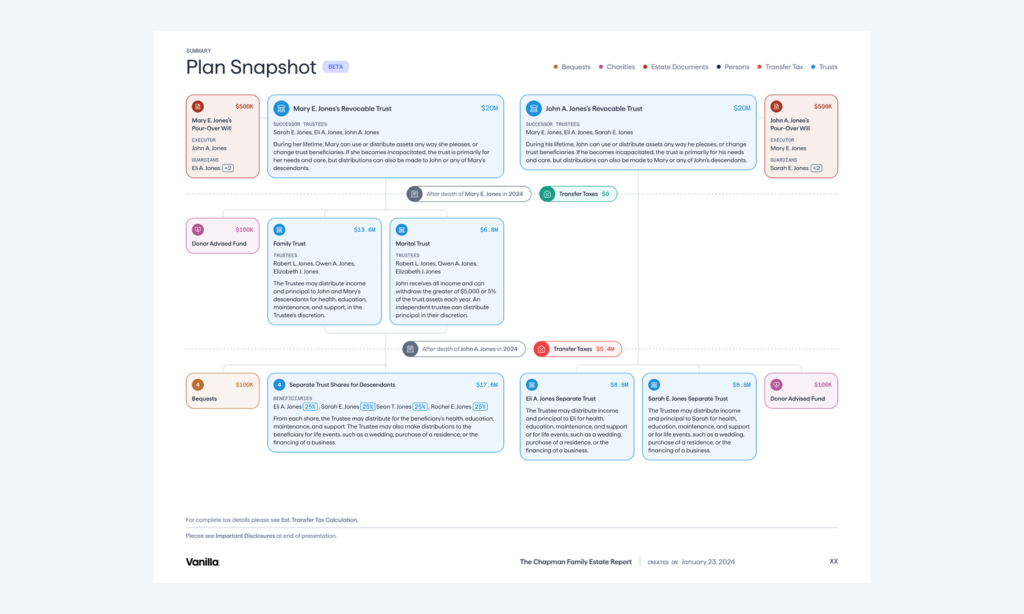

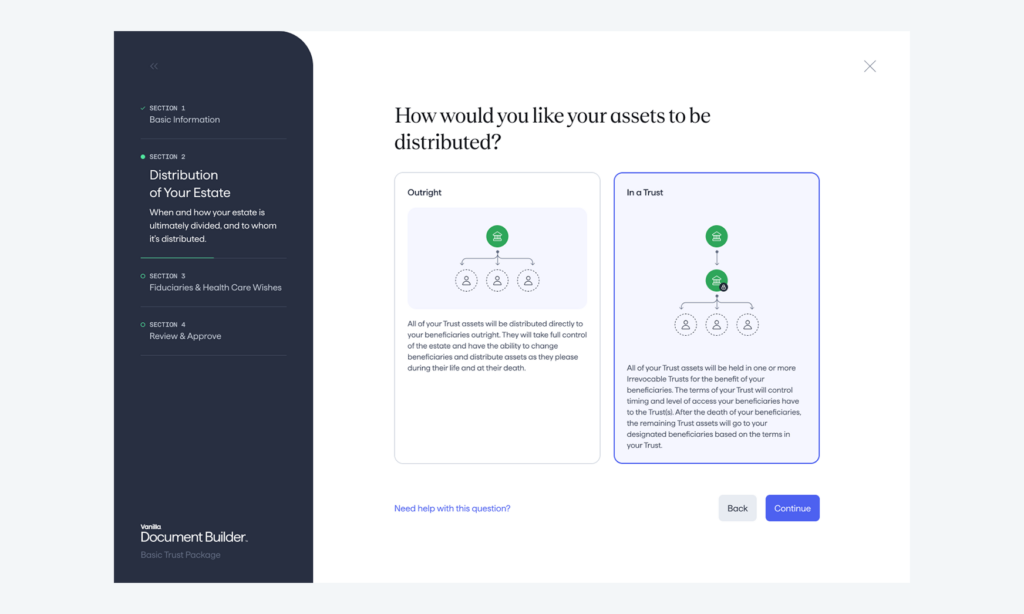

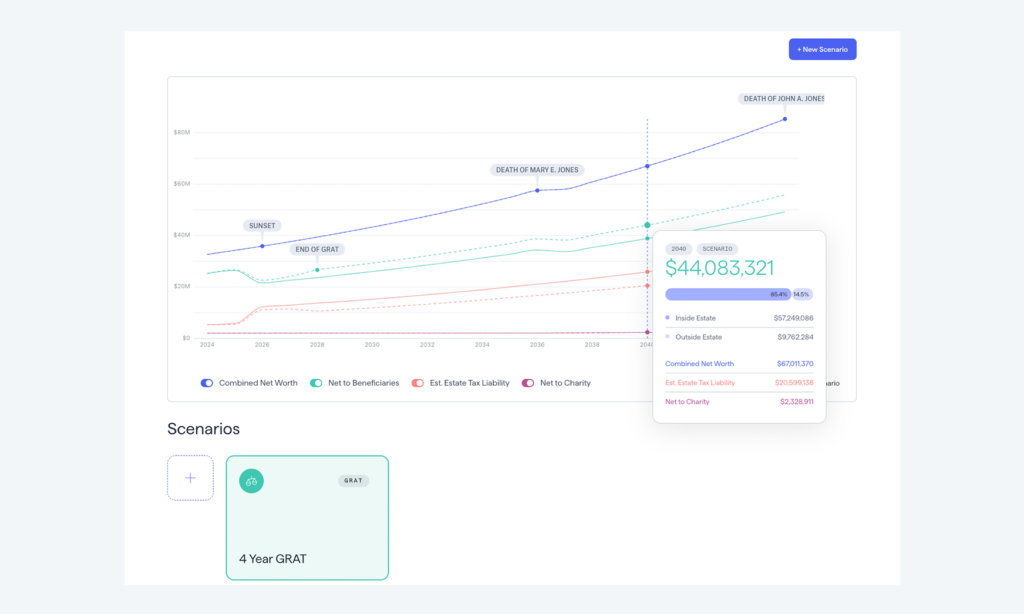

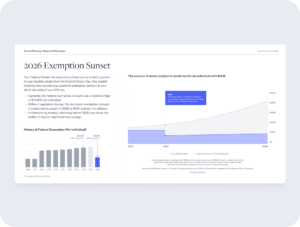

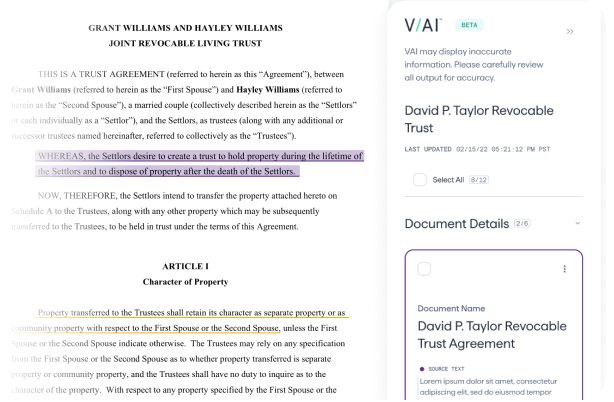

Estate planning software helps financial advisors, lawyers, and individuals analyze existing estate plans, identify gaps, calculate potential federal and state estate tax liabilities, and create new planning documents such as trust, wills, power of attorney, and healthcare directives. It can automate many of the manual tasks involved in estate planning, such as drafting documents, calculating taxes and waterfalls, and building visualizations to explain how the plan works.

Advisors need estate planning software because it can help them:

- Provide better service to their clients by helping them create comprehensive and effective estate plans.

- Understand their clients balance sheet and total net-worth.

- Create a deeper connection to the client and their goals.

- Retain assets by creating a connection with the second generation.

Estate planning software can help advisors educate clients about estate planning and build trust and rapport through using a modern, interactive experience.