Vanilla

•

Apr 17, 2025

Mariner Offices Drive Revenue and Growth with Vanilla

Mariner sees a 200% increase in revenue growth rates among the advisors who have adopted Vanilla for holistic planning

Head of Content Marketing

Dan is the head of content at Vanilla, where he works to untangle the often inscrutable worlds of estate planning, finance and technology. Prior to joining Vanilla, he led a team of writers, designers and video producers to build out an industry-leading content program for TaxJar, which was acquired by Stripe. Between Vanilla and TaxJar, you could say that Dan is cultivating a unique expertise on death and taxes.

Previously, he led brand, advertising, visual design and content as the director of brand creative at Axon, where he oversaw the successful launches of several key products, including body cameras for law enforcement. Before moving in-house, Dan worked as a writer and creative leader on the agency side for clients such as Microsoft, Amazon, Hulu, Starbucks, Homestreet Bank and more. He lives in Seattle, WA.

Vanilla

•

Apr 17, 2025

Mariner sees a 200% increase in revenue growth rates among the advisors who have adopted Vanilla for holistic planning

Vanilla

•

Apr 17, 2025

Vanilla Delivers Modern Estate Planning Capabilities to More Than 700 Advisors at Mariner Salt Lake City, UT – April 17, 2025 – Vanilla, the leading platform in modern estate planning, announced a partnership with Mariner, a national financial services firm, to deliver estate planning and advisory capabilities to the more than 700 advisors managing $560B in assets at the firm. Since the partnership began, Mariner has seen a 200% increase in revenue growth rates among the advisors who have adopted Vanilla for holistic planning. “We’re thrilled to have expanded our relationship with an iconic firm like Mariner, which is leading...

Vanilla

•

Apr 16, 2025

As advisors well know, periods of market volatility can elicit anxiety, frustration, and lots of questions from clients. These moments of instability are the time for advisors to lean in, calmly and confidently helping clients navigate through uncertainty. Rather than hunkering down to wait out the storm, savvy advisors can pivot to other planning opportunities during times like these. In this webinar, Vanilla’s experts will draw on their years of industry experience to share tips for navigating market volatility, like: Think about asset protection Focus on the long-term planning goals Look beyond investing to more holistic planning Optimize tax efficiency...

Sarah D. McDaniel, CFA

•

Apr 10, 2025

For advisors, staying on top of financial markets and structural developments to identify opportunities for your clients and prospects—and then guiding them through implementation—is essential for success. When markets are turbulent, it’s a smart time to revisit estate planning. While the instinct might be to pause and wait for stability, volatile periods can actually open up strategic opportunities. Using the blog The Building Blocks of Estate Planning Techniques as a guide, we’ll outline some timely actions advisors can take to calmly and confidently help clients at different wealth stages navigate periods of uncertainty. For a deeper dive, download the complete...

Vanilla

•

Apr 09, 2025

Vanilla Recognized in Product Innovation and Outstanding Contribution categories; Chairman Steve Lockshin a Finalist for Outstanding Individual Contribution Salt Lake City, UT – April 7, 2025 – Vanilla, the leading platform in modern estate planning, has been selected as a finalist for the Twelfth Annual Family Wealth Report Awards 2025 program in the following categories: Product Innovation (B2B) Outstanding Contribution to Wealth Management Thought Leadership (Company) Outstanding Contribution to Wealth Management Thought Leadership (Individual) – Steve Lockshin Through a rigorous and independent judging process, the annual Family Wealth Report Awards program honors the most innovative and exceptional firms, teams and...

Vanilla

•

Apr 08, 2025

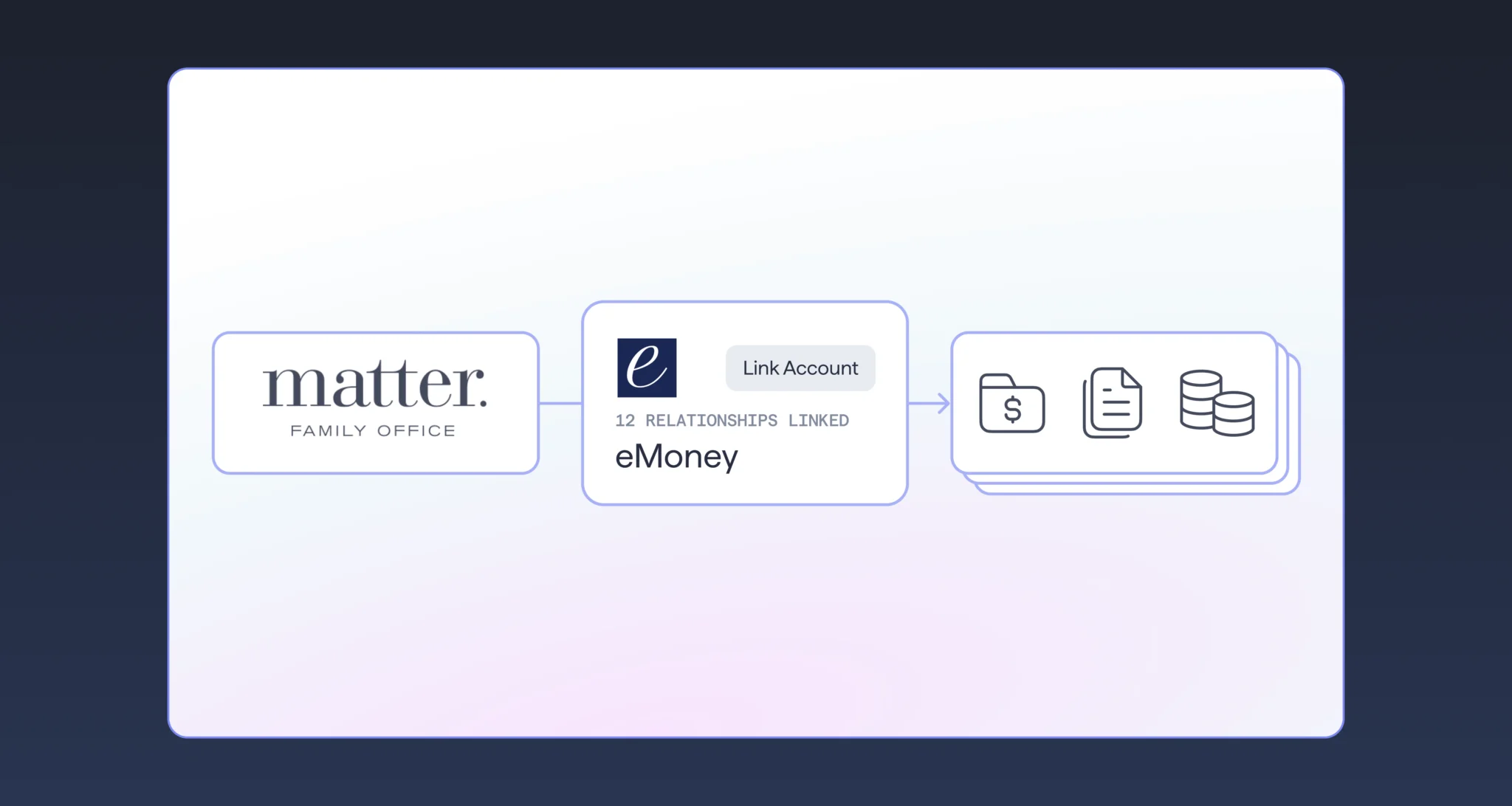

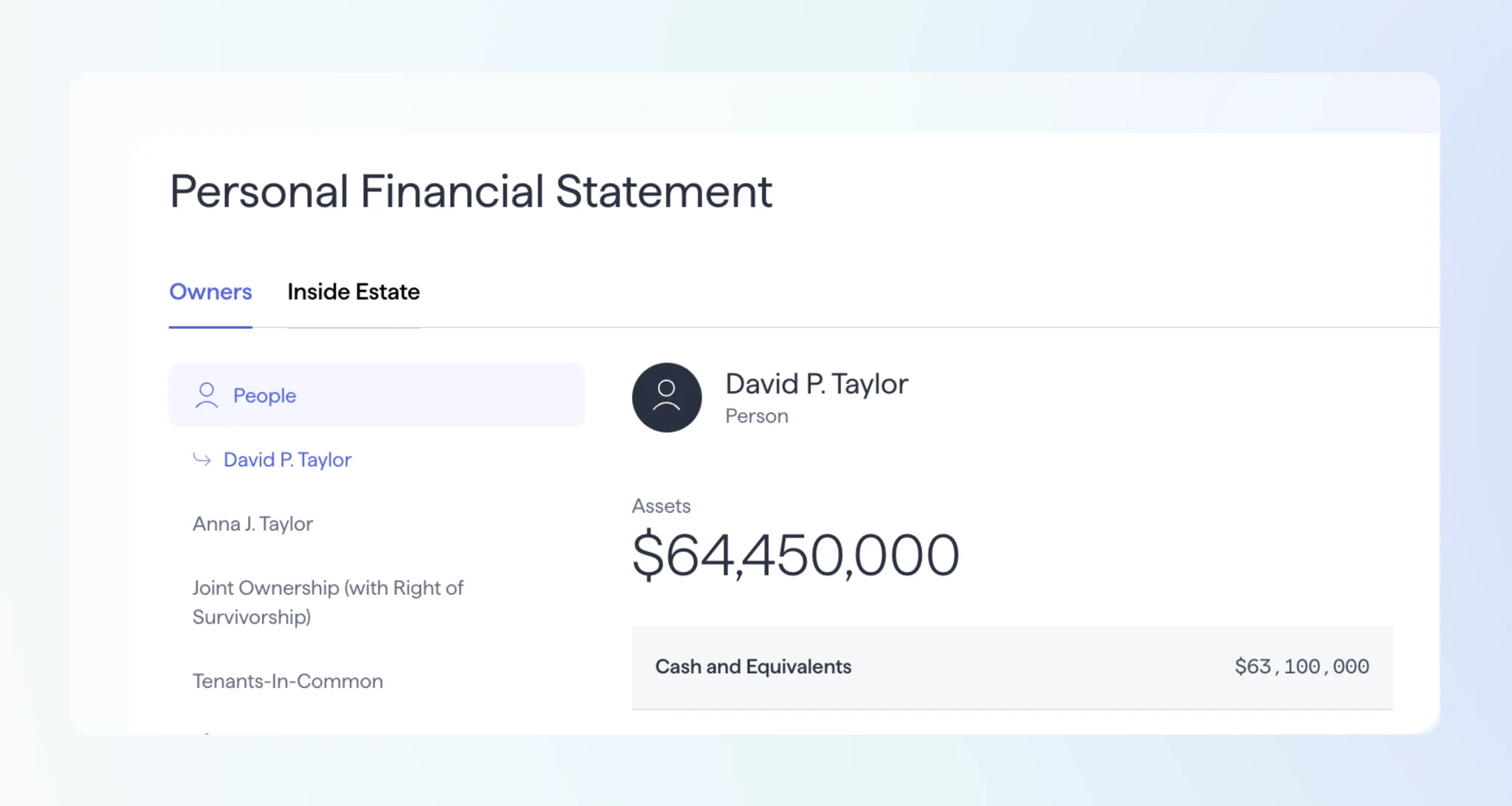

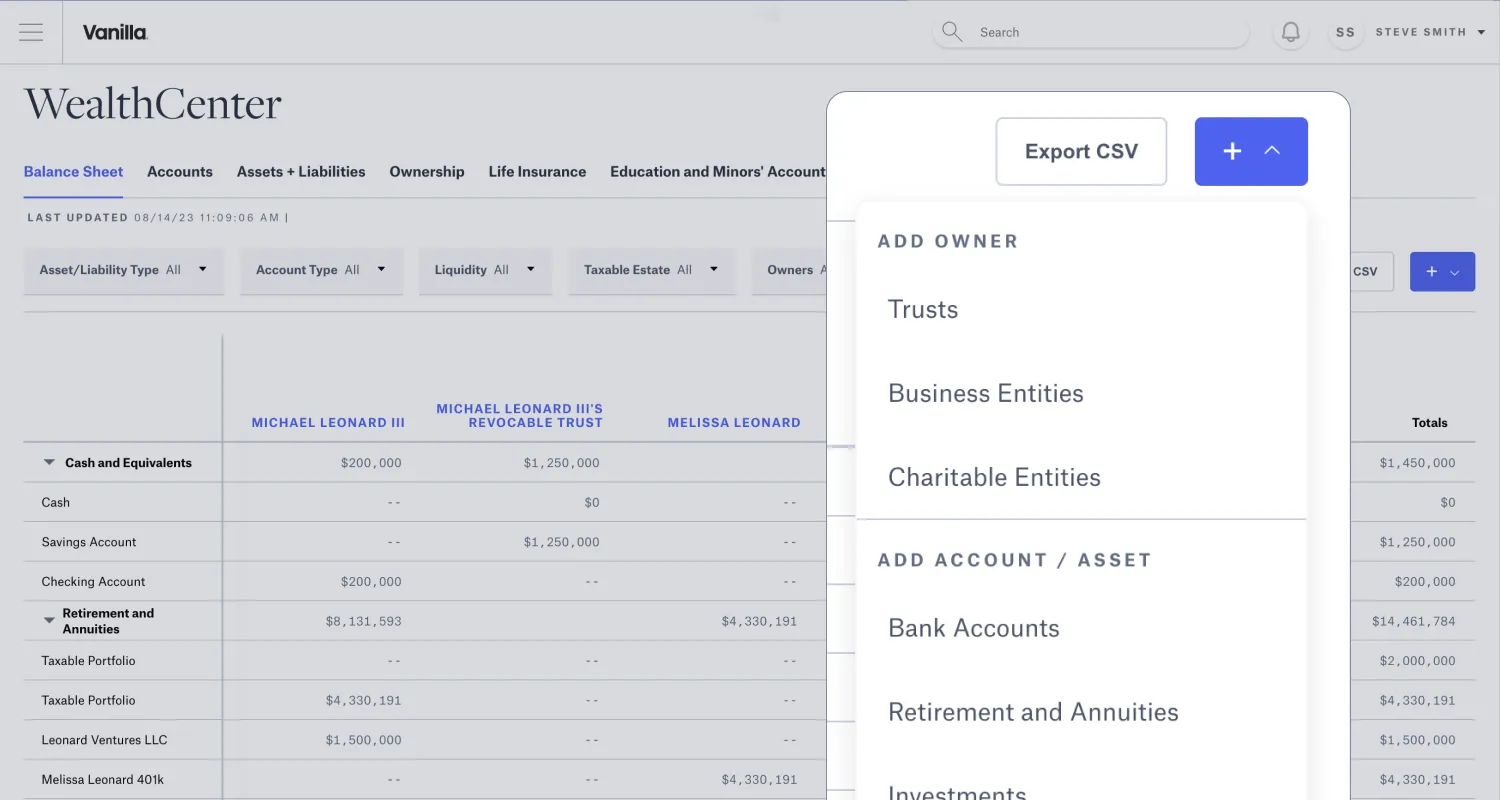

Vanilla recently announced our integration with eMoney, empowering financial advisors to streamline their estate planning workflows like never before. Matter Family Office, a nationally recognized advisory firm managing approximately $3.5 billion in assets, is already leveraging this integration to enhance efficiency, improve client engagement, and scale the impact of estate planning across their client base. The Power of Integration A truly comprehensive approach to estate planning is not complete without visibility into the client’s balance sheet. For many advisory teams, this data already exists in eMoney. Until now, this gap has led to inefficient workarounds to get eMoney data into...

