Search Results for: irrevocable

Blog

Blog

Vanilla

•

Jan 26, 2023

What is an irrevocable life insurance trust (ILIT)?

Irrevocable Life Insurance Trusts (ILITs) are legal vehicles established specifically to own one or more life insurance policies and are set up during an insured’s lifetime. ILITs are created to own a life insurance policy and keep its proceeds out of the insured’s or owner’s estate to avoid increasing the size of their estate when the insured dies. When an individual owns an insurance policy (whether on his or her life or the life of another individual), the insurance policy is included in the individual’s estate at death and is therefore subject to federal estate tax (to the extent the...

Glossary

Madison Eubanks

•

Apr 12, 2024

Irrevocable Trust

An irrevocable trust is a type of trust agreement in which the grantor (the person who established the trust) cannot modify or revoke the trust’s terms or conditions, with rare exceptions. This is in contrast with a revocable trust, which can be changed or revoked by the grantor at any time during their lifetime. Irrevocable trusts offer various estate planning benefits like reducing estate taxes, protecting assets from creditors, providing for the financial needs of beneficiaries, and potentially preserving eligibility for government benefits like Medicaid. Benefits of an irrevocable trust might include: Tax efficiency: Generally, assets that are transferred into...

Blog

Blog

Daniel Brockley

•

Nov 17, 2022

What is a trust, and what are the different types of trusts?

Trusts come up a lot in estate planning, and for good reason. They can be incredibly effective in helping fund education, provide for heirs, donate to charities and more. For high net worth individuals, trusts are also an important strategy to reduce taxable estates. The basics: What are trusts? Trusts are legal entities, much like corporations, which are considered distinct from the various parties involved. Trusts come in many forms, but in essence they are fiduciary arrangements in which, as the IRS states, “one person (the trustee) holds title to property or assets…for the benefit of another (the beneficiary).” The...

Blog

Blog

Madison Eubanks

•

Oct 24, 2024

An Intro to Revocable and Sub-Trusts for Estate Planning

A sub-trust, often created within a larger trust, is a type of estate planning tool that can allow you to customize how portions of your estate are managed and distributed to specific beneficiaries. They can add both flexibility and control to your plan, bringing peace of mind that your estate will be distributed according to your wishes and your beneficiaries will be cared for. Whether you want to set aside funds for minor children, protect a special needs beneficiary, or create tax-efficient structures, sub-trusts offer a tailored approach to address the unique needs of your family. In this blog post,...

Blog

Blog

Jim Sinai

•

Sep 19, 2022

10 Diagrams to explain advanced estate planning strategies

Tax planning for clients with taxable estates has always been complex. We’ve learned the best way to explain estate planning strategies is with diagrams, not documents. That’s why we’ve put together this deck of 10 diagrams to explain some of the advanced strategies and why household with $10M in assets should care about estate tax. Why $10M in household assets? In 2026 the Estate Tax exemption drops down to just about $10M (or higher based on inflation). The 10 diagrams explain both why you need advanced strategies and how 8 different strategies work. We’ve explained them all below but if...

Blog

Blog

Simona Ondrejkova, CFP

•

Sep 26, 2023

A guide to estate tax planning for financial advisors

Beyond helping clients reduce capital gains taxes or income taxes, advisors are uniquely positioned to help clients preserve more of their wealth through proper estate tax planning. Imagine that just a few months after the unfortunate death of one of your clients, their surviving spouse or children find out they have to pay a large unexpected estate tax bill. What if this tax bill could’ve been avoided? Taking advantage of estate tax planning tools like gifting, trusts, and the marital deduction can help clients achieve their unique goals, maximize tax savings, and reduce survivors’ financial stress. Here, you’ll learn how...

Blog

Blog

Simona Ondrejkova, CFP

•

Nov 15, 2023

What is an Intentionally Defective Grantor Trust (IDGT)?

An intentionally defective grantor trust (IDGT) is among the many estate planning strategies that can help your clients preserve wealth and leave a lasting legacy. It is especially effective for high net worth individuals who want to pass on highly appreciated or high-growth assets while minimizing estate taxes and potentially reducing income taxes. Due to their more complex nature, IDGTs can sometimes be misunderstood and underutilized, causing clients to miss out on their many tax-saving benefits. So what is an intentionally defective grantor trust? What makes it “defective” and how can this feature be used to help your clients pass...

Blog

Blog

Simona Ondrejkova, CFP

•

Mar 14, 2024

Dynasty Trusts: Everything You Need to Know

To achieve estate planning objectives, it helps to be familiar with various types of trusts. A dynasty trust can be a great tool for clients who want to preserve their wealth or family business for several generations while minimizing estate taxes. Here, we’ll help you understand what exactly a dynasty trust is, how it works, how it differs from other trusts, how to set one up, and when it might be a good idea to use one. We’ll also discuss the tax implications of using a dynasty trust and how it can minimize a certain type of tax that specifically...

