Madison Eubanks

Madison Eubanks

An Intro to Revocable and Sub-Trusts for Estate Planning

A sub-trust, often created within a larger trust, is a type of estate planning tool that can allow you to customize how portions of your estate are managed and distributed to specific beneficiaries. They can add both flexibility and control to your plan, bringing peace of mind that your estate will be distributed according to your wishes and your beneficiaries will be cared for.

Whether you want to set aside funds for minor children, protect a special needs beneficiary, or create tax-efficient structures, sub-trusts offer a tailored approach to address the unique needs of your family. In this blog post, we’ll explore what sub-trusts are and highlight the key benefits they bring to a well-rounded estate plan.

What are sub-trusts?

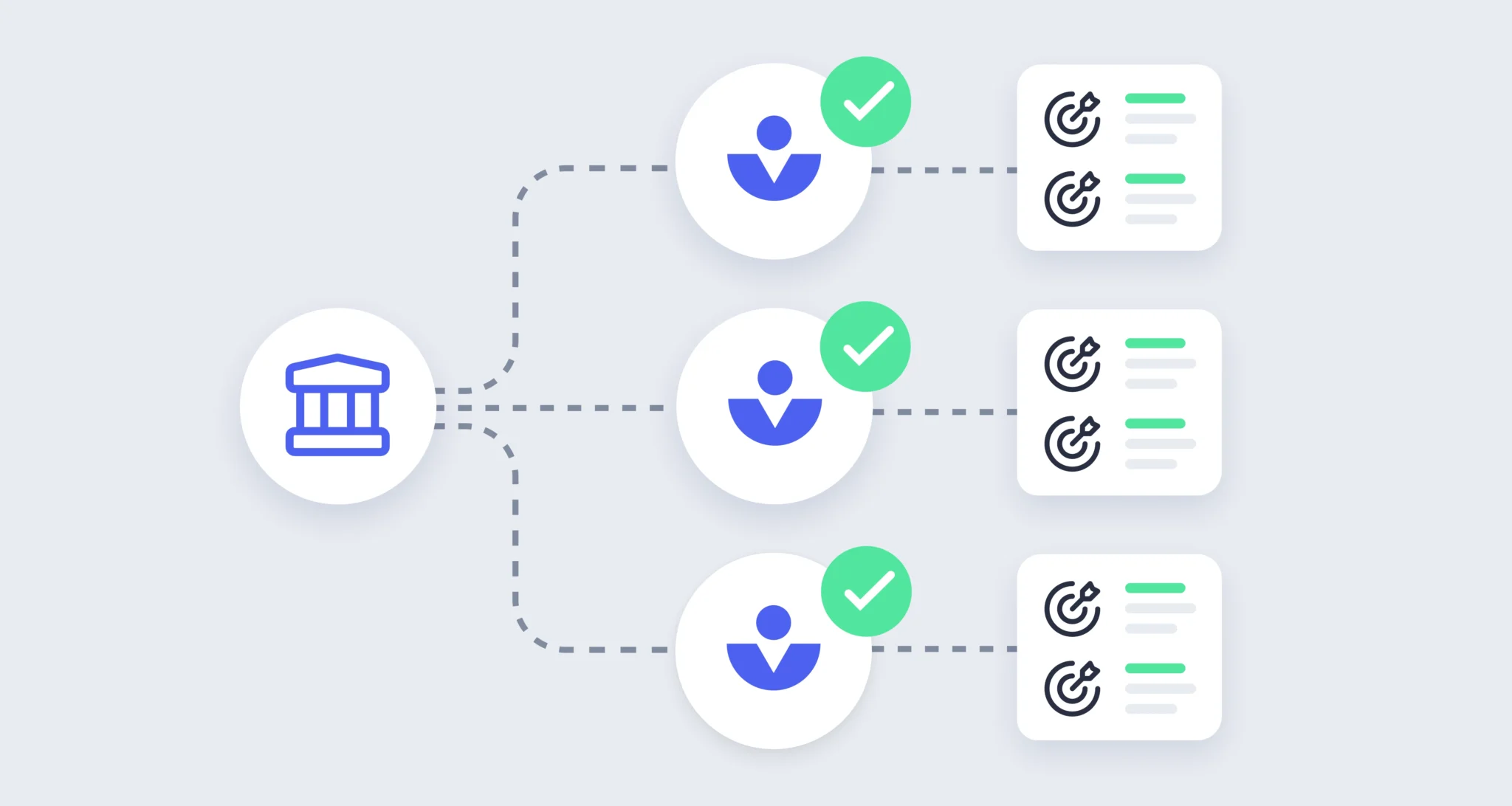

Essentially, a sub-trust is a trust within a trust. The primary trust acts as the initial container for assets, and the sub-trust acts like a secondary compartment within the larger trust that’s designed for specific purposes or beneficiaries.

A sub-trust is a secondary trust created under the umbrella of a primary trust, and can be revocable or irrevocable depending on the terms of that trust. The sub-trust’s activation is triggered by an event that’s defined in the primary trust terms, usually the death of the grantor.

Benefits of sub-trusts

There are several reasons why a person might choose to include sub-trusts in their estate plan. Here are five benefits of sub-trusts:

1. Asset protection

Sub-trusts can shield assets from creditors or legal claims—commonly, divorce or lawsuits. In this case, the sub-trust can ensure the assets remain protected for their intended purpose or beneficiary.

