Amjad Hussain

Amjad Hussain

New Vanilla innovations accelerate customers’ ability to deliver Estate Advisory

When we launched the Vanilla Estate Advisory Platform just over a year ago, we did so because we saw a problem without a solution. There was a deep need for a tool that enabled wealth advisors to help clients with their estate strategy as part of their holistic financial planning. Over the past year, our customers have not only used the Vanilla platform to grow their business and bring value to clients – they have helped us grow, too. We have worked hand in hand with our customers, from small RIAs to the largest enterprise firms to innovate and bring exciting new product enhancements to the Vanilla Platform. And today, we are thrilled to unveil some of those enhancements. These new product features not only will help customers deliver more estate advice more efficiently, they will help advisors and clients plan with greater nuance and foresight.

Artificial intelligence for estate planning

Earlier this year, I shared a point of view on how artificial intelligence will transform estate planning. Today, we are taking an important step forward on this mission by introducing VAI™. VAI is purpose-built artificial intelligence to simplify the estate planning experience. Through leveraging multiple AI techniques, including large-language models (LLMs), specifically on the problems of estate planning, VAI is embedded across the platform helping accelerate user workflows. Embedded in our document abstraction tool, Vanilla Estate Builder™, it will dramatically reduce the time it takes to turn estate documents into powerful diagrams, federal and state-specific estate tax projections, and beneficiary summaries. In the future, VAI will continuously monitor clients’ assets, insurance, as well as tax laws across 50 states. And since it understands the client’s family structure, it will proactively identify planning opportunities. For example, if a market event drives a rapid decrease in asset value or change in interest rate, Vanilla will surface clients with assets in GRATs that have an opportunity to re-GRAT the asset(s) and capture any rebound appreciation. We also see a world in which VAI will assist advisors and clients across the platform with various tasks such as identifying clients in need of an estate review, suggesting client discussion topics, and recommending the best next action for users.

The impact of AI across industries is massive. In estate planning, like many other aspects of the financial industry, the risk tolerance for AI creating errors is low. Instead of aiming to replace humans, which could introduce risk to estate analysis and planning, VAI will work primarily to suggest inputs and guide the user, creating a more frictionless experience. Like the rest of the Vanilla platform, VAI is built with security in mind. Customers will have the ability to control use of their data in VAI.

The impact of AI across industries is massive. In estate planning, like many other aspects of the financial industry, the risk tolerance for AI creating errors is low. Instead of aiming to replace humans, which could introduce risk to estate analysis and planning, VAI will work primarily to suggest inputs and guide the user, creating a more frictionless experience. Like the rest of the Vanilla platform, VAI is built with security in mind. Customers will have the ability to control use of their data in VAI.

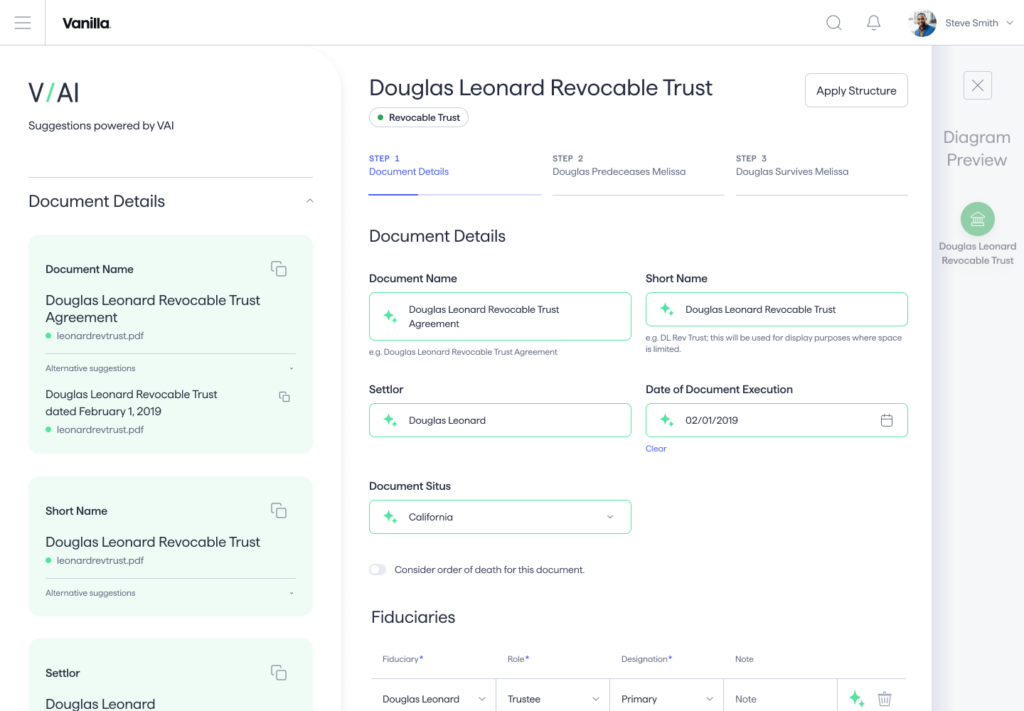

Vanilla Estate Builder™ powered by VAI™ adds scale and efficiency for wealth planning teams

Reading through dense estate documents and translating them into estate diagrams and reviews is time consuming for estate advisors, and getting all of the details right is challenging. In addition, estate strategists often support many advisors and don’t have the capacity to take on all the reviews in a timely manner. This leads to a poor experience for advisors and clients alike. With the introduction of Vanilla Estate Builder™ powered by VAI™ , we’ve reimagined how estate strategists can scale estate reviews for their teams and partner more closely with advisors.

