Simona Ondrejkova, CFP

Simona Ondrejkova, CFP

Dynasty Trusts: Everything You Need to Know

To achieve estate planning objectives, it helps to be familiar with various types of trusts. A dynasty trust can be a great tool for clients who want to preserve their wealth or family business for several generations while minimizing estate taxes.

Here, we’ll help you understand what exactly a dynasty trust is, how it works, how it differs from other trusts, how to set one up, and when it might be a good idea to use one. We’ll also discuss the tax implications of using a dynasty trust and how it can minimize a certain type of tax that specifically applies when passing down wealth through generations.

What is a dynasty trust?

A dynasty trust is designed to hold and manage assets for multiple generations while minimizing estate taxes. It is a perpetual trust that allows high-net worth families to grow and distribute wealth over time without incurring additional transfer taxes with each generational transfer.

One of the ways that a dynasty trust is unique is its potential to minimize the impact of the generation-skipping transfer tax (GSTT). The GSTT rate is equal to the highest federal estate tax rate, which today is a flat 40% tax rate imposed on transfers to beneficiaries at least two generations younger or, if unrelated, 37.5 years younger than the person making the transfer. Essentially, the GSTT is designed to prevent families from continually passing wealth down through generations without paying taxes on those transfers.

By using a dynasty trust as part of their estate planning, your clients may be able to mitigate the effects of the GSTT to some level. However, it’s important to note that the use of dynasty trusts is only available in certain states due to the rule against perpetuities.

Which states allow dynasty trusts?

There is a legal principle called the “rule against perpetuities” that restricts the duration of certain interests in property. This rule is relevant in estate planning because it potentially restricts how long a trust can last.

There are 31 states that have either abolished the rule against perpetuities or have significantly extended the duration of the restriction period. As of 2018, these states include, but aren’t limited to:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Florida

- Georgia

- Hawaii

- Indiana

- Kansas

- Massachusetts

- Minnesota

- Montana

- Nebraska

- Nevada

- New Jersey

- New Mexico

- North Carolina

- North Dakota

- Oregon

- South Carolina

- South Dakota

- Tennessee

- Utah

- Virginia

- West Virginia

- Washington, D.C.

Because the laws of each state change over time, it’s best to consult with an estate planning attorney in your state to see if a dynasty trust can be established there.

How do you establish a dynasty trust?

Like other trusts, setting up a dynasty trust is best done with an estate planning attorney in your state.