Vanilla

•

Apr 07, 2025

The 2024 Financial Financial Planner Productivity Study from Kitces, How Financial Planners Actually Do Financial Planning, collects data on the key drivers of team productivity for advisory firms. This data is crucial for firm success as clients continuously expect more from their relationships with their advisors, and advisors are faced with finding ways to meet these evolving needs without adding hours to their day or increasing overhead costs. Importantly, this survey reflects how real advisors operate in their practices day to day—shedding light on the tools they use, how they approach certain processes, their client interactions, and more. This sets...

Vanilla

•

Apr 04, 2025

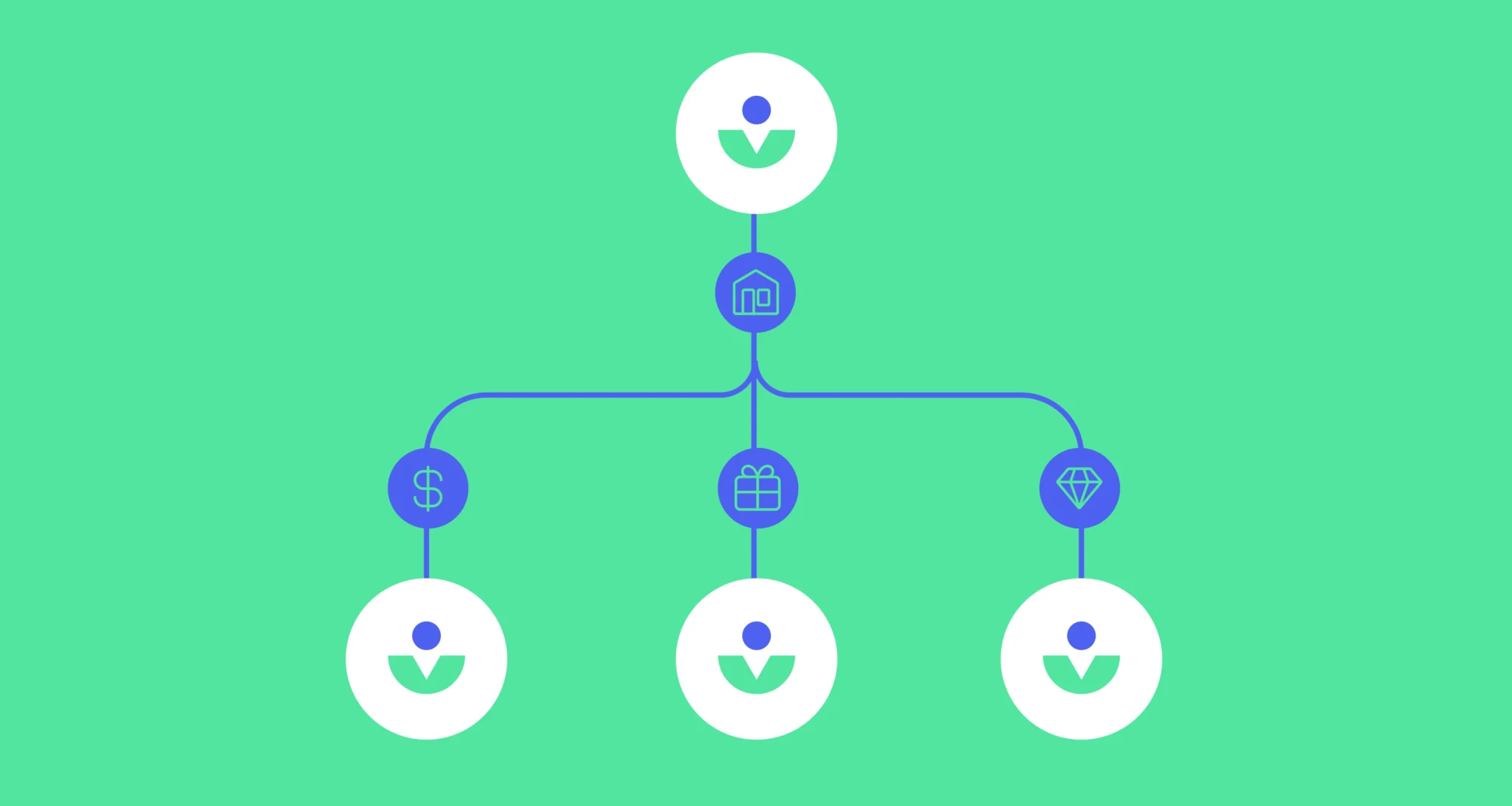

Gifting to your children is an excellent way to reduce estate tax liabilities, but sometimes it makes more sense to give directly to grandchildren, rather than to your children. Because these gifts “skip” a generation, they are referred to as generation-skipping transfers (GST) and have special tax treatment. There are a few important things to keep in mind when considering a generation-skipping transfer gift, including the generation-skipping transfer tax. We’ll break the tax down for you and give you a few more important pointers to pay attention to. What is the generation-skipping transfer tax? The generation-skipping transfer tax (or “GSTT”)...

Jessica Lantz

•

Mar 26, 2025

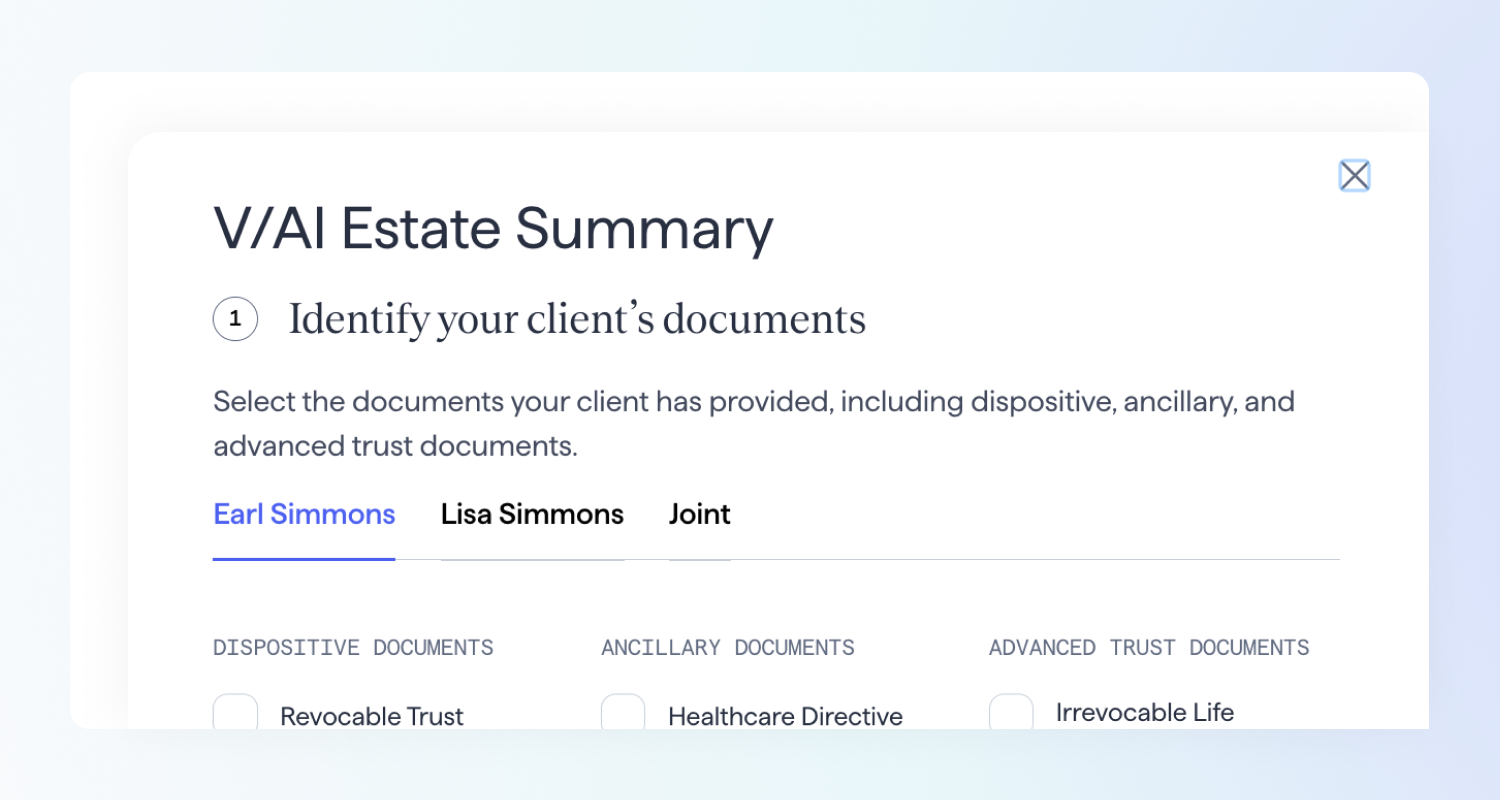

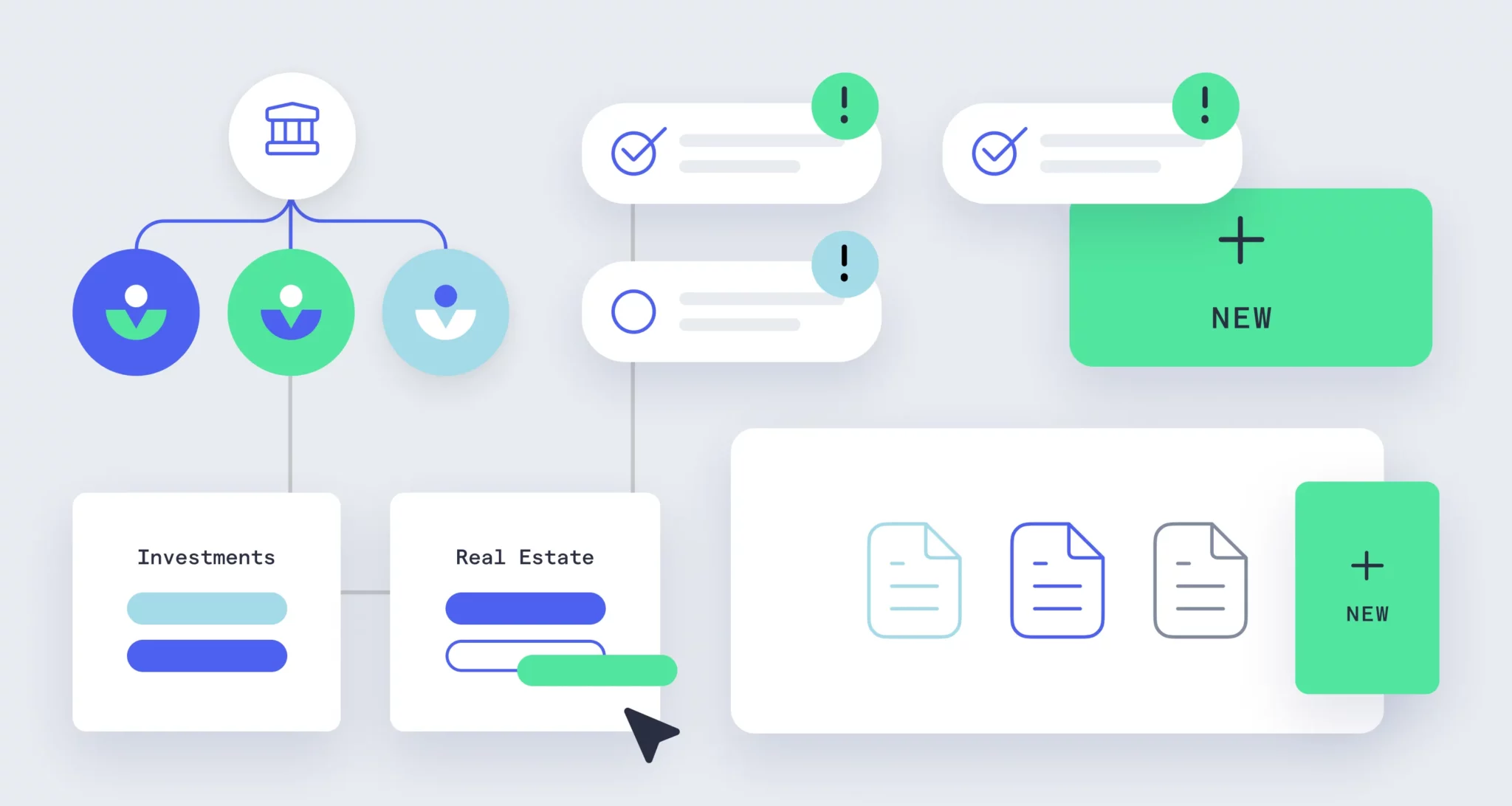

At Vanilla, we're excited to share our March lineup of powerful new features designed to enhance your estate planning workflows and provide deeper insights for you and your clients. Here's what's new this month: Unlock integrated Estate Summaries and onboard clients in minutes with V/AI Summarizing documents individually adds value. But synthesizing them into a single, integrated estate view within minutes sets a new standard for what’s possible in estate planning. With the launch of V/AI Estate Summaries and our expanded V/AI Automatic Profiles, you are able to: Upload multiple estate plan documents to unlock a high-level overview of your...

