Simona Ondrejkova, CFP

Simona Ondrejkova, CFP

How to Create a Family LLC for Estate Planning

Clients who own a business often face an additional layer of complexity when it comes to estate planning. From determining the most effective strategy for passing on the business to minimizing taxes and maximizing wealth transfer for loved ones, navigating through countless estate planning strategies can be exhausting.

The good news is that there are certain business structures, such as the family limited liability company (family LLC), that could make things easier for those who run a business that’s meant to stay in the family.

Here, we explain what a family limited liability company is, how it can help business owners with their estate and business succession planning, and how they can create one so they can leave a legacy in alignment with their personal wishes and business goals.

What is a family LLC?

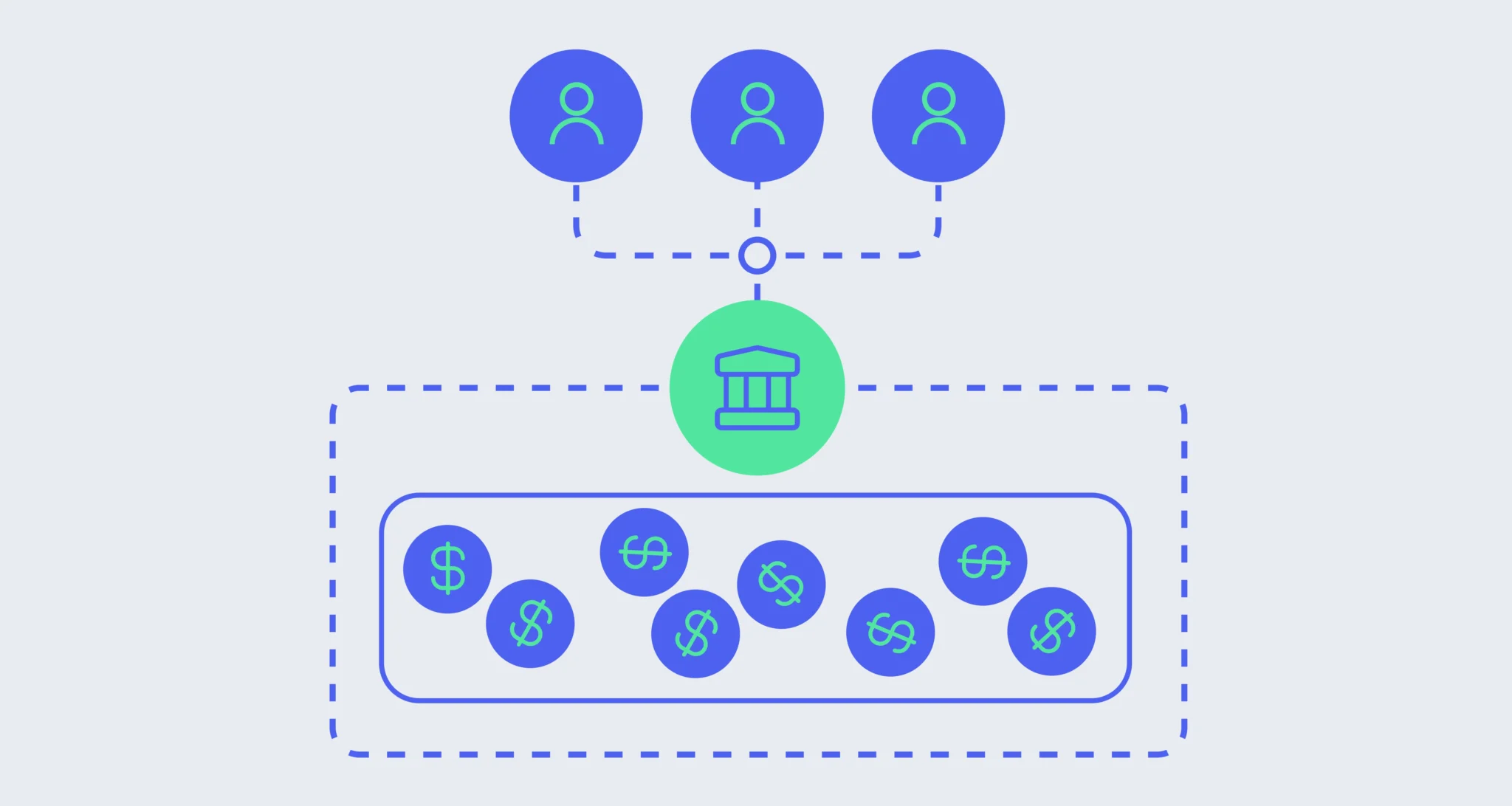

A family LLC is a type of business structure designed for members of a family who manage or invest in a business together. As such, family LLCs are established by individuals who are either related by blood, marriage, or adoption. This ensures that control of the business stays in the family. The business can be an actively managed business and it can also include ownership and management of real estate assets (excluding a personal residence) or brokerage account management.

Family LLCs offer benefits such as valuation discounts and asset protection that may otherwise be difficult for business owners to get through other types of corporate structures.

To get a better grasp of how this family corporation type works, it helps to understand what a limited liability company (LLC) is and how it differs from other business structures.

An LLC is a business entity that provides liability protection for the owners of the business. This means that their personal assets, such as their home, personal bank accounts or investment accounts, are not at risk of being confiscated by company creditors. This asset protection feature is one of the biggest benefits of setting up a family LLC.

Like a traditional LLC, a family LLC also offers its owners the flexibility in selecting a taxation structure that works best for them. Family members can elect pass-through taxation, allowing for distribution of profits to members who then pay personal income taxes on the distributions.

How do you set up a Family LLC?

A family LLC can be set up with an attorney or online by first reviewing your state’s guidelines and instructions for filing an LLC. This process includes filing articles of organization with the state in which the LLC will be established, outlining the name and purpose of the business. One of the family members will need to become a “registered agent “ who will pay the filing fees and receive documents on behalf of the business.

Upon establishing an LLC, the states of Arizona, Nebraska, and New York also require that the business owner publish a notice in the newspaper regarding their intention to form the LLC.