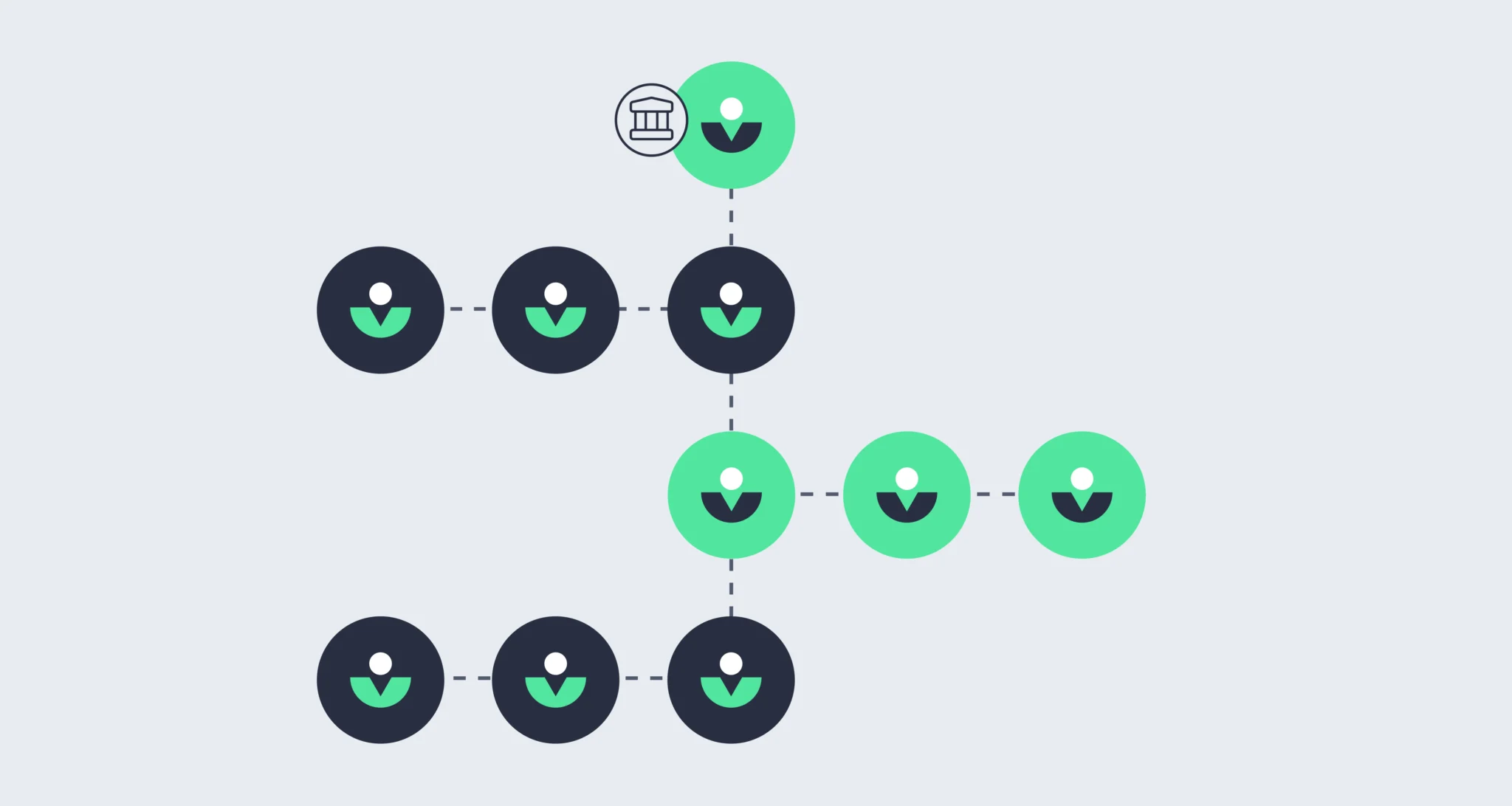

One of the first steps involved in setting up a dynasty trust is that the individual creating the dynasty trust, the settlor, will need to designate the beneficiaries and trustees of the trust. The settlor gets to define when and how assets will be distributed to beneficiaries in accordance with the family’s values and goals.

Because of the long-lasting nature of a dynasty trust, it’s extra important to be mindful when setting the terms and trustees of the trust. Several successor trustees could be appointed to manage the assets in case something happens to one of the trustees. Or your client may consider appointing a bank or financial institution as the trustee.

The trust can be funded with assets like cash, investments, personal and real property, and shares of a clients’ business. Once established and funded, the dynasty trust becomes irrevocable. At that point, the provisions of the trust are typically hard to change, other than court-mandated changes that can occur if a beneficiary or trustee legally gains permission to do so.

What are the tax implications of dynasty trusts?

When used in estate planning, dynasty trusts are often structured with tax efficiency in mind. Trustees and beneficiaries may work together to strategize and minimize tax responsibilities. Additionally, the choice of where the trust is set up and where the beneficiaries live can play a significant role in shaping the overall tax structure.

One of the greatest advantages of using a dynasty trust is that it could help clients minimize the effect of the generation-skipping transfer tax (GSTT) mentioned above. In addition to the federal estate and gift tax exemption that can be used to offset estate taxes ($13.61 million per individual or $27.22 million per couple in 2024), clients can also use the GSTT exemption to reduce the GSTT tax. This exemption is separate from the federal estate and gift tax exemption and is also $13.61 million per individual.

Because the trust is irrevocable, once it is funded, the assets put into the trust and any future appreciation on those assets are outside of the settlor’s taxable estate for estate tax purposes. If the settlor has assets that could appreciate significantly in the future (such as business interests), placing them into the dynasty trust essentially “freezes” the value of those assets for gift and estate tax purposes.

So what are the income tax implications for the settlor and the beneficiaries of a dynasty trust? Because a dynasty trust is irrevocable, it is a type of non-grantor trust that pays taxes under its own tax identification number. This means that the trust is responsible for reporting and paying taxes on its generated income at the applicable trust income tax rates.

