Vanilla

Vanilla

Vanilla’s hottest features for June 2024: Executive Summary, planning Essentials, and more!

Summer’s here and new features at Vanilla are hotter than New York City asphalt. This month we’re excited about:

- Executive Summary and an enhanced Estate Diagram for the Vanilla platform and PDF report

- Vanilla Essentials: key documents for your client’s loved ones

- Generation Skipping Transfer Tax available in Vanilla Estate Builder, Estate Diagram, and more

- ILITs now available as a modeling strategy in Vanilla Scenarios

- New fields present in Estate Builder powered by VAI for advanced trusts

Give clients a personalized snapshot of their estate with Executive Summary

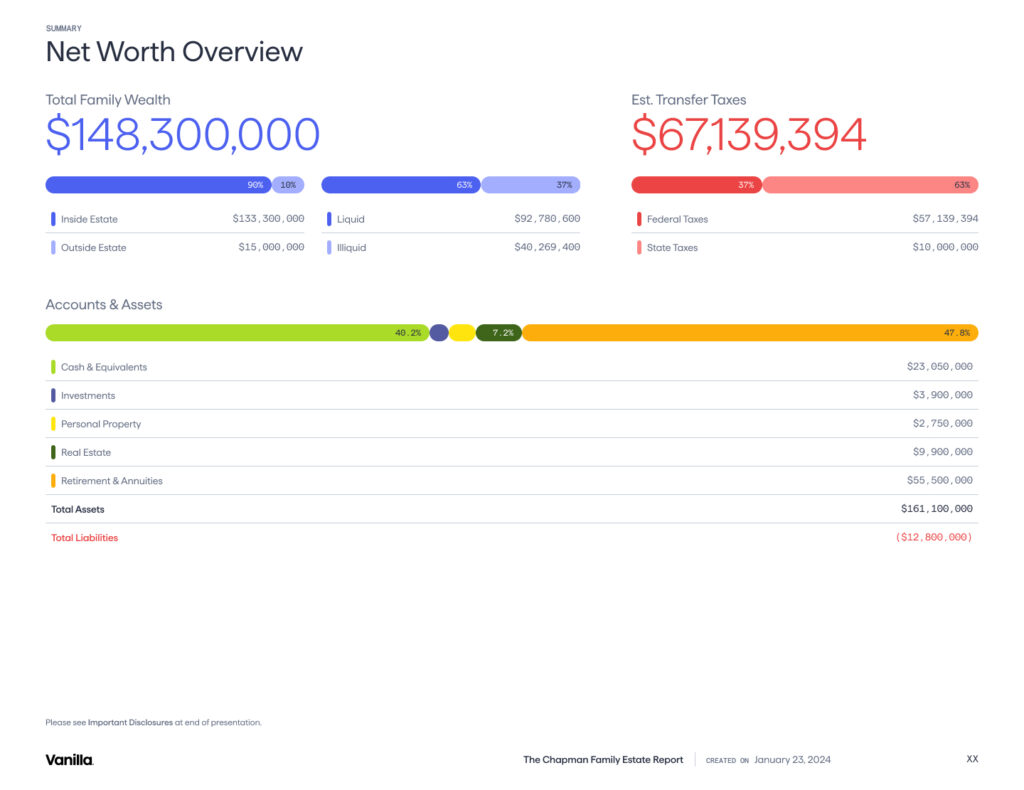

Thanks to feedback from Vanilla customers, we have added an Executive Summary to the Vanilla Estate Advisory Platform and PDF report. Advisors can now present the most important estate details to clients with a condensed summary and enhanced visualizations before diving deeper into the plan. New overviews include a Net Worth and Beneficiaries Summary and coming soon is an enhanced Estate Diagram!

The new Estate Diagram launching in a few weeks will summarize highlights of document notes and funding numbers making it easier for the client to understand what the plan really means and how assets flow. The provision notes are easy to update allowing advisors to make the necessary changes from one client meeting to the next. With the new Executive Summary and Estate Diagram, advisors will have the flexibility to personalize their client’s estate planning experience and tell the story that matters most to them.