Glossary

Madison Eubanks

•

Apr 12, 2024

Inter Vivos Trust

What is an inter vivos trust? An inter vivos trust is a type of trust created by an individual or a married couple to hold and manage assets during their lifetime. Also known as a living trust, this trust is often used by individuals or married couples to avoid probate, maintain privacy, and ensure efficient distribution of assets during their lifetime and after death. An inter vivos trust set up during an individual’s lifetime can ensure that the assets remaining in the trust after the settlor’s death are distributed to beneficiaries according to the settlor’s wishes. To do this, the...

Glossary

Madison Eubanks

•

Apr 12, 2024

Marital Trust

What is a marital trust? [embed]https://justvanilla.wistia.com/medias/bz3sx9ueev[/embed] A marital trust, also known as a marital deduction trust, is a trust set up by an individual to provide for their surviving spouse upon their death. It also allows the spouse establishing the trust, the settlor, to specify how the assets should be distributed after the death of the surviving spouse. In addition to ensuring that the surviving spouse is financially provided for, the marital trust is also used by couples to avoid lengthy probate proceedings, reduce or eliminate estate taxes, and protect family wealth. This type of trust is often used by...

Blog

Blog

Madison Eubanks

•

May 22, 2024

Is a Medicaid Trust Right For You or Your Clients?

Typically, we think of an estate plan as an arrangement to maximize wealth transfer and minimize taxes after a person passes away. However, there are some elements of estate planning that can take effect while a person is still living—like a Medicaid trust. In this article, you’ll learn what trusts and Medicaid have to do with one another, the advantages and disadvantages of Medicaid trusts, as well as when it may be appropriate for your clients to set one up. What is a Medicaid asset protection trust (MAPT)? [embed]https://justvanilla.wistia.com/medias/prx1k9xyba[/embed] A Medicaid asset protection trust—also known as a Medicaid trust or...

Blog

Blog

Simona Ondrejkova, CFP

•

Sep 29, 2023

Estate planning for high-net-worth and ultra-high-net-worth individuals

While everyone can benefit from a properly structured estate plan, it becomes even more critical for those with higher levels of wealth. High net worth and ultra-high net worth families often face unique challenges that may demand more sophisticated approaches to preserve and protect their wealth. Estate planning for high net worth individuals often starts with the same foundation as for smaller estates. But because larger estates are more likely to be exposed to estate taxes, creditors, and family or business conflicts, additional planning is required to mitigate these and other risks. Before offering several strategies that advisors and clients...

Glossary

Madison Eubanks

•

Apr 12, 2024

Settlor

What is a settlor of a trust? A settlor is someone who creates or establishes a trust, either for the benefit of a beneficiary after the settlor’s death and/or for their own benefit during their lifetime. The trust settlor typically owns assets that are then legally transferred into a trust which is managed by a trustee based on the terms and conditions that the settlor outlined when creating the trust. In some circumstances, the settlor can also be the trustee and the one receiving benefits from the established trust. A settlor of a trust expresses their goals for how they...

Glossary

Madison Eubanks

•

Apr 12, 2024

Decanting Provision

A decanting provision is a method by which a trustee may remove or modify the provisions of an irrevocable trust to distribute its assets into a new trust with different terms due to significant life or law changes. Decanting provisions are typically included in the original trust document to provide trustees with flexibility to modify or update the terms of an irrevocable trust under certain circumstances. Decanting may only occur if the trust was created in a state that allows trust decanting. There are several reasons to decant a trust, including but not limited to: Correct errors or ambiguities Update...

Glossary

Madison Eubanks

•

Apr 12, 2024

Revocable Trust

A revocable trust, which is also called a living trust or inter vivos trust, is a legal arrangement in which a grantor transfers ownership of assets into a trust for the benefit of a designated beneficiary. The grantor appoints a trustee to manage the trust, which can be themselves, another individual, or even a corporate trustee. In contrast to an irrevocable trust, a revocable trust can be changed or revoked during the grantor’s lifetime. Assets that are transferred into a revocable trust might include investments, real estate, bank accounts, etc. One of the key benefits of a revocable trust is...

Blog

Blog

Simona Ondrejkova, CFP

•

Feb 15, 2024

Grantor Trust vs Non-Grantor Trust: What’s the Difference?

If you or your clients are considering an estate planning strategy that includes a trust, you may be wondering about the difference between the many types of trusts out there. Specifically, if you hear a trust referred to as a grantor trust, what does that mean? And how is this different from a non-grantor trust? Today, we’ll explain the difference between a grantor trust and a non-grantor trust and help you understand when to use each one to achieve your estate planning goals. What is a grantor trust? A grantor trust is a type of trust in which the person...

Blog

Blog

Daniel Brockley

•

Jun 20, 2023

The 2026 estate tax exemption sunset is coming. Here’s what you need to...

