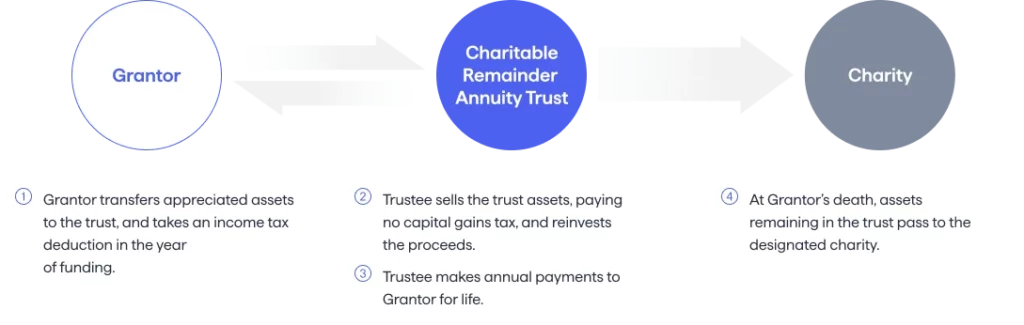

Charitable estate planning strategies are also affected by rising interest rates. A core tenet of giving to a charitable trust is to move value from the client’s estate to the charitable estate. A good plan maximizes the value to the charity (reducing the taxable estate) while at the same time providing cash flow back to the client or appreciation to the client’s family.

- In a charitable remainder trusts (CRT), individuals donate assets to a charitable organization while retaining an income stream from those assets for a specific period or for life. To ensure that a CRT is a legitimate charitable giving vehicle, IRS guidelines require that the present value of the charitable beneficiaries’ remainder interest be at least 10% of the trust assets’ value when contributed.CRTs become more attractive as interest rates rise. This is because the value of the charitable remainder interest in a CRT is based on the §7520 rate. As interest rates rise, the §7520 rate rises as well, which means that the value of the charitable remainder interest increases, making it much easier to meet the IRS guideline. This, in turn, also means that the amount of the charitable gift (and therefore charitable deduction) increases as well.

- Charitable lead trusts (CLTs) become less attractive as interest rates rise. This is because the value of the charitable lead interest in a CLT is based on the §7520 rate. As interest rates rise, the §7520 rate rises as well, which means that the value of the charitable lead interest increases. This, in turn, means that the assets must appreciate at a greater rate in order for the CLT to successfully pass appreciation to the non-charitable beneficiaries.

How advisors can help guide clients

Advisors can take advantage of estate planning software that is purpose built to help them simplify and visualize the strategies with clients. Finally, it’s important the advisor partners with an estate planning attorney to move from estate advisory to estate planning.

***

The information provided here does not, and is not intended to, constitute legal advice or tax advice; it is provided for general informational purposes only. This information may not be updated or reflect changes in law. Please consult with your financial advisor or estate attorney who can advise as to whether the information contained herein is applicable or appropriate to your particular situation.

Published: Aug 02, 2023

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.