Vanilla

•

Mar 11, 2025

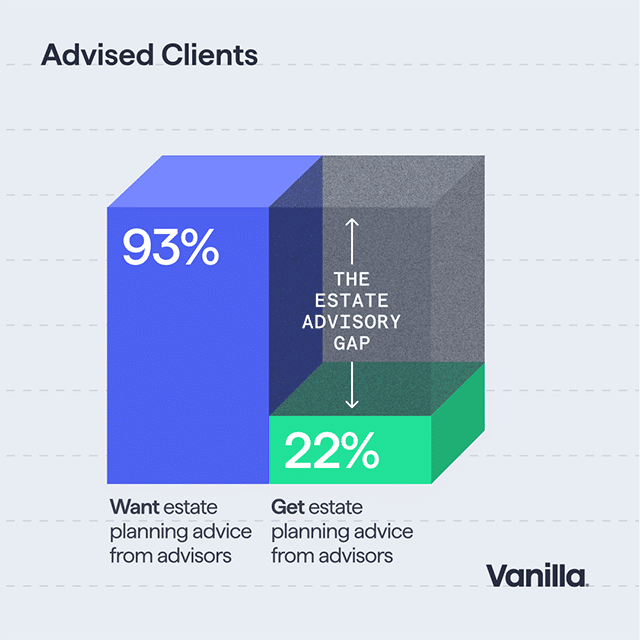

More and more clients are seeking holistic financial planning from their advisors, rather than just investment advice. According to Vanilla’s 2025 State of Estate Planning survey, 8 in 10 people expect estate planning to be incorporated into their financial advisor’s offerings in some way. The data plainly shows that advisors who want to remain competitive need to offer estate planning—but getting started can seem daunting. In this webinar, Vanilla’s experts will dive into practical, bite-sized ways advisors can begin to fold estate planning into their firm’s services. They’ll discuss topics and considerations like: How to determine the scope of estate...

Vanilla

•

Mar 04, 2025

Tax planning for clients with taxable estates has always been complex. We’ve learned the best way to explain estate planning strategies is with diagrams, not documents. That’s why we’ve put together this deck of 10 diagrams to explain some of the advanced strategies and why household with $10M in assets should care about estate tax. Why $10M in household assets? In 2026 the Estate Tax exemption drops down to just about $10M (or higher based on inflation). The 10 diagrams explain both why you need advanced strategies and how 8 different strategies work. We’ve explained them all below but if...

Jessica Lantz

•

Feb 28, 2025

February brings exciting enhancements to the Vanilla platform, with new features designed to support advanced planning techniques and make document creation easier than ever. Here's what you can expect: Make starting the estate conversation easier than ever The latest evolution of Estate Health Check arrives with an improved advisor landing page to help enable clients and prospects access Estate Health Check more easily. This comprehensive update revolutionizes how advisors engage with prospects and clients and identify planning opportunities, featuring: Facilitate conversations with personalized discussion topics based on client inputs Branded public links for seamless prospect and client outreach An enhanced...

Think Advisor

•

Feb 26, 2025

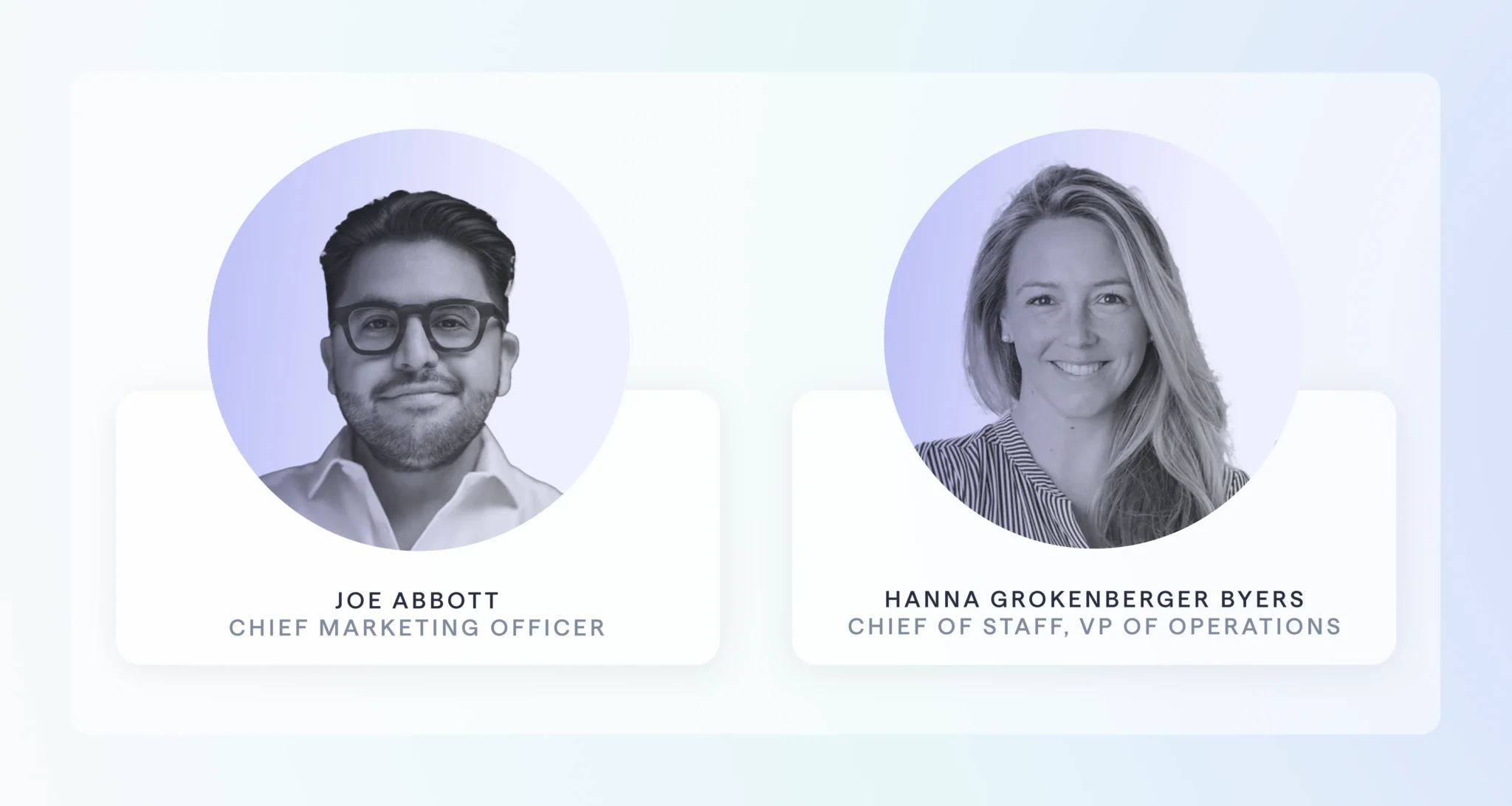

Vanilla, the estate planning technology provider, has appointed a new chief marketing officer, Joe Abbott, as well as a new chief of staff and vice president of operations, Hanna Grokenberger Byers. The executive appointments come a few weeks after Vanilla closed its fiscal year with nearly 300% year-over-year platform growth, surpassing 15,000 client estates, and some eight months after it secured $35 million in additional capital led by Insight Partners and new strategic investors Edward Jones Ventures, Nationwide and Allianz. “Bringing in experienced startup operators like Joe and Hanna is a critical part of further accelerating business momentum,”...

Vanilla

•

Feb 26, 2025

Joe Abbott joins as Chief Marketing Officer and Hanna Grokenberger Byers named Chief of Staff and VP of Operations as the Vanilla platform surpasses 15,000 client estates Vanilla, the leading platform in modern estate planning, today announced the appointment of Joe Abbott as Chief Marketing Officer and Hanna Grokenberger Byers as Chief of Staff and Vice President of Operations. This comes just weeks after the company ended its fiscal year with 293% year-over-year platform growth and the release of V/AI Copilot, the first AI agent for estate advisory. In the last year, Vanilla has cemented its position as category leader...

Jessica Lantz

•

Feb 24, 2025

As we gear up for our first product release in the new fiscal year, we’re reflecting on 2024 and the remarkable achievements and transformative features that have shaped estate planning for advisors and their clients. Here are some high points: Platform adoption skyrocketed 300% 16,000+ estates and $250B in assets were modeled with Vanilla 80+ new features were shipped to make estate planning easier than ever Let’s dive into our top product releases of 2024. Accelerate onboarding and planning with the power of AI Delivering time savings and facilitating client conversations with AI was a big focus in 2024. We...

Madison Eubanks

•

Feb 21, 2025

Going to the dentist, getting an oil change, getting a flu shot, cleaning out the gutters, taking your pet to its annual vet appointment—these aren’t things that most people look forward to doing, but they’re all regular maintenance tasks that we do throughout the year. And while no one wants to add yet another item to life’s list of chores, estate planning updates deserve a place on the docket. This doesn’t need to be done every year, but ongoing maintenance is crucial for an optimized plan. In this article, we’ll discuss why updating an estate plan is important, how often...

Madison Eubanks

•

Feb 21, 2025

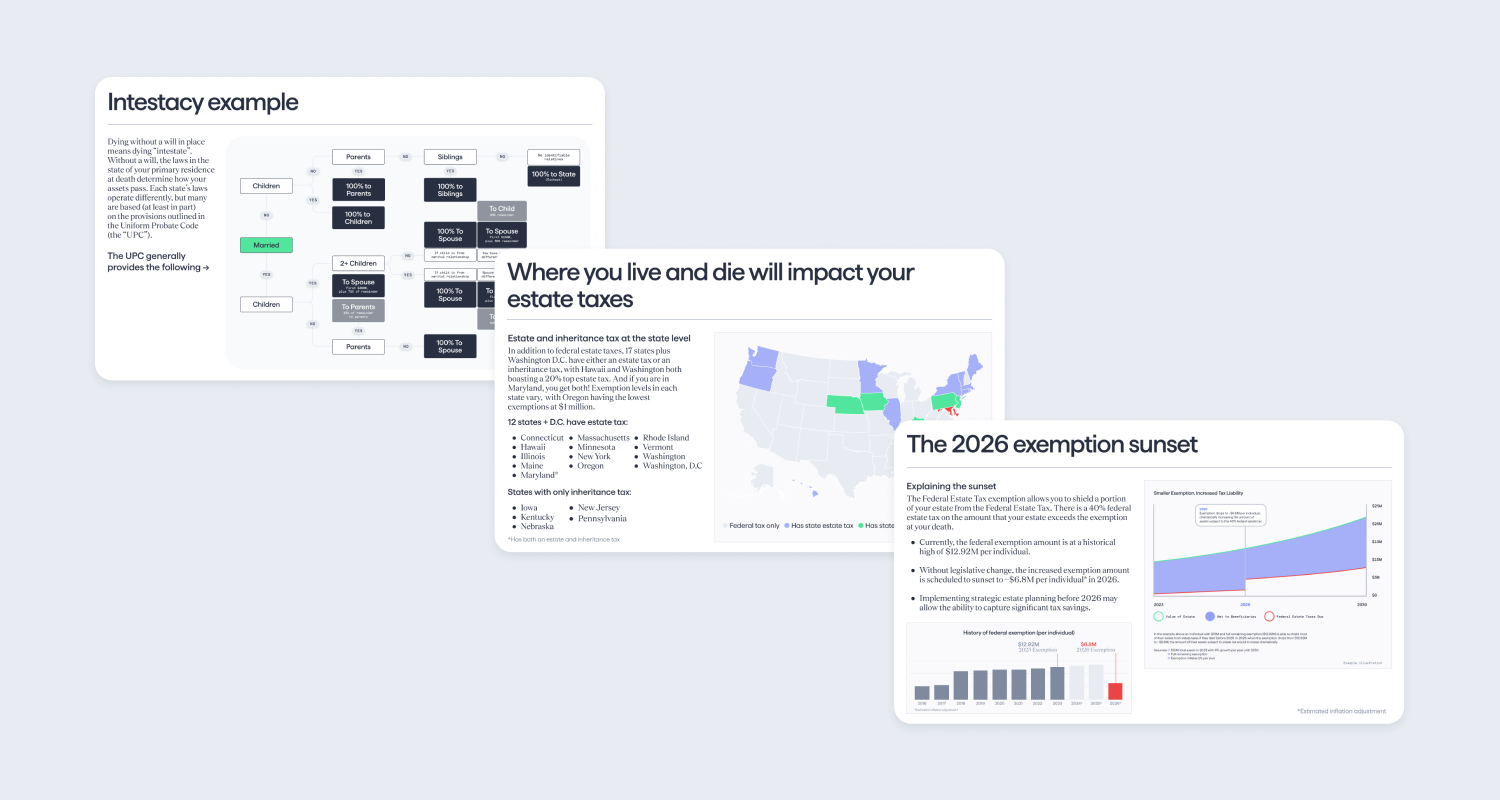

Intestacy, or dying intestate, is legalese for when a person passes away without a will. When a person dies “intestate,” their estate is subject to the intestacy laws of the state they lived in. This means that who inherits the estate is left up to the government as defined by the state’s intestacy laws, rather than by the deceased person’s choice. This can give rise to any number of issues and can create headaches for the intestate person’s family and loved ones. The purposes of wills and trusts are, of course, to communicate one’s wishes for what should happen to...

