Sarah D. McDaniel, CFA

Sarah D. McDaniel, CFA

An Advisor’s Guide to Helping Clients Navigate Market Volatility

For advisors, staying on top of financial markets and structural developments to identify opportunities for your clients and prospects—and then guiding them through implementation—is essential for success.

When markets are turbulent, it’s a smart time to revisit estate planning. While the instinct might be to pause and wait for stability, volatile periods can actually open up strategic opportunities.

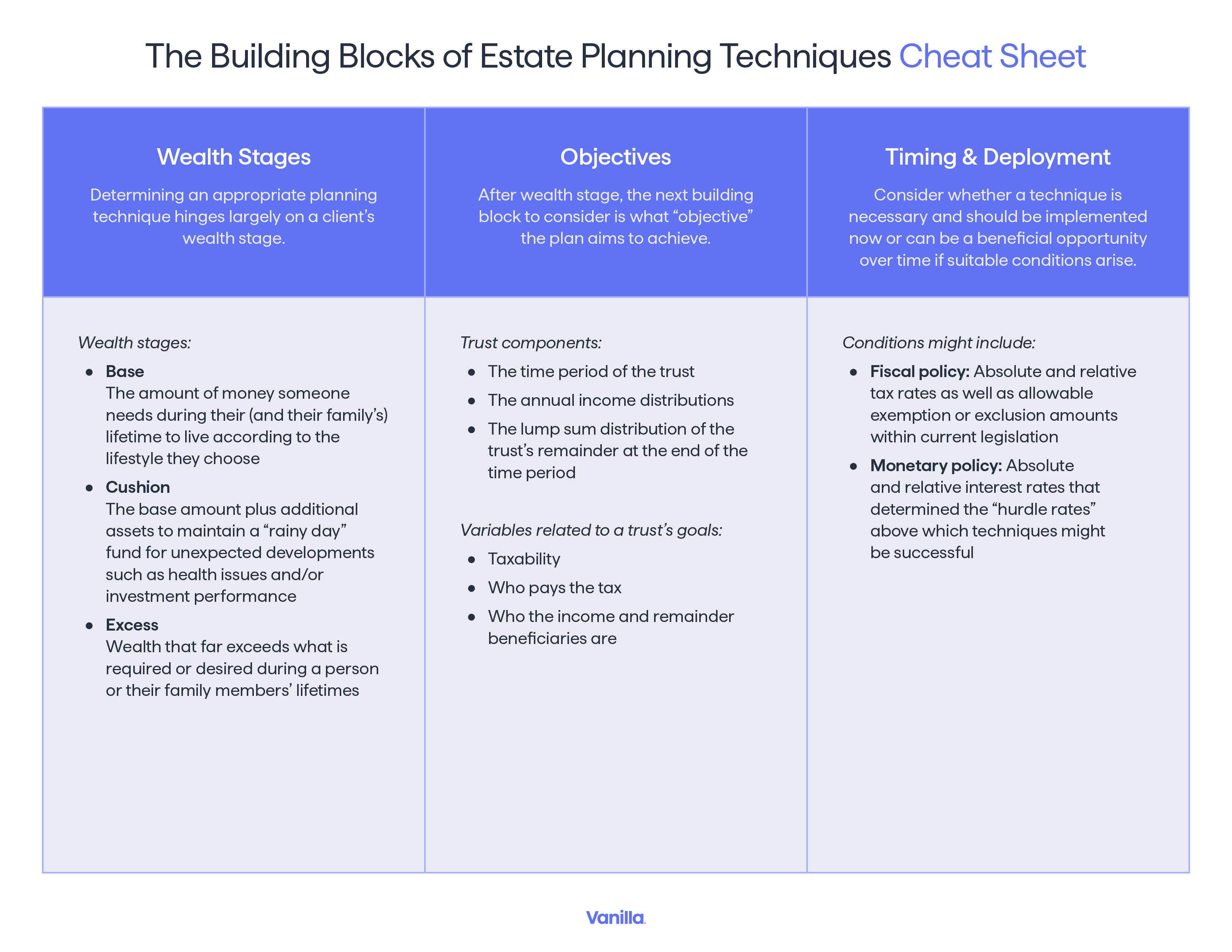

Using the blog The Building Blocks of Estate Planning Techniques as a guide, we’ll outline some timely actions advisors can take to calmly and confidently help clients at different wealth stages navigate periods of uncertainty.