For the past few years, most US tax residents haven’t needed to worry too much about estate tax. In 2018, the estate tax exemption was raised to an historical high of $11.18 million ($22.35 million per married couple), which has been raised yearly to adjust for inflation and put it out of sight for most estates. But the same law that raised the exemption, The Tax Cuts and Jobs Act (TCJA), is set to expire in 2026, bringing the estate tax exemption back down to an estimated $6-8 million per person or $12-16 million per couple (adjusting for inflation) –...

Blog

Blog

Vanilla

•

May 03, 2023

Level setting: How to approach estate planning differently depending on estate size

Many clients (and some financial advisors as well) tend to reduce estate planning to two simple categories: taxable estates and non-taxable estates. While it’s true that there are important differences in these asset levels, estate planning is not binary. It takes a nuanced approach, one that requires understanding a client’s situation and goals deeply. However, even with the understanding that a good advisor will always tailor their approach to each individual client’s needs, it can be helpful to think of client needs according to a few different distinct buckets of asset classes – beyond just taxable and non-taxable. We’ve...

Blog

Blog

Vanilla

•

May 24, 2021

The 4 Core Estate Documents: What they are and why they’re essential for...

According to a survey from Caring.com, 2021 marks the first year that young adults ages 18-34 are more likely to have a will than those ages 35-54. COVID-19 seems largely responsible for this shift, but the pandemic hasn’t just impacted the younger generation. Participants of all ages agreed that the advent of COVID-19 has caused them “to see a greater need for estate planning.” As a financial advisor, this means you can expect more clients to turn to you for estate planning guidance in the coming days. With this influx of client needs, it’s important that you understand and can...

Blog

Blog

Simona Ondrejkova, CFP

•

Sep 05, 2023

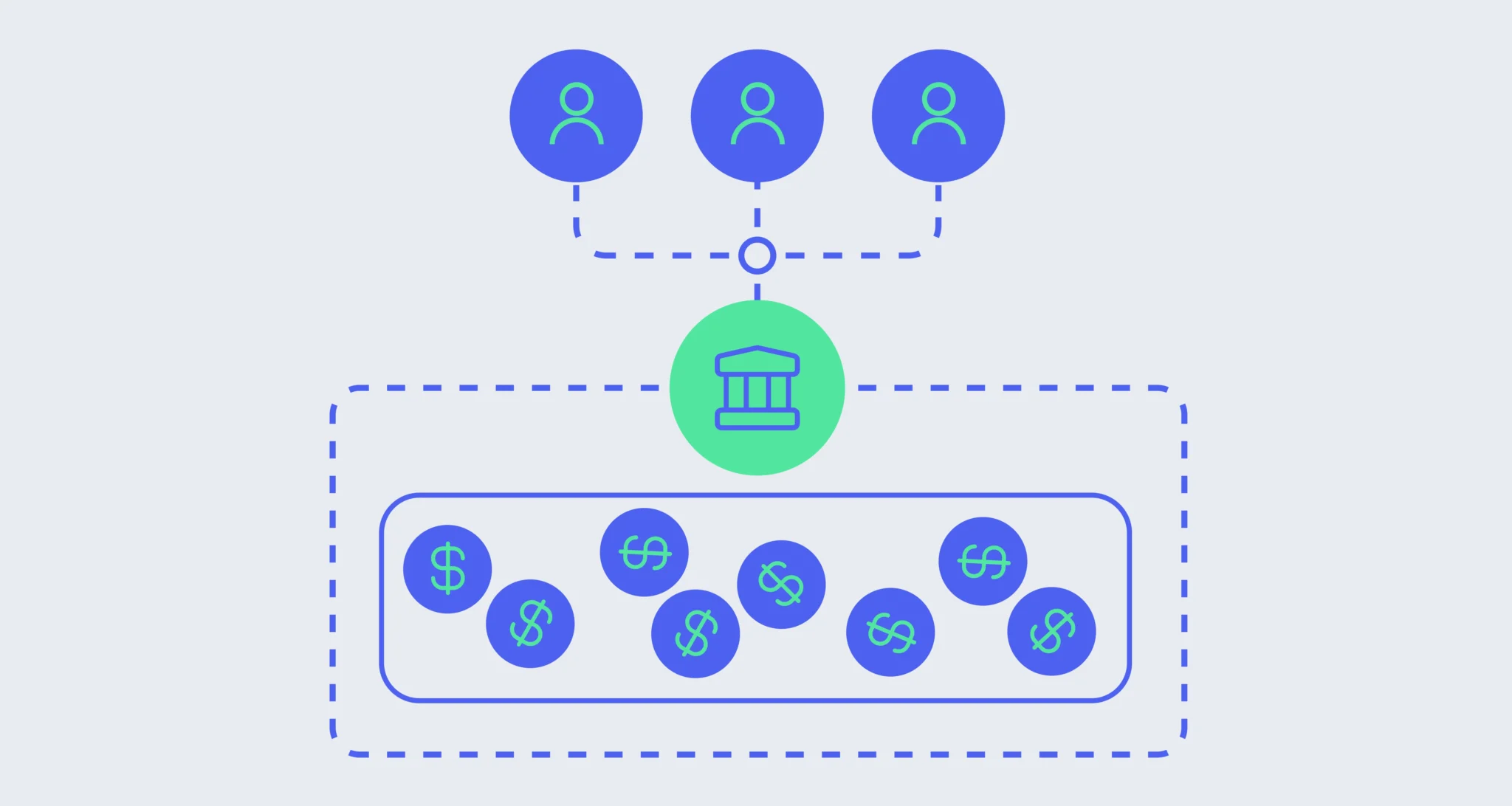

What is a pot trust and how could it benefit your clients?