Next, when setting up a family LLC, there needs to be a family LLC operating agreement. This document outlines the ownership rights, guidelines, and responsibilities for day to day management of the company. It is this agreement where family members should be very clear and specific about who is in charge of making the decisions about the business, as well as how the business interests can be transferred.

Setting up a family LLC to minimize potential conflict in the family

To prevent conflict and disputes in the family, participating family members should use the operating agreement to provide rules and structures for running the family limited liability entity in line with their wishes. For example, the operating agreement can prevent members from doing things that could harm the business such as removing a member in an attempt to dissolve the business.

The family LLC operating agreement is also a great place to address estate planning issues such as how business interests will be transferred upon a member’s death.

Here, your clients can specify who will receive the deceased member’s shares or how to address potential liquidity issues to ensure that the surviving spouse or children are taken care of. This could be done, for example, through setting up a buy-sell agreement to buy out the business interests of a deceased family member.

The advantages of using a family LLC for estate planning

In terms of estate planning, one of the greatest benefits of setting up a family LLC is that it allows members to take advantage of valuation discounts which could help reduce estate taxes when business interests are transferred.

In a typical business structure, if your client wants to leave their business interests to their heirs, that business interest is likely to be valued at fair market value for purposes of calculating the value of the estate. The value of the taxable estate at death determines the amount of estate taxes due, based on the remaining estate and gift tax exemption of the individual that owns the business.

However, the family LLC offers a few beneficial options that other structures do not when it comes to valuing the business. Because the ownership of the business is limited to family members, which limits the liquidity of the shares, family members may have access to valuation discounts. The two most common discounts that family members who are part of a family LLC can use include a lack of control discount and a lack of marketability discount, discussed below.

Lack of control discount

A lack of control discount, also known as a minority interest discount, is applied when an interest in a business doesn’t provide meaningful control over business operations. This discount reflects the reduced value of a minority interest due to the holder’s inability to influence key business decisions. The exact discount varies but is generally in the range of 10% to 30% of the value of the interest.

Lack of marketability discount

A lack of marketability discount is applied to reflect the reduced liquidity of an interest in a business that is not easily sold or transferred to outsiders as is the case for a family LLC. The discount for lack of marketability can range from 15% to 50%, depending on factors such as the size of the interest, restrictions on transfer, and the overall liquidity of the business.