Madison Eubanks

•

Feb 16, 2025

Where you live (and where you own property) can have a major impact on your estate planning. Taxes, probate, documents, and other estate planning processes vary from one state to another, and a quality plan takes these factors into account to ensure a person’s family isn’t left high and dry when they pass. The best course of action is to hire a professional planner or attorney who’s experienced with the laws in your state, but familiarizing yourself with the basics is a good place to start. Here are some of the most notable state-specific estate laws to know. States with...

Vanilla

•

Feb 11, 2025

As the wealth management industry evolves, client expectations around advisory services are shifting, particularly regarding cost transparency, technology, and advisor performance. As clients seek a more integrated approach to financial planning, it becomes clear that the role of the advisor is expanding beyond investment management. Advisors who can offer value-driven services, including holistic estate planning with clear fee structures, will be better positioned to meet the needs of today’s more discerning clients. In this webinar, we’ll walk through some of the key findings from our survey of 1,000 consumers on the state of estate planning in 2025, with commentary and...

Vanilla

•

Feb 04, 2025

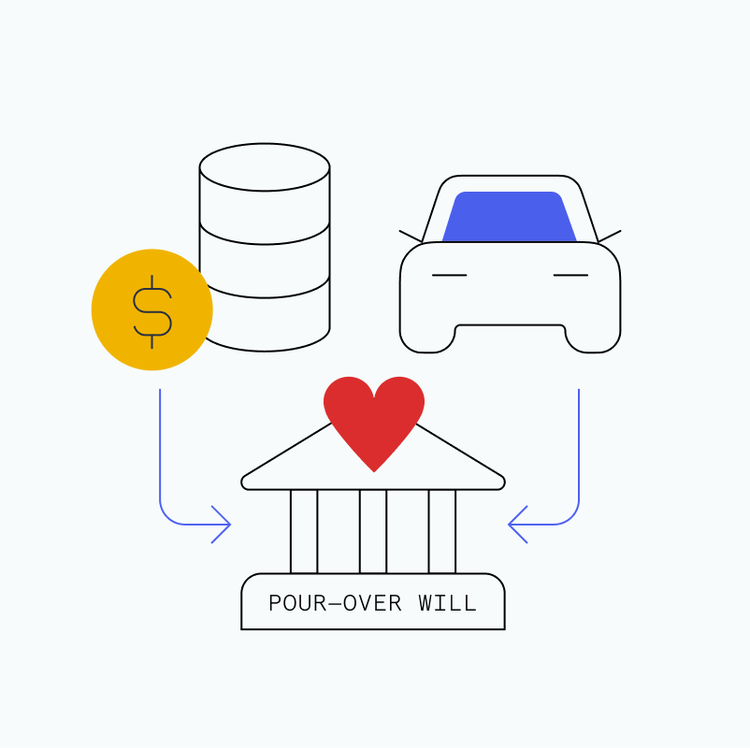

According to a 2024 survey from Caring.com, 40% of Americans don’t think they have enough assets to create a will. This reveals a general lack of understanding around the purpose of a will, which does more than handle financial assets. There’s an enormous opportunity for advisors to help educate clients about the goals of estate planning and core estate documents. If you have a handle on the core estate documents and how they benefit your clients’ finances in the long term, you’ll be more likely to provide advice and guidance that will strengthen ongoing relationships with clients and their families....

Jessica Lantz

•

Jan 29, 2025

At Vanilla, we're starting 2025 with powerful new features designed to streamline estate planning workflows and provide deeper insights for advisors and their clients. Here's what's new this month: Now Available: Attorney Network: Seamless Legal Support Our new Attorney Network provides direct access to qualified estate planning attorneys through the Vanilla platform. Key benefits include: Flexible engagement options from quick consultations to full service support Transparent pricing and clear service options Coverage across all 50 states Expert support for trust funding and estate administration Estate Health Check: Simplified Client Engagement We're excited to introduce our enhanced Estate Health Check feature,...

Sarah D. McDaniel, CFA

•

Jan 28, 2025

Trust, tax, and estate planning can be intimidating to behold. Not only is there a sea of new terminology, acronyms, and legalese to decipher, there’s also an enormous gravity to the decisions being made and how they’ll affect the financial wellbeing of a client’s loved ones. There are three sequential components underpinning trust, tax and estate planning: wealth stages, objectives, timing & deployment. Creating an optimized plan requires understanding the interdependence of each of these building blocks and how they relate to a client's estate. In this article, we’ll walk through how these three elements add up to effective trust,...

Vanilla

•

Jan 28, 2025

Use this cheat sheet as a guide for aligning estate planning building blocks with the most appropriate planning techniques to meet clients' needs.

Citywire RIA

•

Jan 27, 2025

V/AI Copilot gives advisors new capabilities, including one-page summaries of client estate planning documents and answers questions about those documents. Estate planning technology startup Vanilla has launched an artificial intelligence-driven assistant as part of its platform, marking a new step in the broader race to implement AI into wealth management tech. The assistant, dubbed V/AI Copilot, gives advisors the ability to generate one-page summaries of details from client estate planning documents, answers specific questions about those documents and can be used for overall guidance and planning for working with clients. Vanilla chief technology officer Amjad Hussain said...

Vanilla

•

Jan 23, 2025

By Lisa A. Cohen, CEO of Visible National Trust Special needs trusts are the cornerstone of disability estate planning, and disability affects many more people and families than we might expect. Incorporating special needs trusts into estate planning brings certainty that families’ wishes will be implemented for their loved ones. Visible National Trust serves families and individuals across the country with complete turnkey special needs trust solutions that meet families’ high service standards and evolving needs. Seventy (70) million Americans live with a disability, according to the CDC. Twenty-three (23) million people with disabilities require lifetime support, affecting seventeen percent...

Vanilla

•

Jan 22, 2025

Vanilla is thrilled to unveil V/AI Copilot, the industry’s first AI-driven estate planning assistant. Designed to simplify complex tasks and empower financial advisors, V/AI Copilot is an advisor’s partner for assisting clients with estate planning with speed and confidence. Why advisors need V/AI Copilot Estate planning is no small task. Advisors have to read and understand lengthy legal documents, navigate family dynamics, and stay on top of tax strategies. V/AI Copilot is more than a feature—it’s your partner in delivering efficient, accurate, and insightful services to your clients. V/AI Copilot helps advisors: Simplify document analysis: Whether you’re reviewing a trust...

Vanilla

•

Dec 20, 2024

In 35+ years of solving estate planning challenges for clients—including some of the most complex ultra-affluent cases—our founder Steve Lockshin learned that simplicity, precision, and practicality are the keys to success. That’s why we're excited to introduce Vanilla Labs, our new hub for lightweight, innovative tools that redefine how advisors engage with their clients. Vanilla Labs is designed to ideate quickly and launch tools that make it easier for you to illustrate impactful planning concepts without overwhelming your clients or requiring extensive data inputs. These prototypes allow us to gather your feedback, iterate rapidly, and integrate the most effective solutions...

Jessica Lantz

•

Dec 18, 2024

At Vanilla, we're dedicated to evolving our estate planning platform to meet the needs of our users. As we close out 2024, we're excited to share several powerful enhancements that will streamline your workflow and help you deliver even more value to your clients. eMoney Integration: Keeping Financial Data Current Facilitate your planning with Vanilla's new eMoney integration. Say goodbye to manual data entry – this powerful integration keeps your client's financial data current through daily updates, ensuring you always have the most accurate information at your fingertips for better decision-making and planning. This also ensures data accuracy and consistency...

ThinkAdvisor

•

Dec 12, 2024

ThinkAdvisor is pleased to announce the winners of the 2024 Luminaries Awards, who were acknowledged on stage Wednesday at the Fontainebleau Las Vegas. This year’s Luminaries Awards gala was staged in cooperation with the 16th edition of The MarketCounsel Summit, held Dec. 9-11 at the Fontainebleau Las Vegas. The popular wealth management event, led by MarketCounsel CEO Brian Hamburger, serves as the industry’s yearly capstone event. The Luminaries Awards showcase excellence in financial services and spotlight innovative contributions from both firms and individuals. From a large group of nominations, 85 winners were selected from 242 finalist organizations for...

