Madison Eubanks

Madison Eubanks

The Complete Guide to Estate Planning

Though an often overlooked part of financial planning, estate planning is a critical part of a well-rounded wealth management strategy. In fact, estate planning is about much more than just creating a will. A thoughtful estate plan is a comprehensive strategy for things like:

- Managing one’s wealth during life and after death

- Ensuring one’s family is cared for

- Supporting causes that align with one’s values

- Minimizing taxes and fees

- Documenting wishes in case of incapacitation

- Planning for one’s future legacy

The common myth that estate planning is only for the ultra-wealthy is patently false. Estate planning benefits individuals at all ages and wealth levels, from young professionals who are just starting out to retirees who are planning for their descendants’ futures.

In many cases, estate planning is actually more important for individuals and families who don’t have significant wealth. The consequences of not planning can lead to unnecessary strain—both emotional and financial—on a person’s loved ones, which can be even more burdensome for those with limited means.

In this guide, you’ll learn about key estate planning documents, common tax minimization strategies, examples of planning tactics for different types of estates, associated costs, ways to get started, and more.

What is estate planning?

Estate planning is the process of determining and documenting how a person’s assets will be managed and distributed after their death. This can include physical property, monetary assets, investment accounts, life insurance policies, business interests, personal property like jewelry and vehicles, digital assets like cryptocurrency, intellectual property like trademarks or licensing agreements, items with sentimental value, and more.

Additionally, estate planning includes making decisions about a person’s own medical care in the event they become incapacitated. For example, an estate plan can dictate whether a person wants to be kept alive with life support, whether they want to be an organ donor, name someone who can make medical decisions on their behalf, and more.

For people who care for minors, an estate plan designates who should assume guardianship if the caregiver dies or becomes incapacitated. Many people also include the person they wish to care for their pet in their estate plans.

Finally, an estate plan can be a way to communicate charitable intent, specifying if a person wishes to leave money or property to a charitable organization after they die.

For all types of assets, the core purpose is to ensure they’re transferred as seamlessly as possible and according to a person’s wishes. This is done by creating a plan that reduces tax burdens, avoids legal delays, and provides clarity and specific instructions for a person’s beneficiaries and loved ones.

Here’s a brief example of what might happen if someone dies without a will:

Samuel dies unexpectedly at 62 years old without any type of estate plan. He had two adult children and a long-time partner to whom he wasn’t married. His estate takes several months to go through probate, after which his partner receives nothing because they weren’t legally married. Samuel’s children inherit everything, but they argue over who should manage the estate. Ultimately, the court appoints an administrator, delaying the children’s access to the assets they inherited. The moral of this story is that when a person fails to document their wishes, the court decides how their estate is distributed.

Here’s an example of what can happen if someone lacks medical or financial directives:

A 45-year old woman, Linda, has a stroke and goes into a coma. She hasn’t named a healthcare proxy or financial power of attorney to make decisions while she’s incapacitated. Without instructions from Linda, her family argues about her medical treatment and whether she should be kept on life support. Additionally, no one can access her bank accounts to pay bills or medical expenses. All of this results in Linda’s sister going to court to be appointed her legal guardian in order to make decisions on Linda’s behalf, which takes weeks and costs thousands of dollars in legal fees. If Linda had set up medical and financial powers of attorney or similar documents, her family would have been able to handle her care and finances much more easily.

These two examples illustrate the negative effects of not having an estate plan. The sad truth is when a person passes away without an estate plan, it’s typically their family and loved ones who suffer the consequences and are left to deal with the fallout. Not only can this be financially burdensome, it can create disputes and rifts between family members.

Creating an estate plan—even a basic one—brings control, protection, and peace of mind for an individual and their loved ones.

Key components of an estate plan

A thorough estate plan consists of a few core legal documents that each serve a specific purpose in leaving instructions for a person’s estate. This section will walk through three types of documents that make up the foundation of an estate plan.