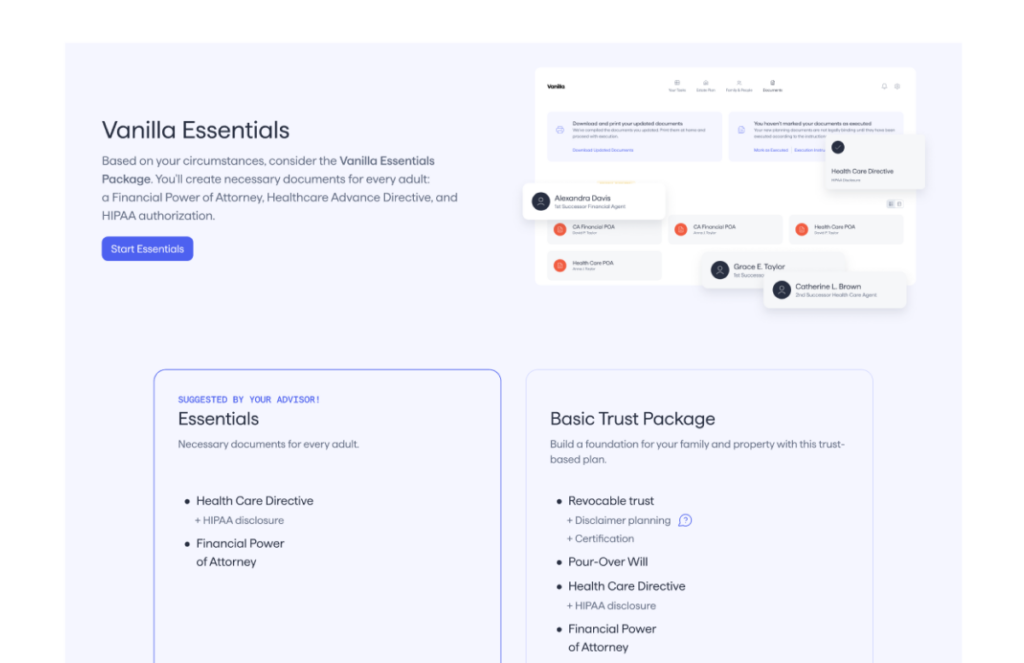

Introducing the Essentials Package: Deepening Client Relationships with Care

Are you looking to strengthen client relationships through an offering that protects your clients’ children? Say hello to our Essentials Package! Designed for young adults aged 18-30, this package includes the documents every young adult should have: a Health Care Advance Directive (HCAD), Financial Power of Attorney (FPOA), and HIPAA Disclosure. Priced at just $150, it’s a quick and affordable way to provide peace of mind and open meaningful conversations with the next generation. This thoughtful addition to your advisory services can also pave the way to discuss other important products like insurance. Show your clients you care about their holistic well-being and be their trusted advisor through every stage of life. Bonus: since college kids are home for summer, now’s the perfect time to sign!

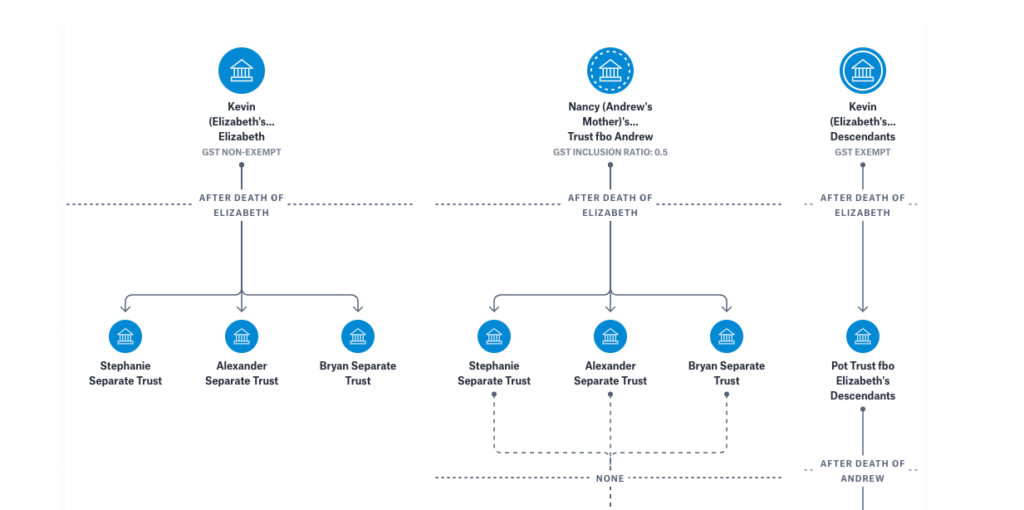

Account for GSTT (Generation Skipping Transfer Tax) when visualizing a client’s estate

GSTT is now generally available in the Vanilla platform to help advisors ensure their clients understand their total potential transfer tax liability. Vanilla now accounts for where a client’s plan is subject to taxation as the result of generation skipping in addition to the standard gifting and estate tax (federal and state-specific). In Vanilla Estate Builder, a planner can designate and easily see the GST tax exemption status and inclusion ratio on irrevocable trusts and enter any GSTT exemption used to date. GSTT status will also show up in the Estate Diagram and can be added from Balance Sheet and Documents, allowing an advisor to show their client which trust documents will be subject to taxation. If an advisor knows their client has already used some of their GSTT exemption, they can indicate in Profile Builder during the client onboarding process or quickly from Settings.