Madison Eubanks

•

Dec 10, 2024

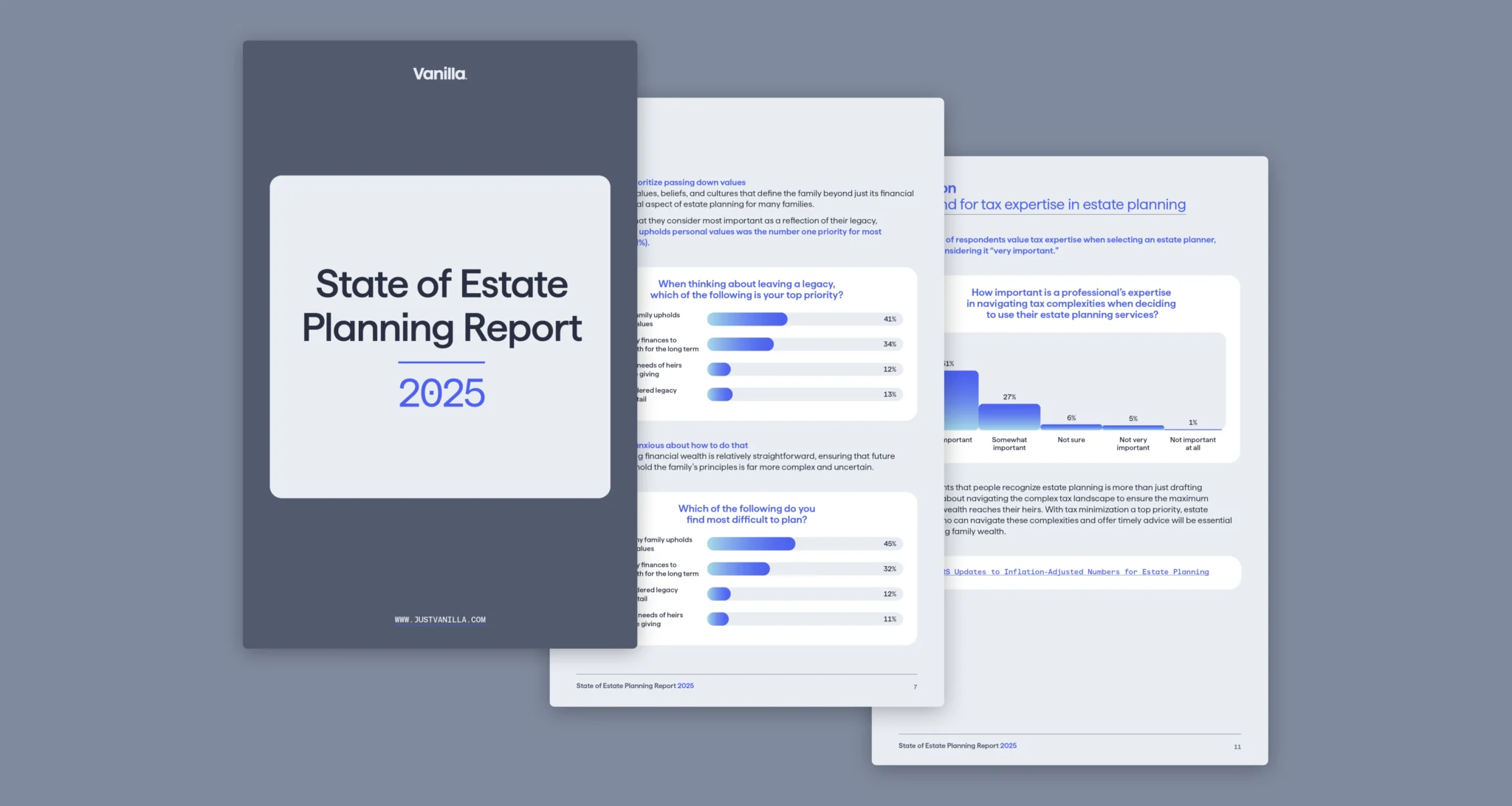

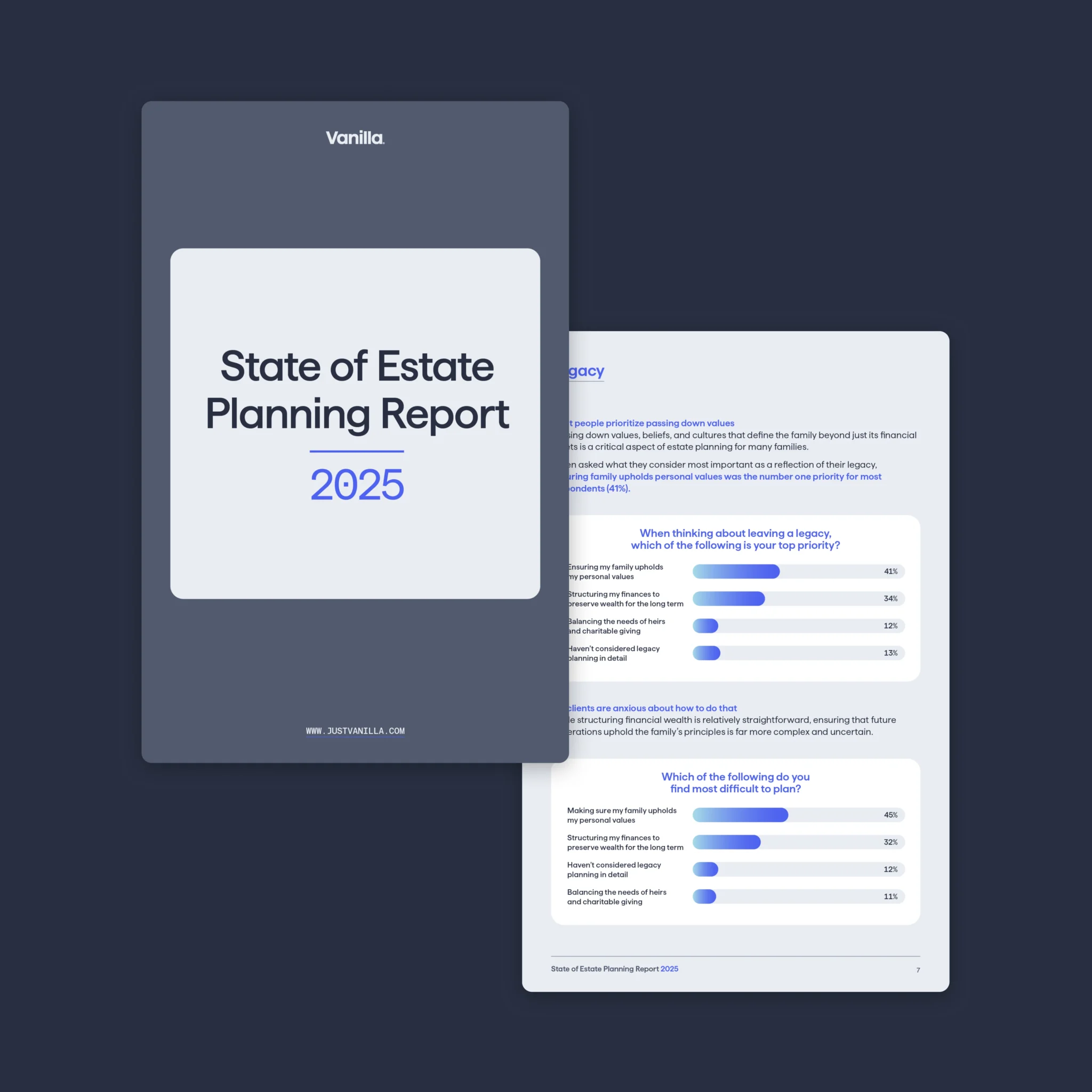

In case you missed it, our recently released Vanilla’s 2025 State of Estate Planning Report is chock full of relevant facts and figures about what’s new and noteworthy in consumer mindsets around planning. This annual survey of 1,000 US consumers is designed to unlock insights about how people view their families and values as well as the role of advisors and technology in the context of estate planning. While the full report is well-worth a read, we also put together this skimmable roundup of some of the most important (and sometimes surprising) findings. Read the complete, ungated State of Estate...

Vanilla

•

Dec 05, 2024

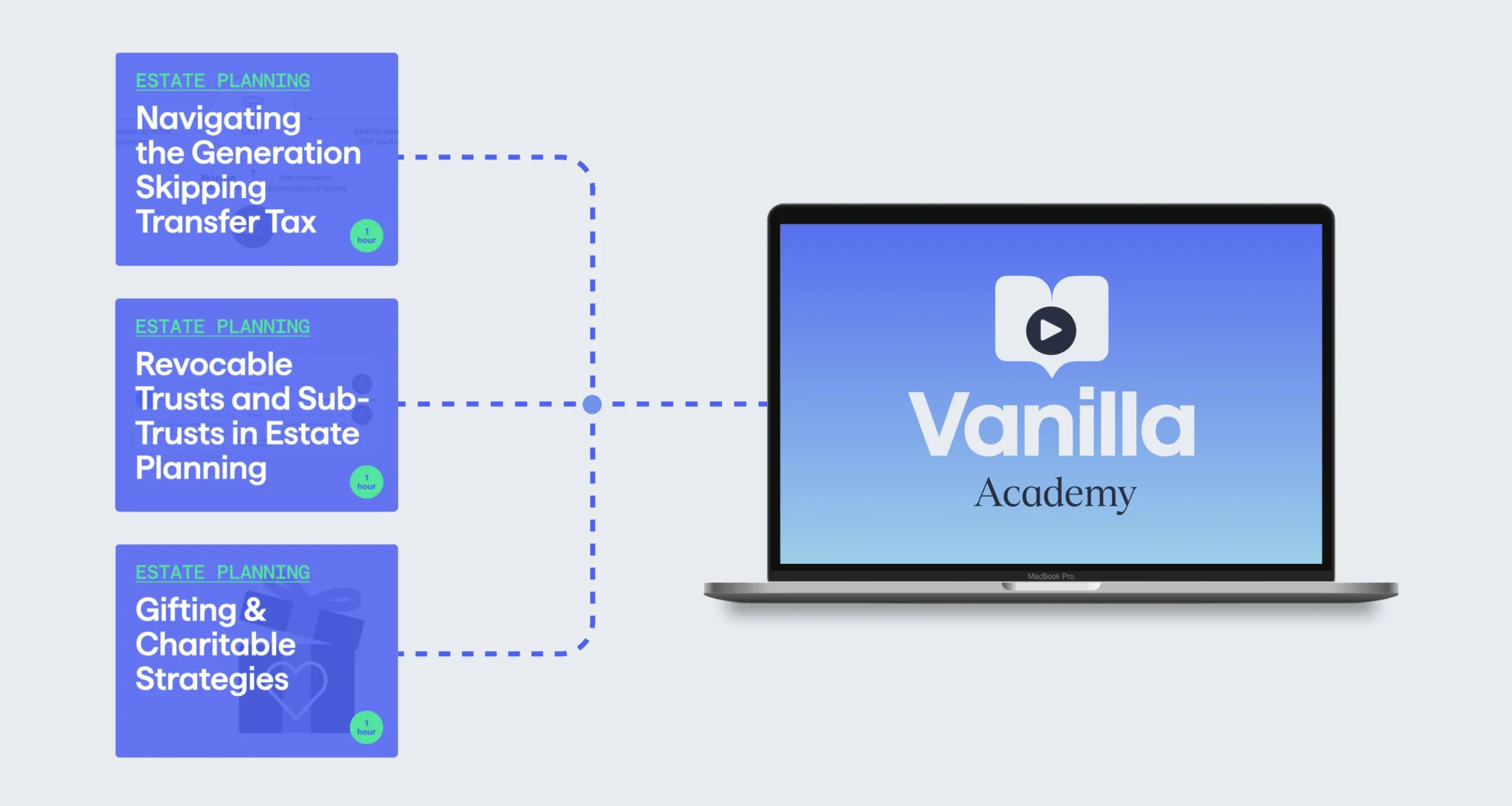

The best advisors (and, truthfully, our favorite people) are the curious ones—they dig in, ask questions, and are always learning. They want to bring clients great advice that’s backed by education, experience, and perspective. For all the lifelong learners out there, Vanilla is your partner for refreshing, broadening, honing, brushing up, mastering, reviewing, or just dipping your toes into estate planning topics and skills. Vanilla Academy launched earlier this year as an estate planning learning hub for advisors who want to up-level their offering and show clients a breadth of expertise, and we’ve just added three additional courses to the...

Sarah D. McDaniel, CFA

•

Dec 03, 2024

Let’s face it—most people procrastinate. Deadlines are often the only motivators that spur action, and for financial planning, this “crunch time” tends to hit in November and December. Unfortunately, this end-of-year rush isn’t ideal for a number of reasons: The holidays: Advisors and clients alike are juggling travel, vacations, and family obligations. Emotional rollercoasters: Whether it’s the stress of family reunions or the joy of celebrations, emotions can cloud judgment. Rushed decisions: Big-picture financial planning requires clarity and focus, neither of which are easy to achieve in a hectic environment. The result? A less-than-optimal setup for making critical long-term decisions....

Vanilla

•

Dec 03, 2024

Download this calendar for a schedule of timely topics and techniques to help you provide continual value for clients and discover ways to grow your business.

Vanilla

•

Dec 01, 2024

A step-by-step checklist to guide your client conversations, updated for 2025. This playbook is inspired by the guide used by Vanilla founder Steve Lockshin and his advisory firm AdvicePeriod, based on Lockshin’s 30+ years of financial advice and estate planning for some of the most successful ultra-high net worth clients in the world.

Insurance News Net

•

Dec 01, 2024

Life insurance has long played a crucial role in estate planning and wealth transfer. Its evolution has addressed two primary challenges: creating an estate when liquidity is insufficient to support the needs of an insured’s survivors and preserving an estate in the face of illiquidity, which may occur in large estates or business succession scenarios. Life insurance traditionally was viewed mainly as a tool for providing death benefits. Today, it has expanded far beyond this original purpose. It is now often leveraged for its tax advantages, even when there isn’t a significant need for insurance coverage. This expanded role...

Investment News

•

Nov 26, 2024

Advisors who aren’t prioritizing estate planning as a core service offering might be doing themselves a disservice, a recent report from Vanilla has found. Vanilla’s second annual State of Estate Planning report revealed an overwhelming 93 percent of people said it’s important to discuss estate plans with loved ones, with 80 percent expecting estate planning support from their advisor. “If you're an advisor who's not offering this, I think you're at a huge disadvantage when you're competing for business, and we see that play out in the data,” said Gene Farrell, CEO of Vanilla, an estate planning platform....

Brian Falldin

•

Nov 20, 2024

This month, Vanilla introduces powerful updates designed to address the real-world challenges of estate planning. From expanded client options to time-saving innovations, these features reinforce Vanilla Document Builder™ as the premier solution for advisors and their clients. Vanilla Document Builder™ updates Advisor Access: Clearer collaboration with clients Advisor Access allows clients to share questionnaire progress and drafts of their planning documents directly with their advisors. Advisors gain insights into client planning without clients giving up control of their data. This feature helps collaboration happen more smoothly and securely, while keeping advisors informed. Guardians, stepchildren, and future children: Plan for possibilities...

CityWire

•

Nov 19, 2024

High taxes, the integration of artificial intelligence (AI) and tensions with the next generation of heirs remain front of mind for consumers when it comes to estate planning. Those were some of the main takeaways from estate planning technology startup Vanilla’s 2025 ‘State of Estate Planning Report,’ in which the company surveyed 1,000 consumers nationwide. The survey asked respondents to evaluate their stance toward various factors impacting their estate planning decisions along with their evaluation of advisors in that process. ‘In short, estate planning has become central to how clients manage their lives and legacy, not just their...

Wealth Management

•

Nov 19, 2024

Clients increasingly view estate planning as a core element of holistic wealth management, not just a one-time task, according to a survey from online estate planning platform Vanilla. ... The survey results imply a preference for advisory services that integrate estate planning into broader financial strategies, with concerns around taxes and complicated, often conflicting feelings about legacy driving more personalized and comprehensive estate strategies. [...] Read more: Estate Planning Offerings are Quickly Becoming Table Stakes [Wealth Management, David Lenok]

John Costello

•

Nov 19, 2024

New findings highlight increasing expectations for comprehensive estate planning services and technology including AI Vanilla, the award-winning estate planning software company, today announced the release of its second annual State of Estate Planning report, which surveyed 1,000 U.S. consumers on their estate planning priorities, challenges, and expectations. Vanilla’s 2025 State of Estate Planning report reveals that consumers are seeking comprehensive services and strategies from advisors to preserve both their wealth and their personal values across generations. It also highlights the need for advisors to harness technology to efficiently manage complex estate plans and provide comprehensive wealth advisory with the personal...

Vanilla

•

Nov 19, 2024

The State of Estate Planning Report, newly released for 2025, reveals emerging trends and client sentiments advisors need to know.

Fortune

•

Nov 18, 2024

Though “estate planning” may bring to mind visions of rich families squabbling over the ancestral silver, it isn’t just for the wealthy or older people, financial planners say. It can be beneficial for families with more modest assets and 20- and 30-somethings, as well. The first time many people start considering creating an estate plan—which can include something as simple as crafting a will, to more complex maneuvers like establishing irrevocable trusts—is when they have children. That’s a good time to do so, says Jessica Majeski, wealth management advisor at Northwestern Mutual. But it can also make sense to...

ThinkAdvisor

•

Nov 14, 2024

Gene Farrell, the president and CEO of Vanilla, finds that media coverage of estate planning tends to focus almost exclusively on tax-savings strategies that apply to the ultra-wealthy. This is especially true in the current post-election environment, with many policy experts monitoring what will happen with the many provisions of the 2017 tax overhaul set to expire at the end of 2025 — including the historically high estate tax exemption for individuals and couples. The consensus is that the Republican Party’s control of Congress and the White House almost assures a long-term extension of the 2017 legislation, with...

Vanilla

•

Nov 13, 2024

There are over 33 million small businesses in the United States, employing over 60 million people. In many ways, private businesses are the heart and soul of the country’s economy, and—unsurprisingly—business owners often feel passionately about what happens to their share when they pass away. Wealth advisors should be prepared to help their business-owning clients create a thoughtful succession plan, regardless of the size or value of their business. In a recent webinar, estate planning experts Steve Lockshin and Patrick Carlson sat down to discuss everything from foundational concepts to advanced strategies wealth advisors should consider for clients who own...

Vanilla

•

Nov 07, 2024

Making lifetime gifts is one of the most common, tried-and-true strategies to reduce estate tax liability. We’ll walk you through the major types of charitable and non-charitable gifts that you might want to consider, as this year draws to an end.

Vanilla

•

Oct 30, 2024

FMB Wealth Management’s Grant Blindbury, CFP® and John D’Anna, CFP® of Hirtle, Callaghan & Co., share their first-hand insights on using Vanilla day to day. Hear how these cutting-edge firms are using Vanilla to simplify the estate planning process, drive loyalty with a modernized experience, offer more holistic financial advice, and more.

Vanilla

•

Oct 30, 2024

Vanilla CEO Gene Farrell walks us through the future vision of Vanilla and estate advisory technology.