Wills and trusts

A will, or a last will and testament, is a legal document that specifies how a person would like their property and assets to be distributed after their death, and appoints guardians for any minor children. The person who creates a will is referred to as the testator, and those who receive assets from a will are referred to as beneficiaries. Beneficiaries might be individuals, groups of people, or organizations such as charities.

A trust is a legal arrangement in which the creator of the trust transfers legal ownership of assets to a trustee for the benefit of one or more beneficiaries. Trusts are established through a written document, or trust agreement, which details the terms and conditions of the trust and how it operates. The person creating the trust is known as the trustor, grantor, or settlor, while the person or party receiving ownership is called the trustee. For most revocable trusts, the settlor and the trustee are the same person.

There are two primary benefits of trusts over wills:

- Trusts can typically avoid probate, while a will must go through probate to be administered

- Trusts provide more privacy for the settlor and their family, while the contents of a will become public record during probate

In both wills and trusts, it’s important to specifically name an executor, a trustee (if applicable) and beneficiaries. Without these key details, assets may end up in the hands of unintended beneficiaries, or decisions might not be made in accordance with the deceased person’s wishes.

Here’s an example of using a trust and a will together:

Vivian is a 40-year old single mother with two children, ages eight and 10. She owns a house, a life insurance policy, and about $250,000 in investments. While she wants to ensure her children will be financially supported if she passes away unexpectedly, she doesn’t want them to receive their entire inheritance when they turn 18.

To address these wishes, Vivian sets up a revocable living trust into which she puts her home, her life insurance policy, and her investments. She names her brother as the successor trustee, who would manage the trust upon her death, and creates trust terms providing that the funds should be used to cover her children’s education, housing, and basic needs. Then, the trust dictates that a percentage of the money will be distributed to her children when they turn 25, and the remainder when they turn 30.

In addition to the trust, Vivian creates a simple will to appoint a guardian for the children and specify instructions for personal items like her vehicle. Since Vivian has a living trust, the will includes a pour-over provision that directs the probate court to pour any assets into her trust at death that weren’t transferred to the trust during her lifetime. If all of Vivian’s assets are transferred in her trust during her lifetime, probate administration is not needed to administer assets.

In Vivian’s case, the trust serves primarily to ensure that her children will be cared for but won’t have access to their entire inheritance at too young an age. The trust also allows Vivian to avoid probate administration if the trust is fully funded with her assets. This prevents her estate from spending several months in probate and incurring substantial costs and expenses.

A thorough estate plan consists of a few core legal documents that each serve a specific purpose in leaving instructions for a person’s estate. This section will walk through three types of documents that make up the foundation of an estate plan.

Powers of attorney

A power of attorney (POA) is a legal document where a person (known as the principal) gives someone the authority to act and make decisions on their behalf if they become incapacitated. There are two primary types of powers of attorney:

- Financial power of attorney: This type of POA gives someone the ability to make financial decisions on a person’s behalf. They are authorized to manage things like money, bills, and property.

- Healthcare power of attorney or proxy: A healthcare power of attorney empowers someone to make medical and healthcare decisions on a person’s behalf.

For both healthcare and financial powers of attorney, choosing a trusted person is essential. Ideally, the person who is appointed as agent will understand the principal’s wishes and values, and be able to make decisions accordingly. Without a power of attorney, a court-appointed guardian or conservator must step in to make decisions with their own judgement, which may not align with what the incapacitated person would have wanted.

Because accidents can happen at any time, at any age, powers of attorney are just as important for young people as they are for the elderly. A power of attorney simply ensures that the person making important medical or financial decisions is someone who the principal knows and trusts.

Advance directives

Advance healthcare directives are documents that express a person’s wishes for medical treatment, end-of-life care, and their remains in the event they are unable to act for themselves. Though similar to a healthcare POA, advance directives are broader in scope, and can include:

- Living will: This type of will details specific medical instructions and interventions, like the use of feeding tubes, life support, resuscitation, etc.

