Vanilla

Vanilla

How outdated estate planning practices can cost you and your clients

Estate planning is evolving.

In a shifting landscape, financial advisors need to demonstrate value to their clients. One of the best ways to help your clients is to educate them about the risks of outdated estate planning documents, which, if left unchecked, can lead to serious consequences for them and their families.

Of course, the estate planning process itself is somewhat outdated. Financial advisors often have no visibility into the conversations clients are having with third-party attorneys, creating an opaque, disconnected system with many moving parts. It’s difficult for financial advisors to offer the best advice when they can’t see the full picture.

With that in mind, we’ll dig into the key ways that the current estate planning process is broken, and we’ll look at how that process costs advisors and clients time, resources, and peace of mind.

Estate plans need to evolve with your clients

As life goes on, circumstances change. So, too, should your clients’ estate planning documents.

Clients are often aware that if they’ve gotten married since they last created their estate plan, their documents might not reflect their current situation, and they may need to update the plan. Other events, such as getting divorced, can also merit changing an estate plan. However, clients often overlook complications that arise from their beneficiaries’ marital status or even their premature deaths, among other significant life milestones.

It’s crucial to update estate plans because:

-

Changing laws mean documents are outdated after five or 10 years (or even earlier),

-

Beneficiaries may have gotten married or divorced,

-

A client’s net worth has increased so they should consider relevant tax exemptions,

-

Designated fiduciaries quickly become outdated,

-

New members of the family are not listed as beneficiaries, or

-

Beneficiaries have died since the estate plan was made.

If your client’s children or other beneficiaries were married after creating their estate plan, any inheritance those beneficiaries receive could be divided in the case of a divorce. This outcome could be against your clients’ wishes, but you’ll need to have a conversation with them to discuss their options.

Clients may have planned to leave assets to a beneficiary who is now deceased, and this is very common with outdated estate plans. If a contingency plan is not included in the event of a beneficiary’s death, these assets could otherwise be subject to probate or face other issues if your client has not updated their documents. On top of that, these assets could get taxed at a higher rate or be subject to hefty government fees, or the deceased beneficiary’s estate may simply receive no inheritance at all.

Another key issue to consider is inevitable changes in the applicable laws. Trust and estate laws are constantly evolving, and new legislation often impacts your client’s plans. One example is the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which eased penalties on emergency withdrawals from retirement accounts and changed how beneficiaries must handle these accounts after a person’s death.

Another example is the Setting Every Community Up for Retirement Enhancement Act (SECURE) Act of 2019, which changed how beneficiaries could inherit retirement accounts, among other critical developments.

Nobody wants to put their clients at risk of legal ramifications due to changing regulations, or face ramifications themselves as an advisor. To guide your client’s family toward the best outcome, you should sit down with your client and plan accordingly. Reviewing an estate plan periodically, such as once a year, is a good practice for these situations.

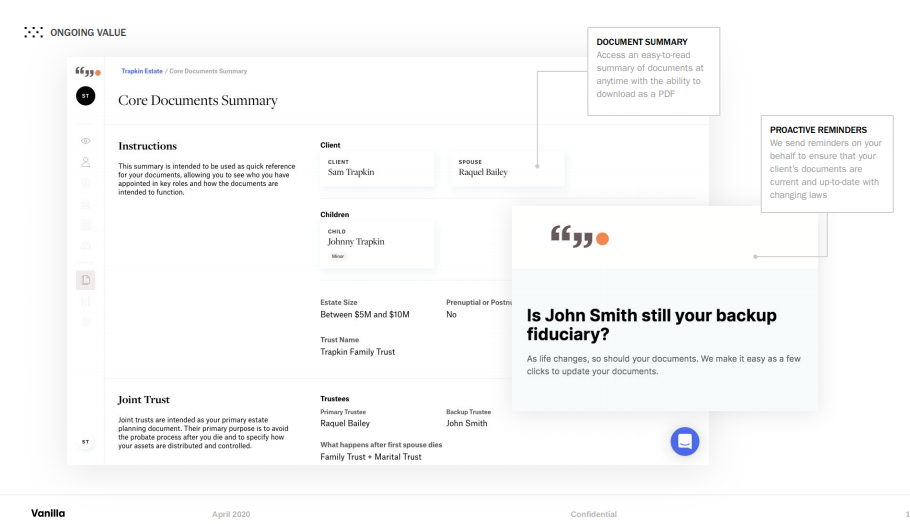

If you want to automate this review process while maintaining the highest quality estate documents for your clients, get in touch.

