Vanilla

Vanilla

Unlocking Scale: How Matter Family Office Streamlines Estate Planning with Vanilla + eMoney

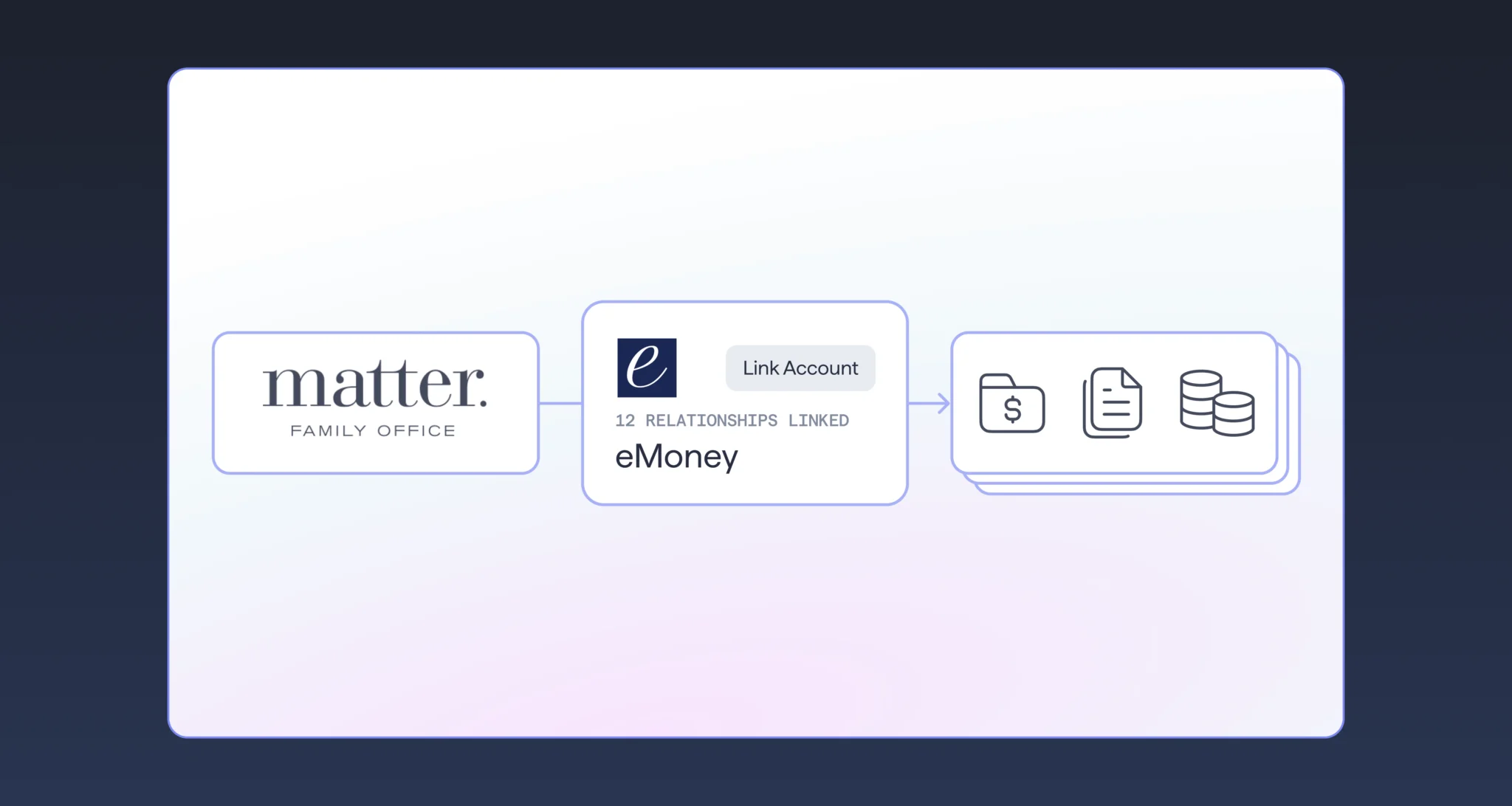

Vanilla recently announced our integration with eMoney, empowering financial advisors to streamline their estate planning workflows like never before. Matter Family Office, a nationally recognized advisory firm managing approximately $3.5 billion in assets, is already leveraging this integration to enhance efficiency, improve client engagement, and scale the impact of estate planning across their client base.