- Healthcare proxy or medical power of attorney: These documents name someone to make medical decisions on a person’s behalf if they are unable to do so themself and can include specific provisions relevant to the principal’s medical care.

Though creating these documents force people to consider difficult possibilities, they save family and loved ones from having to make painful decisions without guidance. These simple planning measures can help avoid confusion, familial disputes, and feelings of guilt or regret.

Strategies to minimize estate taxes

Many people enter into the estate planning process because they want to know how to reduce estate taxes. Often, this can be done through estate tax planning strategies, which vary depending on a person’s wealth level, where they live, and a number of other factors.

In 2025, every individual in the US has a federal exemption amount of $13.99 million, meaning they must die with more than $13.99 million in assets before their estate is subject to any federal estate tax. For a married couple, the exemption amount is $27.98 million.

(The currently high exemption rate is set to sunset to around $7 million in 2026, unless legislative action is taken.)

Most people’s estates will never exceed the federal exemption amount, but high-net-worth and ultra-high-net-worth individuals and families must use careful planning to avoid large tax bills.

There are several common tax planning strategies that can help people avoid paying federal estate taxes, most of which focus on moving assets out of one’s estate to bring it below the tax threshold. Some of these strategies include:

- Transferring assets from one’s taxable estate into an irrevocable trust

- Using the annual gift exclusion to give assets to children, grandchildren, or other beneficiaries. Currently, individuals can gift up to $19,000 per year per beneficiary without incurring gift tax ($38,000 for married couples).

- Making charitable gifts to support causes a person values while excluding those funds from their taxable estate.

- Using spousal portability, in which a surviving spouse can take advantage of any unused exemption their spouse had at the time of their death.

- Freezing one’s estate through tools like grantor retained annuity trusts (GRATs)

- Discounting the value of assets in the estate through tools like a family limited partnership.

If a person’s estate is taxable or is approaching taxability, it’s critical they work with a financial advisor who can connect them to estate planning tools or legal support with tax planning expertise to ensure they have the appropriate tax minimization tools in place.