Using gifting for estate planning with a family LLC

As in other estate planning strategies used to minimize taxes, individuals who set up family LLCs can also take advantage of annual gifting to pass on a portion of their business interest gift tax-free every year (up to $18,000 in 2026 per beneficiary per year). This helps to lower the overall value of that family member’s estate when they pass away, thus minimizing potential tax liability for heirs.

Advantages of a family LLC for income taxes

Because participating members can elect to have their family LLC taxed as a pass-through entity, income from the business can be divided among generations and shifted to family members who may be in a lower tax bracket.

By transferring membership interests to family members in lower tax brackets, the income generated by the LLC can be distributed in a way that takes advantage of certain family members’ lower tax rates, reducing the overall family tax burden.

The downsides of a family LLC

One major downside of a family LLC structure is that because the business ownership is limited to family members only, it cannot be sold to potential outside investors. This can make it difficult for family members who aren’t interested in running the business to liquidate their interests.

Setting up an LLC can also involve significant initial costs, including state filing fees, legal fees for drafting the operating agreement, and costs associated with transferring assets into the LLC.

In addition to the legal costs, there’s also the human aspect of things to consider – such as family relationships. Disagreements about management decisions, profit distribution, or the future direction of the business can sometimes lead to family conflict or resentment.

An example of using a family LLC for estate planning

If you’re looking for examples of LLC structures designed to help family members simplify estate planning, let’s see how a family LLC could be used to transfer assets to the next generation while reducing tax consequences.

The Johnson family owns a successful real estate business and several investment properties. John and Jane are a married couple who are also the owners and active managers of the business. John and Jane want to ensure that if something happens to them, their business can smoothly transfer to their two kids Mike and Mia…all while minimizing estate taxes and maintaining control over the business while they are alive.

John and Jane set up a family LLC and transfer their real estate business and investment properties into the LLC while retaining a majority interest by keeping 35% ownership each or 70% ownership combined. They give Mike and Mia 15% of the company each. Due to the lack of control they have over business decisions, these minority interests may be valued at a discount to reduce the overall taxable value of the business if John and Jane were to pass away. Also due to the lack of a market for the business since it is meant to be retained in the family, John and Jane’s shares of the business might be valued at a much lower percentage than their true value when it comes time to value their estate.

John and Jane can also use their annual gift tax exclusions to gift portions of their LLC interests to Mike and Mia each year, thus reducing the taxable value of their estate without giving away more control of the business. John and Jane meet with their estate planning attorney every year to review and update their estate plan so their trusts are set up to transfer their business interests in a way that makes the most of the current estate and gift tax exemption amount.

What’s the difference between a family LLC and a family limited partnership (FLP)?

In the context of estate planning, another tool that your clients may have looked into when seeking to minimize taxes and maximize transfer efficiency is the family limited partnership (FLP).

Family LLCs and FLPs differ in that a family limited partnership has both general and limited partners. While the general partners of the FLP are involved in daily business operations and make major decisions for the business, the limited partners usually have only a financial interest in the company.

Unlike a family LLC where all members get asset protection from any potential creditors of the business, asset protection in an FLP extends only to the limited partners of the business. This is one of the main reasons that family LLCs may often be considered to have more advantages than FLPs in estate planning.

Other considerations when setting up a family LLC

Family dynamics can change unexpectedly and adjustments may need to be made when a family member passes away. If you have clients that set up a family LLC, it’s important to review and update the terms of the LLC periodically to ensure everything is in alignment with their needs and wishes.

When creating an estate plan for your business owner clients, it’s important to take into account all of their different types of assets as well as their individual and family-related legacy goals. In addition to setting up a family LLC, it may also be helpful to look at the different types of trusts that can help clients achieve other goals such as charitable trusts or other irrevocable trusts.

Not sure where to start? Use our estate planning checklist to help clients gather the documents needed to create a comprehensive estate plan. Plus, you can now make it even easier for clients to visualize the flow of their business interests and other estate assets with an estate planning software like Vanilla.

The information provided here does not constitute legal, financial, or tax advice. It is provided for general informational purposes only. This information may not be updated or reflect changes in law. Please consult with an estate attorney, financial advisor, or tax professional who can advise as to your particular situation.

Published: Jul 08, 2024

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.