Madison Eubanks

•

Oct 24, 2024

A sub-trust, often created within a larger trust, is a type of estate planning tool that can allow you to customize how portions of your estate are managed and distributed to specific beneficiaries. They can add both flexibility and control to your plan, bringing peace of mind that your estate will be distributed according to your wishes and your beneficiaries will be cared for. Whether you want to set aside funds for minor children, protect a special needs beneficiary, or create tax-efficient structures, sub-trusts offer a tailored approach to address the unique needs of your family. In this blog post,...

John Costello

•

Oct 24, 2024

Vanilla recognized as a leader in modernizing estate planning for wealth management NEW YORK, October 24, 2024 – CB Insights today named Vanilla to its seventh annual Fintech 100, showcasing the 100 most promising private fintech companies in the world. “The 2024 Fintech 100 winners are high-momentum companies shaping the future of financial services,” said Laura Kennedy, Principal Analyst at CB Insights. “Unsurprisingly, this year’s cohort is deploying AI across a wide variety of solutions. But they’re also diverse in their reach in emerging and developing economies, and focus on everything from fraud prevention to financial inclusion.” "As Vanilla continues...

Wealth Management

•

Oct 16, 2024

Estate-planning platform provider Vanilla announced this week that it had closed a previously announced $35 million in additional funding. The funding round, which was previously announced in August without the exact amount, was led by returning investor Insight Partners, with contributions from Venrock, Vanguard, strategic investors Edward Jones Ventures, Nationwide and Allianz, and new investor Alumni Ventures. A note on the post said that it had been updated from August “to reflect new investors in the round” (Nationwide and Allianz were not present earlier). As announced in August, the funding will support growth, customer adoption and continued development...

Axios

•

Oct 16, 2024

Vanilla, which provides estate planning software for financial advisers and wealth management firms, has raised $35 million, CEO Gene Farrell tells Axios exclusively. Why it matters: More than $80 trillion in assets will be handed down through the great wealth transfer, but only about a third of Americans have an estate plan. How it works: Vanilla's platform enables financial advisers to create new estate plans for clients who don't have them, review and update existing plans, and analyze and optimize taxes for those with more complex needs. It uses AI to ingest existing client documents and extract information...

Jim Sinai

•

Oct 16, 2024

this blog was originally published on 8/15/24 and updated on 10/16/24 to reflect new investors in the round Award-winning estate planning software company to accelerate investments in AI, expansion of platform, and customer adoption. Welcomes Edward Jones, Nationwide, and Allianz as strategic investors Vanilla, the award-winning estate planning software company, today announced it has closed its latest fundraising round at $35m, led by returning investor Insight Partners, in addition to contributions from Venrock, Vanguard, and other previous investors. Vanilla also welcomes new strategic investors, Edward Jones Ventures*, Nationwide, and Allianz, and new investor Alumni Ventures. In addition to supporting its...

Vanilla

•

Oct 16, 2024

Vanilla, the award-winning estate planning software, is excited to announce a strategic integration with eMoney, the industry’s leading financial planning platform. This collaboration delivers a seamless, unified planning experience for financial advisors, combining sophisticated AI-powered estate planning tools with comprehensive financial data to offer a more holistic approach to client wealth management. With this integration, Vanilla is the first estate planning solution to bring together the best of both worlds: AI-powered estate planning combined with eMoney’s industry-leading financial planning capabilities. This allows advisors to provide their clients with a truly holistic financial plan that includes not only investment strategies and...

Vanilla

•

Oct 11, 2024

At Vanilla, we believe in making estate planning accessible to everyone—and that means providing advisors and financial professionals with the education and resources they need to deliver estate planning services. On October 30th, we’re hosting Vanilla Academy Live, a free half-day estate planning summit featuring two hours of free CFP® CE credit, an estate planning tech spotlight, and an advisor-led panel discussion on streamlining the estate planning experience day-to-day. Curious to learn more about what’s in store? Here’s a quick overview of what you can expect at Vanilla Academy Live for Fall 2024. Register to attend here. Welcome & Tech...

Vanilla

•

Oct 10, 2024

At Vanilla, we’re constantly innovating to help advisors and planners streamline their estate planning process, and we’re thrilled to share a preview of some powerful new tools coming soon to the Vanilla Estate Advisory Platform. These new features will enhance how you work with clients, improving everything from initial conversations to advanced estate planning. Here’s what’s coming later this month: Legacy Planning Calculators for quick, detailed insights IDGTs, a new table view, and other enhancements in Vanilla Scenarios™ The Client Portal available to all Vanilla customers My Notes Library in Vanilla Estate Builder™ Provide clients with quick, actionable insights with...

Madison Eubanks

•

Oct 01, 2024

In estate planning, gifting and charitable funds can serve many purposes: not only are they a way to impart assets to beneficiaries like charities and family members, they can also be mechanisms for reducing income and estate taxes for the giver. In this webinar with Vanilla and UI Charitable Advisors, you’ll learn approaches to charitable giving, non-charitable gifting, Donor Advised Funds, annuities and more that allow clients to meet their tax and planning goals while benefiting their chosen people and causes. Topics covered in the webinar include: The different types of charitable strategies, and the benefits of incorporating them in...

Madison Eubanks

•

Sep 24, 2024

Whether your firm embraces or resists it, artificial intelligence (AI) is here to stay in the wealth management industry. Since the release of ChatGPT in 2022, use cases for AI in day to day processes have taken off, with nearly three quarters (73%) of US companies using AI in some aspect of their business. Recently, Vanilla hosted a panel of three AI thought leaders to discuss how AI is being incorporated in the wealth management and financial technology spaces: Amjad Hussain, CTO, Vanilla; Parker Ence, Cofounder and CEO, Jump; and Greg Matusky, Founder and CEO, Gregory FCA Public Relations. Here,...

Madison Eubanks

•

Sep 19, 2024

Estate planning strategies are like tools in a toolbox: Different tools do different jobs. Deciding which estate planning strategies to employ depends on any number of personal factors including (but not limited to) marital status, level of wealth, whether or not someone has children, charitable inclination, liquidity, and many more. A savvy planner takes all these variables into account and chooses the most appropriate tool for a person’s situation, values, and goals. In this article, we provide fictional examples of when someone might use six different trust strategies, and illustrate how the right strategy can achieve their estate planning goals. ...

Vanilla

•

Sep 17, 2024

In this webinar, hosted by Erica Ellis, Vanilla Product Counsel, advisors will learn the key components of revocable trusts. The session will focus primarily on sub-trusts and how they can be used to address the needs of a client and their particular estate planning goals. Sub-trusts can provide a range of benefits including creditor protection or protection from divorcing spouses, post-death management of assets, multi-generational legacy creation, and more. You’ll learn: What constitutes a sub-trust, and how they work How sub-trusts can offer benefits like asset protection, tax planning, and more The practicalities of how sub-trusts function in different situations...

Brian Falldin

•

Sep 12, 2024

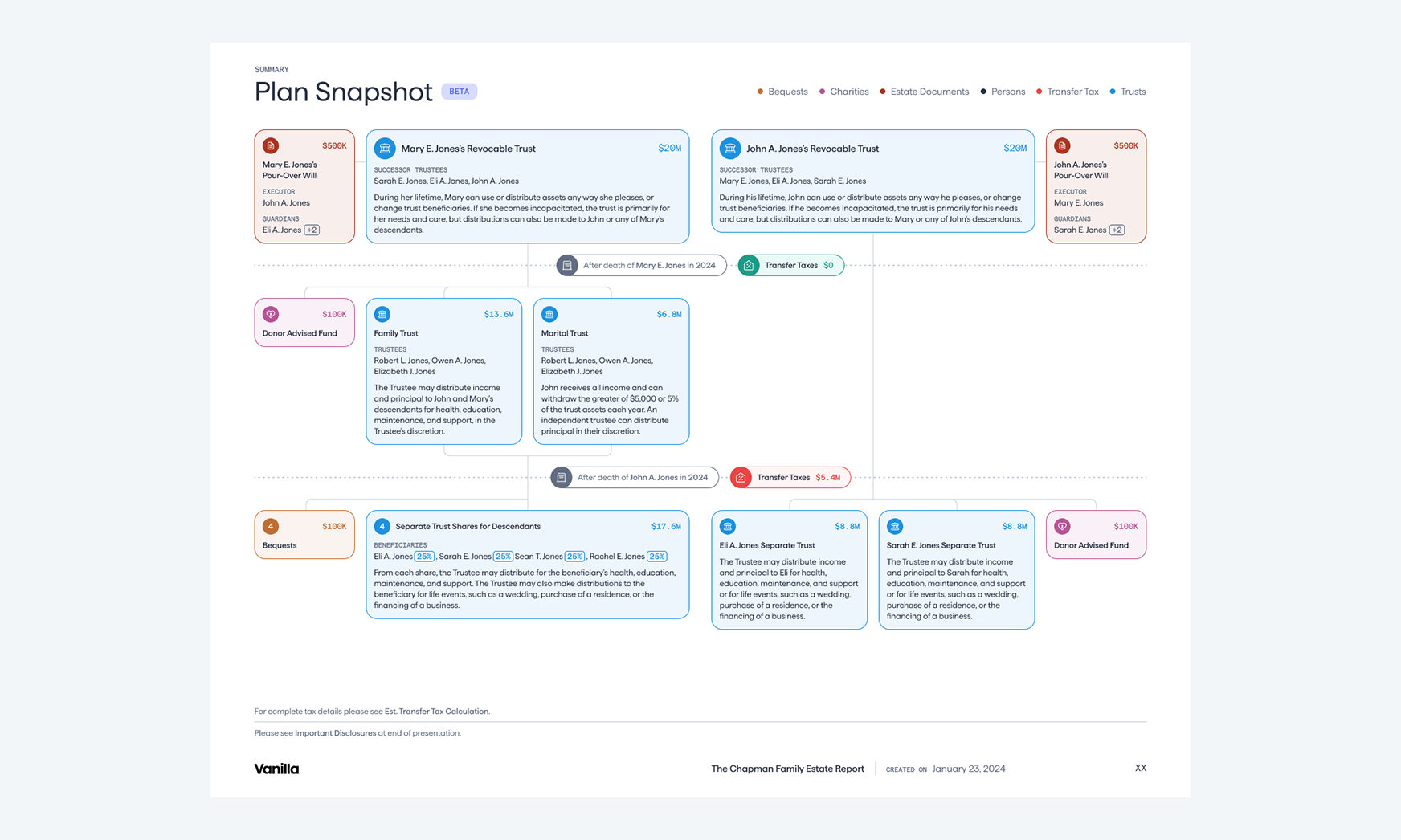

Today, we’re excited to announce VAI Automatic Profiles to instantly transform clients' existing plans into powerful visuals, saving hours of time wasted diagramming plans in powerpoint. You can read more about the announcement on our blog: Here are several new features for advisors and planners to help clients achieve their estate planning goals, coming in the next few weeks: Document creation now included in most subscriptions, joint trusts in several separate property states, and an Advanced Trust Package available with Vanilla Document Builder™ New Funding Options available in Vanilla Estate Builder™ A new Client Portal where your clients will be...

Vanilla

•

Sep 12, 2024

With Vanilla, advisors can offer a new deliverable that both clients and prospects have never seen before. Plan Snapshot visualizes family, financial, and estate information in one easy to understand diagram to provide an intuitive and personalized overview of your client's plan.

Vanilla

•

Sep 12, 2024

Every advisor can create modern, visual reviews of every client’s estate in seconds Vanilla, the award-winning estate planning software company, announces V/AI Automatic Profiles, a new AI enabled capability that makes it easy for advisors to quickly create and share a visual summary of their clients current estate plan within minutes of uploading their estate documents. With V/AI Automatic Profiles, Vanilla can read estate planning documents using AI and automatically create an estate profile, including visual estate diagrams, beneficiary summaries, fiduciary summaries, and more. Advisors can edit key information such as names, dates, trust details, and other relevant information in...

Madison Eubanks

•

Sep 10, 2024

For the ultra wealthy, a well-planned gifting strategy can be a great way to reduce the size of the taxable estate over time. However, various tax laws mean gifting isn’t always as straightforward as it may sound. When gifting, it’s important to understand annual and lifetime exclusions, when gifts must be reported to the IRS, and how to plan for tax exposure. Read on for a complete overview of gifting. For a deeper dive on gifting strategies, download the Vanilla Guide to Gifting here. Introduction to gifting In the eyes of the IRS, a gift is any property or assets...

John Costello

•

Sep 09, 2024

Out of 3,500+ eligible emerging B2B tech companies, Vanilla is recognized for creating a strong workplace culture where humans thrive and do great work together Vanilla, the award-winning estate planning software company, announced today it has been named to Will Reed’s Top 100, a curated list of one hundred emerging tech companies that are building values-driven cultures where employees and customers thrive. Will Reed, a leading go-to-market executive search firm, in conjunction with PitchBook, a private market database, releases Will Reed’s Top 100 every September, this year honoring Series A and Series B B2B tech companies who are actively building...

WealthTech Today

•

Aug 30, 2024

The wealth management industry faces a seismic shift. A staggering $59 trillion wealth transfer looms on the horizon, promising to reshape the landscape of estate planning. Meanwhile, technology stands ready to modernize this traditionally paper-heavy process. Enter Vanilla. This newcomer to the estate planning software arena has just secured a significant round of funding. Their move underscores a growing appetite for innovation in a sector long dominated by conventional methods. I recently sat down with Gene Farrell, CEO of Vanilla, to discuss the company’s latest fundraising efforts and their vision for the future. Our conversation painted a picture of...

Madison Eubanks

•

Aug 28, 2024

As a financial advisor, you don’t need to be an expert on estate planning documents. However, you do need enough foundational knowledge to understand what makes quality documents, to spot red flags, and ultimately to ensure your clients’ documents serve their long-term goals. Documents vary widely from client to client, with the complexity, density, and number of documents often increasing as wealth does. With so much nuance, how is an advisor to know what to look for in a client’s plan? Dana Foley, Founder and Partner at Accelerant Law, outlines the four hallmarks of quality estate planning documents that advisors...