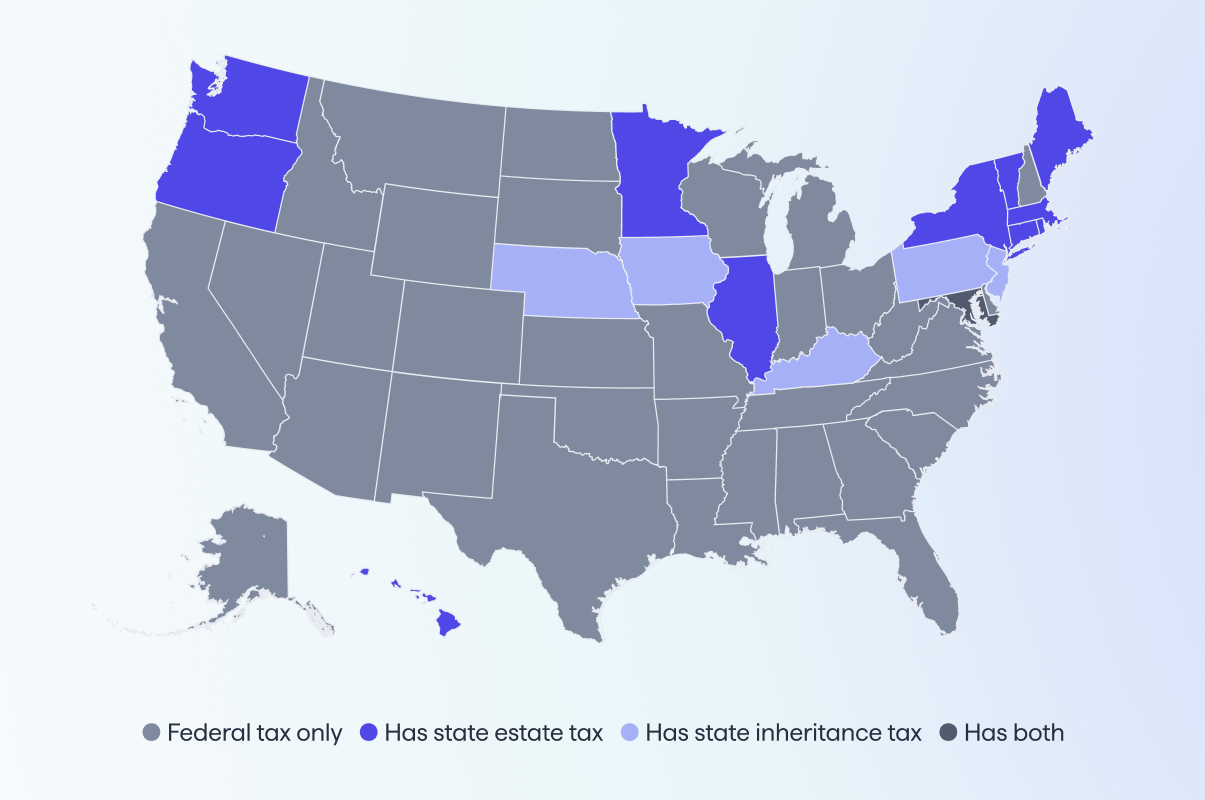

It’s also important to remember that 12 states and Washington, D.C. impose state estate taxes. In those states, the exemptions are often significantly lower than the federal estate tax exemption. For people who live in any of these states, tax planning is even more important as more people are affected by them than federal taxes.

Estate planning examples

In this section, we’ll share three fictional examples of how estate planning works in real life, using three different scenarios.

Example 1: Young married couple with children

Travis and Jackie are a married couple in their thirties with two young children, who they want to ensure have care and financial security if something happens to them. They take several measures:

- Wills: Travis and Jackie each create a will naming an agreed-upon guardian for their children and distributing their property to each other, then to their children. This ensures guardianship and asset distribution would be carried out according to their wishes.

- Life insurance: They purchase term life insurance that would provide financial support for the children. This replaces income and supports their dependents if they pass away.

- Powers of attorney: They designate healthcare and financial powers of attorney for themselves in case of incapacitation. They also write living wills to outline their medical treatment preferences. This acts as a plan if one or both of them are unexpectedly incapacitated.

Example 2: High-net-worth entrepreneur

Jamal, 54, owns a successful real estate company and has a $16 million estate, putting him over the federal estate tax threshold. To secure his business and minimize taxes, Jamal uses:

- Irrevocable trust: By moving assets into an irrevocable trust, he can reduce estate taxes and protect those assets from creditors, lawsuits, etc.

- Buy-sell agreement: Jamal sets up a buy-sell agreement with his business partner so that the company can continue to operate smoothly if he dies or retires, and his estate receives a fair value for his portion of the business This helps to ensure business continuity and fair valuation.

- Charitable remainder trust (CRT): Finally, Jamal sets up a CRT for a non-profit he supports, which reduces his taxable estate while supporting a cause he values.

Example 3: Retired widow

Joann, 78, is a retired pediatric nurse with a modest home, some savings, and no debt. When planning for the end of her life, her goals are to make things as easy as possible for her children and support her community. To do this, she sets up:

- Revocable trust: She puts her home and bank accounts into a revocable trust. This way, her estate can avoid probate and simplify the transfer of her assets to her children.

- Charitable gift: Joann designates part of her savings to the local Boys and Girls Club, to support her community’s children and their well-being.

- Successor trustee: Joann names her daughter as the successor trustee to manage her estate after her death, avoiding disputes among siblings.

These examples illustrate how estate planning is applicable to anyone, regardless of their wealth level. Planning strategies are highly flexible and different techniques can be combined to fit a person or family’s unique circumstances.

