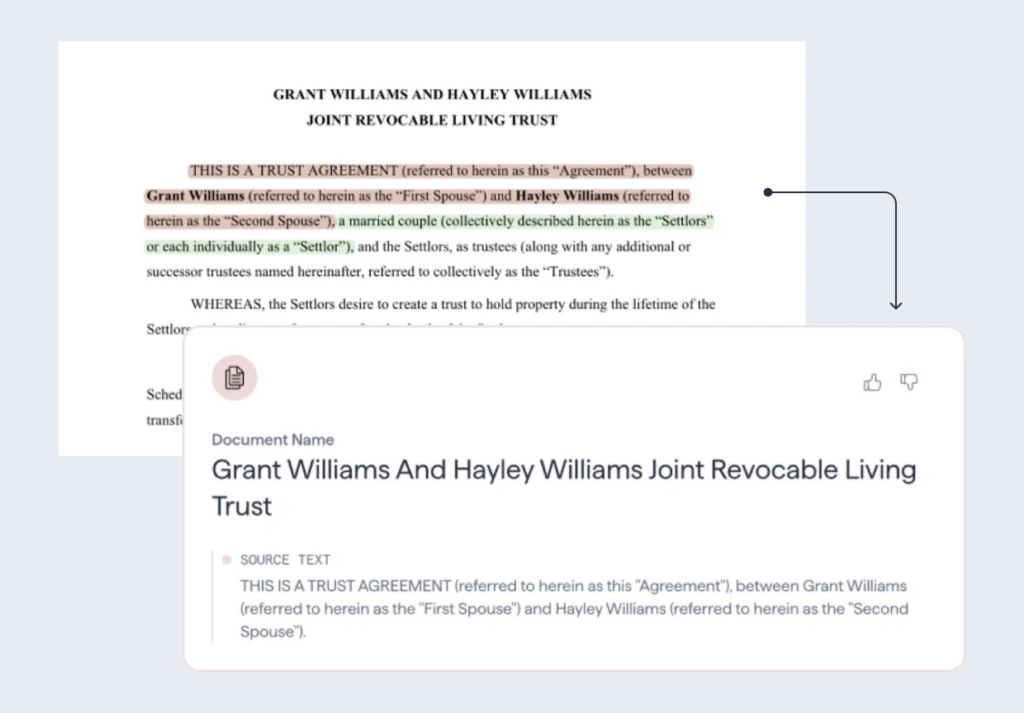

“V/AI has been a huge productivity boost for our planners using Vanilla Estate Builder. With the new V/AI Automatic Profiles, we are excited about how we can scale our estate planning conversations across every advisor.”

Julie Olander, CFP, CTFA, AAMS

Senior Wealth Planner