Fiduciaries are not forever

In your client’s documents, they’ll appoint fiduciaries into important roles like trustee and executor of their will. A fiduciary is someone your client trusts who is legally bound to act in their best interests. They’ll make decisions about your client’s well being, managing their financial assets, and administering their trusts.

Your client may designate a fiduciary into a specific role as executor, who takes control of assets during the probate process, if there is one. In their temporary role, executors do the following:

-

Collect assets of the deceased

-

Notify heirs, beneficiaries, and creditors of the probate proceeding

-

Pay off final debts and expenses

-

File reports and provide an accounting to the court

-

File tax returns

A fiduciary may also be appointed as a trustee, who distributes funds to beneficiaries in accordance with terms of the trust. The role of a trustee may be permanent, and trustees are required to do the following:

-

Manage the trusts prudently

-

Keep accounts and records of all financial activity

-

Keep beneficiaries informed (as needed or required by law)

-

Know and follow the wishes of the client’s estate plan

People often choose family members to be fiduciaries, but a professional, such as an attorney or even a corporation, can also carry out the role. The position carries a significant amount of responsibility and even personal liability. Estate plans often designate two fiduciaries, either as a “primary” and “backup,” or as “co-trustees” to distribute the burden.

Here are some common problems with fiduciaries in outdated estate plans:

Designated fiduciaries are outdated

People have a habit of setting up estate plans and forgetting about them. Often, by the time an advisor and their client revisit the document, the original fiduciaries are no longer appropriate for the role. Perhaps your client appointed a close friend when they created their documents a decade ago, but their friend is now deceased or no longer has a close relationship with your client.

Outdated fiduciaries may find it more difficult to execute on your client’s wishes. So, when was the last time your client thought about who they’d named as a fiduciary?

Legal professionals may no longer be practicing

Fiduciaries who are third-party professionals, such as attorneys, may no longer be working with your client. In fact, they may not even be practicing anymore — they may be retired or deceased. It’s also possible that their qualifications or skill sets may no longer be relevant to modern regulations and practices.

People often stick with a family attorney for all legal advice, but has that attorney stayed abreast of new developments in estate planning?

Corporations may be unable to act as a fiduciary

If a corporation named as a fiduciary in your client’s estate plan is entering insolvency, there may be major delays in paying out assets. There may even be a risk of reduced or abandoned payment. Equally, corporations that have been acquired or have entered into a merger with another company will have more complicated fiduciary duties than originally intended.

More likely, however, is that a corporation may decline to act as a fiduciary because they often have asset size minimums before they will accept a trustee appointment. The end result may be that the corporation may refuse to act as your trustee when the time comes.

Obviously, this is not an ideal situation, and you can avoid it by having regular chats with your client.

An estate plan may not account for modern circumstances

Estate planning is a long-running, well-established industry. However, even the largest industries need to evolve with the times, and it’s your responsibility to monitor the regulatory landscape for new changes.

Consider this: In 2011, the average American owned over $55,000 in digital assets. That figure has likely increased since then, although no new major studies have emerged yet. This wealth in digital assets may come as a surprise to clients, although they probably own more digital assets than they realize.

Digital assets include the following:

-

Files such as photographs kept in cloud storage

-

Log-ins to social media platforms

-

Online businesses and other web domains

-

Cryptocurrencies

-

Credit card reward points

-

Software

These assets are often vulnerable to identity theft and hacking once their original owner has passed away, particularly if they have not transferred ownership or otherwise created a plan for what happens after a client’s death. Online businesses can suffer greatly if their income is delayed or seized during probate, or if your clients’ beneficiaries don’t have the necessary log-in details.