Do your clients struggle to structure their estate plan in a way that aligns with their wishes while providing for their heirs in cases of need? They might want to consider a pot trust. A pot trust is a type of trust that puts clients’ assets into a single pool for a certain group of beneficiaries. It gives the trustee the flexibility to distribute the assets as needed to benefit any given beneficiary. While some advisors highly recommend pot trusts because of their unique benefit of allowing for equitable, but not necessarily equal distribution, others view pot trusts differently. No...

Blog

Blog

Vanilla

•

Apr 07, 2023

Communicating Between the Lines: Using Letters of Wishes to Guide Trustees

When it comes to estate planning, there’s no substitute for having the right core legal documents drafted, and ensuring they align with your clients’ wishes. But no matter how carefully estate planning documents are drafted, it’s impossible to anticipate every eventuality – and, the truth is, life often moves faster than clients do when it comes to updating their documents. One great way to bolster an estate plan against the unexpected, and to help trustees make decisions in accord with client expectations, is through letters of wishes. What is a letter of wishes? A letter of wishes is simply a...

Glossary

Madison Eubanks

•

Sep 05, 2024

IDGT

An IDGT, or Intentionally Defective Grantor Trust, is an advanced estate planning strategy most commonly used by high net worth or ultra-high net worth individuals. Essentially, an IDGT is an irrevocable trust structured to allow certain assets to be passed on without being subject to estate taxes while still retaining the settlor’s liability for income taxes generated within the trust. Unlike a standard irrevocable trust, an IDGT is structured as a “grantor trust,” allowing the settlor to be treated as the owner of the assets for income tax purposes. This intentionally defective grantor trust tax reporting feature is what makes...

Blog

Blog

Simona Ondrejkova, CFP

•

Dec 14, 2023

8 Key estate planning tools for financial advisors and clients

Advisors often hesitate to bring up estate planning with clients because they’re not sure where to start…or which aspects of estate planning to cover. While some estate planning strategies can be complex, advisors can still start meaningful conversations by understanding some basic estate planning tools that every client should consider. While many basic estate planning tools are simple to implement, many clients are simply unaware of their existence or importance. That’s where great advisors can come in and potentially help uncover missing pieces that could drastically affect how a clients’ wishes are carried out. Regardless of your level of estate...