GSTT estimates for taxable terminations and direct skips (coming soon!) will be included in Transfer Tax details and Waterfall. Additional GSTT features will be available later this year such as the allocation of GST Exemption toward sub-trusts.

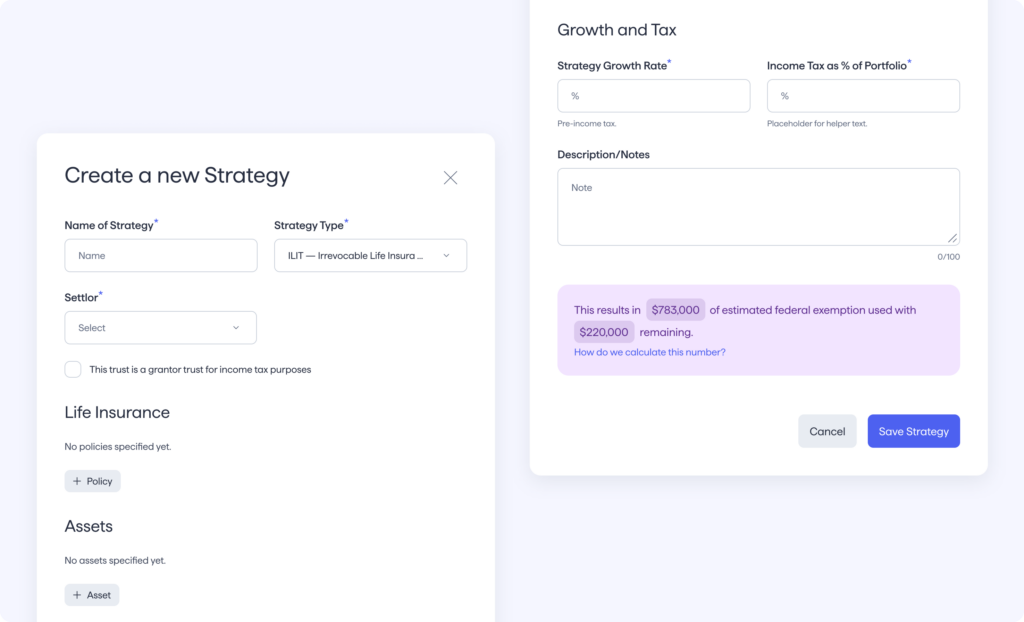

Offer additional advanced planning strategies to clients with ILITs now available in Vanilla Scenarios™

When modeling how a client’s estate plan might look in the future, advisors can now layer an ILIT (Irrevocable Life Insurance Trust) on top of the existing plan. With an ILIT, a client’s life insurance death benefit is moved to outside of the taxable estate to create liquidity to pay any estate taxes and satisfy other liquidity needs of the estate. Advisors can also model moving existing life insurance policies into an ILIT or the creation of a hypothetical policy. Advisors can quickly visualize in Vanilla how an ILIT could benefit the client by reducing their estate tax liability and maximizing the amount to beneficiaries. With the addition of an ILIT in Vanilla Scenarios, advisors now have more flexibility in visualizing how advanced planning could positively impact their client’s estate planning for the future.

Abstract estate documents even faster with additional fields now available through VAI

Estate Builder powered by VAI now supports extracting complex details from trust documents, including distributions, dispositions, and other sub-trust related fields. Additionally, VAI highlights critical issues to completing an abstraction, such as missing and out-of-order pages. Estate planners can save more time by reviewing detailed trust information alongside existing fields like names, dates, locations, and fiduciary details. To ensure an efficient abstraction, planners can also verify document completeness before beginning an abstraction.

To learn more about these new features, reach out to the Vanilla sales team today!

The information provided here does not constitute legal, financial, or tax advice. It is provided for general informational purposes only. This information may not be updated or reflect changes in law. Please consult with an estate attorney, financial advisor, or tax professional who can advise as to your particular situation.

Published: Jun 18, 2024

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.