Benefits of estate planning

Proper estate planning provides financial, legal, and emotional benefits both for the individual doing the planning and for their family and loved ones. Estate planning isn’t only beneficial for the affluent—it’s advantageous for people of all wealth levels.

Here are six of the primary benefits of estate planning:

Ensures a person’s wishes are followed

When a person dies without a will or estate plan, any assets they leave behind will be distributed according to the laws in their state. This could lead to long delays and assets going to unintended beneficiaries.

Reduce taxes and fees

Many estate plans include tax optimization strategies, both for federal and state estate taxes. For taxable estates with no planning, as much as 40% of a person’s estate could be taxed. Additionally, estate planning can help to avoid legal and probate fees after a person dies.

Avoids probate

Probate has a bad reputation, and in many cases, for good reason. Not only is it lengthy, taking months or even years depending on the estate’s complexity, it can also be expensive and deplete the assets the decedent left behind. Additionally, the probate process can be stressful and tedious for surviving family and loved ones.

Watch: Why do people often want to avoid probate?

Protects minor children or dependents

No parent or caregiver wants their children to have an uncertain future. Proper estate planning ensures that minor children or dependents have a designated guardian and will be cared for financially if something happens to the parent.

Prevents family disputes

Over a third (35%) of adults in the US say they or someone they know have experienced a familial conflict due to a lack of estate planning. When a person communicates their healthcare wishes and how they want their estate to be distributed, it reduces the likelihood of beneficiaries fighting over assets or disagreeing over medical decisions.

Gives peace of mind

Ultimately, all of these benefits add up to ease worries and create peace of mind for the person creating the estate plan as well as their loved ones. Knowing that one’s values will be upheld and family will be cared for is often the most foundational goal of estate planning.

Regardless of the amount of wealth a person has to leave behind, estate planning is a smart move and benefits everyone involved.

How much does an estate plan cost in the U.S.?

How much does estate planning cost? The answer varies widely depending on an estate’s complexity, the type of professional support needed, and what’s included in the plan.

Here are common price ranges for some basic elements of an estate plan:

- Simple will: $300 to $1,000

- Trust-based estate plan: $1,000 to $5,000+

- Online plans: $100 to $500

For people with relatively simple estates (e.g. a young family with a small savings and a single home), a DIY estate plan or online service can be effective.

As an estate grows and becomes more complex (say, for a blended family, someone who owns a business, or people with high net worth), it’s often a good idea to hire a professional.

Though creating an estate plan can be expensive, the cost of not planning is likely to be much higher due to court fees, tax bills, or resulting family conflict.

Common myths about estate planning

There are plenty of misconceptions about estate planning. In this section, we’ll debunk four of the most common estate planning myths.

“Estate planning is only for the wealthy.”

Estate planning is beneficial to everyone, regardless of wealth level. It helps ensure that anything a person leaves behind—savings, life insurance policies, property, personal items, or anything else—is distributed according to their wishes.

Additionally, communicating wishes around asset distribution and healthcare preferences is enormously beneficial for surviving family members, who could otherwise be burdened with difficult decisions, confusion, unexpected expenses, and even disagreements.

“I’m too young to need estate planning.”

Estate planning isn’t only about what happens after a person dies. Every adult needs at least a few essential estate planning documents in case of an accident. Even if a person doesn’t have significant assets or property, they should document their preferences for their own healthcare, appoint a healthcare proxy in case of incapacitation, and designate guardians for minor children or other dependents.

“A will is enough.”

While a will is a good starting point, there can be major drawbacks to only having a will. For one, wills are subject to probate, which can be a lengthy, stressful, and expensive process for surviving family members. A will also does not protect assets from taxes and creditors, or provide a long-term plan in the same way that a trust does. A will is better than nothing, but it can still leave family and loved ones in a difficult spot.

“Estate planning is too expensive or complicated.”