Blog

Blog

Madison Eubanks

•

Sep 19, 2024

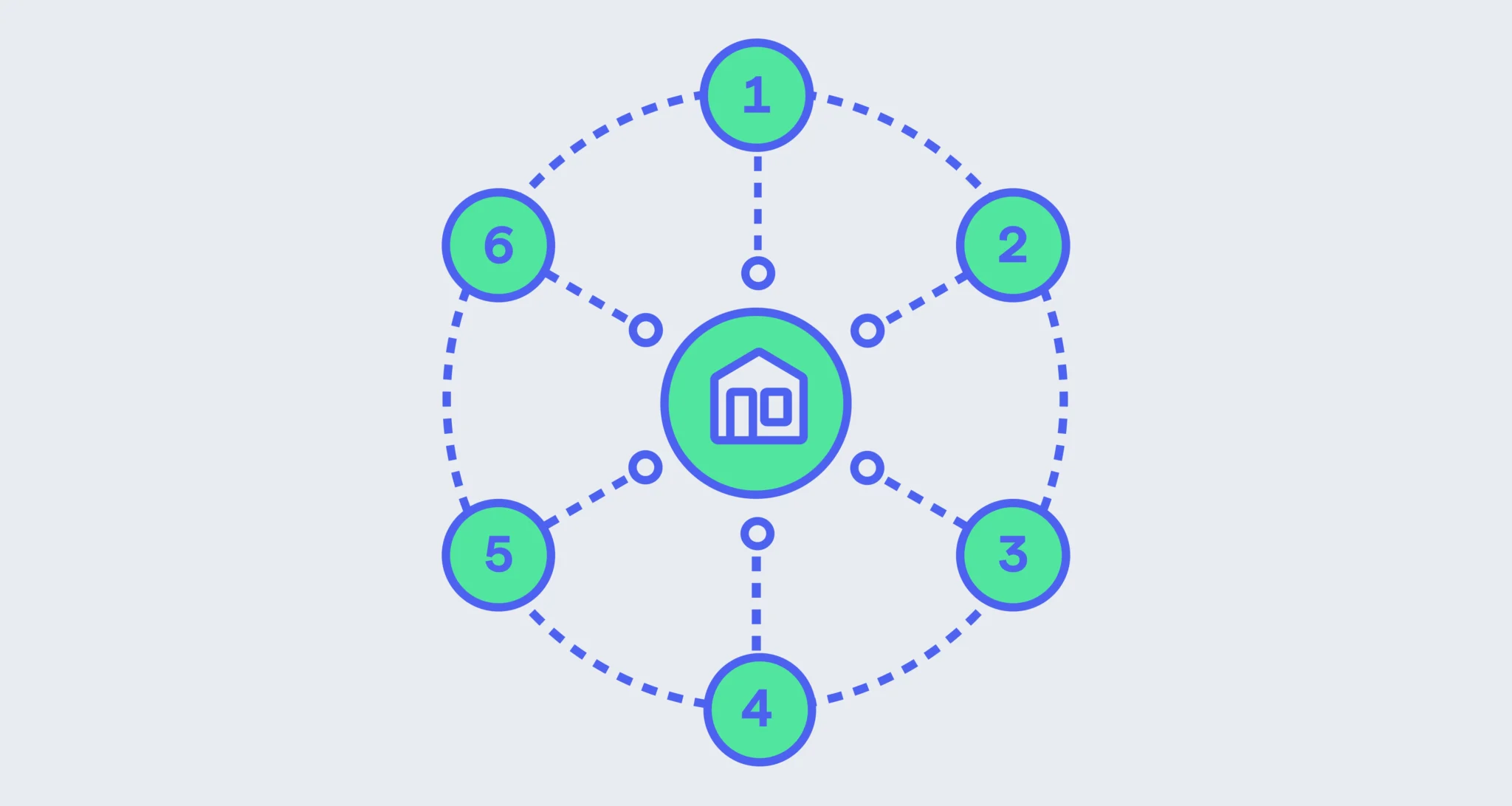

6 Estate Planning Scenarios: When to Use Which Strategy

Estate planning strategies are like tools in a toolbox: Different tools do different jobs. Deciding which estate planning strategies to employ depends on any number of personal factors including (but not limited to) marital status, level of wealth, whether or not someone has children, charitable inclination, liquidity, and many more. A savvy planner takes all these variables into account and chooses the most appropriate tool for a person’s situation, values, and goals. In this article, we provide fictional examples of when someone might use six different trust strategies, and illustrate how the right strategy can achieve their estate planning goals. ...

Blog

Blog

Simona Ondrejkova, CFP

•

Feb 20, 2024

What Is a Credit Shelter Trust? And How Can It Help Minimize Estate...

In estate planning, there are several types of trusts especially designed to help individuals avoid or reduce estate taxes. One of these is the credit shelter trust. The credit shelter trust is often used by married couples as one of many estate planning strategies that can help them pass on more wealth to beneficiaries after both spouses pass away. Here, we explain what a credit shelter trust is, how it works, and when you or your clients should consider using it to leave a greater legacy by minimizing or even eliminating the estate tax bill. What is a credit shelter...

Blog

Blog

Madison Eubanks

•

Jul 15, 2024

Qualified Disability Trusts: Everything You Need to Know

For families planning for individuals with disabilities or special needs, special considerations have to be made to ensure the person is cared for long-term. In some cases, specialized planning tools like qualified disability trusts can be used to achieve certain benefits like tax exemptions or federal aid eligibility. At the most basic level, a qualified disability trust (also known as a QDisT or QDT) is a trust that qualifies for a federal tax exemption. It’s a financial planning tool that an individual with special needs or disabilities’ family or caregivers may use to provide for their needs. Here, we’ll walk...

Blog

Blog

Simona Ondrejkova, CFP

•

Apr 29, 2024

Survivor’s Trusts: Everything You Need to Know

Of the many different types of trusts out there, some are designed specifically to help married couples transfer their assets according to the wishes and needs of each individual within the marriage. These trusts can be structured to provide for the surviving spouse while also being mindful of estate tax considerations for the surviving spouse and future beneficiaries. A survivor's trust is an estate planning tool used by married couples to ensure that after one spouse passes away, the surviving spouse will have access to a portion of the assets to provide for their living needs. There are several benefits...

Blog

Blog

Rachel Pettis

•

Jun 18, 2024

Vanilla’s hottest features for June 2024: Executive Summary, planning Essentials, and more!

Summer’s here and new features at Vanilla are hotter than New York City asphalt. This month we’re excited about: Executive Summary and an enhanced Estate Diagram for the Vanilla platform and PDF report Vanilla Essentials: key documents for your client’s loved ones Generation Skipping Transfer Tax available in Vanilla Estate Builder, Estate Diagram, and more ILITs now available as a modeling strategy in Vanilla Scenarios New fields present in Estate Builder powered by VAI for advanced trusts Give clients a personalized snapshot of their estate with Executive Summary Thanks to feedback from Vanilla customers, we have added an Executive Summary...