The dynasty trust could contain special provisions that qualify it as a “grantor trust” for income tax purposes. This means then that the settlor will pay the income taxes related to the income generated by the assets of the dynasty trust. This is not considered a gift and can also help reduce the amount of wealth subject to estate tax when the settlor dies.

Dynasty trust example

John and Sue wish to transfer $20 million of their assets to their three children, seven grandchildren, and any future descendants. They name their three children as the initial beneficiaries of the trust and their grandchildren and future descendants as subsequent beneficiaries. They name their wealth management company as the trustee to make decisions on the dynasty trust after their passing.

John and Sue utilize a part of their combined federal estate and gift tax exemption and a part of their GSTT exemptions to transfer $10 million of their business and $10 million of their investment assets into the dynasty trust. Since their GSTT exemptions and combined estate tax exemptions cover the gift to the trust, these assets are no longer counted as part of their estate.

Even as the trust value grows after the assets are transferred into the trust, the trust is not subject to John and Sue’s estate and therefore avoids federal or GSTT taxes.

By leveraging a dynasty trust, John and Sue are able to:

- Allow the trust to grow and compound over time

- Avoid triggering the GSTT at each generational transfer

- Extend their financial legacy well into the future for their heirs

In addition to these benefits, a dynasty trust also offers several additional advantages to clients looking to leverage advanced estate planning strategies to maximize their legacy.

What are the benefits of a dynasty trust?

A dynasty trust is unique in its ability to last for several generations. Since dynasty trusts allow flexibility in choosing beneficiaries, including the ability to include future generations not yet born at the time of trust creation, they can easily accommodate changing family dynamics.

Additionally, individuals creating the trust can choose to incorporate provisions for distributions to beneficiaries based on their health, education, and maintenance needs in order to promote financial responsibility among heirs.

Like many other irrevocable trusts, a dynasty trust also offers asset protection. Assets held within a dynasty trust are typically safeguarded against risks such as creditors, legal claims, and potential divorces among beneficiaries.

What are the downsides to a dynasty trust?

Although dynasty trusts offer many advantages, it’s important to be aware of some of the potential downsides that might not make a dynasty trust the best option for your client. One of these is the irrevocable nature of these trusts which limits the flexibility in managing family wealth as the settlor loses control of the assets within the trust and cannot make changes to the trust terms after its establishment.

Additionally, loss of access to the trust assets should also be considered. Dynasty trusts are designed to preserve wealth for future generations, and gifts made to the dynasty trust by the settlor cannot be reacquired. The settlor is also not entitled to receive income generated by the trust assets during their lifetime.

Lastly, it’s important to consider the impact on beneficiaries. The long duration of the trust could pose risks to family harmony as the risk of family disputes and conflicts may increase with the amount of heirs that are included in the trust. While dynasty trusts aim to provide financial support across generations, beneficiaries may become dependent on the trust and may not pursue their personal and professional goals independently.

Is there a difference between a legacy trust vs dynasty trust?

The terms “legacy trust” and “dynasty trust” are sometimes used interchangeably, but there is a slight difference between the two that is helpful to understand as you help clients understand the complexity of dynasty trusts.

A legacy trust is a type of trust that encompasses both financial legacy and non-financial elements like family traditions, values, and personal narratives. Unlike dynasty trusts, legacy trusts may not always continue indefinitely; they might have a specified endpoint, such as distributing assets to a particular generation or after a predetermined period.

While both trusts share the common objective of preserving wealth and values for future generations, the key difference lies in the perpetuity associated with dynasty trusts.

Is it time to consider a dynasty trust?

Because of the 2026 federal estate tax exemption sunset, high-net-worth clients who haven’t recently had their estate planning updated or reviewed may want to consider doing so before the exemption amount gets cut significantly.

With dynasty trusts explained in this article, consider if you currently have any clients who could benefit from setting one up to achieve their estate planning and legacy goals more efficiently.

Not sure how to start the estate planning conversation with clients? Use our estate planning checklist for financial advisors and attorneys to ask the right questions to guide clients in selecting the best estate planning strategies for their needs.

Published: Mar 14, 2024

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.