It’s true that there are costs and complexities associated with estate planning, but the upfront fees will likely be paid off many times over in savings and benefits down the road. Basic plans can be created online for a few hundred dollars, which is a small price to pay for the peace of mind that comes with having a plan for assets, healthcare, and family members. While estate planning can be complicated for people with high net worth, business interests, multiple properties, etc., it’s actually quite straightforward for most people who need a few essential documents.

Don’t wait—it’s important to explore estate planning early so there’s a plan in case of an accident or other unexpected event. Getting the basics of an estate plan together is easier and more accessible than people tend to think.

Steps to create an effective estate plan

In this section, we’ll walk through how to create an estate plan step by step.

You can also download this estate planning checklist for easy reference.

Step 1: List your assets and liabilities

Start by making a comprehensive inventory of everything you own and any debts you owe. This might include:

- Real estate

- Bank accounts

- Investments

- Retirement plans

- Life insurance policies

- Business interests

- Personal property

- Digital assets

- Medical bills

- Credit card debt

- Mortgages

For each item in the list, write down an estimated value, relevant account numbers, and details about where the assets are held. Do the same for debts.

Understanding your full financial picture—assets as well as liabilities—is essential for making informed decisions about your estate, your beneficiaries, and your tax obligations.

Step 2: Define your goals and legacy wishes

This step is all about setting the intentions for your estate plan. Is your primary goal to ensure that your family is financially cared for, to donate to charity, to be remembered in a certain way, or something else?

Ask yourself questions like:

- Who do I want to benefit from my estate?

- Are there minor children, dependents with special needs, or charitable causes I want to support?

- What kind of legacy do I want to leave?

Other considerations might include determining business succession goals or property you want to keep within your family, if applicable.

Essentially, this step is all about your personal values and wishes that will inform your planning process.

Step 3: Choose key people you trust

There are a few critical roles that you’ll need to assign in your estate plan. They include:

- An executor: The person who administers your will

- A trustee: A person or company that manages the assets in a trust

- Guardian(s): Someone to care for any minors you leave behind

- Healthcare and financial power of attorney agents: A person to carry out your medical or financial wishes if you become incapacitated or can’t act for yourself

It’s important to choose people who are trustworthy, reliable, financially responsible, and willing to serve in their assigned role. You’ll likely want to choose someone who shares or understands your values and will be able to make decisions in accordance with what you would want. Many people also choose to name backups or alternates for these roles, in case someone is unwilling or unable to assume the responsibility.

Make sure to have conversations with these people ahead of time to confirm they are willing to perform their duties if the time comes.

Step 4: Draft the essential legal documents

With the prep work done in steps one through three, this is when the formal estate plan begins to take shape. It’s time to work with an estate planning attorney or use a reputable online service to draft your basic documents:

- A last will and testament

- A revocable living trust, if appropriate

- Durable powers of attorney for finances and healthcare

- An advance directive or living will

Legal requirements vary from state to state, but national legal standards require that documents must be properly signed, witnessed, and stored to be valid.

Step 5: Update beneficiary designations

Some assets don’t pass via a will or trust but are distributed according to beneficiary or transfer-on-death designations , on retirement accounts, life insurance policies, and investment accounts.

This means that even if you “leave everything” to a certain person in your will, these accounts won’t be included in that designation. It’s important to update these beneficiary designations according to your estate planning goals. Cash accounts and investments can be transferred during your life to a trust to be distributed according to your trust terms. If you have a will, ensure the beneficiary designations on all assets match your intended beneficiaries in your will. For retirement accounts, it’s important to get advice on how to properly identify beneficiaries when you complete your estate plan as these have income tax implications.

For example, say you set up an IRA over 20 years ago and your then-spouse was the beneficiary. After your divorce, you updated your will to remove your ex-husband, but you didn’t update the designated beneficiary on your IRAaccount. If you pass away, that money may still go to your ex-husband despite what your will says.