Blog

Blog

Vanilla

•

Feb 02, 2021

Top 6 costly risks that come with free estate planning documents

Tempted to give your clients free estate planning documents to create a will, trust, or other after-death protections? Think again. Free estate planning documents come with risks that may ultimately cost clients and their heirs more than they saved in legal fees. Let’s take a look at some of the significant — and expensive — problems that using free estate planning documents could cause. 1. Excluding family members from a will Free DIY wills don’t always tailor an estate plan to an individual’s circumstances and goals. This is particularly the case for blended families and new additions when it's easy...

Glossary

Madison Eubanks

•

Apr 12, 2024

Joint Revocable Trust

A joint revocable trust is a legal arrangement established by two people—usually a married couple—to hold their assets together to be managed and distributed during their lifetimes and after their deaths. Both spouses are considered grantors of the trust and jointly manage the trust. A joint revocable trust, also referred to as a joint living trust or a joint revocable living trust, can be funded with jointly owned or separately owned assets. Benefits of a joint revocable trust might include: Flexibility: Unlike an irrevocable trust, the grantors of a joint revocable trust are able to make changes to the trust...

Glossary

Madison Eubanks

•

Apr 12, 2024

Charitable Remainder Trust

A charitable remainder trust (CRT) is a type of irrevocable trust that allows an individual (the grantor) to transfer assets to one or more charitable organizations while retaining a stream of income for their family or themselves for the trust’s specified time period. When the trust term ends or the last income beneficiary dies, the remaining assets in the trust are given to the designated charity or charities. Read more: What is a charitable remainder trust? (With examples)

Blog

Blog

Vanilla

•

Jul 19, 2021

Top 5 challenges of estate planning for blended families (and how to solve...

Deciding who gets what after one’s passing is tough. According to a survey by Caring.com, only 42% of American adults have essential estate planning documents, such as a will or a living trust. People avoid planning for the inevitable for many reasons. But for blended families, a major reason is that estate planning requires more than a simple will. Many difficult questions come up: How do I ensure everyone is well taken care of after I am gone? Should I leave everything to my spouse and hope they take care of my children? How do I avoid disinheriting my children?...

Glossary

Madison Eubanks

•

Apr 30, 2024

Intentionally Defective Grantor Trust (IDGT)

An intentionally defective grantor trust is an irrevocable trust structured to allow certain assets to be passed on without being subject to estate taxes while still retaining the settlor’s liability for income taxes generated within the trust. Read more: What is an intentionally defective grantor trust (IDGT)?

Glossary

Madison Eubanks

•

Apr 30, 2024

Spousal Lifetime Access Trust (SLAT)

A Spousal Lifetime Access Trust (“SLAT”) is an irrevocable trust set up by an individual (the “donor”) during his or her lifetime for the benefit of the individual’s spouse and if, desired, other family members. Read more: What is a spousal lifetime access trust (SLAT), and how does it work?

Blog

Blog

Vanilla

•

Sep 13, 2021

Here’s how capital gains tax changes could impact your clients’ estate planning for...

Estate planning is often treated as a “set-it-and-forget-it” topic, but it is vital—especially for wealthy clients—to stay on top of changes in law and in assets because failing to account for current tax law can put your heir’s inheritance at risk of significant reduction. Proposed capital gains tax changes will dramatically shift thresholds, making it more vital than ever for financial advisors to help their clients keep estate plans current and comprehensive. Historically, the step-up basis has been one of the strongest strategies for wealthy individuals to avoid paying capital gains taxes at death, but proposed changes to tax law...

Blog

Blog

Simona Ondrejkova, CFP

•

Jul 08, 2024

How to Create a Family LLC for Estate Planning

Clients who own a business often face an additional layer of complexity when it comes to estate planning. From determining the most effective strategy for passing on the business to minimizing taxes and maximizing wealth transfer for loved ones, navigating through countless estate planning strategies can be exhausting. The good news is that there are certain business structures, such as the family limited liability company (family LLC), that could make things easier for those who run a business that’s meant to stay in the family. Here, we explain what a family limited liability company is, how it can help business...

Glossary

Madison Eubanks

•

Sep 05, 2024

ILIT

[embed]https://justvanilla.wistia.com/medias/a6o64kz1pm[/embed] An ILIT, or irrevocable life insurance trust, is a specialized type of trust designed to own and manage a person’s life insurance policy outside of the person’s estate. The purpose of an ILIT is to prevent the proceeds of a life insurance policy from being subject to the policyholder’s estate tax. Although life insurance is income tax-free, it is subject to estate taxes. An ILIT allows people to have those life insurance assets exist outside of their taxable estate. ILITs are often structured to provide liquidity for the estate, in order to keep assets within the family to provide...