Vanilla

•

Aug 26, 2024

AI is shifting how business is done in profound ways, but what does that mean for an industry that historically has placed a premium on personal one-on-one relationships? Will AI dilute the client/advisor connection? Or can it actually help advisors get even more personal and tailored with a larger book of business? We are pleased to bring together three C-suite technology and wealth management leaders to discuss the current landscape of AI and the potential it holds to evolve the industry. They’ll discuss: The current state of AI. What’s actually possible in wealth management today–right here, right now How advisors...

Investment News

•

Aug 15, 2024

Estate planning software company Vanilla has closed a new funding round to expand its platform and accelerate adoption among financial advisors. The fintech provider’s latest funding round, which also includes Alumni Ventures and Vanguard, will support its continued growth and AI push. [...] Read more: Estate wealth tech platform Vanilla gets a boost from Edward Jones [Leo Almazora, Investment News]

ThinkAdvisor

•

Aug 15, 2024

Vanilla has gained a new strategic investor in Edward Jones Ventures, a recently launched venture capital program aimed at finding new areas of growth for the firm via partnerships. The estate planning platform provider has also announced new fundraising led by returning investor Insight Partners, alongside contributions from Venrock, Vanguard and other previous investors. Vanilla is also working with new investor Alumni Ventures. In addition to supporting growth goals and customer adoption, the company will use the funding to expand its platform, including its embedded artificial intelligence capabilities. Vanilla’s core goal remains modernizing how financial advisors and estate...

Vanilla

•

Aug 14, 2024

Summer may be winding down but we’re busier than ever at Vanilla. This month we’re eagerly anticipating several new features coming next week to the platform: Included document creation through Vanilla Document Builder A customized overview of a client’s estate plan with Plan Snapshot A new eMoney import template New funding options in Vanilla Estate Builder (coming in late August) The ability to easily update documents in Vanilla Document Builder New educational videos in the Basic Trust Package questionnaire Document creation included with Vanilla Document Builder™ Last year we announced that we would begin to offer on-demand documents using Vanilla...

Wealth Management

•

Aug 09, 2024

As financial advisors, we’re no strangers to the roller coaster of market volatility. This week's sell-off is a stark reminder of how quickly market conditions can change and the need for proactive planning. Amidst this turbulence, estate planning is one area where advisors can truly add value. This often-overlooked aspect of financial planning becomes crucial when markets are volatile, offering unique opportunities to secure your clients’ legacies and provide them peace of mind. FOMO is real, and missing out can also be expensive. During periods of extreme market volatility, advisors should consider certain estate planning opportunities that are (almost) too...

Kiplinger

•

Aug 08, 2024

The transfer of wealth across generations has long been a complex and emotionally charged topic. Parents often struggle with balancing their desire to provide financial security for their children while ensuring this wealth does not diminish their drive, values or happiness. As an adviser specializing in wealth transfer and focused on the impact of wealth, I have observed the profound effects that money can have on individuals and families. Most parents I know emphasize the importance of passing on not just financial assets but also values, principles and a sense of purpose to ensure the well-being and happiness of future...

Vanilla

•

Aug 07, 2024

We are thrilled to announce that Sarah McDaniel has joined Vanilla in the newly created role of Head of Enterprise Enablement. With her extensive industry experience and strategic insight, Sarah is set to lead our efforts in expanding and enhancing advisor enablement at RIAs and enterprise wealth divisions across our customer base. Sarah brings a wealth of expertise to Vanilla. Her background in financial services and her dedication to advocating for and guiding innovative solutions for trust, tax, and estate practices make her an invaluable addition to our team. In her new role, Sarah will be instrumental in shaping the...

Daniel Brockley

•

Aug 06, 2024

How to take back control with thoughtful financial and estate planning My dad has dementia. He survived stage-four esophageal cancer against every medical prediction, and then, just a couple years after his remission, his memory began to falter. It was hardly noticeable at first. Over a glass of wine, my mom confided in my brother and sister and me that she felt like something wasn’t right, that he wasn’t able to hold on to what they had just talked about or done. We didn’t see it, not at first. We listened to my mom and nodded along, but we all...

Vanilla

•

Aug 01, 2024

A new IRS ruling issued on July 18, 2024 cleared up lingering confusion around inherited individual retirement accounts (IRAs) and required minimum distributions (RMDs). Here’s a quick overview of why this long-awaited ruling was necessary and what it can mean for the beneficiaries of IRAs going forward. Summary In short, the new IRS ruling says that non-eligible designated beneficiaries (which includes most non-spousal beneficiaries) of inherited IRAs from someone who died on or after their Required Beginning Date (RBD) do have to take the annual RMD each year after an inheritance, and that the account must be fully depleted at...

Wealth Management

•

Jul 29, 2024

Estate advisory platform Vanilla announced the relaunch of education-focused Vanilla Academy on Monday. The revamped educational platform will feature multimedia content ranging from checklists to client-facing PowerPoint presentations to free, on-demand courses approved for continuing education credits. “One of the biggest obstacles to getting advisors into estate planning is education.” Vanilla Director of Content Marketing Dan Brockley said. “We’re trying to give advisors the information they need to engage in estate planning conversations more confidently and comfortably.” Vanilla Academy’s content, which will initially be free with sign-up for advisors (though in the future, some courses will be...

Investment News

•

Jul 29, 2024

Vanilla, the estate planning-focused fintech provider, is helping to raise the bar on estate planning across the wealth space as it revives a key advisor education initiative. The fintech firm is doubling down on its mission to raise estate planning awareness with the relaunch of its learning program, Vanilla Academy. [...] Read more: Vanilla boosts advisor support with education platform reboot [Leo Almazora, Investment News]

Vanilla

•

Jul 29, 2024

Vanilla continues its investment in the tools and education that help advisors to empower a higher level of estate planning Vanilla, the company behind the leading estate advisory platform, announces the relaunch of Vanilla Academy, the first estate planning educational hub specifically designed for financial advisors and planners. The updated offering features free, on-demand continuing education, multimedia content, and a range of downloadable guides and resources. Several of the courses offer continuing education credit for CERTIFIED FINANCIAL PLANNER® professionals. The new educational hub highlights the company’s commitment to providing its customers and their clients not only with the technology they...

Madison Eubanks

•

Jul 26, 2024

Traditional estate planning advice revolves around moving as many assets as possible out of the estate to minimize estate tax liability. However, most people’s estates will never approach taxability, meaning they need a different approach to estate planning. At the most foundational level, planning for non-taxable estates—those valued at less than $13.61 million—means ensuring clients have appropriate documents like wills, trusts, and powers of attorney in place. However, just because a client isn’t subject to federal estate tax doesn’t mean they can ignore tax planning. In this blog, we’ll look at tax planning strategies for non-taxable estates where the owner...

Madison Eubanks

•

Jul 26, 2024

Whether or not you’re a financial planning professional, being on top of trends and facts about estate planning can help you make informed decisions with regards to finances. In this article, we’ve rounded up 50 estate planning statistics from 2024 from Vanilla research and sources around the web that you’ll want to remember. Why estate planning matters Why is estate planning important, and why does it seem like more people are talking about it now? Not having a plan can cause problems down the road Over a third (35%) of US adults say they or someone they know have experienced...

Brian Falldin

•

Jul 26, 2024

As summer heats up, so do the new features at Vanilla. This month, we’re excited to introduce several enhancements designed to streamline your estate planning processes and provide even greater value to your clients. Here’s a quick summary of what's new: V/AI for Estate Builder improvements: Estate Builder users now get automatic document summaries and can automatically import text into the client profile. Generation Skipping Transfer Tax - Direct skip calculations: We’ve expanded the power of our platform to support GSTT calculations for direct skips so that each client profile reflects comprehensive tax analysis. Additional distribution customizations: Now you can...

Financial Planning

•

Jul 25, 2024

Financial Planning as published an article written by Daniel Brockley, head of content at Vanilla, on the crucial role financial advisors can play in helping clients and their families navigate the challenges of dementia. Drawing from personal experience, Daniel writes: "Financial planning is a game of 'what if.' We plan for fluctuations in the market, for business buying and selling, for education, for retirement — even for premature death. But one scenario we tend to overlook, maybe because it’s so utterly painful to consider, even harder than the idea of death for many, is dementia. And it’s an...

Vanilla

•

Jul 23, 2024

Discover non-taxable estate planning strategies that focus on minimizing income taxes, planning for IRA-heavy estates, and leveraging capital gains strategies.

Amjad Hussain

•

Jul 22, 2024

We think a lot about artificial intelligence at Vanilla. The promise of AI is enormous – arguably greater than any new technology to come along since the dawn of the internet – and yet it is in its infancy and carries some risk, especially if not approached carefully. At Vanilla, we are thrilled by the prospect of how AI can improve the everyday lives of our customers and their clients, making estate planning more efficient and delivering insights, but we are keenly aware that we operate in a sensitive space. The security of customer and client data is sacrosanct, and...

Madison Eubanks

•

Jul 15, 2024

For families planning for individuals with disabilities or special needs, special considerations have to be made to ensure the person is cared for long-term. In some cases, specialized planning tools like qualified disability trusts can be used to achieve certain benefits like tax exemptions or federal aid eligibility. At the most basic level, a qualified disability trust (also known as a QDisT or QDT) is a trust that qualifies for a federal tax exemption. It’s a financial planning tool that an individual with special needs or disabilities’ family or caregivers may use to provide for their needs. Here, we’ll walk...

Simona Ondrejkova, CFP

•

Jul 08, 2024

Clients who own a business often face an additional layer of complexity when it comes to estate planning. From determining the most effective strategy for passing on the business to minimizing taxes and maximizing wealth transfer for loved ones, navigating through countless estate planning strategies can be exhausting. The good news is that there are certain business structures, such as the family limited liability company (family LLC), that could make things easier for those who run a business that’s meant to stay in the family. Here, we explain what a family limited liability company is, how it can help business...

Vanilla

•

Jun 18, 2024

Summer’s here and new features at Vanilla are hotter than New York City asphalt. This month we’re excited about: Executive Summary and an enhanced Estate Diagram for the Vanilla platform and PDF report Vanilla Essentials: key documents for your client’s loved ones Generation Skipping Transfer Tax available in Vanilla Estate Builder, Estate Diagram, and more ILITs now available as a modeling strategy in Vanilla Scenarios New fields present in Estate Builder powered by VAI for advanced trusts Give clients a personalized snapshot of their estate with Executive Summary Thanks to feedback from Vanilla customers, we have added an Executive Summary...

Madison Eubanks

•

Jun 11, 2024

When it comes to planning for the future, trusts are helpful tools that can protect your money and make it easier to pass it on to others. Some trusts are simple, while others are more advanced and offer special tax benefits. One of the more advanced types is called a beneficiary deemed owner trust, or BDOT. Although the name sounds complicated, the main idea is that the trust is set up in a way that makes the beneficiary, not the person who created the trust, responsible for paying income taxes on the money the trust earns. This can sometimes save...

Madison Eubanks

•

Jun 05, 2024

For wealth management firms that want to offer their clients complete, holistic financial advice, estate planning services are an absolute must. The snag is that most firms have far more advisors than planners, and resources don’t allow central planning teams to work closely with every single client. Because estate planning is an important part of the client experience, planners need to find ways to scale the practice to the advisor level. This doesn’t mean advisors need to become the final authority on all things related to estate planning, but rather that they need to know enough to open the door...

Wealth Management

•

May 30, 2024

One of the growing trends in the financial advice industry is advisors talking (and for the most part, just that) about leveraging estate planning to both add value for current clients and to create stronger connections with their families (aka potential future clients). In response, the past few years have seen several tech companies (largely founded by financial professionals) create products to facilitate the estate planning process for clients, advisors or both... [...] Steve Lockshin’s Vanilla, after unveiling its fully integrated estate advisor platform in mid-2023, then announced its own partnership with Vanguard in January of this year after a successful...

Vanilla

•

May 29, 2024

For wealth management firms of all shapes and sizes, offering estate planning services for your clients is a proven way to grow your business and build long-term relationships. Often, advisors are in the perfect position to initiate estate planning conversations, but lack the knowledge, confidence, or resources to do so. In this on-demand webinar, planners share how they enable and empower advisors to initiate estate planning conversations with clients, including: Providing educational resources and learning opportunities Optimizing certain internal systems for better efficiency and scalability Implementing technology that supports advisors, clients, and the entire firm

Vanilla

•

May 29, 2024

Discover how central planning teams can prepare and empower advisors to have foundational yet meaningful estate planning conversations with clients.

Vanilla

•

May 29, 2024

In a crowded marketplace, how can small firms stand out among the competition? Wealthstone Private Wealth Management has cracked the code. Watch on-demand to hear from Zak Gardezy, CFP, on how he uses sophisticated estate advisory practices to delight his high net-worth client base and build lasting relationships at Wealthstone. This interview-style webinar will dive into: Best practices for bringing estate planning to high net-worth clients The key Vanilla features Wealthstone leverages day-to-day Why offering estate planning is an effective way to differentiate your firm

Vanilla

•

May 29, 2024

As a financial advisor, you don’t need to know how to draft legal documents like trusts and wills yourself – but understanding the basics of how they work and flags to look out for is important. This foundational understanding can enable you to add huge value for your clients. In this webinar, you’ll learn: the building blocks of quality estate planning documents the role templated docs can play in modern estate planning how Vanilla document builder can deliver clients top-notch, flexible trusts and more Prior to founding Accelerant Law, Dana practiced in the Trusts & Estates and Private Client Services...

Vanilla

•

May 29, 2024

At the most basic level, the Generation Skipping Transfer Tax (GSTT) is a federal tax that applies to transfers of property or wealth that skip a generation. But who, exactly, does this tax apply to, and why does it exist at all? In this webinar, Jenny Raess and Patrick Carlson, members of Vanilla’s Product Counsel, host an educational, CE-eligible session on what advisors need to know about the GSTT, how it might affect clients, and to approach the tax in estate planning. They’ll be joined by Boyd Butler, Principal Product Manager, who will show how Vanilla determines GSTT liability and...

