Vanilla

Vanilla

From Income Tax to IRAs: Tax Optimization Strategies for Non-Taxable Estates

Read the guide

At the most foundational level, planning for non-taxable estates means ensuring clients have appropriate documents like wills, trusts, and powers of attorney in place.

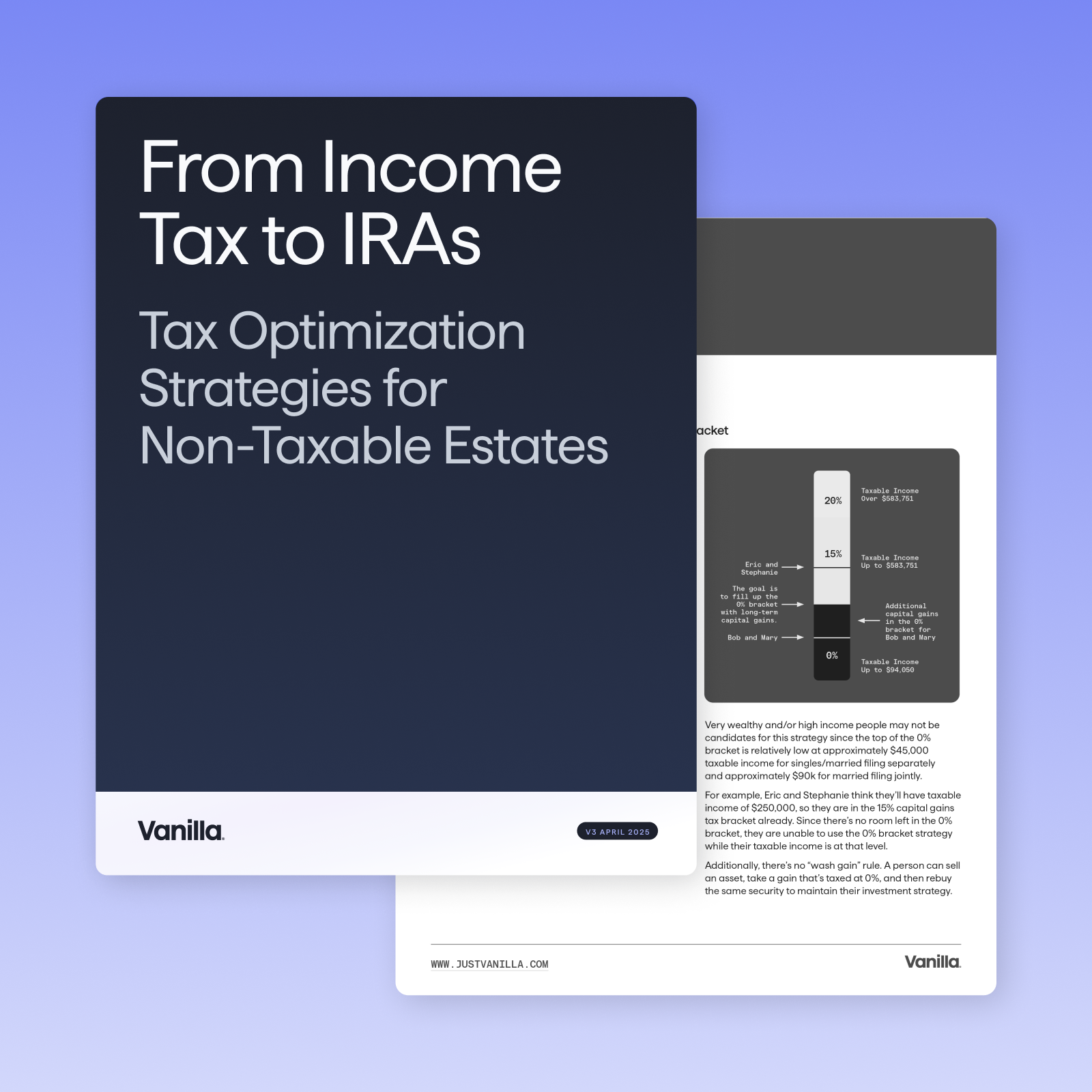

This guide explores how to take planning for non-taxable estates even further, with strategies that focus on minimizing income taxes, planning for IRA-heavy estates, and leveraging capital gains strategies.

Some principles of planning for non-taxable estates covered in this guide include:

- How to approach basis

- Basics of capital gains

- Income tax considerations

- State estate taxes

- Illustrative sample scenarios for key ideas

Read the guide

Published: Jul 23, 2024

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.