Similarly, a sub-trust can be designed to prevent a financially irresponsible beneficiary from misusing the assets by putting limitations on their access to the funds.

2. Post-death asset management

Sub-trusts can ensure that there is a structure for asset management after the grantor dies. The terms of a sub-trust can be such that they are carefully overseen by a fiduciary and distributed according to the grantor’s wishes. This gives the grantor peace of mind that their estate will be passed on in the he or she intended after their death.

3. Multi-generational planning

The transfer of wealth can lead to major conflict among surviving family members, but a clearly structured estate plan can help to minimize tension. Sub-trusts can facilitate a seamless transfer of wealth over multiple generations, and ensure the distribution process has the right balance of rigidity and flexibility.

4. Tax planning

Minimizing taxes is one of the primary considerations in estate planning, especially for high and ultra high net worth individuals. Sub-trusts can offer opportunities for tax planning and optimization, helping to minimize tax liabilities and preserve wealth for future generations.

For example, a marital trust and a bypass trust can be created as sub-trusts to minimize estate taxes.

5. Planning for beneficiaries with disabilities

Beneficiaries with disabilities or special needs may have more or different long-term needs than other family members. In cases like this, certain types of sub-trusts may be necessary to ensure these beneficiaries are provided for. Specifically, a sub-trust for a beneficiary with special needs is designed to account for their needs while preserving their eligibility for government support programs.

Different types of sub-trusts

As with primary trusts, different types of sub-trusts serve different purposes. Here are a few common types of sub-trusts and their use cases.

1. Marital trust (QTIP)

A qualified terminable interest property election, or QTIP election, allows a person to leave assets to their spouse in a trust free of estate tax on the first death, while still controlling how those assets are distributed after the first spouse dies.

Without a QTIP, estate tax might be due on first death. This election allows for a marital deduction for the portion of an estate that qualifies. Effectively, a QTIP defers the payment of any estate tax until the death of the surviving spouse and can protect assets for future generations after the grantor’s death.

2. AB trust/Credit shelter trust

An AB trust structure utilizes a credit shelter trust (sometimes called a bypass trust) to minimize estate taxes for married couples. The basic idea behind a credit shelter trust is to make full use of the estate and gift tax exemptions for each individual and shelter the exemption and appreciation of those assets from estate taxation at the second spouse’s death.

This strategy goes into effect at the first death to minimize estate taxes upon the death of the surviving spouse.

3. Pot trust

A pot trust is a singular trust, meaning that clients’ assets are funded into a single pool for a certain group of beneficiaries, usually the settlor’s children.

A pot trust typically gives the trustee the flexibility to distribute assets to any of the designated beneficiaries as needed, even if the distributions are unequal.

For example, if a family has three children, ages 20, 15, and 3, the youngest child may have greater needs than the older children. By establishing a pot trust, the parents give the trustee the power to provide more resources to the youngest child that has greater needs. The trust continues until the trust terms dictate its termination, which may be based on the age of the youngest child.

4. Supplemental needs trust

A supplemental needs trust (SNT) is a legal arrangement established to provide for individuals with special needs or disabilities. This type of trust is designed to hold assets and provide for the financial well-being of the beneficiary without precluding them from eligibility for government benefits like Medicaid or Supplemental Security Income (SSI).

A supplemental needs trust is managed by an appointed trustee who disburses funds to supplement needs not covered by public assistance programs like medical assistance, education, therapy, personal care attendants, transportation, and recreational activities.

Practical applications of sub-trusts

Distributions to beneficiaries

Sub-trusts are often created so that the grantor can create conditions for beneficiaries to receive assets, like reaching a certain age, completing a degree, demonstrating financial responsibility, and so on.

In some cases, trustees have discretion to adapt the trust distributions to unforeseen circumstances, while others may have more rigid instructions.

Sub-trusts can be set up to account for grandchildren who weren’t yet born at the time of the grantor’s death, to ensure unborn beneficiaries are accommodated.

Income tax implications

The income tax outcome of a trust can depend, upon other factors, on whether the trust is revocable or irrevocable.

In a revocable trust, income generated by held assets is taxable to the settlor, and no separate tax return or EIN is required.

Income generated and accumulated by assets held in a non-grantor irrevocable trust is taxable at the trust tax bracket level, if retained in the trust. However, income earned and distributed to a beneficiary before the end of the year is taxable to the beneficiary who received it. This income also requires an EIN, a separate tax return, and a K-1 Trust Distribution Form.

Irrevocable subtrusts are beneficial for asset protection and management, but require more maintenance due to income taxation complexity.

Power to amend/modify

Different types of trusts and sub-trusts have varying levels of flexibility, both during the grantor’s life and after their death.

Irrevocable sub-trusts allow the creator to ensure their wishes are met after the deaths of their beneficiaries, because the trust’s terms generally cannot be changed. In contrast, a revocable trust allows the creator to make modifications during their life as their families and beneficiaries’ needs change over time.

Trust provisions, like independent trustee provisions and trust protector provisions, can be added to ensure the necessary flexibility is applicable to irrevocable sub-trusts if unforeseen circumstances arise.

Ready for more deep dives on estate planning topics? Create a free Vanilla Academy account to take courses, earn CFP® CE credits, and get tips and tricks for using Vanilla.

The information provided here does not constitute legal, financial, or tax advice. It is provided for general informational purposes only. This information may not be updated or reflect changes in law. Please consult with an estate attorney, financial advisor, or tax professional who can advise as to your particular situation.

Published: Oct 24, 2024

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.