Developed in partnership with leading wealth management firms, Vanilla Estate Builder transforms planning documents into simple diagrams and powerful visualizations. And with complex fact patterns and estate structures, estate strategists can support the planning needs of clients across the wealth spectrum.

Developed in partnership with leading wealth management firms, Vanilla Estate Builder transforms planning documents into simple diagrams and powerful visualizations. And with complex fact patterns and estate structures, estate strategists can support the planning needs of clients across the wealth spectrum.

With VAI, Vanilla Estate Builder automatically identifies thousands of dispositive details, factors in tax and state-specific rules, and then abstracts them into Vanilla. VAI reads the estate documents, identifies key data, maps it to the relevant fields, and then points the estate strategist to the information’s location in the planning document so they can accept the suggestions or manually enter information, saving hours of painstaking review. The output is an illustrative summary of a client’s current plan including funding waterfalls, beneficiary summaries, and estimated state and federal estate tax calculations. And the advisor, now armed with that complete picture, can provide action-oriented advice during planning conversations with their client.

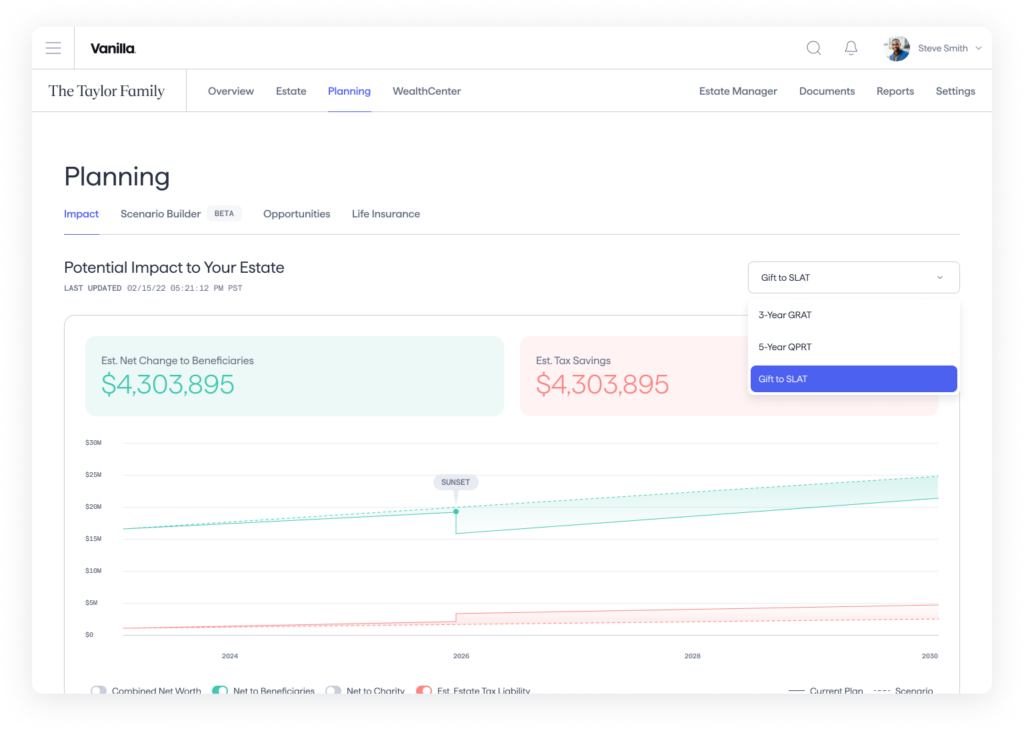

Illustrate the impact of estate planning with Vanilla Scenarios™

Another theme that we’ve heard from advisors is the desire to drive meaningful conversations with clients that minimize planning gaps or potential tax implications. With the upcoming 2026 sunset of the federal estate tax exemption, advisors and their clients need to plan now for the potential impact on estates that are taxable today or will be when the federal tax threshold drops to $6.2M per individual or ~$13 million per couple. That is why we are excited to introduce Vanilla Scenarios™, a powerful, dynamic platform for advisors, wealth planners and estate lawyers to model estate planning scenarios now and in the future to illustrate the impact of planning.

With Vanilla Scenarios, advisors can visualize a client’s estate at a future point in time and layer on advanced strategies to demonstrate the value of additional planning. Vanilla Scenarios will start with support for popular strategies such as GRATs, ILITs, QPRTs, and SLATs with new strategies, like sales to grantor trusts, charitable options, and more to be added over time.

With Vanilla Scenarios, advisors can visualize a client’s estate at a future point in time and layer on advanced strategies to demonstrate the value of additional planning. Vanilla Scenarios will start with support for popular strategies such as GRATs, ILITs, QPRTs, and SLATs with new strategies, like sales to grantor trusts, charitable options, and more to be added over time.

Vanilla Scenarios can also help advisors differentiate by showing prospects unique strategies based on their planning goals. With a few data points from a balance sheet, an advisor can illustrate income and tax projections or how some basic estate planning could reduce or eliminate taxes and avoid a lengthy probate process. And as more of the client’s information is added to the Vanilla platform, more sophisticated scenarios and projections can be generated and saved to the Vanilla Scenarios dashboard.

With Vanilla Scenarios added to the Estate Advisory platform, advisors can ensure a client’s estate plan aligns with their wishes now and in the future.

If you’re interested in learning more about the Vanilla platform and how these new innovations can help your estate advisory business, click here to talk with our team.

Published: Oct 19, 2023

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.