The Power of Integration

A truly comprehensive approach to estate planning is not complete without visibility into the client’s balance sheet. For many advisory teams, this data already exists in eMoney. Until now, this gap has led to inefficient workarounds to get eMoney data into a client’s estate. The Vanilla + eMoney integration eliminates these inefficiencies by seamlessly connecting client financial data in eMoney with Vanilla’s advanced estate planning tools. As the only estate planning platform integrated with eMoney, Vanilla offers a differentiated advantage for advisors seeking to elevate their service and scale estate planning offerings.

Meet Matter Family Office

Matter Family Office is an independent multi-family office with locations in St. Louis, Denver, and Dallas. Founded in 1990 to empower ultra-high-net-worth families to achieve long-term success, Matter manages approximately $3.5 billion in assets across 234 client accounts. Through an integrated, personalized approach to wealth management, Matter serves as a strategic partner, guiding families to navigate wealth complexities, make informed decisions and build enduring legacies. The team’s services span investment management, wealth planning and coordination, and family culture and learning—reflecting its belief that true wealth is about more than just money. With a team of 56 professionals, including 35 investment advisors, the firm delivers highly personalized service and innovative family office solutions designed to support multigenerational success.

The Turning Point

To enhance its estate planning capabilities, Matter Family Office adopted Vanilla, a platform designed to simplify estate planning visualization and execution. With the launch of the eMoney integration, Matter Family Office saw an opportunity to enhance its existing workflows and streamline estate planning with less manual effort. Implementation was seamless, and the benefits became evident immediately.

Real Results: How the Integration Transforms Planning at Matter Family Office

By integrating Vanilla and eMoney, Matter Family Office removes time-consuming manual steps and enhances its ability to deliver personalized estate planning at scale.

- Automatic data syncing reduces the need for manual entry, ensuring financial data stays current.

- Estate plan visualizations are generated faster with detailed analyses, fueling deeper and more frequent planning conversations.

- Proactive planning insights as a result of the up-to-date data help advisors identify gaps and opportunities that may have previously been overlooked.

- Deeper client engagement across the book of business have followed, with clients responding positively to high quality, actionable conversations about their legacy.

The impact has been immediate:

- Time Savings: Advisors cut estate plan prep time by hours per client.

- Expanded Capacity: The team can now engage more clients in estate planning conversations effectively.

- New Planning Opportunities: Efficiency gains uncovered additional areas for advisory and estate planning

“This integration is a great example of how the right technology can enhance both client service and firm efficiency. It’s helped us expand our planning capacity and uncover new opportunities without increasing operational burden.”

—Marly Raycraft, Managing Director @ Matter Family Office

What This Means for Advisors

Matter Family Office’s success demonstrates what’s possible when technology quietly enhances workflows—freeing advisors to focus more deeply on what matters most: their clients. By unifying financial data and estate planning, advisors can scale estate advice efficiently, enhance client relationships, and unlock new growth opportunities.

Advisors looking to modernize and optimize their estate planning processes can learn more about the Vanilla + eMoney integration at www.justvanilla.com.

About Vanilla

Founded by Steve Lockshin, a #1 nationally ranked financial advisor by Barron’s, Vanilla is the category-defining leader in estate planning technology, transforming how advisors deliver estate advice at scale. Backed by leading investors including Venrock, Insight Partners, and NBA legend Michael Jordan, Vanilla has raised $80+ million and assembled an unmatched team, enabling an unrivaled pace of innovation and expertise. The platform has processed over 40,000 estate planning documents, is connected to more than $250 billion in assets, and is the most widely adopted platform by institutional and enterprise firms, including over 50% of the top 25 largest firms in the U.S. With 20+ in-house planning experts, 180+ years of collective experience, and a legal advisory board featuring partners from top national law firms, Vanilla is setting the new standard in estate planning. Vanilla is the only platform that has demonstrated ROI at scale, driving measurable growth for firms like Mariner Wealth Advisors and Vanguard. The company has earned numerous prestigious awards, including multiple Luminaries Awards, WealthTech Americas honors, recognition for innovation from Family Wealth Report and WealthManagement.com, and the Inspiring Fintech Females award for leadership in fintech.

Learn more at justvanilla.com.

Published: Apr 08, 2025

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.