However, attempting to transfer ownership of digital assets, such as log-in details and computer software, is often against the Terms of Service Agreement (TOSA). Breaching the TOSA, in turn, can equate to a federal violation under the Computer Fraud and Abuse Act.

In recent years, the Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA) or equivalent legislation has passed in most states to help combat this problem. RUFADAA provides a legal framework allowing fiduciaries to manage digital assets as directed in estate planning documents.

Does your client’s estate plan account for RUFADAA, or is it out of date? And does your client’s estate plan account for the value of their digital assets, and what happens to those assets post-death? For estate plans that are even just a few years old, the answer is often no. This is a potential regulatory blind spot in your clients’ estate plans, and it’s not the only one.

Since 2013, the U.S. Congress has allowed people to inherit their deceased spouse’s unused tax exemption (referred to as portability), and as of 2022, the joint tax exemption is valid up to a value of $24.12 million. However, the exemption isn’t automatic, and the executor of the estate in question must take affirmative action to elect to preserve it within nine months after the deceased spouse’s death. The solution is a simplified estate tax return tax filing, but if your client and their executors aren’t aware of this legislation, the estate can get taxed unnecessarily.

To curb these kinds of issues, ensure your client’s trust documents are set up to take advantage of these kinds of tax exemptions. For example: Many trusts give 100% of a client’s assets outright to their spouse at the time of their death. This kind of structure prevents you from pursuing relevant tax exemptions. Instead, your trust document at minimum should call for a creation of a “marital trust” (which defers estate tax until after your spouse passes away) and/or a “bypass trust” (which is exempt from estate tax) until the trust terminates.

In other trusts, assets go outright to children or other beneficiaries after the death of a spouse. This also fails to maximize the estate tax benefit of keeping assets in a trust for those beneficiaries.

It’s vital that you stay up to date on the developing landscape of estate planning regulations. As we’ll see below, there are tools you can use to keep on top of new legislative changes as they come to pass.

Keeping your clients protected

As you know, outdated estate plans can disrupt trusts, kill online businesses, and create conflict within your clients’ families. That’s why Betterment has partnered with Vanilla, an estate planning platform designed to keep client’s documents updated and send notifications when new estate planning opportunities or challenges arise.

Vanilla automatically stays abreast of changing laws and regulations, alerting you and your clients to new and beneficial opportunities in the world of estate planning.

How Vanilla can help

Vanilla offers solutions in the following areas:

-

Keeping client’s fiduciaries up to date

-

Updating you on regulatory and statutory changes

-

Improving the disconnected, opaque planning process

-

Solving the issue of non-standardized documentation

-

Bringing efficiency to estate planning

-

Saving clients costs on hourly legal fees

The platform simplifies the estate planning process, and allows your clients to get a bird’s-eye view of their plan with a Core Documents Summary that helps them make decisions about necessary updates.

Vanilla allows your clients to answer the questions necessary to create their estate plan and connects them with a state-licensed attorney to generate and review their documents.

The hourly billing systems traditionally used by lawyers don’t necessarily incentivize efficiency, but not all estate planning processes require legal expertise. Because Vanilla automates the process of gathering information from the client, the cost is far lower — which translates to lower legal fees for your clients.

The platform also standardizes the documents you use for all your clients, which helps you know what to look for and where to find it quickly. We help you handle estates of all shapes and sizes with documents for taxable estates out of the box.

Make the estate planning process faster, more efficient, and more aligned with changing regulations. If you want to learn how to get started, get in touch.

Build relationships that go deeper than money

This article is for educational purposes only and should not be considered legal advice. If you feel that the information in this article is pertinent to your situation, you may wish to consult a qualified attorney for advice tailored to your circumstances.

Published: Aug 24, 2020

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.