Simona Ondrejkova, CFP

•

May 29, 2024

If you have clients who own a business, it’s important to be familiar with the buy-sell agreement. This type of contract can act as both a business succession tool and an estate planning tool. Putting a buy-sell agreement in place can avoid potential threats to the continuation of the business that your clients have worked so hard to build or help avoid liquidity issues to ensure their loved ones are taken care of. If a partner in a business dies or exits the business because of a disability or other reasons, a buy-sell agreement provides the method for transferring that...

Vanilla

•

May 22, 2024

Use this checklist to understand the essential documents that should be included in any estate plan and the purpose of each.

Madison Eubanks

•

May 22, 2024

Typically, we think of an estate plan as an arrangement to maximize wealth transfer and minimize taxes after a person passes away. However, there are some elements of estate planning that can take effect while a person is still living—like a Medicaid trust. In this article, you’ll learn what trusts and Medicaid have to do with one another, the advantages and disadvantages of Medicaid trusts, as well as when it may be appropriate for your clients to set one up. What is a Medicaid asset protection trust (MAPT)? [embed]https://justvanilla.wistia.com/medias/prx1k9xyba[/embed] A Medicaid asset protection trust—also known as a Medicaid trust or...

etf.com

•

May 15, 2024

Most financial advisors are in constant pursuit of wealthy clients, but they might not fully understand what it takes to land and keep high-net-worth clients. With that in mind, etf.com spoke with an advisor who specializes in working with wealthy families and individuals. Steve Lockshin is a principal of Los Angeles-based AdvicePeriod, a Mariner Wealth Advisors company, and a co-founder of Vanilla, the estate advisory platform. Jeff Benjamin: How do you gain access to high-net-worth prospects? Steve Lockshin: It's hard to break in. I would become an expert at something ultra-high-net-worth people need and want. Aviation, estate...

Brian Falldin

•

May 15, 2024

As we embrace the vibrant spring season, Vanilla is excited to unveil even more new features and enhancements designed to simplify complex processes, provide intuitive planning tools, and foster deeper advisor-client conversations: Get estate planning answers fast with the full launch of VAI Chat, now generally available. VAI chat offers immediate AI-driven answers and insights, enabling users to efficiently navigate the complexities of estate planning. Streamline client assessments with the Estate Health Check, a quick and effective way for advisors to gather critical insights about a client's current estate situation without the need for exhaustive document reviews. Optimize wealth transfer...

Madison Eubanks

•

May 14, 2024

There are many different types of trusts that can be used in estate planning to achieve a range of various purposes and goals. One common element among all trusts is the appointment of a trustee to manage its assets. What exactly does a trustee do? This article will cover everything you need to know about trustee responsibilities, how a trustee should be chosen, and more. What is a trustee? [embed]https://justvanilla.wistia.com/medias/lzt8tzm231[/embed] A trustee is a person or entity that holds and administers a trust’s assets or properties for the trust’s beneficiaries. In general, a trustee is tasked with managing a trust’s...

FPA New England

•

May 14, 2024

Host Brad Wright is joined by Jim Sinai. Jim is Chief Marketing Officer at Vanilla, the Estate advisory platform designed to transform how wealth advisors help their clients manage their estate and build their legacy. Jim is a seasoned cloud executive and experienced marketer, with a background in sales, business development, and a passion for new technology, telling the story and helping make complex software easy to understand. Jim is also a former college rugby player, at Brown. They discuss: Adding estate planning software to an advisor’s arsenal How it integrates with performance and tax planning software, as well as...

Vanilla

•

May 10, 2024

Explore how permanent life insurance can support a holistic estate plan Insurance and estate planning go together like peanut butter and jelly. Both planning instruments require a complete view of your client’s total financial picture. And, when used together, they can help clients achieve peace of mind while also helping them preserve generational wealth. Watch on-demand to learn: Insurance use cases for mass affluent and high-net-worth clients How life insurance can help mitigate estate taxes. Best practices to build and present a complete view of the estate to clients to explain different insurance strategies.

Madison Eubanks

•

May 08, 2024

The retirement accounts you've built over decades represent more than just numbers on a statement. They embody years of work, sacrifice, and planning for a secure future. While most people focus on growing these accounts during their working years, fewer consider what happens to these valuable assets when they're no longer here to manage them. This oversight can leave your financial legacy exposed to risks you never anticipated and beneficiaries unprepared for managing sudden wealth. Retirement trusts offer a level of protection and control that goes well beyond simply naming beneficiaries on your accounts. By creating specific instructions for how...

John Costello

•

May 08, 2024

Vanilla for Attorneys helps trust and estate attorneys streamline estate planning and modernize client experiences. Vanilla, a leading provider of innovative estate planning software, today announced the launch of Vanilla for Attorneys. This newly tailored offering redefines estate planning, allowing attorneys to shift from transactional meetings to fostering ongoing, modern client relationships. Vanilla for Attorneys provides attorneys with a powerful, easy-to-use platform to help them onboard clients, model complex estate planning scenarios, and elevate client conversations. Designed to support the legacy building process end to end, Vanilla for Attorneys enables attorneys to provide a differentiated, holistic planning approach that results...

Kiplinger

•

Apr 30, 2024

Over the years, I’ve seen many estate plans that have been well crafted and tax-optimized fail when it comes to the one thing that matters most: leaving heirs better off for their inheritance. Contributing to this is poor or little guidance for the trustees and little thought given to the damage that sudden wealth can cause. You need not look further than the statistics of lottery winners to see the failures caused by unexpected and rapid access to money. What do you want to achieve with what you leave behind? And how can you prepare your trustees and...

Wealth Management

•

Apr 29, 2024

Len Bias was a star basketball player at the University of Maryland drafted by the Boston Celtics in 1986 and one step away from becoming a pro athlete. Unfortunately, he passed away just two days after being selected but before signing any MBS or sponsorship documents, leaving him and his family just out of reach of the riches he would have gotten due to the timing of his death. With host David Lenok and special guest Steve Lockshin, founder of AdvicePeriod and a co-founder of Vanilla, an estate planning advisory platform, they unravel the nuances surrounding name, image and...

Madison Eubanks

•

Apr 29, 2024

At Vanilla’s most recent estate advisory summit, Legacy Now Spring 2024, thought leaders from across the estate planning industry to discuss emerging trends, best practices, and informed strategies for all types of firms. This year’s virtual event featured three expert panels, an interview with former Vanguard CEO Bill McNabb, a sneak peek at Vanilla’s product roadmap, and a conversation between NBA champion Shane Battier and his advisor, Steve Lockshin. The 90 minutes were jam-packed with insights from experienced advisors, attorneys, and planners, all of which you can watch here in the complete recording. Otherwise, keep reading for four must-know highlights...

Simona Ondrejkova, CFP

•

Apr 29, 2024

Of the many different types of trusts out there, some are designed specifically to help married couples transfer their assets according to the wishes and needs of each individual within the marriage. These trusts can be structured to provide for the surviving spouse while also being mindful of estate tax considerations for the surviving spouse and future beneficiaries. What is a survivor’s trust? [embed]https://justvanilla.wistia.com/medias/fsmtiu16us[/embed] A survivor's trust is an estate planning tool used by married couples to ensure that after one spouse passes away, the surviving spouse will have access to a portion of the assets to provide for their...

Vanilla

•

Apr 29, 2024

Serving and scaling HNW families comes with an array of challenges. When it comes to organizing and presenting the families entire wealth with an integrated estate plan, MFOs need a better way. Join Gary Hirschberg, CEO of Aaron Wealth Advisors, and Jim Sinai, CMO of Vanilla, as they discuss how MFOs can guide clients through estate planning. Their conversation will touch best practices for handling some of the key challenges modern MFOs face, including: Organizing complex data: Bringing together various types of family, financial, and estate information and keeping it up to date Distilling information for clients: Providing a digestible summary...

Vanilla

•

Apr 26, 2024

A panel discussion with Beverly Hills Private Wealth cofounder Lisa Westermark and Premier Path Wealth Partners COO Derek Wittjohann.

Vanilla

•

Apr 26, 2024

A panel discussion with Baird – Private Wealth Management VP and senior estate planner Rick Holman on scaling planning at your firm.

Vanilla

•

Apr 26, 2024

A conversation between 2x NBA champion, philanthropist, and investor Shane Battier and his advisor, Vanilla and AdvicePeriod founder Steve Lockshin.

Vanilla

•

Apr 26, 2024

A panel discussion with The Art of Planning founder Kevin Donovan on how T&E attorneys can prepare for the coming gift tax exemption sunset.

The WealthStack Podcast

•

Apr 26, 2024

Is estate planning the next frontier of wealth management? Estate planning solutions are becoming steadily more popular with advisors, especially those seeking to differentiate their services. As clients become increasingly aware of the complexities of wealth transfer, asset protection and legacy planning, they expect comprehensive guidance from their advisors. By using estate planning tools, advisors can offer a holistic approach to wealth management, addressing not only investment strategies but also the essential aspects of estate distribution and tax implications. In this episode, Shannon Rosic, director of WealthStack content and solutions, speaks with Gene Farrell, CEO of Vanilla, about the...

Investment News

•

Apr 24, 2024

Vanilla, a leading estate planning software provider, has enhanced a key piece of its platform to provide a better experience for advisor users. At the firm’s biannual virtual event, Legacy Now, the financial advisors, attorneys, and planners in attendance became the first to know about the new features for its Vanilla Document Builder. The expanded features within the Vanilla Estate Advisory Platform include the ability to directly get in touch with top legal experts through an attorney engagement package. That offering is being launched in partnership with Accelerant Law, who will work directly with clients to build plans...

John Costello

•

Apr 24, 2024

New Vanilla Document Builder™️, announced at biannual Legacy Now event, delivers modern estate planning for all wealth levels. Vanilla, a leading provider of innovative estate planning software, today announced an expanded set of features for Vanilla Document BuilderTM, the modern document creation engine within the Vanilla Estate Advisory Platform. Financial advisors using Vanilla can now offer a compelling modern estate planning experience for clients across the wealth spectrum. New features include the ability to connect directly with legal experts, to get powers of attorney for adult children, and to tap into advanced tax planning options. These enhancements were unveiled at...

Vanilla

•

Apr 16, 2024

Spring (and Legacy Now) is in the air! April is showering Vanilla with multiple new features, enabling our customers to: Expedite document reviews in Vanilla Estate Builder with smart suggestions powered by VAI™ and additional customization with Advanced Distributions Show the potential future impact of layering on a SLAT or GRAT with Vanilla Scenarios™ Invite clients to engage an estate attorney in certain states when completing their documents with Vanilla Document Builder Include the cost of Vanilla Document Builder in your firm’s fee structure with a Charge Me option Add your firm’s custom compliance disclosures to the Vanilla PDF report...

Simona Ondrejkova, CFP

•

Apr 15, 2024

Do you have clients who own a business or have just recently inherited one? When it comes to estate planning for business owners, understanding section 6166 of the US tax code could make a big difference in ensuring continuity of the business after the owner passes away. While there are several estate planning strategies that can help clients reduce their overall estate tax bill, those who own a business should also be aware of strategies to defer payments on estate taxes to keep their heirs from having to do a fire sale of the business just to pay taxes. So...

Financial Planning

•

Apr 11, 2024

In my 30-plus years of experience as an financial advisor, I’ve delivered impactful service not by simply focusing on maximizing investment performance, but by considering approaches that improve and protect the well-being of my clients and their families on a more human level. My most important objectives as an advisor are ensuring that my clients sleep well at night, safe in the knowledge they are in good hands; helping them to meet their financial goals; and ensuring their experience is such that they can wholeheartedly say they are glad they met us. Advisors who want to ensure that those...

Simona Ondrejkova, CFP

•

Apr 04, 2024

When helping clients with their estate plan, taxes are one of the key components to take into account as part of the planning process. And while there are several estate planning strategies that can be used to minimize or eliminate estate taxes for clients, here we’ll talk specifically about taxes that an estate or a trust incurs on its income. One of the forms that clients should be familiar with if they are trustees, administrators, or beneficiaries of an estate or a trust is schedule K-1. Since there are a few different types of K-1 forms, it’s important to understand...

USA Today

•

Apr 03, 2024

Fewer of us are writing wills, a new survey says, a finding that suggests Americans are worrying less about mortality as the pandemic fades. [...] A downturn in wills could be bad news for survivors. [...] Someone who dies without a will might leave big questions unanswered: Who cares for a child? Who gets the family home? Some assets are tricky to divide among multiple heirs. “People with children should probably have a will. People with minor children should probably have a will, just to determine who will take care of them,” said Gal Wettstein, a...

Madison Eubanks

•

Apr 02, 2024

Creating a last will and testament is one of the most fundamental efforts in estate planning, and a key component is naming an executor to carry out the will’s instructions. The executor is the person who will administer the estate, sees it through the probate process, and settles the decedent’s final affairs—in short, it’s a big responsibility. Before the executor can begin administering a deceased person’s estate, though, the executor needs to obtain a Letter of Testamentary (also called letters testamentary). In this article, we’ll explain what a letter of testamentary is, why you might need one, how to get...

Simona Ondrejkova, CFP

•

Mar 28, 2024

When it comes to estate planning, each individual’s needs dictate the simplicity or complexity of the solution that will best fit their goals. For those who care about avoiding probate, ease of distribution to beneficiaries, and simplicity of set-up, a transfer on death (TOD) account could be a great option. A TOD account provides a simple way to transfer assets to beneficiaries without the need for complex legal structures like trusts. Here, we’ll explain what a TOD account is, its main benefits and drawbacks, and how it can be used as part of an estate plan to transfer wealth quickly...

Simona Ondrejkova, CFP

•

Mar 26, 2024