Glossary

Madison Eubanks

•

Sep 05, 2024

Medicaid Trust

[embed]https://justvanilla.wistia.com/medias/prx1k9xyba[/embed] A Medicaid asset protection trust—also known as a Medicaid trust or a MAPT—is a type of irrevocable trust that might be used in estate planning if a client or their spouse believes they will need long-term care at some point in the future. These trusts may be used as part of a strategy to qualify for Medicaid long-term care benefits, either alone or to supplement long-term care insurance if their insurance coverage is not sufficient. By law, people must fall below a certain wealth threshold to qualify for Medicaid long-term care assistance. This means that, if a person who...

Blog

Blog

Vanilla

•

Nov 13, 2024

Estate Planning for Business Owners: Strategies and Solutions for Wealth Advisors

There are over 33 million small businesses in the United States, employing over 60 million people. In many ways, private businesses are the heart and soul of the country’s economy, and—unsurprisingly—business owners often feel passionately about what happens to their share when they pass away. Wealth advisors should be prepared to help their business-owning clients create a thoughtful succession plan, regardless of the size or value of their business. In a recent webinar, estate planning experts Steve Lockshin and Patrick Carlson sat down to discuss everything from foundational concepts to advanced strategies wealth advisors should consider for clients who own...

Glossary

Madison Eubanks

•

Apr 12, 2024

Pour-over Will

A pour-over will is a legal document that typically works in conjunction with a revocable or irrevocable trust. It is designed to transfer, or “pour over,” an individual’s remaining assets into an existing trust upon their death. A pour-over will serves as a safety net to ensure that any assets not already held in the trust will be distributed to the trust at death to be administered according to the terms of the trust. Read more: What is a pour-over will? The essentials financial advisors and clients need to know

Blog

Blog

Vanilla

•

Dec 11, 2020

7 Major reasons why estate planning isn’t a ‘set it and forget it’...

Imagine that you're having your first consultation with a new client. You ask them whether they have an estate plan in place. They proudly tell you that they drew up a will and assigned guardianship as soon as their first child was born — 25 years ago. Job well done, next question — right? Not quite! Let's examine why treating an estate plan as a one-off task comes with significant risks that could end in nightmare scenarios for your client and their family. 1: Beneficiaries and fiduciaries are often temporary While your client may express a desire to designate loved...

Blog

Blog

Rachel Pettis

•

May 18, 2023

Leverage sample profiles to illustrate Vanilla’s value to your clients

With the launch of taxable and non-taxable sample profiles, advisors can now review an example of a completed client account in Vanilla. Their clients can see how the complete picture of their estate and financial plan would be represented on the platform before onboarding their own family, financial, and estate information. During client and prospect conversations, advisors can share the completed sample profile or download the taxable or non-taxable estate PDF report. The Taylor Family is an example of a high-net worth family living in Florida with a taxable estate of $117,050,000. Their estate plan includes revocable trusts, an irrevocable...

Glossary

Madison Eubanks

•

Apr 12, 2024

Family Trust

What is a family trust? A family trust is one of many different types of trusts to help individuals pass on their assets according to their wishes. The person creating the family trust, the settlor, will specifically name family members such as spouses, children, grandchildren, nephews, nieces, or other family members as the beneficiaries of the trust so they can preserve and pass on wealth to future generations. How does a family trust work? In a family trust, the settlor will specify which assets will go into the family trust fund and how those assets will be distributed to beneficiaries....

Blog

Blog

Vanilla

•

Jan 17, 2023

What is a grantor retained annuity trust (GRAT)?

In a grantor retained annuity trust (GRAT) , a grantor transfers a particular asset(s) into an irrevocable trust and retains an annuity stream from the trust for a specified term of years. The annuity amount is calculated based on an IRS interest rate (referred to as the “hurdle rate”). At the end of the trust’s term, if the grantor survives the term of the trust, any assets remaining in the GRAT (the appreciation above the hurdle rate) will pass transfer-tax-free to the named “remainder beneficiary”, generally a trust for family members. How does a GRAT work? Grantor retained annuity trusts...

Blog

Blog

Jim Sinai

•

Dec 22, 2022

What you need to know about generation-skipping gifts (and their tax implications)

Gifting to your children is an excellent way to reduce estate tax liabilities, but sometimes it makes more sense to give directly to grandchildren, rather than to your children. Because these gifts “skip” a generation, they are referred to as generation-skipping transfers (GST) and have special tax treatment. There are a few important things to keep in mind when considering a generation-skipping transfer gift, including the generation-skipping transfer tax. We’ll break the tax down for you and give you a few more important pointers to pay attention to. What is the generation-skipping transfer tax? The generation-skipping transfer tax (or “GSTT”)...

Glossary

Vanilla

•

Jan 20, 2023

Trust Certification

What is a certificate of trust? A certificate of trust, also known as a trust certificate, certification of trust document, or an affidavit of trust, is used to represent and verify an interest or ownership in a trust. The certificate of trust is similar to a stock certificate for a corporation. It includes important information about the trust to confirm its existence to outside parties without disclosing sensitive information that the creator of the trust (the settlor) may not want to share publicly. What’s the purpose of a certificate of trust? Before allowing trustees to act on behalf of a...