For a deeper dive, download the complete cheat sheet for estate planning strategies to use by wealth stage here.

Base wealth stage: Focus on financial planning foundations

For clients who are at the base wealth stage, advisors can help them think through budgeting, liquidity, taxes, and risk management.

Challenges

Budgeting and re-evaluating liquidity needs

In changing environments, market turmoil can highlight potential liquidity challenges. Balanced budgets identify sources of income and expenses to maintain a client’s desired level of liquidity. There may be stress on cash flow in these instances.

Advisors can help to instill discipline, understanding, and adherence to “need vs. want” and “fixed vs. variable,” which is particularly important in servicing debt payments and paying taxes.

Risk profile

Investment policy statements are intended to maintain investment discipline and manage behaviors through varied market environments. During periods of market volatility, advisors can help to anchor risk profiles by rebalancing assets with the predetermined asset allocation ranges that may result in gains and losses.

Care should be taken with illiquid assets whose values may not be marked to market compared to liquid assets whose drops in value may result in exacerbating the concentration of an illiquid asset.

Opportunities

Tax loss harvesting

Advisors can focus on managing buy/sell turnover to intentionally take advantage of offsetting gains or losses. This can help to mitigate resulting income and capital gains taxes for clients.

Cushion wealth stage: Focus on estate planning

For clients who have a cushion of wealth, periods of market uncertainty can be a good time to think about estate planning through leveraged gifting, asset transfer, and annual exemptions.

Challenges

Leveraged gifting

When an estate is on the cusp of becoming taxable, a new dynamic can arise between current and future generations. Families will need to determine whether future asset growth happens within or outside of the current generation’s estate.

Discussing leveraged gifting techniques like GRATs or IDGTs funded with assets that are temporarily undervalued can remove future appreciation from an estate, given they work best when assets appreciate after transfer.

Having this conversation with clients and their families demonstrates your estate planning expertise and positions you as a holistic advisor who can integrate estate and asset management strategies.

Opportunities

Annual exemption

Currently, the annual gift exemption is $19,000 per year, per beneficiary ($38,000 per couple). This gives people the flexibility to use some or all of their annual exemption for as many or few beneficiaries as they choose to customize how much they gift out of their estate over time.

Wealth transfer

Estate planning can be a great way to shift client attention from daily market movements and emotional reactions, focusing instead on asset allocation across legal structures whose provisions reflect family values, needs, and long-term goals.

Excess wealth stage: Focus on legacy planning

If you have clients who are in the excess wealth stage, help them look ahead to their future legacy by planning for gifting, lifetime exemption, and the next generation.

Challenges

Gifting assets at lower valuations

When markets dip, so do asset values. This can be a prime chance to transfer wealth and alleviate gift and estate tax implications by using some of all of a person’s or couple’s lifetime exemption. Taking advantage of this opportunity can potentially reduce future tax burdens.

Having the peace of mind to gift assets in down markets can signify confidence in the level of assets retained and the risk profile of assets invested.

Opportunities

Lifetime exemption

There’s flexibility in using all or some of a person’s or couple’s lifetime exemption—though it’s possible that the current higher level of exemption will expire at the end of 2025 depending on legislation, significantly reducing the future exemption amount.

Given the step-up cost basis of assets at death (which coincides with paying estate tax), higher cost basis assets may be better candidates for gifting.

Multi-generational relationships

Estate planning creates natural introductions and inroads for advisors and their clients’ family members. Connecting with the next generation makes it more likely that they will keep their assets with your firm in the future.

Click here to download the complete cheat sheet of estate planning strategies (and when to use which) for quick reference.

The information provided here does not constitute legal, financial, or tax advice. It is provided for general informational purposes only. This information may not be updated or reflect changes in law. Please consult with an estate attorney, financial advisor, or tax professional who can advise as to your particular situation.

Published: Apr 10, 2025

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.