Step 6: Organize and store your documents

It’s important to store your documents in a safe, accessible place such as a fireproof safe.. It’s a good idea to tell your executor or trustee where the documents are kept, and even provide them with copies if necessary.

Some people choose to include a letter of wishes with their official estate documents. A letter of wishes is an informal, supplementary document that provides instructions for how you want your assets to be distributed, explanations for decisions you made in your dispositive document, funeral preferences, and any other personal or sensitive information that might not be appropriate for formal legal documents. This document is not binding on your trustee, but meant to be used as guidance and to clarify your intentions.

Step 7: Review and update regularly

Estate planning is not a one-time task. Your estate plan should evolve as your life and family does. There’s no hard and fast rule for how often you should review and update your documents, but a good rule of thumb is:

- Every three to five years

- After any major life event (marriage, divorce, birth, death, moving to a new state, starting a business, retiring, etc.)

- If tax laws change

An outdated plan can give rise to all sorts of issues. It’s best to update your plan regularly to ensure that it still aligns with your wishes, your family dynamics, and the law.

How often should I update my estate plan?

Estate planning is an ongoing process. You should review your plan every three to five years, or after any major life event or legal changes. These might include:

- Marriage or divorce: Update your beneficiaries, executors, and healthcare decision-makers to reflect your current relationship.

- Birth or adoption of a child or grandchild: Add new family members to your will or trust and revise guardianship provisions accordingly.

- Death of someone named in your plan: If an executor, trustee, guardian, or beneficiary passes away, make updates to your plan as necessary.

- Major changes in assets: If you sell a business, receive an inheritance, buy real estate, or have any other significant financial changes, you may need to update your strategy to reflect them.

- A decline in health or new diagnosis: If a significant health event occurs, it could be wise to adjust your estate plan or revisit your healthcare provisions to ensure they’re up to date.

- Moving to another state: Different states have different laws around things like executing wills, powers of attorney, and taxes, so make sure to consult a professional who knows the laws in your state.

- Tax law changes: Monitoring changes to tax laws is especially important for high-net-worth individuals. Laws like the federal estate tax exemption can change from year to year, which might affect how much your estate owes.

An outdated estate plan can be almost as detrimental as having no plan at all. Make sure to mark your calendar to revisit your plan and check in with your planning professional every few years.

Choosing the right professionals for estate planning

For many people, it can be extremely beneficial to work with some type of advisor or financial planning professional to start to take inventory of your financial assets and discuss an estate planning strategy. A financial advisor or planner can help you understand your holistic financial picture and connect you with the right estate planning resources or professionals to receive assistance.

Without a professional’s guidance, critical gaps and missed opportunities can arise in an estate plan, opening the door to unnecessary taxation, unintended beneficiary designations, and more.

The types of professionals involved in estate planning may include:

- Estate planning attorney: Drafts legal documents and ensures compliance with laws

- Financial planner: Aligns a client’s estate plan with their financial goals

- Tax advisor/CPA: Offers recommendations for tax-efficient strategies

Watch: How do the roles of estate attorney and financial planner differ?

When choosing a professional to work with, ensure they have the appropriate credentials (like Certified Financial Planner®, or Juris Doctor [JD]), or act as a fiduciary and have expertise in the appropriate type of estate.

Word of mouth is a great way to find a planning professional in your area. Ask friends and family members for referrals and recommendations, and set up consultations to determine if the advisor is a good fit for your circumstances.

Conclusion

Estate planning is essential for everyone, regardless of age, location, or wealth level. In addition to passing on assets, estate planning provides peace of mind for you and your loved ones.

No matter your circumstances, you can take the first steps toward creating an estate plan today—whether it’s taking stock of your assets or setting up a consultation with a financial advisor.

The information provided here does not constitute legal, financial, or tax advice. It is provided for general informational purposes only. This information may not be updated or reflect changes in law. Please consult with an estate attorney, financial advisor, or tax professional who can advise as to your particular situation.

Published: Apr 22, 2025

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.