Blog

Blog

Madison Eubanks

•

Apr 02, 2024

Letter of Testamentary: What It Is & Why You Need It

Creating a last will and testament is one of the most fundamental efforts in estate planning, and a key component is naming an executor to carry out the will’s instructions. The executor is the person who will administer the estate, sees it through the probate process, and settles the decedent’s final affairs—in short, it’s a big responsibility. Before the executor can begin administering a deceased person’s estate, though, the executor needs to obtain a Letter of Testamentary (also called letters testamentary). In this article, we’ll explain what a letter of testamentary is, why you might need one, how to get...

Blog

Blog

John Costello

•

Mar 12, 2024

Vanilla Unveils Vanilla Scenarios™ to Power Interactive Estate Planning and Modeling

Vanilla Scenarios provides advisors and estate strategists with powerful planning tools to identify planning gaps, visualize future projections, and optimize plans for maximum impact. Vanilla, a leading provider of innovative estate planning software, today announced the availability of Vanilla Scenarios™, a powerful new tool designed to optimize clients' estate plans for the future. Vanilla Scenarios modernizes estate planning by providing advisors, wealth planners, and estate lawyers with unparalleled capabilities to model multiple planning scenarios dynamically and in real-time. Advisors can effortlessly layer multiple strategies onto existing plans and customize the details of each strategy, including changes to their client’s state...

Blog

Blog

Vanilla

•

Feb 14, 2023

What is a spousal lifetime access trust (SLAT), and how does it work?

A Spousal Lifetime Access Trust (“SLAT”) is an irrevocable trust set up by an individual (the “donor”) during his or her lifetime for the benefit of the individual’s spouse and if, desired, other family members. How does the SLAT Work? A SLAT is created under a trust agreement, which contains the terms of the trust and the name of the individuals or entity that will act as trustee (typically a trusted friend or advisor). A SLAT is funded by way of a gift from the donor to the SLAT. During the donor’s lifetime, the trustee can make distributions to...

Blog

Blog

Daniel Brockley

•

Nov 03, 2022

Turning-Point Conversations: How to use important life events to refocus clients and deepen...

Curiosity – genuine curiosity – is one of the most important traits a financial advisor can have. Sure, this means curiosity about the different levers and pulleys of the economic machine, but it also means curiosity about clients. Not just about their risk tolerance, but about what makes them tick. Their goals, their fears. What gets them out of bed in the morning. A deeper understanding of clients as people, not just portfolios, enables you to bring the kind of value that goes far beyond index funds. There are certain times in life that lend themselves to these clarifying conversations–when...

Blog

Blog

Vanilla

•

Mar 08, 2023

11 Common Estate Planning Mistakes to Avoid

These common estate planning mistakes could leave your clients vulnerable to unintended consequences such as probate, loss of assets in a divorce, and avoidable estate tax liability. Financial advisors can help their clients avoid the 11 most common estate planning mistakes listed below. #1 Not updating estate planning documents regularly Some clients may think that creating an estate plan is a one-and-done proposition, but you should review and update your client’s estate plan with them when they experience any of the following: Major life events: Your client’s estate planning documents should reflect significant milestones, such as having a child, getting...

Blog

Blog

Simona Ondrejkova, CFP

•

Oct 09, 2023

A Guide to Estate Planning for Individuals with Special Needs

Estate planning for clients who have adults or children with special needs in their lives can be complex. Unlike traditional estate planning, special needs estate planning requires paying careful attention to the individual with special needs’ eligibility for government benefits. This is in addition to skillfully leveraging assets to most effectively attend to their unique health and wellness needs. Imagine that one of your clients is a family with three adult children, all living in different states. The two younger brothers have established their own families and are financially comfortable. But their oldest sister is living with muscular dystrophy and...

Course

Course

Guide

Guide

Vanilla

•

Aug 10, 2023

A guide to trusts for estate planning

Trusts are an important component of financial and estate planning, but there are many types of trusts – each with unique pros and cons. This guide helps financial advisors and clients sort through the many different types of trusts to better understand what they might want to employ for their own estate strategies.

Webinar

Webinar

Vanilla

•

May 24, 2023

The 2026 estate tax exemption sunset: How to prepare – and why you...

For the past few years, most US tax residents haven’t needed to worry too much about estate tax. But that’s all about to change. At the end of 2025, the historically high estate exemption of $12.92M ($25.84 million per married couple) will sunset back down to an estimated $6-8 million per person or $12-16 million per couple (adjusting for inflation) – suddenly making the estate tax an important consideration for many more households. And the time to act is now. In this webinar, you’ll learn: How the estate tax exemption sunset will impact your clients Key strategies including SLATS, gifting,...

Blog

Blog